The Weekly View (3/2/20)

Last Week’s Highlights:

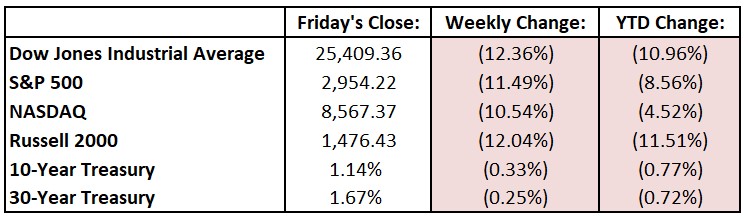

Equities plunged as the coronavirus spread beyond China. Pandemic fears shifted from China, where the outbreak began, to South Korea, Japan Italy and Iran. The United States reported its first case that couldn’t be traced overseas. Oil prices tumbled and “safe haven” assets soared – yields on 10-year Treasuries fell to record lows, and the yield-curve inverted. For the week the Dow Jones Industrial Average (DJIA) tumbled 3583.05 points, or 11.5%, to 25,409.36, while the S&P 500 fell 11.5% to 2954.22. The tech-heavy NASDAQ was down 10.5%, closing at 8567.37. Stock market futures were all over the place Sunday night, setting up what will be another very volatile week ahead on Wall Street.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. Monday brings earnings releases from Dentsply Sirona (XRAY) and Evergy (EVRG). The Census Bureau reports construction spending for January – consensus estimates call for a seasonally adjusted annual rate of $1.34 trillion, up 0.6% from December’s level. AutoZone (AZO), Nordstrom (JWN), Ross Stores (ROST) and Target (TGT) release financial results on Tuesday. It’s Super Tuesday in the Democratic primary, with a third of all delegates up for grabs as 14 states head to the polls. Wednesday brings earnings reports from Brown-Forman (BF), Campbell Soup (CPB) and Dollar Tree (DLTR). Exxon Mobil (XOM) webcasts its 2020 investor day on Thursday, and Burlington Stores (BURL), Kroger (KR) and H&R Block (HRB) report earnings. The Bureau of Labor Statistics (BLS) releases the jobs report for February on Friday – economists forecast a 175,000 rise in nonfarm payrolls and expect the unemployment rate to remain steady at 3.6%.

The Tufton Capital Team hopes that you have a wonderful week!