The Weekly View (6/24/19)

Last Week’s Highlights:

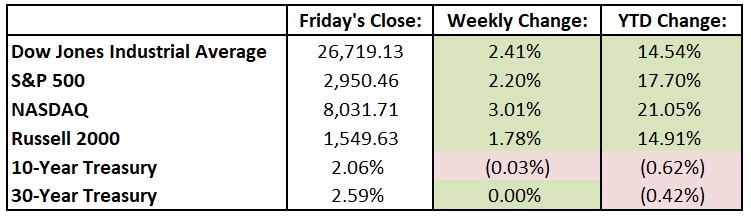

U.S. equities continued their winning ways last week, as equities set records on Thursday after the Federal Reserve and European Central Bank promised to ease interest rates if needed. Bond yields and the dollar fell, and oil rose as U.S. tensions with Iran escalated. For the week, the Dow Jones Industrial Average (DJIA) increased 629.52 points, or 2.4%, to 26,719.13, while the S&P 500 advanced 2.2% to 2950.46. The tech-heavy NASDAQ gained 3% to 8013.71. Stock markets have shown strength all month, as the S&P has advanced 7.2% despite lingering trade tensions and earlier uncertainty over the future of Federal Reserve policy. The index is heading towards its best June since 1955.

Looking Ahead:

Centene (CNC) and WellCare Health Plans (WCG) hold shareholder meetings on Monday in St. Louis and New York, respectively. Centene agreed to acquire WellCare in late March in a deal valued at $17.3 billion. FedEx (FDX), Lennar (LEN) and Micron Technology (MU) release financial results on Tuesday. The Census Bureau reports new-home sales data for May – consensus estimates call for a seasonally adjusted annual rate of 677,500, up from April’s 673,000 print. The Federal Housing Finance Agency releases its House Price Index for April – expectations are for a 0.2% rise after a 0.1% increase in March. Look for earnings results from General Mills (GIS), IHS Markit (INFO) and Paychex (PAYX) on Wednesday. Boston Scientific (BSX) hosts an investor day in New York. The Census Bureau reports its Durable Goods report for May – new orders for durable goods are expected to rise 0.1% after a 2.1% drop in April. Accenture (ACN), McCormick (MKC), Nike (NKE) and Conagra Brands (CAG) report quarterly results on Thursday. The Bureau of Economic Analysis reports the third and final estimate for first-quarter gross domestic product. Real GDP for the first quarter increased at an annual rate of 3.1% and is expected to remain unchanged with the final release. The business week ends with Constellation Brands (STZ) reporting financial results on Friday. The two-day G20 Summit convenes in Osaka, Japan, and all eyes will be on President Donald Trump and China’s President Xi Jinping and their ongoing trade discussions. The Institute for Supply Management releases its Chicago Purchasing Manager Index for June – consensus estimates call for a 54.4 reading, up from May’s 54.2.

The Tufton Capital Team hopes that you have a wonderful week!