The Weekly View (4/29/19)

Last Week’s Highlights:

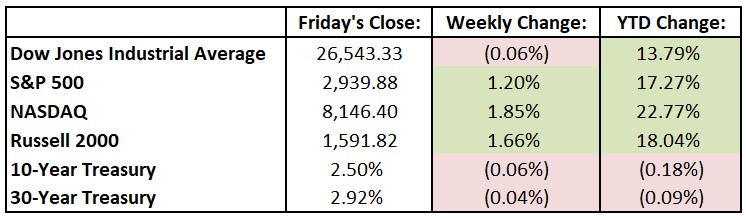

U.S. equities rallied to record closing highs – the S&P 500 and the tech-heavy NASDAQ hit record levels on Tuesday before slightly losing ground on Wednesday. A more accommodative stance from central banks, rising earnings and signs of easing trade tensions continue working together to keep the market moving higher. For the past week, the Dow Jones Industrial Average (DJIA) slipped 16.21 points, or 0.06%, to 26,543.33, while the S&P 500 advanced 1.2% to 2939.88. The NASDAQ was up 1.85%, closing at 8146.40. The main driver for last week’s market strength was corporate earnings. With over 40% of the S&P 500 companies having reported results, corporate profits appear to be on track for small gains in the first quarter, supporting current market valuations. On the economic front, Friday’s Q1 gross domestic product (GDP) number came in above expectations – the U.S. economy grew at a 3.2% pace in the first quarter, accelerating from 2.2% at the end of 2018. On the big screen, “Avengers: Endgame” became the first film in Hollywood history to gross more than $1 billion in its worldwide box office debut over the weekend.

Looking Ahead:

First-quarter earnings season remains in full swing this week. Monday brings financial reports from Google-parent Alphabet (GOOG), MGM Resorts International (MGM), SBA Communications (SBAC) and Western Digital (WDC). The Bureau of Economic Analysis releases personal income data for March – economists forecast a 0.4% rise in personal income after a 0.2% gain in February. Boeing (BA) and Honeywell International (HON) hold their annual meetings of stockholders in Chicago and Morris Plains, NJ, respectively. Tuesday is another bevy of financial results, including numbers from Advanced Micro Devices (AMD), Amgen (AMGN), Apple (AAPL), General Motors (GM) and Mondelez International (MDLZ). The Conference Board releases its Consumer Confidence Index for April – expectations call for a 125.4 reading, a slight increase from March’s 124.1 print. Wednesday is May Day – the Federal Open Markets Committee (FOMC) announces its monetary-policy decision. The central bank is widely expected to keep its benchmark federal-funds rate unchanged at 2.25% to 2.5%. Automatic Data Processing (ADP), CVS Health (CVS), Qualcomm (QCOM) and CME Group (CME) report earnings. On Thursday, look for financial results from Cigna (CI), Dow (DOW), DowDuPont (DWDP), Kellogg (K) and Under Armour (UA). The BLS releases productivity and labor-costs data for the first quarter – nonfarm productivity is expected to rise 1%, down from the 1.9% report in the last quarter of 2018. The busy business week ends with earnings reports from American Tower (AMT), Dominion Energy (D) and Noble Energy (NBL) on Friday. The BLS releases its Employment Situation Summary for April – economists forecast a 175,000 rise in nonfarm payrolls. Down from March’s 196,000 gain.

The Tufton Capital Team hopes that you have a wonderful week!