The Weekly View (1/20/20)

Last Week’s Highlights:

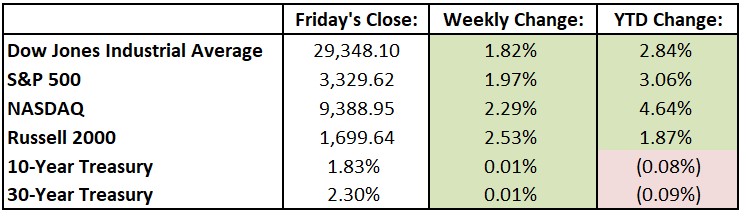

U.S. stocks ended a strong week on a strong note, with the three major equity indexes each rising about 2% last week to record highs. The first wave of companies reporting fourth-quarter earnings was largely positive, as many of the big banks posting strong financial results. Several of these banks’ consumer-related businesses showed robust growth, a positive sign for the overall economy (and market). Alphabet (GOOG) became the fourth U.S. stock to cross the trillion-dollar market-cap line (other members of the trillion-dollar club include fellow tech companies Apple (AAPL), Microsoft (MSFT) and Amazon.com (AMZN)). The U.S. and China signed a phase-one trade deal in Washington – the pact takes some U.S. tariffs on Chinese goods off the table and opens the U.S. to more Chinese purchases. Next up is phase-two which looks to tackle more complicated matters. For the week, the Dow Jones Industrial Average (DJIA) rose 542.33 points, or 1.8%, to 29,348.10, while the S&P 500 advanced 2.0% to 3329.62. The tech-heavy NASDAQ was up 2.3%, closing at 9388.94.

Looking Ahead:

U.S. markets are closed on Monday in observance of Martin Luther King Jr. Day. Fourth-quarter earnings seasons ramps up once markets reopen Tuesday morning, with 43 S&P components releasing financial results through Friday. Capital One Financial (COF), IBM (IBM), Halliburton (HAL) and Netflix (NFLX) release numbers on Tuesday. The World Economic Forum’s 50th annual meeting convenes in Davos, Switzerland. Political and business leaders from around the world will attend, and this year’s theme will be “Stakeholders for a Cohesive and Sustainable World.” On Wednesday, earnings reports include results from Abbott Laboratories (ABT), Johnson & Johnson (JNJ) and Texas Instruments (TXN). The National Association of Realtors reports existing home sales for December – economists forecast a 1.5% rise after declining 1.7% in November. American Airlines Group (AAL), Procter & Gamble (PG) and Southwest Airlines (LUV) report earnings on Thursday. The European Central Bank announces its monetary-policy decision and is widely expected to announce that interest rates will remain steady at negative 0.5%. Friday brings financial results from American Express (AXP) and Air Products & Chemicals (APD). Many markets throughout Asia, including China and South Korea, are closed in observance of the lunar New Year, which falls on Saturday, January 25th.

The Tufton Capital Team hopes that you have a wonderful week!