The Weekly View (1/25 – 1/29)

What’s On Our Minds

Everyone has been talking about oil, so let’s revisit the energy markets this week. Oil is solidly above $30 a barrel- which sounds great until you remember that even sub-$50 was unthinkable not long ago. Talks and rumors abound suggesting that major oil-producing countries, if they perhaps aren’t about to enter a “grand bargain,” will at least move to stop the free fall. Additionally, some major US shale companies announced capital expenditure reductions, meaning 2016 supply should come down.

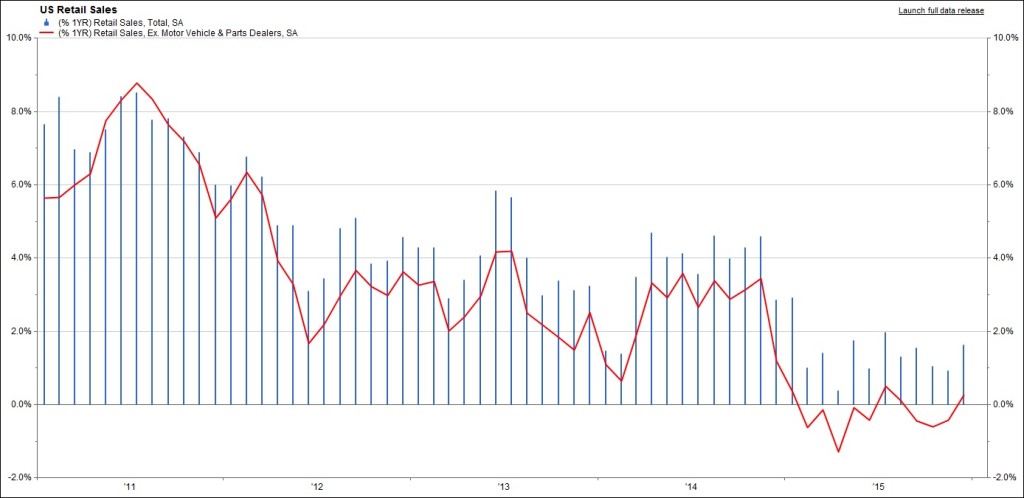

Also, what happened to the “oil dividend”? Prevailing theory is that a reduction in oil prices is like a check made out to the American consumer. Consumer demand hasn’t been awful (see chart), but it hasn’t been great, either. It seems Americans are saving their gas station discounts.

Last Week’s Highlights

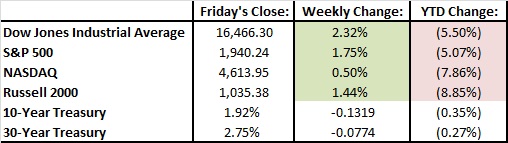

Last week’s numbers were saved by a big rally Friday that turned what would’ve been a down week into a gain of 1.8%. This is the second week of gains in a row, easing some concerns, but we must not (and we certainly don’t around here) forget that we are still down 5% for the year.

Looking Ahead

On Monday morning, the Institute of Supply Management (ISM) released their manufacturing PMI for the US, coming in at 48.2 vs 48.0 last month. Any reading under 50 indicates contraction. The Purchasing Manager’s Index indicates that manufacturers are still feeling the effects of global issues here in the US. We try not to get political here, but we will all certainly be closely watching the Iowa caucus and a new president’s potential effects on the US’ business environment.