The Weekly View (10/7/19)

Last Week’s Highlights:

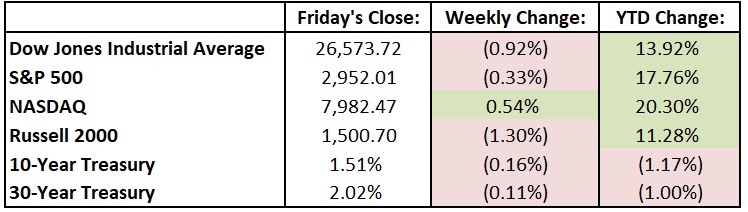

U.S. equities declined for a third straight week while bonds rose. Cyclical sectors led stocks lower as a string of disappointing economic reports fueled concerns that a slowdown in manufacturing might spread to other parts of the U.S. economy. Markets finished the week on a strong note, as the Dow Jones Industrial Average (DJIA) rose 372.72 points (1.42%) on Friday as the September jobs report helped ease fears about an economic slowdown. For the week, the DJIA fell 246.53 points, or 0.9%, to 26,573.72, while the S&P 500 declined 0.3% to 2952.01. The tech-heavy NASDAQ bucked the trend, rising 0.5% and closing at 7982.47.

Looking Ahead:

The Federal Reserve release consumer credit data for August on Monday – economists forecast a $15 billion increase in total outstanding consumer debt to $4.14 trillion, which would be an all-time high. Blue jeans inventor Levi Strauss (LEVI) reports third quarter financials on Tuesday. The Bureau of Labor Statistics reports its producer price index (PPI) for September – expectations are for a 0.1% increase, even with August’s uptick. On Wednesday, the Federal Open Market Committee releases minutes from its mid-September meeting, when it cut the federal-funds rate a quarter of a percentage point to 1.75%-2%. Delta Air Lines (DAL) holds a conference call on Thursday to discuss its September quarter earnings results. The Bureau of Labor Statistics reports its consumer price index (CPI) for September – economists call for a 1.8% year-over-year increase, up from August’s 1.7% rise. Fastenal (FAST) releases earnings results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!