The Weekly View (1/6/20)

Last Week’s Highlights:

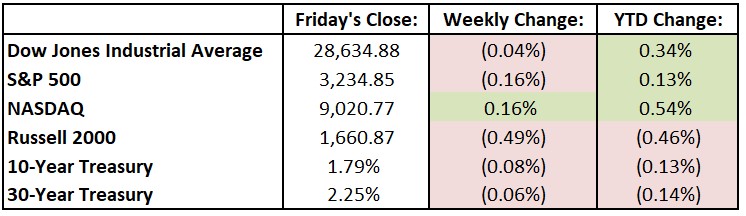

Stocks finished 2019 on Tuesday close to record highs, as the Dow Jones Industrial Average (DJIA) ended the year up 22.3%. The S&P 500 and tech-heavy NASDAQ performed even better last year, finishing up 28.9% and 35.2%, respectively. The new year began with U.S. equities reaching new highs Thursday on reports of China stimulus, then slipped on Friday with the turmoil in the Middle East. For the week, the Dow declined 10.38 points, or 0.04%, to 28,634.88, while the S&P 500 fell 0.2% to 3234.85. The NASDAQ was up 0.2%, closing at 9020.77.

Looking Ahead:

Wall Street returns to its first full week of trading since the holidays began. Cal-Maine Foods (CALM) reports quarterly earnings on Monday. On Tuesday, the Institute for Supply Management releases its Non-Manufacturing Purchasing Managers’ Index for December – consensus estimates call for a 54.5 reading, about even with November’s data. Wednesday brings earnings reports from Bed Bath & Beyond (BBBY), Constellation Brands (STZ) and Walgreens Boots Alliance (WBA). The Federal Reserve reports consumer-credit data – consumer debt is expected to continue its rise to just below the $4.2 trillion level. KB Home (KB), Synnex (SNX) and Acuity Brands (AYI) report financial results on Thursday. The Department of Labor releases initial jobless claims for the week ending on January 4th – the four-week average of claims is 232,500. Infosys (INFY) reports quarterly results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!