The Weekly View (5/4/20)

Last Week’s Highlights:

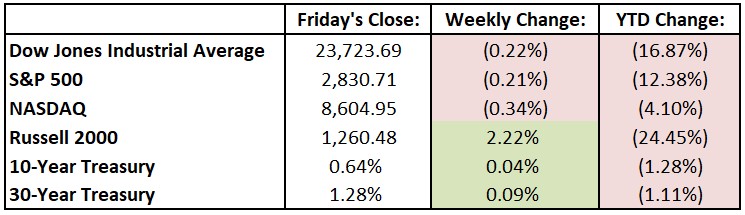

Equities started the week on a positive note, with the S&P 500 rising 3.6% during the first three days, only to fall 3.7% on Thursday and Friday. Even though stocks finished mixed last week, April was the best month since 1987 for the market (up 12.9%!). A slowdown in new coronavirus cases and synchronized initiatives globally have improved trader sentiment from the March 23rd stock market bottom. Earnings season continued with Apple (AAPL) and Amazon.com (AMZN), among many others, reporting financials. Dire economic data, while expected, dampened investors’ moods, as 3.8 million more jobless claims were reported, and March consumer spending fell 7.5%. For the week, the Dow Jones Industrial Average (DJIA) dropped 51.58 points, or 0.2%, to 23,723.69, while the S&P 500 was down 0.2% to 2830.71. The tech-heavy NASDAQ declined 0.3%, closing at 8604.95. Only the small-cap Russell 2000 was able to finish the week higher, up 2.2% to 1260.48.

Looking Ahead:

We’re in the thick of first-quarter earnings season – 150 S&P 500 components release results this week, including big names in media and food. The week begins with financial results from Mosaic (MOS), Tyson Foods (TSN) and Sempra Energy (SRE). On Tuesday, Walt Disney (DIS), DuPont (DD) and Martin Marietta Materials (MLM) report Q1 numbers. American Express (AXP) and General Electric (GE) hold their annual shareholder meetings. Look for earnings results from Ameriprise Financial (AMP), General Motors (GM) and Zoetis (ZTS) on Wednesday. On Thursday, the Department of Labor releases initial jobless claims for the week ending on May 2nd. In the past six weeks, more than 30 million Americans have filed for unemployment benefits, roughly 18% of the workforce. Bristol-Myers Squibb (BMY), Viacom CBS (VIAC) and Raytheon Technologies (RTX) announce earnings. Friday brings financials from Noble Energy (NBL) and Carrier Global (CARR). The Bureau of Labor Statistics releases the jobs report for April – economists call for a decline of 21 million nonfarm payrolls, after a loss of 701,000 in March. The unemployment rate is expected to rise significantly from 4.4% to over 16%.

All of us at Tufton Capital wish you a safe and healthy week!