The Weekly View (1/27/20)

Last Week’s Highlights:

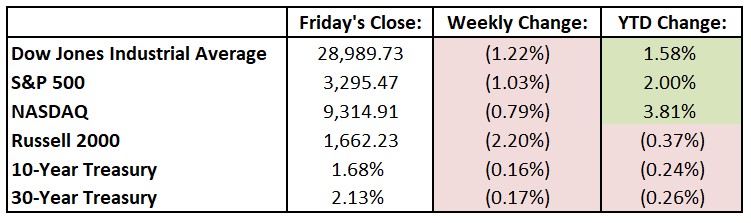

Equities ended the week in the red as American authorities confirmed a second case of the coronavirus in the U.S. and the count of infected patients and deaths rose in China. As of Sunday night, the virus had killed 80, with close to 2100 confirmed cases (including a total of five in the U.S.), while spreading throughout China to neighboring countries. Authorities are especially concerned that the outbreak coincided with the Lunar New Year, when millions of Chinese travel. Earnings season rolled on with largely positive results – numerous companies (and their stocks) performed well, including IBM (IBM), American Express (AXP), Netflix (NFLX), Abbott Laboratories (ABT), and others. However, the coronavirus crisis dampened investors’ moods and market prices. For the week, the Dow Jones Industrial Average (DJIA) fell 358.37 points, or 1.2%, to 28,989.73, while the S&P 500 dropped 1.0% to 3295.47. The tech-heavy NASDAQ lost 0.8%, closing at 9314.91.

Looking Ahead:

This week marks the busiest stretch of fourth-quarter earnings reports, as 132 S&P 500 components release financial results over the next five days. D.R. Horton (DHI), Juniper Network (JNPR) and Whirlpool (WHR) post quarterly numbers on Monday. The Census Bureau releases new home sales data for December – economists forecast a seasonally adjusted annual rate of 728,000 new single-family homes sold, up from November’s 719,000 report. Tuesday is packed with more earnings with releases coming from McCormick (MKC), Lockheed Martin (LMT), Starbucks (SBUX), United Technologies (UTX) and Apple (AAPL). The Conference Board announces its Consumer Confidence Index for January – consensus estimates call for a 128.4 reading, up from December’s 126.5 print. Look for earnings releases Wednesday from AT&T (T), Microsoft (MSFT), Norfolk Southern (NCS), Boeing (BA), T. Rowe Price Group (TROW) and Novartis (NVS). The Federal Open Market Committee (FOMC) announces its monetary-policy decision – the market widely expects the central bank to keep the federal-funds rate unchanged at 1.50%-1.75%. Altria Group (MO), Biogen (BIIB), Coca-Cola (KO) and United Parcel Service (UPS) are among a large group of companies reporting financials on Thursday. The Bank of England releases its monetary-policy decision – futures markets predict a greater-than-50% chance that the central bank will cut its short-term interest rate to 0.50% from 0.75%. Charter Communications (CHTR), Chevron (CVX), Exxon Mobil (XOM) and Honeywell International (HON) report quarterly results on Friday.

The Tufton Capital Team hopes that you have a wonderful week!