The Weekly View (3/16/20)

Last Week’s Highlights:

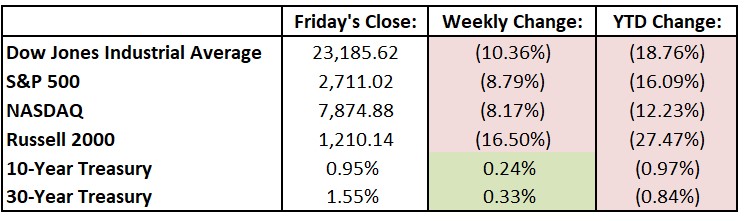

Equity markets finished sharply lower and entered into bear-market territory after the World Health Organization declared the coronavirus a global pandemic and oil prices saw the biggest one-day decline since 1991. Central banks and governments around the globe rushed to announce support measures amid event cancellations, school closures and work-from-home arrangements. For the week, the Dow fell 2,679 points, or 10.4%, to 23,185.62, while the S&P 500 dropped 8.8% to 2711.02. The tech-heavy NASDAQ lost 8.2%, closing at 7874.88. The week’s drop for the Dow Jones came despite an epic 1,985-point rally on Friday. The Federal Reserve took drastic emergency action Sunday evening to stabilize the economy. The Fed cut interest rates by a full percentage point and announced that it would buy $700 billion in Treasuries and mortgage-backed securities. Stock market futures were crushed Sunday night despite the Fed action (down over 4% – trading “limit down”), setting up what will be another very volatile week ahead on Wall Street.

Looking Ahead:

Global investors are preparing for another volatile ride following a week of frantic and at times disorderly trading. Monday brings earnings releases from Coupa Software (COUP) and Tencent Music Entertainment Group (TME). The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for March – consensus estimates call for a 0.5 reading, down from February’s 12.9 print. FedEx Corp. (FDX) announces financial results on Tuesday, and American Express (AXP) webcasts its 2020 Investor Day. Wednesday brings earnings from General Mills (GIS), and Agilent Technologies (A) and Starbucks (SBUX) host their annual shareholder meetings. The Census Bureau reports new residential construction data for February – economists look for a seasonally adjusted annual rate of 1.48 million housing starts, down from January’s 1.55 million. Accenture (ACN) and Darden Restaurants (DRI) report earnings on Thursday. The Conference Board releases its Leading Economic Index for February – consensus estimates are for a flat reading following a 0.8% gain in January. The National Association of Realtors reports existing-home sales for February on Friday – economists forecast a seasonally adjusted annual rate of 5.55 million homes sold, up 1.7% from January’s 5.46 million.

All of us at Tufton Capital wish you a good and safe week!