What’s On Our Minds:

Continuing with the employment theme, the economic team at Tufton presented research to the investment committee about the unemployment rate and how it relates to historical levels.

We are cautious when comparing to past numbers both the current U-6 unemployment rate (see definitions below) as well as the labor force participation rate. We believe that these two figures could reflect a structural change in the nature of employment as low-paying jobs become scarcer as automation increases. We believe that the U-3 rate, which is the “headline” figure, will be affected by these trends less than the U-6 rate.

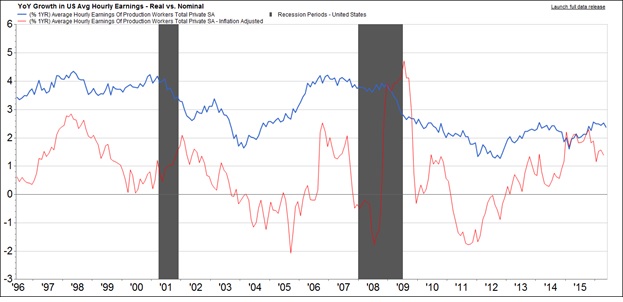

Tufton is also watching trends in hourly earnings. Economic theory states that when unemployment reaches or goes below its natural (equilibrium) level, wages begin to pick up as employers seek to attract employees. We see in the chart below that inflation-adjusted wages (in red) have been picking up for about the last two years, a sign that the economy is strong and employers are having to pay more for qualified candidates.

U-3: total unemployed, as a percent of the civilian labor force (this is the definition used for the official unemployment rate).

U-6: total unemployed, plus all marginally attached workers, plus total employed part time for economic reasons, as a percent of the civilian labor force plus all marginally attached workers.

Civilian Labor Force: The subset of Americans who have jobs or are seeking a job, are at least 16 years old, are not serving in the military and are not institutionalized.

Last Week’s Highlights:

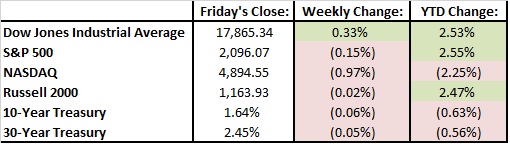

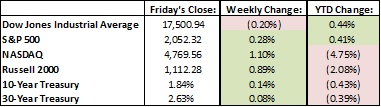

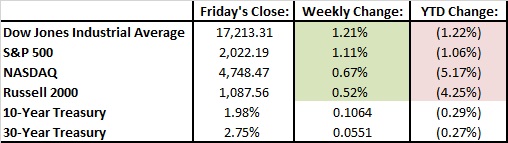

Last week, the major markets again ended mixed. The Dow was up 0.33%, the S&P 500 was mostly unchanged a -.15%, and the Nasdaq was down 0.97%, with some weakness in a few big tech names.

Many commentators poked fun at the Fed last week, noting that for all of Janet Yellen’s talking points and data, no real commitments or information were given.

Looking Ahead:

This week, we’ll be looking at China’s industrial and retail numbers on Monday. The Chinese growth story continues to affect worldwide markets, and numbers coming out of the country, while valuable, have been met with some skepticism in the past.For a checkup on the consumer, we’ll get US retail sales numbers on Tuesday. Another increase would mean consumers are less and less scared of spending their hard-earned cash. And, importantly, we will hear from Janet Yellen at the conclusion of the Fed meeting on Wednesday. We expect no real changes.

What’s On Our Minds:

As first quarter earnings season has wound down, investors’ eyes have been glued on economic data that could influence the Federal Reserve’s decision on whether or not to raise interest rates at their June 14-15 meetings. Last week, the markets were focused on the Nonfarm Payrolls (Jobs) Report that was released on Friday morning. Wall Street was expecting an addition of 160,000 jobs to the US economy. Unfortunately, the report showed that only 38,000 jobs were created in the month of May. Following the announcement, the markets saw a “risk-off” feel as the Dow Jones Industrial Average fell 135 points mid-Friday morning and the yield on the US 10-Year Treasury fell from 1.79% to 1.73% in a matter of minutes. In addition, the market’s view for a probability of an interest rate hike in June dropped from 20% pre-report to 3% after the report was released.

Breaking down the Jobs Report, the headline number was not as horrible as it appears. Verizon employees were recently on strike and hurt job growth by 37,000 jobs. Adjusting for Verizon, the economy added 75,000 jobs – still well below the Wall Street estimates and below the Federal Reserve’s sweet spot for raising rates (which is estimated to be monthly growth of 145,000 to 175,000 jobs.) Federal Reserve Chair Janet Yellen has stated “to simply provide jobs for those who are newly entering the labor force probably requires under 100,000 jobs per month.” Nevertheless, the May number may still be somewhat low.

