The Weekly View (5/6/19)

Last Week’s Highlights:

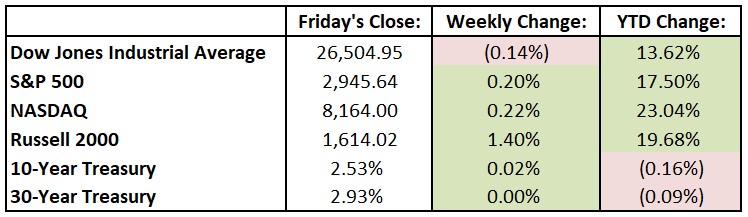

U.S. equities rallied on Friday (up 1% on the day), moving the S&P 500 to positive territory for the week and leaving it just below its recent record. A more accommodative stance from central banks, rising earnings and signs of easing trade tensions (more on that below) continue working together to keep the market moving higher. For the past week, the Dow Jones Industrial Average (DJIA) slipped 38.38 points, or 0.1%, to 26,504.95, while the S&P 500 advanced 0.2% to 2945.64. The tech-heavy NASDAQ was up 0.2%, closing at 8164.00, capping off its best four-month start to a year since 1991. The main driver for last week’s market strength was corporate earnings. With earnings season more than three-quarters over, corporate profits appear to be on track for modest gains (0.9%) in the first quarter. While these gains are small, they’re much better than feared going into reporting season. On the economic front, Friday’s jobs report was above expectations, with nonfarm payrolls increasing by a seasonally adjusted 263,000, the Labor Department reported. The unemployment rate ticked down to 3.6%, the lowest level in 50 years. The news wasn’t all rosy, as President Trump threatened to drastically ramp up U.S. tariffs on Chinese imports, a surprise twist to the recently positive trade talks. In a pair of Twitter messages Sunday, the president wrote that he planned to raise levies on $200 billion in Chinese imports to 25% starting Friday, from 10% currently. He added that he would impose 25% tariffs “shortly” on $325 billion in Chinese goods that haven’t yet been taxed. These developments resulted in S&P 500 futures falling sharply on Sunday night.

Looking Ahead:

Earnings season winds down this week, with only 10% of the companies in the S&P 500 reporting their first-quarter results. Investors will be focusing closely on Sunday’s Twitter comments by President Trump (please see details above) and their impact on trade developments and global markets. Monday brings financial reports from American International Group (AIG), Kilroy Realty (KRC) and Occidental Petroleum (OXY). Aflac (AFL) and Eli Lilly (ELI) hold their annual meetings of stockholders in Columbus, Ga., and Indianapolis, respectively. Expect earnings results on Tuesday from Allergan (AGN), Anheuser-Busch InBev (BUD), Lyft (LYFT) and Sempra Energy (SRE). American Express (AXP) and Danaher (DHR) hold their annual meetings of stockholders in New York and Washington, D.C., respectively. The Bureau of Labor Statistics releases its Jobs Openings and Labor Turnover survey for March – economists forecast 7.1 million job openings in March, even with February. Walt Disney (DIS), Microchip Technology (MCHP) and Marathon Petroleum (MPC) report earnings on Wednesday. Intel (INTC) holds an investor meeting in Santa Clara, Ca. On Thursday, look for financial results from Cardinal Health (CAH), Becton Dickinson (BDX) and Symantec (SYMC). The Bureau of Labor Statistics releases the producer price index (PPI) for April – economists look for a 0.3% increase in wholesale prices after a 0.6% rise in March. On Friday, ride-sharing giant Uber Technologies begins trading under the ticker symbol UBER. The company is going public by selling shares at an expected range of $44 to $50, which would value Uber at over $80 billion. Viacom (VIA) and Marriott International (MAR) report their first-quarter financial results.

The Tufton Capital Team hopes that you have a wonderful week!