The Weekly View (6/3/19)

Last Week’s Highlights:

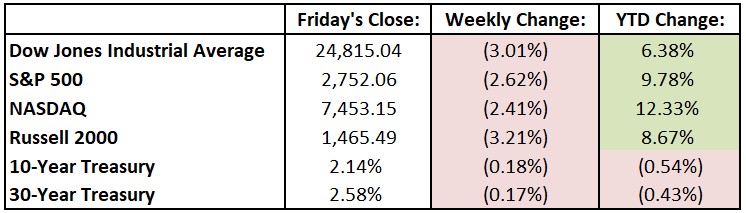

The continued stalemate between the U.S and China on a potential trade deal continued to pressure equity markets. Rhetoric from politicians on tariffs and trade once again resulted in share weakness of companies that rely on sales in China and those that buy supplies there. Things got even more volatile late in the week when President Trump announced that the U.S. will impose 5% tariffs on Mexican imports due to the border crisis. The Dow Jones Industrial Average (DJIA) closed lower for a sixth consecutive week, its longest such losing streak since 2011. For the past week, the DJIA declined 770.65 points, or 3.01%, to 24,815.04, while the S&P 500 fell 2.6% to 2752.06. The tech-heavy NASDAQ dropped 2.4%, closing at 7453.15. While May marked the largest stock market pullback this year, bonds rallied significantly, with the 10-year Treasury ending the week at 2.14%, the lowest level in 21 months.

Looking Ahead:

The business week begins with quarterly earnings results from Box Inc. (BOX) and Coupa Software (COUP). President Trump begins a three-day state visit to the United Kingdom. The Institute for Supply Management reports its Manufacturing Purchasing Managers’ Index for May – economists forecast a 53 reading, about even with April’s print. Salesforce.com (CRM), Tiffany (TIF) and Navistar International (NAV) report financials on Tuesday. General Motors (GM) hosts its annual meeting of stockholders – the meeting will be online only. The Census Bureau reports factory orders for April – estimates call for a 0.9% decline after a 1.9% rise in March. Look for earning releases from Campbell Soup (CPB), Five Below (FIVE) and Brown-Forman (BF) on Wednesday. Walmart (WMT) holds its annual shareholder meeting in Rogers, Ark. ADP releases its National Employment Report for May – economists forecast a 178,000 gain in private sector jobs after a 275,000 increase in April. Vail Resorts (MTN) and J.M. Smucker (SJM) report earnings on Thursday. Netflix (NFLX) holds its annual meeting of shareholders online. The European Central Bank announces its monetary-policy decision – the ECB is widely expected to keep its key short-term interest rate at negative 0.4%. On Friday, the Department of Labor releases the jobs report for May – the unemployment rate is estimated to remain at a 50-year low of 3.6%. Nonfarm employment is expected to increase by 183,000, down from April’s 263,000 print. Theresa May steps down as Conservative Party leader after a three-year tenure. She will stay on as U.K. prime minister until her successor is elected this summer. Financial markets in China and Hong Kong are closed in observance of the Duanwu Festival, also known as the Dragon Boat Festival.

The Tufton Capital Team hopes that you have a wonderful week!