The Weekly View (12/16/19)

Last Week’s Highlights:

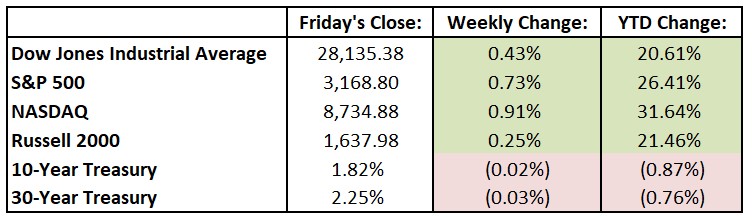

Quite a bit went right last week for equity investors. The Federal Reserve left interest rates unchanged and signaled a pause through 2020, while the European Central Bank pledged continued favorable monetary support. In the United Kingdom, Boris Johnson’s Conservative Party received a landslide victory, signaling that the Brexit drama is nearing an end. And on Friday, President Trump announced that a phase-one deal with China had been completed and that negotiations on phase two would begin immediately. Stock markets, however, were only slightly up, as much of the week’s positive news appears to already be discounted in equity valuations. For the week, the Dow Jones Industrial Average (DJIA) rose just 120.32 points, or 0.4%, to 28,135.38, while the S&P 500 advanced 0.7% to 3168.80. The tech-heavy NASDAQ was up 0.9%, closing at 8734.88.

Looking Ahead:

With third-quarter earnings season largely in the books, economic reports will take center stage this week. On Monday, the National Association of Home Builders releases its NAHB/Wells Fargo Housing Market Index for December – economists estimate a 71 reading, up slightly from November’s print. On Tuesday, FedEx (FDX), Cintas (CTAS) and Navistar International (NAV) report earnings results. The Bureau of Labor Statistics releases its Jobs Openings and Labor Turnover Survey for September – economists forecast seven million job openings on the last business day of October, unchanged from the prior month. Look for financial results from General Mills (GIS), Paychex (PAYX) and Micron Technology (MU) on Wednesday. The Conference Board releases its Leading Economic Index for November on Thursday – forecasts call for a 0.1% rise after falling the three previous months. CarMax (KMX) reports quarterly results on Friday.

Tufton Capital Team hopes that you have a wonderful week!