The Weekly View (8/31/20)

Last Week’s Highlights:

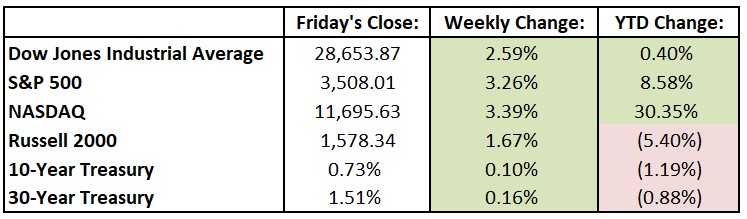

U.S. equity markets finished higher last week and are on track for the best August performance since 1984. The Dow Jones Industrial Average (DJIA) announced a shake-up to its components, swapping out Exxon Mobil (XOM), Raytheon Technologies (RTX) and Pfizer (PFE) for Salesforce.com (CRM), Amgen (AMGN) and Honeywell (HON). This comes after Apple’s (AAPL) 4-for-1 stock split, which reduces the index’s exposure to information technology. Federal Reserve Chairman Jerome Powell led off a virtual economic summit in Jackson Hole and presented a change in the Fed’s policy on inflation, a move that could possibly lead to an extended period of low interest rates. For the week, the Dow Jones rallied 723.54 points, or 2.6%, to 28,653.87, while the S&P 500 rose 3.3% to 3508.01. The NASDAQ gained 3.4%, closing at 11,695.63. The S&P is up nearly 52% since the bear market bottom on March 23rd and has risen over 8% for the year.

Looking Ahead:

Zoom Video Communications (ZM) reports quarterly results on Monday – the company has been a beneficiary of the work-at-home movement, and continued solid results are expected by Street analysts. H&R Block (HRB) announces financial results on Tuesday. The Census Bureau releases construction spending data for July – expectations are for a 1% monthly gain in construction spending, to a seasonally adjusted annual rate of $1.36 trillion. Wednesday brings earnings releases from Five Below (FIVE) and Brown-Forman (BF). ADP announces its National Employment Report for August – total non-farm private sector employment is expected to rise by 1.1 million after adding 167,000 jobs in July. Broadcom (AVGO), Campbell Soup (CPB) and DocuSign (DOCU) announce financial results on Thursday. The Institute for Supply Management reports its Services Purchasing Managers’ Index for August – economists call for a 57.8 reading, in-line with the previous two months’ data. The Bureau of Labor Statistics (BLS) releases the jobs report for August on Friday – estimates call for the economy to add 1.5 million nonfarm jobs, following a 1.76 million rise in July.

All of us at Tufton Capital wish you a safe and healthy week.