The Weekly View (6/17/19)

Last Week’s Highlights:

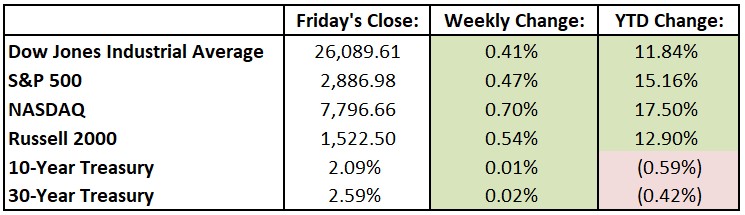

Stocks edged up early last week as the U.S. announced that it would not levy tariffs on Mexican imports. Markets sagged a bit mid-week as Chinese trade rhetoric picked up, followed by disappointing financial results reported by Broadcom (AVGO). The company lowered its full-year sales guidance by $2 billion, warning that the U.S.-China trade tensions are dampening demand. There was bad geopolitical news as the U.S. blamed Iran for attacking two tankers carrying petroleum products. Despite these negative reports, the Dow Jones Industrial Average (DJIA) extended its recent strength and rose 105.67 points, or 0.4%, to 26,089.61, while the S&P 500 rose 0.5% to 2886.98. The tech-heavy NASDAQ advanced 0.7%, closing at 7796.66. After last week’s market rise, the S&P 500 is up 4.9% in June and just 2% shy of its record close. The index is having a difficult time breaking through the 2900 mark, a level that has been identified as resistance by technical analysts. The initial public offering (IPO) calendar remained strong, as a number of companies made their public debut, including Crowd-Strike Holdings (CRWD), Fiverr (FVRR) and Chewy (CHWY). It was a big week for sports fans, as the St. Louis Blues won hockey’s Stanley Cup, and Toronto’s Raptors edged past the Golden State Warriors to capture their first NBA title. Gary Woodland won golf’s U.S. Open late Sunday at Pebble Beach.

Looking Ahead:

The National Association of Home Builders releases the NAHB/Wells Fargo Housing Market Index for June on Monday – economists forecast a 66 reading, equal to May’s print. The Federal Reserve Bank of New York reports its Empire State Manufacturing Survey for June – consensus estimates call for a 11 reading, down from May’s 17.8. On Tuesday, Adobe (ADBE) reports its financial results. MetLife (MET) hosts its annual shareholder meeting in New York. The Census Bureau releases data on new residential construction for May – estimates call for 1.25 million housing starts at a seasonally adjusted rate. The Federal Open Market Committee (FOMC) announces its monetary-policy decision on Wednesday – the futures market predicts a 25% chance that the Fed will cut the federal-funds rate by a quarter of a percentage point, to 2%-2.25%. The Fed’s tone regarding possible rate cuts later in the year will be especially interesting to investors. Oracle (ORCL) reports earnings results. Look for financial results from Darden Restaurants (DRI), Kroger (KR) and Red Hat (RHT) on Thursday. The Bank of England and the Bank of Japan announce their monetary-policy decisions. Both central banks are expected to keep their key short-term rates unchanged at 0.75% and minus 0.1%, respectively. The business week ends with earnings results from CarMax (KMX) on Friday. The National Association of Realtors reports existing-home sales data for May – expectations call for a seasonally adjusted annual rate of 5.3 million home sales, up from April’s 5.2 million.

The Tufton Capital Team hopes that you have a wonderful week!