The Weekly View (10/14/19)

Last Week’s Highlights:

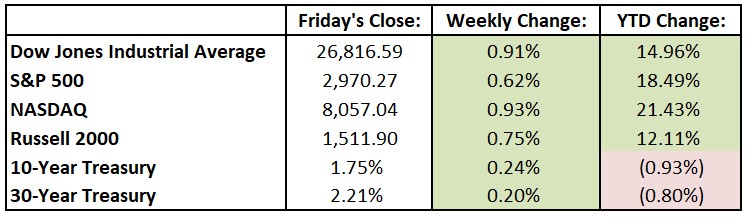

Global equities snapped a three-week losing streak on optimism that U.S. and Chinese delegates are making progress in their ongoing trade negotiations. While talks appear to be more of a “cease-fire” for now, markets responded favorably and investors were relieved that trade discussions seem to be moving forward. Positive comments on the Brexit front added to traders’ optimism, leading international developed-market stocks to record their biggest weekly rise in over four months. For the past week, the Dow Jones Industrial Average (DJIA) rose 242.87 points, or 0.9%, to 26,816.59, while the S&P 500 advanced 0.6% to 2970.27. The tech-heavy NASDAQ was up 0.9%, closing at 8057.04.

Looking Ahead:

Third-quarter earnings season ramps up this week, with 50 S&P 500 constituents reporting financial results. Things accelerate next week, as 110 release earnings and 114 the week after that. U.S. bond markets are closed on Monday in observance of Columbus Day, while Canadian bourses are closed in observance of Thanksgiving. Tuesday brings quarterly earnings results from BlackRock (BLK), Johnson & Johnson (JNJ), United Airlines Holdings (UAL) and UnitedHealth Group (UNH). Big Banks also report numbers, including results from Citigroup (C), Goldman Sachs Group (GS), Wells Fargo (WFC) and JPMorgan Chase (JPM). Look for financials from Abbott Laboratories (ABT), Bank of America (BAC). IBM (IBM) and Netflix (NFLX) on Wednesday. The Census Bureau reports retail-sales data for September – consensus estimates call for a 0.3% gain after a 0.4% rise in August. On Thursday, Morgan Stanley (MS), Philip Morris International (PM) and Taiwan Semiconductor (TSM) announce earnings. The Census Bureau releases new residential construction data for September – forecasts call for a seasonally adjusted annual rate of 1.35 million building permits and 1.3 million housing starts. The busy week ends with financials reports from American Express (AXP), Coca-Cola (KO) and State Street (STT) on Friday. The Conference Board releases its Leading Economic Index for September – economists forecast a 112.2 reading, little changed from the past two months’ data.

The Tufton Capital Team hopes that you have a wonderful week!