The Weekly View (10/28/19)

Last Week’s Highlights:

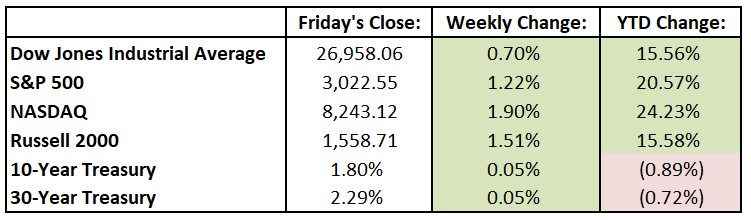

The S&P 500 index closed the week just shy of a new record high as investors welcomed solid corporate earnings and an encouraging update on trade talks between the United States and China. For the past week, the Dow Jones Industrial Average (DJIA) rose 187.86 points, or 0.7%, to 26,958.06, while the S&P advanced 1.2% to 3022.55. The tech-heavy NASDAQ was up 1.9%, closing at 8243.12, its fourth consecutive week finishing in positive territory. The yield on the 10-year U.S. Treasury note rose, another indication that investors are more optimistic about growth and overall economic prospects. The yield closed at 1.805% on Friday, climbing 0.058 percentage points for the week. (Bond yields and bond prices move in opposite directions). The Brexit drama continued as Parliament blocked United Kingdom Prime Minister Boris Johnson yet again, forcing him to seek a three-month extension from the European Union. Over the weekend, Microsoft (MSFT) won a landmark Pentagon contract, one that many investors thought would go to cloud-computing rival Amazon (AMZN). Tiffany (TIF) received a takeover offer from French conglomerate LVMH Moet Hennessy Louis Vuitton, valuing Tiffany at $14.5 billion.

Looking Ahead:

Third-quarter earnings season remains in full swing this week with over 145 S&P companies reporting their financial results. Alphabet (GOOG), AT&T (T), T-Mobile US (TMUS) and Spotify Technology (SPOT) report their Q3 numbers on Monday. Tuesday brings more earning releases from Advanced Micro Devices (AMD), Chubb (CB), General Motors (GM) and Merck (MRK). The National Association of Realtors reports pending home sales for September – economists forecast a 1.0% increase after a 1.6% rise for September. The Federal Reserve Open Market Committee (FOMC) meeting begins. The FOMC announces its monetary-policy decision on Wednesday – the central bank is widely expected to cut the federal-funds rate for the third time this year, to 1.50%-1.75%. Earnings continue with financial results from Apple (AAPL), Automatic Data Processing (ADP) and General Electric (GE). Potential Game 7 of the World Series may be played Wednesday evening. On Thursday, look for earnings results from Altria Group (MO), Bristol-Myers Squibb (BMY) and DuPont (DD). And Boo! – Thursday is Halloween. Friday, the first day of November, brings earnings from AbbVie (ABBV), American International Group (AIG) and Exxon Mobil (XOM).

The Tufton Capital Team hopes that you have a wonderful week!