Why Business Owners Should Hire Fiduciaries to Advise Their 401(k) Plans

In today’s highly regulated world of retirement planning for your business and your employees, owners offering 401(k) plans have the increasing responsibility of serving as a fiduciary to the plan. Not meeting your fiduciary duties as a plan sponsor is a violation of new ERISA regulations and leaves you vulnerable to potential litigation if the plan underperforms.

In today’s highly regulated world of retirement planning for your business and your employees, owners offering 401(k) plans have the increasing responsibility of serving as a fiduciary to the plan. Not meeting your fiduciary duties as a plan sponsor is a violation of new ERISA regulations and leaves you vulnerable to potential litigation if the plan underperforms.

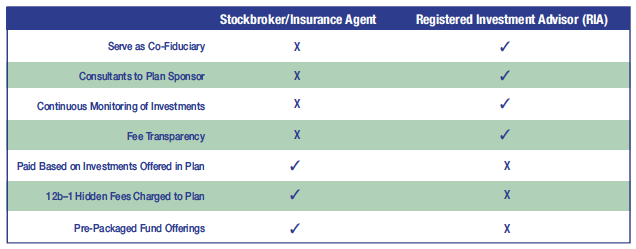

As the owner of a business with a 401(k) plan, you and your board have a legal obligation, or a fiduciary duty, to act in the best interest of your employees. Many unsuspecting owners, or plan sponsors, hire outside advisors to oversee their plans who are not considered fiduciaries. By hiring non-fiduciaries as advisors (such as investment brokers or insurance agents), your legal responsibilities may not be upheld. Since these salespeople may put their companies’ (and their own) interests first, your fiduciary duty to your employees could be compromised. While these non-fiduciaries may have a “suitability standard” to provide you with reasonable financial products, these offerings are often likely to benefit the brokers more than your employees.

A Registered Investment Advisor (RIA) has a fiduciary duty that sets it apart from stockbrokers and other salespeople. RIAs such as Hardesty Capital Management are held to a higher standard. We share in the fiduciary obligation to plan participants and ensure that the plan abides by ERISA and Department of Labor regulations, thus giving you peace of mind that the plan is being managed properly and according to regulations set forth by ERISA.

There are many other benefits to hiring Hardesty Capital Management to advise your 401(k) plan, including a transparent fee structure, a proven investment management process, and effective communication with employees when choosing funds for their portfolio.

The 401(k) plan was originally established to offer long-term investment growth benefitted by tax-free compounding. This benefit is often offset by excessive fees, which are very harmful to compounded results. Because brokers and agents are incentivized by commissions, they might be tempted to add a mediocre fund with a hefty referral to your line-up versus a superior fund with no fee. With new ERISA 408(b)(2) regulations, 401(k) service providers are required to disclose their entire fee structures. With these positive changes, employees will be better informed about the fees they’re paying, so plan sponsors should be prepared. If participants are paying 1% or more, it’s too much. Hardesty Capital provides a full disclosure of fees to plan sponsors with lower rates than brokers and agents.

Another distinction between brokers and Hardesty Capital is our sound investment management process. We create a formal Investment Policy Statement (IPS) that we adhere to when selecting and managing investments for the plan. Regarding your plan’s fund line-up, our fund selection process allows us to monitor the entire fund universe to select the best funds available. It’s just as important to have the right selection of fund types as it is to ensure those individual funds are the best in their class. Once the funds are chosen for a plan, we monitor the funds and make changes as necessary. Selecting and monitoring funds is an ongoing process that requires discipline.

One of the most important parts of a plan sponsor is making sure participants have the resources necessary to make informed investment decisions. We will also educate your plan’s participants on the principles, risks and rewards of investing in their retirement. And we provide in-person advice on selecting appropriate asset allocation based on your employees’ risk tolerance.

To hear more about how we can help guide you through the process of retirement planning for you and your employees, please contact us at 1-410-400-8500.