The Weekly View (12/17/18)

Last Week’s Highlights:

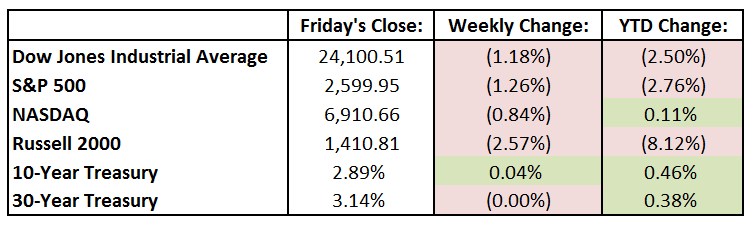

Last week began on a high note for U.S. equities, as low inflation numbers and China’s seeming concessions on trade helped move the market a bit higher through mid-week. The mood, however, turned sour by Friday, with news that the European Central Bank would cease its bond-buying program. This, combined with falling oil prices and slower economic data, led to another large selloff on Friday. For the week, the Dow Jones Industrial Average (DJIA) fell 1.18%, to 24,100.51, while the S&P 500 decreased 1.26% to 2599.95. The tech-heavy NASDAQ slipped 0.84% for the week to 6910.66. Corporate highlights included news Friday on Johnson & Johnson (JNJ), a member of the DJIA, with a Reuters report that the company had known that its talc and baby powder contained small amounts of asbestos. JNJ shares fell 10% for the day on this report. Internationally, England’s Prime Minister Theresa May delayed a House of Commons vote on the draft treaty for the U.K. to leave the European Union. On Wednesday, she survived a no-confidence vote, 200-117. Protests continued in France by the “yellow vest” movement, leading President Macron to promise tax cuts and a higher minimum wage.

Looking Ahead:

The week begins with Oracle (ORCL) reporting its fiscal second-quarter results. The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey, with Economists forecasting a reading of 20.2 for December (down from last month’s 23.3 reading). Merriam-Webster will also announce its Word of the Year Monday. The main focus for the week begins Tuesday, as the Fed meeting begins. We’ll also see quarterly results from Darden Restaurants (DRI), Micron Technology (MU) and FedEx (FDX). The Fed ends its meeting on Wednesday and present its “dot plot” on future interest rate changes. The Fed is expected to hike interest rates by 0.25%. Investors will be looking very carefully for changes in forward guidance and potential signals that the U.S. central bank might be slowing down the pace of rate hikes next year. Thursday brings earnings results from Accenture (ACN), Blackberry (BB), Conagra (CAG) and Nike (NKE). The Bank of Japan and the Bank of England announce interest rate decisions that day. Friday is quadruple witching day, when index futures, index options, stock futures and stock options simultaneously expire. Winter officially begins on Friday.

The Tufton Capital Team wishes you a very Happy Holiday!