The Weekly View (2/10/20)

Last Week’s Highlights:

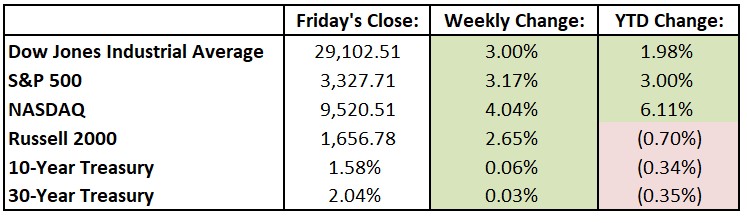

U.S. stocks posted their biggest weekly gains in months as concerns about a global economic slowdown due to the coronavirus eased. Equities hit new highs midweek before slipping on Friday, when the U.S. jobs report came in above expectations (225,000 jobs were added in January, beating the 165,000 estimate). Friday’s selloff is a classic case of good news is bad news, as the strong employment report may reduce the chance of a rate cut by the Federal Reserve in the coming months. For the week the Dow Jones Industrial Average (DJIA) rallied 846.48 points, or 3.0%, to 29,102.51, while the S&P 500 advanced 3.2% to 3327.71. The tech-heavy NASDAQ was up 4.0%, closing at 9520.51. Stocks taking center stage included Tesla (TSLA), which continued its volatile ascent. Alphabet (GOOG) sold off after the company disclosed financials about specific business units (such as YouTube) for the first time. Investors continued to focus on the coronavirus (with 40,000 confirmed cases and over 900 deaths as of Sunday). China pumped more than $200 billion in liquidity into its economy, and the rate of the spread of the virus fortunately appears to have slowed.

Looking Ahead:

Sixty S&P 500 components are scheduled to report their fourth quarter financial results this week, beginning with Allergan (AGN), DaVita (DVA) and Loews (L) on Monday. Automatic Data Processing (ADP) hosts an innovation day in New York. Tuesday brings financial results from Dominion Energy (D), Under Armour (UA), Hasbro (HAS) and Lyft (LYFT). The Bureau of Labor Statistics reports its Jobs Openings and Labor Turnover Survey for December – economists forecast 6.78 million job openings on the last business day of December, little changed from November. Federal Reserve Chairman Jerome Powell delivers his semiannual Monetary Policy Report to Congress before the House Financial Services Committee. Wednesday is packed with earnings releases, including numbers from Applied Materials (AMAT), Cisco Systems (CSCO), CVS Health (CVS) and Barrick Gold (GOLD). On Thursday, Kraft Heinz (KHC), Pepsico (PEP), Zoetis (ZTS) and Duke Energy (DUK) release financial results. Emerson Electric (EMR) holds its annual investor conference at the New York Stock Exchange. The business week ends with earnings from Newell Brands (NWL) and AstraZeneca (AZN) on Friday. The Census Bureau reports retail sales data for January – economists forecast a 0.3% gain, in line with December’s rise.

The Tufton Capital Team hopes that you have a wonderful week!