The Weekly View (7/1/19)

Last Week’s Highlights:

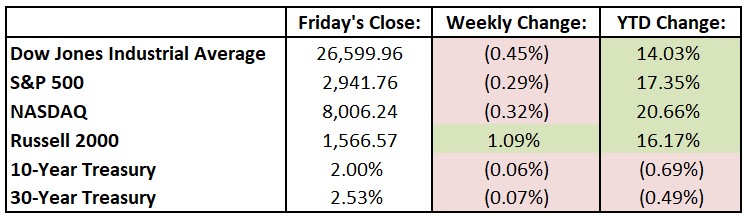

Equity markets finished the week mixed as investors anxiously awaited trade news from the G-20 Summit in Japan. Friday marked the end of the quarter and the first half of 2019 as well as an important milestone: the 10th anniversary of the current economic expansion. For the week, the Dow Jones Industrial Average (DJIA) dropped 119.17 points, or 0.4%, to 26,599.96, while the S&P 500 slipped 0.3% to 2941.76. The tech-heavy NASDAQ declined 0.3% to 8006.24. For the month, the S&P 500 gained 6.9%, its best June since 1955. The index rose 17% for the first six months of 2019, its strongest first half since 1997. The Dow increased 14% during the first six months of the year, its best first half since 1999. Over the weekend, investors received the positive news they were hoping for. At the G-20, the U.S. and China agreed to hold off on implementing additional tariffs on their products in an effort to resume trade talks. Stock market futures rallied Sunday night, and U.S. markets are on track to open at record highs Monday morning.

Looking Ahead:

Monday is the first day of July – rabbit rabbit! Canadian bourses are closed in observance of Canada Day. The Institute for Supply Management releases its Manufacturing Index for June – economists forecast a 51 reading, down from May’s 52.1 print. The World Economic Forum holds its 2019 Annual Meeting of the New Champions in Dalian, China. The three-day summit’s theme for this year is Leadership 4.0: Succeeding in a New Era of Globalization. On Tuesday, the European Union is expected to open a disciplinary procedure over Italy’s rising debt. In 2018, Italy’s debt grew to 132% of GDP, well above the EU’s ceiling of 60% for member states. U.S. stock markets close early (1 p.m.) on Wednesday, and bond markets close an hour later. The Bureau of Economic Analysis reports the trade balance for May – economists forecast a deficit of $52.5 billion for international trade in goods and services. The shortfall would be about even with April’s data. U.S. stock and bond markets are closed Thursday in observance of Independence Day. On Friday, the Bureau of Labor Statistics releases the June jobs report – average hourly earnings are expected to increase 3.2% year over year, and the average workweek is seen remaining unchanged at 34.4 hours.

The Tufton Capital Team wishes you a wonderful Fourth of July holiday!