The Weekly View (12/23/19)

Last Week’s Highlights:

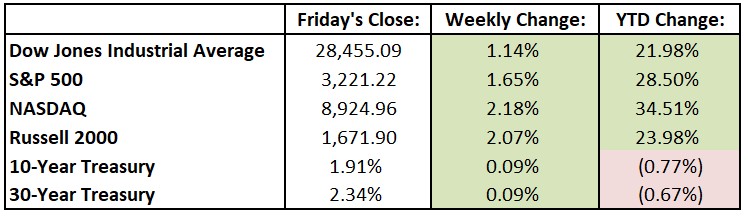

U.S. equities closed out the week at record levels, energized by new signs of economic strength and lessened trade tensions. The U.S. and China agreed last week to a preliminary trade truce, and promising economic numbers released by both countries signaled better than expected global growth. The House voted to impeach President Donald Trump for abuse of power and obstruction of Congress, the third impeachment in U.S. history. For the week, the Dow Jones Industrial Average (DJIA) rose 319.71 points, or 1.1%, to 28,455.09, while the S&P 500 advanced 1.7% to 3221.22. The tech-heavy NASDAQ was up 2.2%, closing at 8924.96.

What a difference a year makes! – current investor optimism and market strength is indeed a different environment than this time a year ago when major indexes couldn’t seem to stop falling. The S&P 500 had dropped 12% through December 21st and was on the way to its worst December since 1931.

Looking Ahead:

It will be a slow week on Wall Street. The Census Bureau reports new-home sales data for November on Monday – consensus estimates call for a seasonally adjusted annual rate of 730,000 new homes sold, roughly the same as the month before. On Tuesday, trading ends at 1pm on the New York Stock Exchange and Nasdaq Composite for Christmas Eve. The bond market closes at 2pm. The Bank of Japan releases minutes from its monetary-policy meeting at the end of October. Markets all over the world are closed on Wednesday in observance of Christmas Day. Many bourses are closed on Thursday, including those in Canada, England and Hong Kong, in observance of Boxing Day. The Department of Labor reports initial jobless claims for the week ending December 21st. On Friday, the U.S. Energy Administration releases its Petroleum Status report for the week ending December 20th.

All of us at Tufton Capital Management wish you and your families a very Merry Christmas and a Happy Holiday!