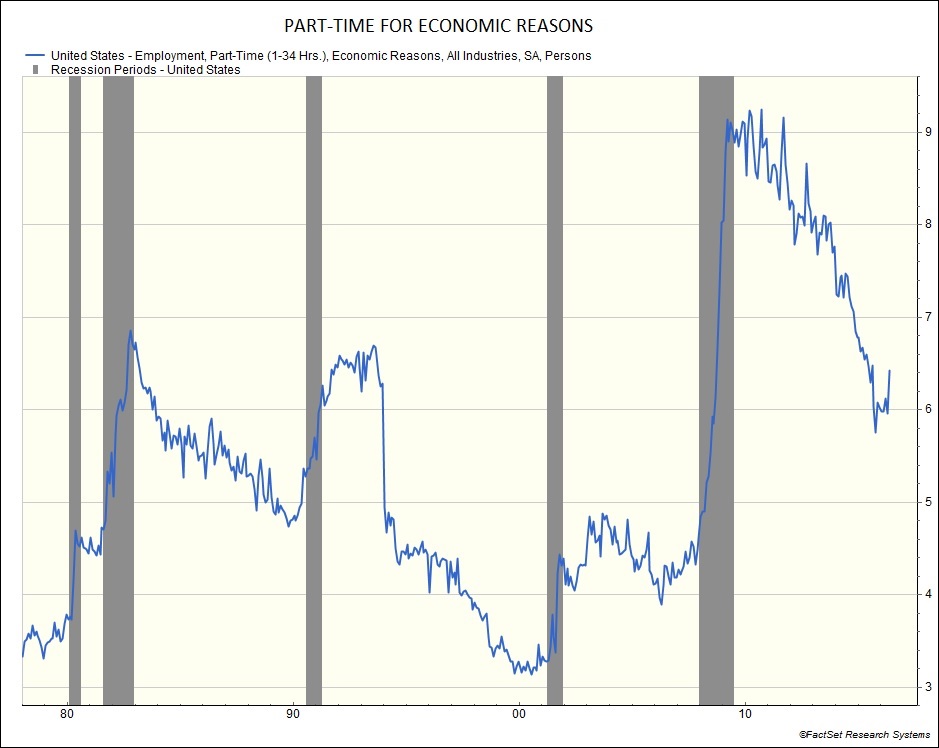

Other than the weak job growth in May, another negative trend is the rise in the amount of jobs categorized as “part-time for economic reasons” after bottoming in October of 2015. According to the Bureau of Labor Statistics, “these individuals, who would have preferred full-time employment, were working part time because their hours had been cut back or because they were unable to find a full-time job.” This implies there are still many people underemployed, leading to lower wages and thus lower spending from those consumers.

So while Chair Yellen may have a lot on her plate, many workers still do not.

Last Week’s Highlights:

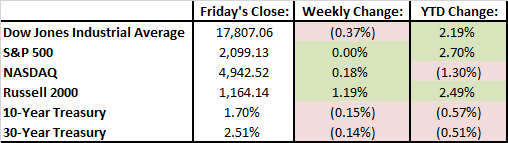

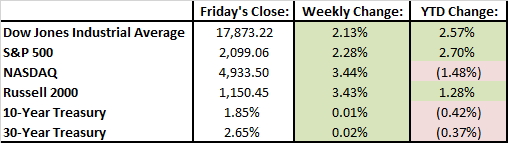

For the week of Memorial Day, the major market averages showed a mixed picture. The Dow was down 0.37%, the S&P 500 was unchanged, while the Nasdaq was up 0.18%. Year-to-date, the Dow and S&P 500 are up 2.2% and 2.7% respectively, not including dividends. With dividends, the S&P 500 Total Return Index actually hit an all-time high last week – showing the advantage of investing in dividend stocks.

With the jobs report blurring the near-term interest rate hike picture, the utility sector was the best performer while financials lagged as anticipated lower rates would continue to help the capital intensive utility companies, but compress bank net interest margins. The energy sector was also down as the OPEC countries did not agree on an oil production freeze last Thursday.

Looking Ahead:

Today, the markets are focused on Federal Reserve Chairman Janet Yellen as she speaks in Philadelphia at 12:30. Investors believe she will have a more “dovish” tone on the economic outlook, implying lower-for-longer interest rates. Investors will also gain insight on China’s economy with the release of several reports throughout the week. The Presidential Primaries will also wrap up on Tuesday with Donald Trump and Hillary Clinton both leading their respective parties in California.

