The Weekly View (1/13/20)

Last Week’s Highlights:

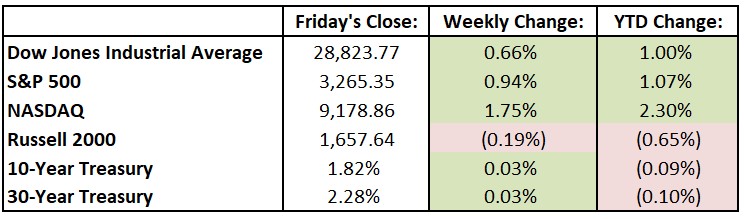

U.S. stocks jumped around last week largely on tensions with Iran and lackluster domestic economic numbers reported later in the week. Equities sold off sharply on Tuesday night on news of an Iranian missile strike. The markets recovered the next morning as it became clear that there had been no casualties and a war was not beginning. By Thursday, the tension in the Middle East was largely forgotten as stocks marched to all-time highs. A lower-than-forecasted December employment number reported Friday led to a selloff, although stocks remained on the positive side for the week. Last week, the Dow Jones Industrial Average (DJIA) rose 188.89 points, or 0.7%, to 28,823.77, while the S&P 500 advanced 0.9% to 3265.35. The tech-heavy NASDAQ was up 1.8%, closing at 9178.86. All three indices are within a half-point of their highest-ever closes.

Looking Ahead:

Fourth-quarter earnings season kicks off this week, with 26 S&P 500 components releasing financial results. Japanese markets are closed on Monday in observance of Coming of Age Day. Banks as usual are among the first to report earnings, and first up are Citigroup (C), JPMorgan Chase (JPM) and Wells Fargo (WFC), as these megabanks release fourth-quarter and full-year 2019 results on Tuesday. The Bureau of Labor Statistics announces the consumer price index (CPI) for December – expectations call for a 2.3% year-over-year rise, following November’s 2.1% increase. Bank of America (BAC), BlackRock (BLK), Goldman Sachs Group (GS) and UnitedHealth Group (UNH) report quarterly earnings on Wednesday. On Thursday, look for more financial results from Bank of New York (BK), CSX (CSX) and Morgan Stanley (MS). The Census Bureau reports retail sales data for December – expectations are for a 0.3% rise, following a 0.2% gain in November. The busy business week concludes with earnings from Citizens Financial Group (CFG), Kansas City Southern (KSU) and State Street (STT) on Friday. The University of Michigan releases its Consumer Sentiment Index for January – economists look for a 99.6 reading, even with December’s print.

The Tufton Capital Team hopes that you have a wonderful week!