The Weekly View (5/13/19)

Last Week’s Highlights:

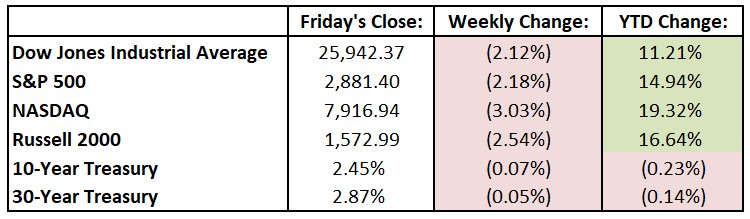

Elevated trade and tariff tensions took center stage last week and set the mood for global equities. The market had been counting on a trade deal between the U.S. and China, so stocks sold off as the rhetoric out of the White House increased. The U.S. levied new tariffs on $200 billion of Chinese goods Friday and threatened more, even as the 11th trade meeting between the U.S and China took place in Washington. For the past week, the Dow Jones Industrial Average (DJIA) declined 562.58 points, or 2.1%, to 25,942.37, while the S&P 500 fell 2.2% to 2881.40. The tech-heavy NASDAQ dropped 3.0%, closing at 7916.94. Ride-hailing leader Uber Technologies (UBER) went public on Friday, pricing its IPO at $45 per share (valuing the company at $82.4 billion). The stock opened at $42 and closed the day at $41, hardly a solid first day of trading. Apparently Wall Street isn’t buying Silicon Valley’s excitement about ride hailing and the sharing economy. On top of Uber’s weak IPO, rival Lyft’s (LYFT) stock is down 30% since its March initial offering. Trade anxieties continued through the weekend, resulting in S&P 500 futures falling sharply on Sunday night.

Looking Ahead:

Earnings season winds down this week, with only nine companies in the S&P 500 reporting their first-quarter results. Investors will continue to focus closely on continued comments from President Trump (please see details above) and their impact on trade developments and global markets. Monday brings financial reports from Legg Mason (LM) and Take-Two Interactive (TTWO). The Federal Reserve Bank of Boston will host a FedListens conference. On Tuesday, Ralph Lauren (RL), Agilent Technologies (A) and Container Store (TCS) are among companies reporting financial results. Trade results will be reported – prices for U.S. imports are expected to rise 0.7% in April, after increasing 0.6% in March. U.S. export prices are expected to advance 0.6% in April after rising 0.7% in March, according to the Bureau of Labor Statistics. On Wednesday, look for financial results from Cisco Systems (CSCO), Macy’s (M), Alibaba Group Holding (BABA) and Tencent Holding (TME). The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market index for May – economists forecast a 64 reading, up from April’s 63. Walmart (WMT), Applied Materials (AMAT) and Pinterest (PINS) report their earnings results on Thursday. The Census Bureau releases housing starts for April – economists forecast 1.22 million seasonally adjusted annual units, up from March’s 1.14 million unit change. On Friday, the Conference Board reports its Leading Economic Index for April – expectations call for a 0.2% rise after a 0.4% gain in March. The University of Michigan releases its preliminary Consumer Sentiment index – estimates call for a reading of 97.5 in May, up slightly from April’s 97.2 print.

The Tufton Capital Team hopes that you have a wonderful week!