The Weekly View (3/9/20)

Last Week’s Highlights:

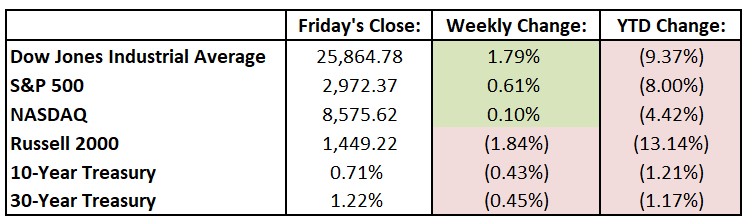

While it certainly didn’t feel like it, the three major U.S. stock market indexes posted modest gains last week following wild swings due to accelerating coronavirus fears and monetary stimulus hopes. (The Dow Jones Industrial Average (DJIA) was up 1293 (Monday), down 785 (Tuesday), up 1173 (Wednesday), down 969 (Thursday) and down 256 (Friday)). For the week, the Dow gained 455.42 points, or 1.8%, to 25,864.78, while the S&P 500 rose 0.6% to 2972.37. The tech-heavy NASDAQ advanced 0.1%, closing at 8575.62. By the end of the week, the yield on the 10-year U.S. Treasury note had fallen to 0.707%, its lowest on record. Stock market futures were crushed Sunday night (down over 4%), setting up what will be another very volatile week ahead on Wall Street.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. Monday brings earnings releases from Franco-Nevada (FNV) and Vail Resorts (MTN). Dick’s Sporting Goods (DKS) reports financial results on Tuesday. Qualcomm (QCOM) holds its annual shareholders meeting in San Diego. On Wednesday, the Treasury Department releases the U.S. monthly budget statement for February. For fiscal 2019, which ended in September, the federal deficit was $984 billion – the largest since 2012. The Congressional Budget Office projects a $1 trillion deficit for 2020. Thursday brings earnings reports from Adobe (ADBE), Broadcom (AVGO), Dollar General (DG) and Ulta Beauty (ULTA). The Bureau of Labor Statistics release the producer price index (PPI) for February – consensus estimates are for a flat reading, with the core PPI expected to rise 0.2%. Friday brings the University of Michigan’s release of its Consumer Sentiment index for March – economists forecast a 94 number, down from February’s 101 print.

The Tufton Capital Team hopes that you have a wonderful week!