The Weekly View (5/20/19)

Last Week’s Highlights:

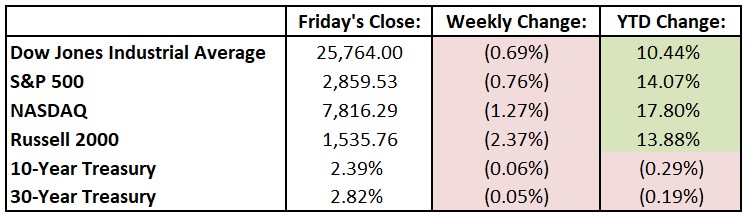

Major U.S. equity markets slumped for yet another week as trade disputes between Washington and Beijing continued. All three U.S. indexes posted weekly declines, with the Dow Jones Industrial Average (DJIA) posting its longest losing streak since May of 2016, and the S&P 500 and NASDAQ recording two straight weeks of losses. Last week began with a bang, as the S&P 500 index dropped 2.5% on Monday when investors realized that the trade war would not end quietly. Markets spent the rest of the week making back Monday’s losses. For the past week, the DJIA declined 178.37 points, or 0.7%, to 25,764.00, while the S&P 500 fell 0.8% to 2859.53. The tech-heavy NASDAQ dropped 1.3%, closing at 7816.28. The trade news wasn’t all negative, nor was it solely between the U.S. and China. On Friday, the Trump administration agreed to drop tariffs on steel and aluminum imports from Canada and Mexico. The two countries dropped their own retaliatory measures in response. The agreement clears the way for the U.S.-Mexico-Canada Agreement (USMCA), which is intended to replace Nafta. Congressional approval is still needed.

Looking Ahead:

The week begins with annual shareholder meetings hosted by Consolidated Edison (ED) and Omnicom Group (OMC) in New York and Boston, respectively. The Federal Reserve Bank of Chicago releases its National Activity Index for April – consensus estimates call for a 0.08 reading, up from March’s -0.15 print. Canadian markets are closed Monday in observance of Victoria Day. On Tuesday, AutoZone (AZO), Home Depot (HD), Nordstrom (JWN) and TJX Companies (TJX) report their quarterly financial results. The National Association of Realtors reports existing-home sales data for April – economists forecast a seasonally adjusted annual rate of 5.3 million, up 2% from March’s 5.2 million sales number. Wednesday brings earnings results from Target (TGT), Lowe’s (LOW), VF (VFC) and Analog Devices (ADI). The Federal Open Market Committee release minutes from its monetary-policy meeting that concluded earlier this month. Amazon.com (AMZN) holds its annual meeting of stockholders in Seattle. Expect financial results on Thursday from Best Buy (BBY), Hewlett Packard (HPE) and Intuit (INTU). The United Kingdom holds European parliamentary elections. Voting in the other 27 European Union (EU) member states takes place over the next four days through Sunday. The Census Bureau releases new-home sales data for April – expectations call for a seasonally adjusted annual rate of 678,000 new single-family home sales, down from March’s rate of 692,000. On Friday, Foot Locker (FL) holds a conference call to discuss quarterly financial results. The Census Bureau releases its Durable Goods report for April – new orders for durable goods are seen declining 2% after rising 2.8% in March.

The Tufton Capital Team hopes that you have a wonderful week!