The Weekly View (2/24/20)

Last Week’s Highlights:

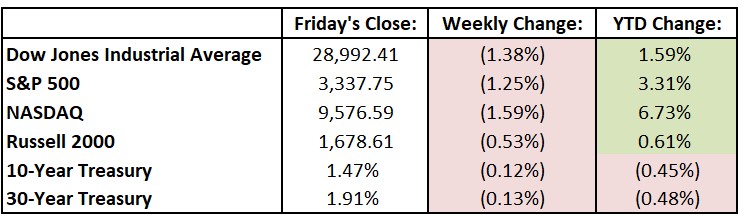

Equities sold off last week as investors flocked to traditionally safer assets such as government bonds and gold. The coronavirus epidemic and its impact on global growth continued to dominate headlines and will likely be the major international news story in weeks to come (more on this below). The yield on the benchmark 10-year U.S. Treasury note reached its lowest level since September on Friday, ending the day at 1.470%. For the week the Dow Jones Industrial Average (DJIA) dropped 405.67 points, or 1.4%, to 28,992.41, while the S&P 500 fell 1.2% to 3337.75. The tech-heavy NASDAQ was down 1.6%, closing at 9576.59. Merger mania continued, as Franklin Resources (BEN) agreed to buy Legg Mason (LM) for $4.5 billion, and Morgan Stanley (MS) announced a $13 billion all-stock deal for E*Trade (ETFC). Stock market futures dropped over 2% Sunday night as global worries about the coronavirus epidemic accelerated, setting up what will be a very volatile week ahead on Wall Street.

Looking Ahead:

A bevy of retailers will report financials this week, signifying the tail end of fourth-quarter earnings season. Japanese bourses are closed on Monday in observance of the emperor’s birthday. HP Inc. (HPQ), Intuit (INTU) and Palo Alto Networks (PANW) release quarterly results. JP Morgan Chase (JPM) hosts its 2020 investor day in New York on Tuesday. American Tower (AMT), Home Depot (HD), Macy’s (M) and Bank of Montreal (BMO) announce earnings results. Wednesday brings financials from L Brands (LB), TJX Companies (TJX) and Crown Castle International (CCI). The Census Bureau reports new residential home sales for January – expectations call for a seasonally adjusted annual rate of 710,000 single-family homes sold, up 2.3% from December. Best Buy (BBY), Dell Technologies (DELL) and Autodesk (ADSK) report numbers on Thursday. The Census Bureau releases the Durable Goods report for January – economists look for a 0.9% decline. The business week ends with earnings results from AES (AES) and Occidental Petroleum (OXY) on Friday. The Institute for Supply Management reports its Chicago Purchasing Manager’s Index for February – expectations are for a 45 reading, up from January’s 42.5 print.

The Tufton Capital Team hopes that you have a wonderful week!