The Weekly View (2/1 – 2/5)

What’s On Our Minds:

Just as the Broncos and Panthers went into Super Bowl 50 with a game plan, investors are re-positioning themselves for what many expect to be a year of decelerated growth. Thus far in 2016, it appears investors are going on the defensive as consumer staples, telecom, and utility stocks have held up during sell offs. Meanwhile, financial, healthcare, consumer discretionary, and technology stocks (which largely led the market in 2015) have sold off in face of a slowdown in the global economy. Although nobody welcomes an economic slowdown, as a value-focused firm, we are reassured that our inherently defensive investment approach prepares our clients’ portfolios for this type of environment.

Last Week’s Highlights:

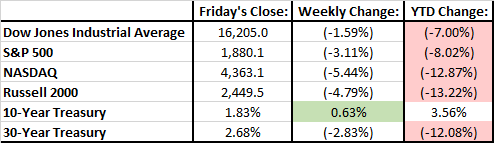

The volatility continued, with Friday capping off yet another turbulent week. Investors focused on oil, the US economy, and weakness in various industries’ corporate earnings, and there was not much good news to be delivered. The Dow Jones fell 1.6% on the week, and the S&P 500 dropped even more, closing down 3.1%. Technology shares were especially pressured, as earnings from companies such as LinkedIn (LNKD) and Tableau Software (DATA) disappointed shareholders. The tech-heavy NASDAQ finished last week down 5.4%.

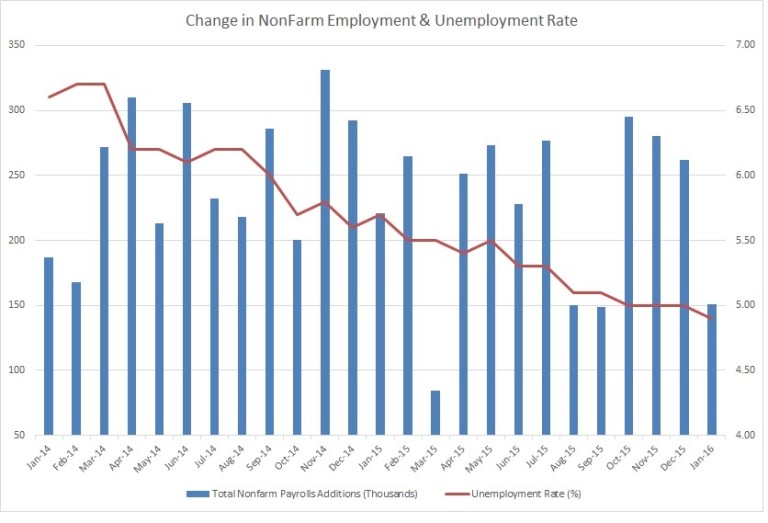

Friday’s jobs report came in below expectations, with the US economy adding 151,000 jobs in January (below economists’ 190,000 estimate). While the figure was slightly disappointing, other employment data was more promising: the unemployment rate dipped to 4.9% (from 5%) and average hourly earnings increased 0.5% in January.

Looking Ahead:

While earnings season is nearing its end, we’ll see 65 more reports this week from S&P 500 companies, including Coca-Cola (KO), Disney (DIS), Time Warner (TWX) and Cisco (CSCO). Of the 315 S&P companies that have reported so far, 77% have beaten earnings estimates, while only 46% have beaten revenue expectations. For the quarter, earnings have declined by 6% and sales by 5%.

The economic calendar remains relatively light this week, although reports on retail sales, import and export prices, and consumer sentiment will be released on Friday. Comments from Fed Chair Janet Yellen will be closely monitored this week, as she’s scheduled to deliver her semi-annual testimony to Congress on Wednesday and Thursday.