The Weekly View (9/23/19)

Last Week’s Highlights:

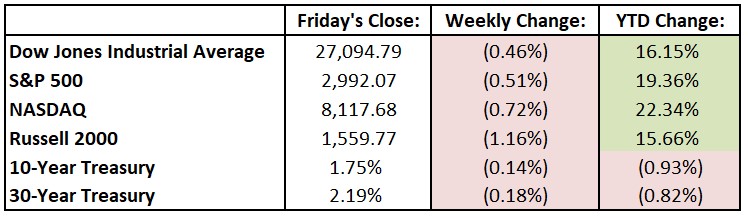

Major U.S. equity indexes broke a three-week winning streak, finishing last week with a modest loss after a volatile stretch in the markets. Recent trading has featured turmoil in money markets and big swings in oil prices following an attack on crude oil facilities in Saudi Arabia. A drone attack knocked out 5.7 million barrels a day of oil production, sending Brent crude prices up 15% on Monday (to $69 a barrel) before slipping back the next day. Additionally, investors continue to be very sensitive to trade-related headlines as discussions with China continue. As expected, the Federal Reserve cut interest rates on Wednesday by a quarter point. For the week, the Dow Jones Industrial Average (DJIA) fell 284.45 points, or 1.0%, to 26,935.07, while the S&P 500 declined 0.5% to 2992.07. The tech-heavy NASDAQ lost 0.7%, closing at 8117.67. Although last week saw stock indexes soften, both the Dow and S&P 500 are still within about 1.5% of their closing records from July.

Looking Ahead:

Climate Week NYC kicks off Monday with the U.N. secretary general’s Climate Action Summit. The event attracts CEOs, government officials and investors from across the globe. The Federal Reserve Bank of Chicago releases its National Activity Index for August – economists forecast a reading of -0.08 for August, up from July’s -0.36 print. On Tuesday, AutoZone (AZO), CarMax (KMX) and Nike (NKE) report their quarterly financial results. The Conference Board releases its Consumer Confidence Survey for September – forecasts call for a reading of 133.3, down from August’s 135.1. President Trump is scheduled to address the United Nations General Assembly. Look for earnings reports on Wednesday from KB Home (KB) and Pier 1 Imports (PIR). The U.S. Census Bureau announces new-home sales for August – consensus estimates are for 659,000 homes, up from July’s 635,000 report. On Thursday, Micron Technology (MU), FactSet Research Systems (FDS) and Vail Resorts (MTN) host earnings conference calls. The National Association of Realtors releases its Pending Home Sales Index for August – economists forecast a 1.5% gain after a 2.5% decline in July. Friday brings the Bureau of Economic Analysis’ release of personal income and outlays for August – personal income is expected to rise 0.4% after a 0.1% gain in July.

The Tufton Capital Team hopes that you have a wonderful week!