The Weekly View (4/20/20)

Last Week’s Highlights:

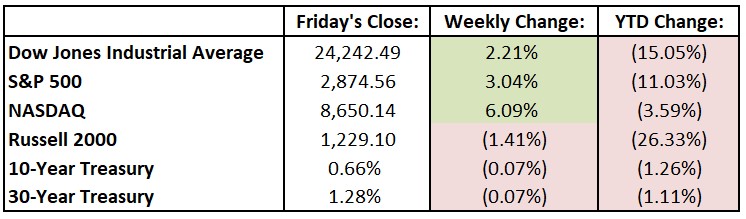

Equities rose for the second week in a row, extending a solid rally despite evidence of increasing economic strain due to the coronavirus pandemic. The stock market’s recent strength is a sign that many investors are positioning their portfolios believing that the U.S. will make a speedy recovery when the coronavirus crises eases. Wall Street has been encouraged in recent days by signs that several states will move to resume business, along with hopes that a viable treatment for Covid-19 could be near. For the week, the Dow Jones Industrial Average (DJIA) rose 523.12 points, or 2.2%, to 24,242.49, while the S&P 500 was up 3.0% to 2874.56 and finished 22% off its March low. The tech-heavy NASDAQ increased 6.1%, closing at 8650.14. Earnings season began last week with mixed results. Management teams from JP Morgan Chase (JPM) and Wells Fargo (WFC) predicted a deep recession, and data from oil companies and retailers was, as expected, weak. On a brighter note, an upbeat early report on Gilead Science’s (GILD) Covid-19 treatment added to a significant stock rally on Friday.

Looking Ahead:

Earnings season picks up, beginning with reports from Cadence Design Systems (CDNS), Equifax (EFX), Halliburton (HAL) and Truist Financial (TFC) on Monday. The Federal Reserve Bank of Chicago releases its National Activity Index for March – economists forecast a minus 0.56 reading, below February’s 0.16 print. Chipotle Mexican Grill (CMG), Chubb (CB), Coca-Cola (KO), Emerson Electric (EMR) and Lockheed Martin (LMT) all report financial results on Tuesday. The National Association of Realtors releases existing-home sales data for March – consensus estimates are for a seasonally adjusted annual rate of 5.47 million homes sold, 5.2% below February’s 5.77 million figure. Wednesday brings earnings results from AT&T (T), Biogen (BIIB) and Delta Air Lines (DAL). Capital One Financial (COF), Intel (INTC), Union Pacific (UNP) and Eli Lilly (LLY) announce financial results on Thursday. The Department of Labor releases its initial jobless claims for the week ending on April 18th – over the past month, 22 million people have applied for unemployment benefits, roughly double the total in all of 2019. American Express (AXP) and Verizon Communications (VZ) hold conference calls on Friday to discuss quarterly results. The Census Bureau reports the durable goods number for March – consensus estimates are for a 11% decline in orders for manufactured durable goods.

All of us at Tufton Capital wish you a safe and healthy week!