The Weekly View (6/10/19)

Last Week’s Highlights:

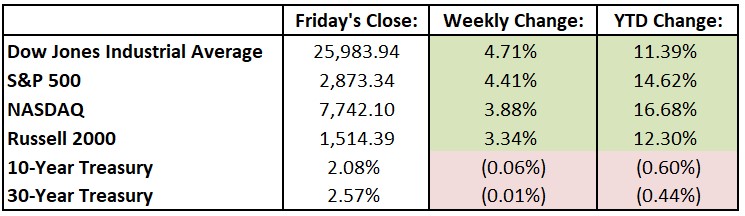

The Dow Jones Industrial Average (DJIA) extended its rally Friday, resulting in the best week for the index in over six months. Investor optimism that the Federal Reserve will cut interest rates was the main driver of recent market strength. Fed Chairman Jerome Powell stated that the central bank would “act as appropriate to sustain the expansion”, alluding to a possible rate cut as a solution to contracting economic data. The Dow rose over 500 points on the day of these comments, followed by a 200+-point rise the following day after private-sector employment data showed a large drop in hiring. For the week, the DJIA rallied 1,168.90 points, or 4.7%, to 25,983.94, while the S&P 500 rose 4.4% to 2873.34. The tech-heavy NASDAQ advanced 3.9%, closing at 7742.10. The Dow is now off just 3.1% from its October record, while the S&P 500 is within 2.5% of its April 30th closing high. Over the weekend, President Trump announced that proposed tariffs on Mexican imports would be suspended indefinitely. Trump said in a Twitter post that he has “full confidence” that Mexico will crack down on migration from Central America. Adding to the bullish sentiment was the announcement of a blockbuster deal in the aerospace industry, as Raytheon (RTN) and United Technologies (UTX) announced an all-stock merger that would create a combined company with $74 billion in annual revenues. Both company stocks rallied in premarket trading.

Looking Ahead:

DuPont de Nemours (DD), formally known as DowDuPont, hosts a conference call on Monday to discuss financial guidance as a stand-alone company. The corporation completed spinoffs of both Dow (DOW) and Corteva (CTVA) earlier this year. The Bureau of Labor Statistics reports its Job Openings and Labor Turnover Survey for April – economists forecast 7.4 million job openings at the end of April, about even with March’s report. On Tuesday, HD Supply Holdings (HDS) and H&R Block (HRB) release their quarterly financial results. Best Buy (BBY) hosts its annual meeting of stockholders online. The BLS releases its producer price index (PPI) for May – expectations call for a year-over-year rise of 2.1% after a 2.2% gain in April. Lululemon Athletica (LULU) reports earnings on Wednesday, and Caterpillar (CAT) and Target (TGT) host annual shareholder meetings in Clayton, N.C., and Columbus, Ohio, respectively. The BLS reports the consumer price index (CPI) for May – economists forecast the annual rate to rise 1.9%. The core CPI is expected to increase 2.1%. Both rates would be about even with April’s prints. Broadcom (BRCM) reports financial results on Thursday. Campbell Soup (CPB) hosts an investor day in Camden, N.J. Friday brings another initial public offering (IPO), as Chewy, the online pet-products retailer, is expected to begin trading on the NYSE under the ticker CHWY. The company plans to go public at $17 to $19 a share, which would result in a market capitalization of $7.5 billion. Centene (CNC) and Corning (GLW) host investor days in New York. The Census Bureau releases retail sales data for May – estimates call for a 0.6% increase after a 0.2% decline in April.

The Tufton Capital Team hopes that you have a wonderful week!