What’s On Our Minds:

Following the 2008 market collapse, hedge fund managers were sometimes viewed as the bad guys who profited from others’ misfortune or perhaps the good guys who were smart enough to realize something wasn’t right in the financial system. Since then, the media and television shows (i.e. Billions) have glamorized the hedge fund industry. Stories about the few managers who predicted the housing market collapse and went on to produce high enough returns for them to retire ten times over have become nothing short of legendary.

Often considered the “smart money” in the world of Wall Street, hedge funds, have struggled in recent years and some investors have been pulling their money noting they are too complicated and too expensive. You may remember in September of 2014 when the California Public Employees Retirement System (Calpers) announced it would liquidate $4 billion it had invested with 24 different hedge funds. Considering Calpers is the nation’s largest pension fund, managing roughly $300 billion, this announcement was particularly newsworthy.

You see, good old traditional investing has outperformed a good portion of hedge funds since 2008. While the S&P 500 is up roughly 11% in the past 5 years, the HFRX global hedge fund composite is down about 1%. The struggle to produce alpha in clients’ portfolios and the traditional hedge fund fee model of 2% on assets and 20% on profits has put a strain on the fund industry. In the 4th quarter of 2015, investors pulled $26.77 billion out of hedge funds and then $14.35 billion during the first quarter of this year. These flows of assets show how critical investors have become of performance and fees.

Last Week’s Highlights:

The market had a very strong week with the Dow and S&P both up over 2%. The NASDAQ went on a tear and was up 3.44% but the index is still down about 1.5% YTD. Based on these moves, it’s clear the market is no longer worried about the the Federal Reserve potentially increasing interest rates in June. Higher crude oil prices also helped the market rally with crude topping out around $50 per barrel. (A tough break for folks looking to make trips back and forth to the beach this summer in gas guzzling SUVs.) In company news, Hewlett Packard Enterprise announcing that it is planning on spinning off its services business. CEO Meg Whitman said of the deal, “It is always better to be on the front end of consolidation.”

Looking Ahead:

Markets were closed on Monday for Memorial Day in honor of those Americans who have paid the ultimate sacrifice. During the abbreviated week of trading, some important data will come across the wire. The European Central Bank is meeting on Thursday to discuss target inflation levels which could go on to influence interest rate and stimulus decisions. OPEC is meeting in Vienna on Thursday. Friday, U.S. nonfarm payrolls are reported. A good number could seal the deal on a June interest rate hike.

What’s On Our Minds:

This week, we take a step back from the financial workings of the economy and instead look at a macro trend that’s been getting a lot of attention but whose market implications haven’t been discussed as much: the phenomenon of self-driving cars. Sure, there has been plenty of attention given to the long term effects on markets like truck driving and shipping (they will be completely overhauled), but how do we get from here to there?

“Truck driver” is the #1 job in a majority of states. When all those jobs go away, it will mean big changes. It will dramatically drive down the cost of shipping, but it will also result in some 3.5 million truck drivers finding themselves out of a job. There will still be plenty of folks working in shipping, but no one will be driving. A ~3% increase in the unemployment rate is no small matter. It will put stress on politicians to do something to help those who are out of work, compounded with economic stresses from the changing US economy.

The question is, when? The technology is mostly here now, but it needs to be implemented, which is no small task. We expect, though, for large shippers to push hard to get regulations streamlined and trucks on the road because of the massive savings. Business Insider projects a major driver shortfall in the coming years (below) as the Millennial generation turns away from truck driving as a profession.

In the coming few years, we expect to see major changes from automation. Many industries and businesses are not prepared. We constantly scan our portfolios for these potential weaknesses – or strengths. Those who have major investments in artificial intelligence, like Google, stand to profit. The loser? Working-class Americans who cannot or will not re-train for a new career.

Last Week’s Highlights:

Stocks were mixed and mostly flat, as the Dow Jones Industrial Average fell .2% and the S&P 500 rose 0.3%. This marked the fourth consecutive week that the Dow has been in the red. On Monday, Warren Buffet disclosed that he had taken a one Billion dollar position in Apple which helped its stock after it has struggled lately. Later in the week, all eyes were on the Federal Open Markets Committee (FOMC) meeting on Wednesday. The federal reserve surprised the market and came out with a hawkish stance on further rate increases in June which caused stocks to fall, treasury yields to increase, and the dollar to gain strength.

Looking Ahead:

With last week’s wake up call from the Fed, investors will continue to weigh the changes that a June interest rate increase could bring to the market. Last time the fed raised rates by 25 basis points in December, the market sold but then recovered. It will be interesting to see how to market reacts to another increase or if the Fed continues to “kick the can down the road”. Internationally, the Eurozone and Japanese economy will be in focus this week as German GDP is released and Japan is hosting the G7 summit.

