The Weekly View (4/22/19)

Last Week’s Highlights:

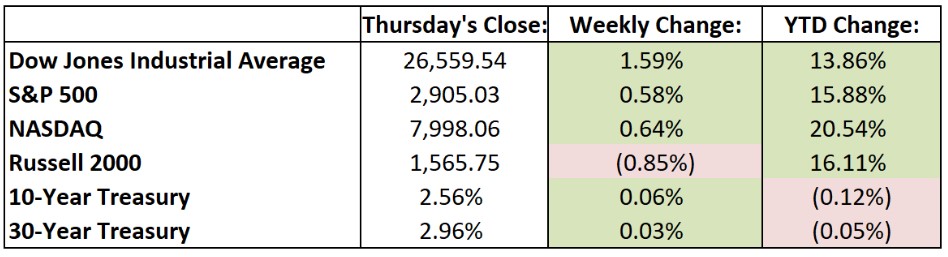

In a holiday-shortened week of trading, equities were essentially flat. Weakness in the health care sector due to increasing political headlines was offset by solid gains in industrial stocks, driven by solid earnings results and better-than-expected manufacturing data from China. It was a very quiet four days on Wall Street trading desks, as anemic trading volumes were some of the lowest seen in the past year. The Cboe Volatility Index, or VIX (also known as the “fear index” – it’s a popular measure of the stock market’s expectation of volatility implied by S&P 500 index options), slipped below 13, further reflecting the current relatively complacent environment for many investors. For the past week, the Dow Jones Industrial Average (DJIA) rose 147.24 points to 26,559.54, while the S&P 500 dipped just over 2 points to 2905.03. The tech-heavy NASDAQ edged up slightly, closing at 7998.06. Apple (AAPL) and Qualcomm (QCOM) settled hours after a case in federal court began on iPhone patent royalties – QCOM shares rallied on the news. Strength in the initial public offering (IPO) market continued as Pinterest priced at $19 per share – two dollars above its expected range – resulting in a valuation of $12.6 billion. Later in the week, the stock rose 28% to $24.40.

Looking Ahead:

First-quarter earnings season takes center stage this week, with about one-third of the S&P 500 components reporting financial results. Monday brings earnings reports from Halliburton (HAL), Kimberly-Clark (KMB), Zions Bancorp (ZION) and Cadence Design Systems (CDNS). Many markets across the globe, including those in Germany, Hong Kong and the United Kingdom, are closed in observance of Easter. Tuesday is full of more earnings reports with numbers expected from Coca-Cola (KO), Harley-Davidson (HOG), Procter & Gamble (PG), Nucor (NUE) and Verizon Communications (VZ). Northern Trust (NTRS) and Wells Fargo (WFC) host their annual stockholders meeting in Chicago and Dallas, respectively. The Census Bureau reports new-home sales data for March – economists forecast a 652,000 seasonally adjusted annual rate, down from February’s 667,000 print. Wednesday brings financial results from Anthem (ANTM), Caterpillar (CAT), Visa (V), Microsoft (MSFT) and General Dynamics (GD), among many others. Thursday includes earning reports from Amazon.com (AMZN), Ford Motor (F) and Bristol-Myers Squibb (BMY). The Bank of Japan announces its monetary policy – expectations call for the central bank to keep its key short-term interest rates at negative 0.1%. The busy business week ends on Friday with earnings numbers from Chevron (CVX), Exxon Mobil (XOM) and Archer-Daniels-Midland (ADM).

The Tufton Capital Team hopes that you have a wonderful week!