The Weekly View (10/21/19)

Last Week’s Highlights:

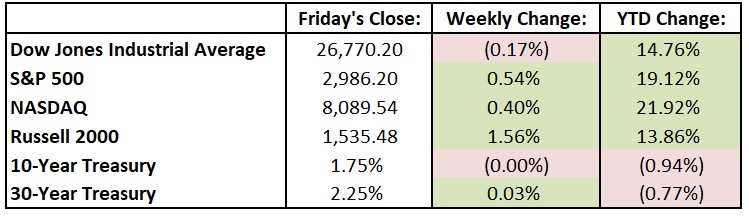

U.S. equities ended the week mostly higher as better-than-expected corporate earnings and optimism around Brexit were offset by continued global growth concerns. The third-quarter earnings season kicked off, and large U.S. banks took center stage with results that exceeded investors’ low expectations. While Wall Street began the week concerned that the lower interest rate environment might dampen results from the big banks (including Citigroup (C), Wells Fargo (WFC), Bank of America (BAC)), results came in largely better than expectations. On Saturday, U.K lawmakers forced Prime Minister Boris Johnson to ask European Union (EU) for yet another delay to Britain’s withdrawal. As the Brexit drama continues, Johnson will bring his proposed deal back to Parliament this week for another critical vote. For the past week, the Dow Jones Industrial Average (DJIA) fell 46.39 points, or 0.2%, to 26,770.20, while the S&P 500 advanced 0.5% to 2986.20. The tech-heavy NASDAQ was up 0.4%, closing at 8089.54. Why was the Dow Jones down but other U.S. indexes up? The Dow is a price-weighted index, while most others are market capitalization-weighted. With the Dow, higher-priced stocks have larger impacts on its pricing than do lower-priced ones. With last week’s weakness in high-priced Boeing (BA), Johnson & Johnson (JNJ) and IBM (IBM), the DJIA declined while the rest of the market traded higher.

Looking Ahead:

Third-quarter earnings season remains in full swing this week. Monday brings financial reports from Halliburton (HAL), TD Ameritrade Holdings (AMTD) and Cadence Design Systems (CDNS). Canadians go to the polls to elect members of Parliament. The Liberal Party, headed by Prime Minister Justin Trudeau, seeks to retain the majority it won four years ago. More earnings are released Tuesday, including numbers from Biogen (BIIB), Lockheed Martin (LMT), McDonald’s (MCD) and Procter & Gamble (PG). It’s a big day for sports fans, as baseball’s World Series begins, and the NBA season tips off. Look for earnings from Boeing (BA), Ford Motor (F), Microsoft (MSFT) and Caterpillar (CAT) on Wednesday. Facebook (FB) CEO Mark Zuckerberg testifies before the House Financial Services Committee. The hearing is titled, “An Examination of Facebook and Its Impact on the Financial Services and Housing Sectors.” Intel (INTC), Amazon.com (AMZN) and Northrop Grumman (NOC) report financials on Thursday. The Census Bureau releases its Durable Goods report for September – new orders for manufactured durable goods are expected to fall 0.5% after a 0.2% gain in August. The busy business week winds down Friday with earnings announcements from Verizon Communications (VZ), Anheuser-Busch InBev (BUD) and Charter Communications (CHTR).

The Tufton Capital Team hopes that you have a wonderful week!