What’s On Our Minds:

Last week, investors received two very different perspectives on retail sales. The government report released on Friday stated that retail sales grew 1.3% in the month of April, which was the largest growth rate the US economy has seen in over a year. On the other hand, the large department stores reported first quarter earnings and offered lower than expected guidance for sales in the second quarter. Beaten up retailers such as JC Penney and Sears have struggled for years, but now their hardship seems to be spreading. For the week, Macy and Nordstrom were both down 17% and 18.5% respectively on the surprising sales guidance.

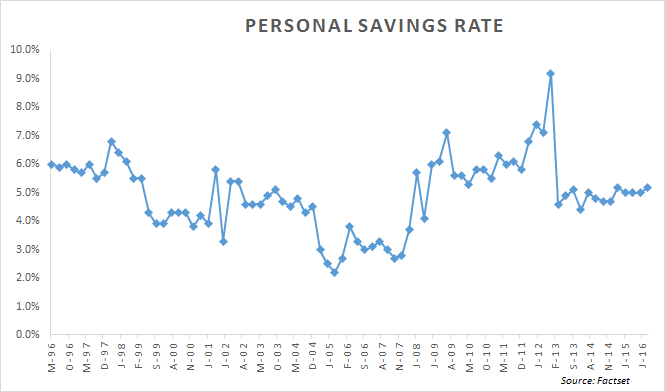

The retail sales report showed that “nonstore retailers” (i.e. online shopping) rose 10.2% on a seasonally adjusted basis from $41.1 billion in April of 2015 to $45.2 billion last month. Some analysts speculate that the day of reckoning is here for the brick and mortar department stores and that online shopping and Amazon are here to stay. Other analysts believe that the consumer is still not spending as the personal savings rate sits at 5.2% of disposable income, above the 20-year average of 4.9%. Perhaps the retail story is a mixture of both.

Nevertheless, the department stores have begun to pivot. Without a doubt, the US department store leader in the online space is Nordstrom. In 2011, the company acquired HauteLook which offers “flash-sales” and limited-time discounts from well-known brands. Last year, they launched Rack.com in order to sell apparel online from their Nordstrom Rack business. They also acquired clothing service company Trunk Club that provides customers with their own personal stylist and ships them handpicked clothing free of charge.

Internationally, department stores have made more radical moves to the ever-changing landscape. Selfridges in London realizes that in order to drive foot traffic, their stores need to become more of a destination. Recently, their London store provided Jedi training sessions that corresponded with the debut of the new Star Wars movie. In Japan, the Isetan Mitsukoshi Group is planning on opening stores in the center of large cities, as well as airports, residential areas and train stations.

Whatever the correct answer may be, we certainly think we’ve seen “The Brighter Side of Sears.”

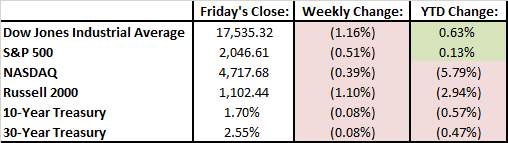

Last Week’s Highlights:

Stocks struggled last week as the Dow Jones Industrial Average fell 1.2% and the S&P 500 slipped 0.5%. In addition to the retail struggles, investors received weak credit data out of China and feared a stronger dollar. Another merger deal collapsed as the Federal Trade Commission blocked the combination office suppliers Staples and Office Depot. As a result, Staples was off 19% for the week while Office Depot was down an astonishing 40%! West Texas Intermediate Crude Oil rose 3.5% despite reports that Saudi Arabia, the world’s largest producer, was attempting to increase market share. The oil market appeared to be more focused on the supply disruptions in Canada and Nigeria.

Looking Ahead:

This week will bring additional news from the retailers with T.J. Maxx and Home Depot reporting first quarter earnings on Tuesday. Target and Home Depot’s rival Lowe’s will release their results on Wednesday and Walmart will polish off the retail news before the opening bell on Thursday. On the macro front, investors will be watching inflation with the release of the April Consumer Price Index reading at 8:30 on Tuesday morning. Analysts are expecting year over year growth of 0.4%. Janet Yellen and the Federal Reserve will certainly continue to watch this number closely as they decide on whether or not to raise interest rates at their meeting in June. Lastly, investors will also get a gauge of the housing sector with the release of April Housing Starting and April Existing Home Sales on Tuesday and Friday, respectively.

