The Weekly View (4/13/20)

Last Week’s Highlights:

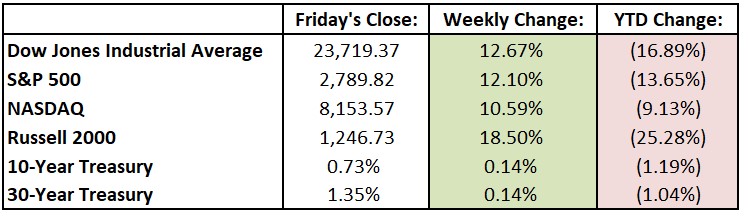

Equities rose to post one of their biggest weeks of gains, extending a solid rally despite evidence of increasing economic strain due to the coronavirus pandemic. Last week’s dismal jobless claims report (an additional 6.6 million claims were reported) was overshadowed by the Federal Reserve’s announcement of more lending backup. Oil prices surged as OPEC appeared to agree on cutting 10 million barrels a day in output. For the week, the Dow Jones Industrial Average (DJIA) rallied 2666.84 points, or 12.7%, to 23,719.37, while the S&P 500 rose 12.1% to 2789.82 – its best week since 1974 – and finished 25% off its March low. The tech-heavy NASDAQ increased 10.6%, closing at 8153.58.

Looking Ahead:

Many bourses are closed around the world on Monday, including Germany and the United Kingdom, in observance of Easter. Fastenal (FAST), J.B. Hunt Transport Services (JBHT) and Johnson & Johnson (JNJ) report earnings results on Tuesday. The International Monetary Fund releases its April 2020 World Economic Outlook – the IMF’s previous update in January forecasted global gross-domestic-product growth of 3.3% and 3.4% in 2020 and 2021, respectively. Wednesday brings financial results from Bank of America (BAC), Goldman Sachs Group (GS), UnitedHealth Group (UNH) and U.S. Bancorp (USB). The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey for April – expectations call for a minus 32 reading, down from March’s minus 21.5 print. Abbott Laboratories (ABT), Bank of New York Mellon (BK) and Taiwan Semiconductor Manufacturing (TSM) hold conference calls on Thursday to discuss earnings results. The Department of Labor releases initial jobless claims for the week ending on April 11th – over the past three weeks, an unprecedented 16.7 million people have filed unemployment claims. Kansas City Southern (KSU) and State Street (STT) report quarterly results on Friday.

All of us at Tufton Capital wish you a safe and healthy week!