The Weekly View (9/9/19)

Last Week’s Highlights:

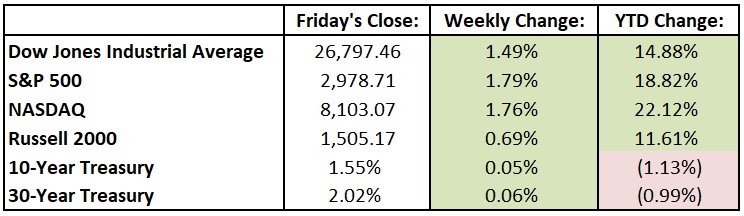

U.S. equities finished the week higher after the August jobs report indicated that hiring slowed in a month highlighted by continued trade threats with China. The soft employment report (130,000 new jobs, below the 150,000 projected by economists) likely keeps the Federal Reserve on track to cut interest rates again at their late September meeting. Wall Street likes certainty, and investors got more of it last week on the interest rate, trade and economic fronts. For the week, the Dow Jones Industrial Average (DJIA) advanced 394.18 points, or 1.5%, to 26,797.46, while the S&P 500 rose 1.8% to 2978.71. The tech-heavy NASDAQ gained 1.8%, closing at 8103.07. A delicate balance continues to face markets. Global investors are on one hand increasingly uneasy about signs that economies around the world are slowing. Any indications about slowing growth, whether it be from rising tariffs or political uncertainty, have sent markets reeling. On the other hand, any indications of economic softness are often met with rate cuts by the Federal Reserve, usually leading to strength for U.S. corporations and equity markets overall. Investors (and we at Tufton Capital, of course) continue to analyze and balance each of these competing dynamics.

Looking Ahead:

The business week begins with earnings results from Ctrip.com International (CTRP) on Monday. The Federal Reserve reports consumer credit data for July. Total outstanding credit topped $4.1 trillion at the end of June, a record high. GameStop (GME) and HD Supply Holdings (HDS) report quarterly results on Tuesday. The Bureau of Labor Statistics (BLS) releases its Job Openings and Labor Turnover Summary for July – consensus estimates call for 7.4 million open jobs on the last business day of July, up from 7.3 million in June. Apple (AAPL) hosts a product launch event in Cupertino, California. The company is expected to unveil three iPhone 11 models. Wednesday is the 18th anniversary of the 9/11 terrorist attacks. The BLS releases the producer price index (PPI) for August – expectations are for a 0.1% gain after a 0.2% rise in July. Broadcom (AVGO), Kroger (KR) and Oracle (ORCL) report financial results on Thursday. The Bureau of Labor Statistics announces its consumer price index (CPI) for August, which is expected to rise 1.8% year over year. The core CPI is seen gaining 2.3%. On Friday, the Census Bureau reports retail sales for August – economists forecast a 0.1% gain for the month.

The Tufton Capital Team hopes that you have a wonderful week!