The Weekly View (9/30/19)

Last Week’s Highlights:

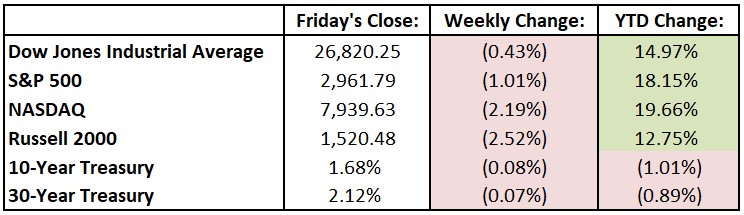

Fading optimism about trade talks with China combined with lackluster economic data, resulting in a second consecutive week of losses for major U.S. stock indexes. It was domestic politics, however, dominating the news wires, as House Democrats announced the initiation of an impeachment inquiry into President Trump. An impeachment would require a supermajority vote in the Senate where Republicans maintain control, making the chances of an actual conviction less likely. Ending the volatile week, reports surfaced Friday that the White House was considering delisting Chinese companies and limiting U.S. investments in China. For the week, the Dow Jones Industrial Average (DJIA) fell 114.82 points, or 0.4%, to 26,820.25, while the S&P 500 declined 1.0% to 2961.79. The tech-heavy NASDAQ lost 2.2%, closing at 7939.63. Talks between Altria Group (MO) and Philip Morris International (PM) ended, largely due to the vaping crisis at Altria investment Juul Labs. Interactive fitness company Peloton Interactive (PTON) spun in reverse, falling 11% on its first day of trading as a public company. Peloton raised $1.16 billion through its initial public offering (IPO) at a valuation of approximately $8 billion.

Looking Ahead:

The Institute for Supply Management releases the MNI Chicago Purchasing Managers Index for September on Monday – economists forecast a 50 reading, about even with August’s print. Spice maker McCormick & Co. (MKC) reports third-quarter earnings results on Tuesday. The Census Bureau releases construction spending data for August – consensus estimates call for a 0.4% rise to a seasonally adjusted annual rate of $1.29 trillion. Wednesday brings earnings reports from Paychex (PAYX), Lennar (LEN) and Lamb Weston Holdings (LW). Eli Lilly (LLY) hosts a webcast to update shareholders on some of its cancer drugs. ADP reports its National Employment Report for September – expectations call for a gain of 150,000 private-sector jobs, down from August’s 195,000 increase. Constellation Brands (STZ), Costco Wholesale (COST) and PepsiCo (PEP) report financials on Thursday. The ISM announces its Non-Manufacturing Index for September – consensus estimates forecast a 55.3 reading, down from August’s 56.4 report. On Friday, the BLS releases the jobs report for September – economists forecast a 150,000 rise in nonfarm payrolls, and that the unemployment rate will remain unchanged at 3.7%.

The Tufton Capital Team hopes that you have a wonderful week!