The Weekly View (7/8/19)

Last Week’s Highlights:

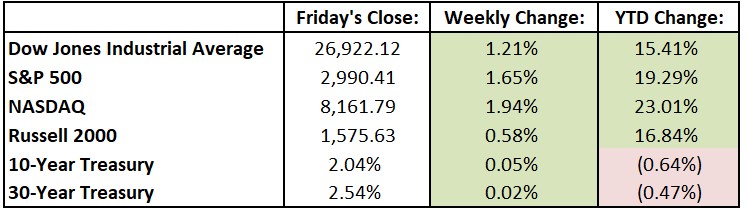

In a holiday-shortened week, U.S. equities hit new highs on expectations of a Fed rate cut and positive news regarding trade talks with China. For the week, the Dow Jones Industrial Average (DJIA) rose 322.16 points, or 1.21%, to 26,922.12, while the S&P 500 gained 1.7% to 2990.41. The tech-heavy NASDAQ climbed 1.9% to 8161.79. The rally in bonds also continued, as the 10-year Treasury yield fell to its lowest level in over two years (closing the week at 2.04%) amid signs of slower U.S. growth and expectations of more central bank easing. The 10-year continues to trade at a lower yield than the three-month bill – an inverted yield curve, which has been a reliable recession predictor over the years. On Sunday, the U.S. women’s national soccer team won its fourth World Cup, defeating the Netherlands 2-0 in Lyon, France.

Looking Ahead:

The Federal Reserve reports consumer credit data for May on Monday – economists forecast a $16 billion increase in consumer credit to $4.07 trillion, an all-time high. Pepsico (PEP) and Levi Strauss (LEVI) announce quarterly earnings on Tuesday. The Bureau of Labor Statistics releases its Job Openings and Labor Turnover Survey for May – forecasts call for 7.4 million job openings at the end of May, down from 7.45 million in late April. Look for earning results from Bed Bath & Beyond (BBBY) and MSC Industrial Direct (MSM) on Wednesday. Federal Reserve Chairman Jerome Powell delivers the semiannual Monetary Policy Report and testifies before the House. The Federal Open Market Committee releases minutes from its June monetary policy meeting. Delta Air Lines (DAL) and Fastenal (FAST) report earnings on Thursday. The Bureau of Labor Statistics announces its Consumer Price Index (CPI) for June – economists forecast the annual rate of inflation to rise 1.6%, slower than May’s 1.8% print. Friday brings the Bureau’s release of its Producer Price Index (PPI) for June – expectations call for a 0.1% increase, even with May’s rise. Excluding volatile food and energy prices, the PPI is seen rising 0.2%, in line with May’s gain.

The Tufton Capital Team hopes that you have a wonderful week!