The Weekly View (4/27/20)

Last Week’s Highlights:

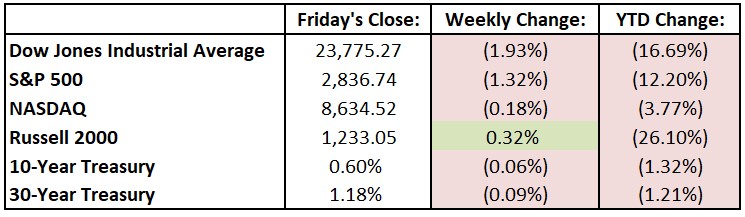

Stocks and bonds fell sharply early in the week as oil futures crashed, then roared back after another stimulus bill was announced. Earnings season for U.S. companies continued, and more weak economic numbers were released – it was reported that an additional 4.4 million Americans are seeking jobless benefits. For the week, the Dow Jones Industrial Average (DJIA) dropped 467.22 points, or 1.9%, to 23,775.27, while the S&P 500 was down 1.3% to 2836.74 and finished 23% above its March low. The tech-heavy NASDAQ declined 0.2%, closing at 8634.52. Late last week, the World Health Organization accidently released what appeared to be disappointing results from a trial of Gilead Sciences’ (GILD) remdesivir, a potential treatment for COVID-19. While this release caused a 400+ point drop in the Dow on Thursday, the index roared back Friday to close up 260 points, or 1.11% on the day.

Looking Ahead:

We’re in the thick of first-quarter earnings season – 142 S&P 500 components release results this week, followed by a similar number next week. The week begins with financial results from CMS Energy (CMS) and NXP Semiconductors (NXPI) on Monday. Tuesday is a busy one for more earnings, as 3M (MMM), Caterpillar (CAT), Mondelez International (MDLZ) and United Parcel Service (UPS) are among a bevy of companies reporting. The Bank of Japan announces its monetary-policy decision – the central bank is expected to keep its key short-term interest rate at negative 0.1%. Wednesday brings financial results from Anthem (ANTM), Automatic Data Procession (ADP), General Electric (GE) and Northrop Grumman (NOC). The Bureau of Economic Analysis reports its initial estimate of GDP for the first quarter – economists forecast an annualized 4% contraction, compared with a 2.1% growth rate in the fourth quarter of 2019. Altria Group (MO), Apple (APPL), Visa (V) and Comcast (CMCSA) are among the many companies reporting numbers on Thursday. The busy business week ends with results from Chevron (CVX), Honeywell International (HON), Colgate-Palmolive (CL) and Charter Communications (CHTR) on Friday. The Institute for Supply Management reports its Manufacturing Purchasing Managers’ Index for April – expectations are for a 36.1 reading, down from March’s 49.1 print.

All of us at Tufton Capital wish you a safe and healthy week!