What’s On Our Minds:

Whether the going is tough or the market is hitting all-time highs, it’s important for investors to get back down to basics and remember their long term strategy. As a value focused investment firm, Tufton follows an investment strategy pioneered by Benjamin Graham during the 1930s, 40s, and 50s. During his time, he revolutionized the investment business by harping on the important difference between “investing” versus “speculating”. Rather than purchasing trendy companies and betting on the success of their emerging products, he focused on companies with good book values, which temporarily traded below their intrinsic value. In his books, Security Analysis (1932) and The Intelligent Investor (1949), he shares his insights on stock evaluation and the mindset needed for value investing. Even though it’s tough to purchase a stock that the rest of the market seems to hate, Graham explains how it’s essential to go against the grain when using his strategy. While markets have become much more efficient since Graham’s era, and it is not as easy to uncover mispriced securities, his strategies are still useful today. Just ask Warren Buffet.

Last Week’s Highlights:

The stock market struggled last week for the second week in a row. It wasn’t horrible though with the the S&P 500 selling off by 0.4%, finding support at its 50-day moving average on Friday. In company news, oil field service companies, Baker Hughes and Halliburton, cancelled their merger plans. The US Dept. of Justice had filed an anti-trust law suit against the merger last month. Economically, the big news was a miss on the US jobs number. Our economy added only 160,000 jobs in April which was the smallest gain we have seen since last September. With unemployment stuck at 5%, it is likely that the Fed will hold off on raising rates in June. In politics, Donald Trump became the presumptive Republican nominee after a win in Indiana. On the Democratic side of the isle, Hilary Clinton lost to Bernie Sanders in Indiana, but she is close to locking up all the delegates she needs for the Democratic bid. On Saturday, the Kentucky Derby favorite, Nyquist, took home $1.24 million. The horse will be arriving in Baltimore on Monday as our town prepares to host the Preakness on May 21st.

Looking Ahead:

We will be a watching a few more reports coming across the wire. Israeli based generic drug producer, Teva Pharmaceuticals, reports earnings on Monday. Disney, which many consider a bellwether for the cable television business, reports earnings on Tuesday. On Wednesday, Macy’s and Wendy’s will report. With analyst expecting a 1% increase, retail sales numbers will be released on Friday. With earnings wrapping up, analysts are likely to shift their focus on the Fed’s Open Market Committee meeting on June 15th.

What’s On Our Minds:

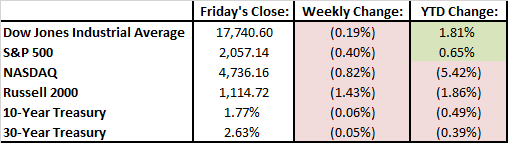

Apple, the world’s largest company by market value, reported disappointing earnings last Tuesday which caused it to fall 11% over the week to $93.74 per share. The company’s quarterly revenue dropped 13% year-over-year to $50.6 billion. This decline goes to show that not everyone can overcome strict government regulations in China. (The Chinese government banned Apple’s iBooks and iTunes Movies sales last month.) Along with the earnings miss, activist investor, Carl Icahn, announced that he had sold his position in the company. The billionaire specified that he had grown concerned with Apple’s growth prospects in China. Last year, when he owned 53 million shares, Icahn was a huge proponent of owning the stock and even went as far as calling his position a “no-brainer”. Icahn estimates that his hedge fund made a $2 billion profit on the stock and he probably wanted to cash in on those big gains.

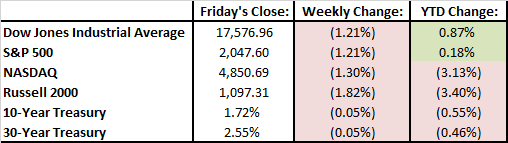

Last Week’s Highlights:

It was a tough week on Wall Street as the Dow Jones and S&P 500 both slipped 1.2%. The Federal Reserve met last week and announced that it had decided to hold off on raising interest rates, but did not give a clear answer as to whether or not they would make a move at their next meeting in June. The Bank of Japan decided that it would not pursue further stimulus. There were three big pharma deals announced last week. Abbot is planning a $30 billion takeover of St. Jude Medical, Sanodi’s plans on purchasing Medivation for $9.3 billion, and AbbVie is making a deal to acquire Stemcentrx for $5.8 billion.

Looking Ahead:

Economic data is heavy this week with manufacturing PMI coming out on Monday, Service Sector PMIs on Wednesday, Eurozone retail sales on Wednesday, and US employment numbers on Friday. The street is expecting that our economy gained 200,000 jobs in April which would be on track to continue the healthy additions we have seen over the last few months.

What’s On Our Minds:

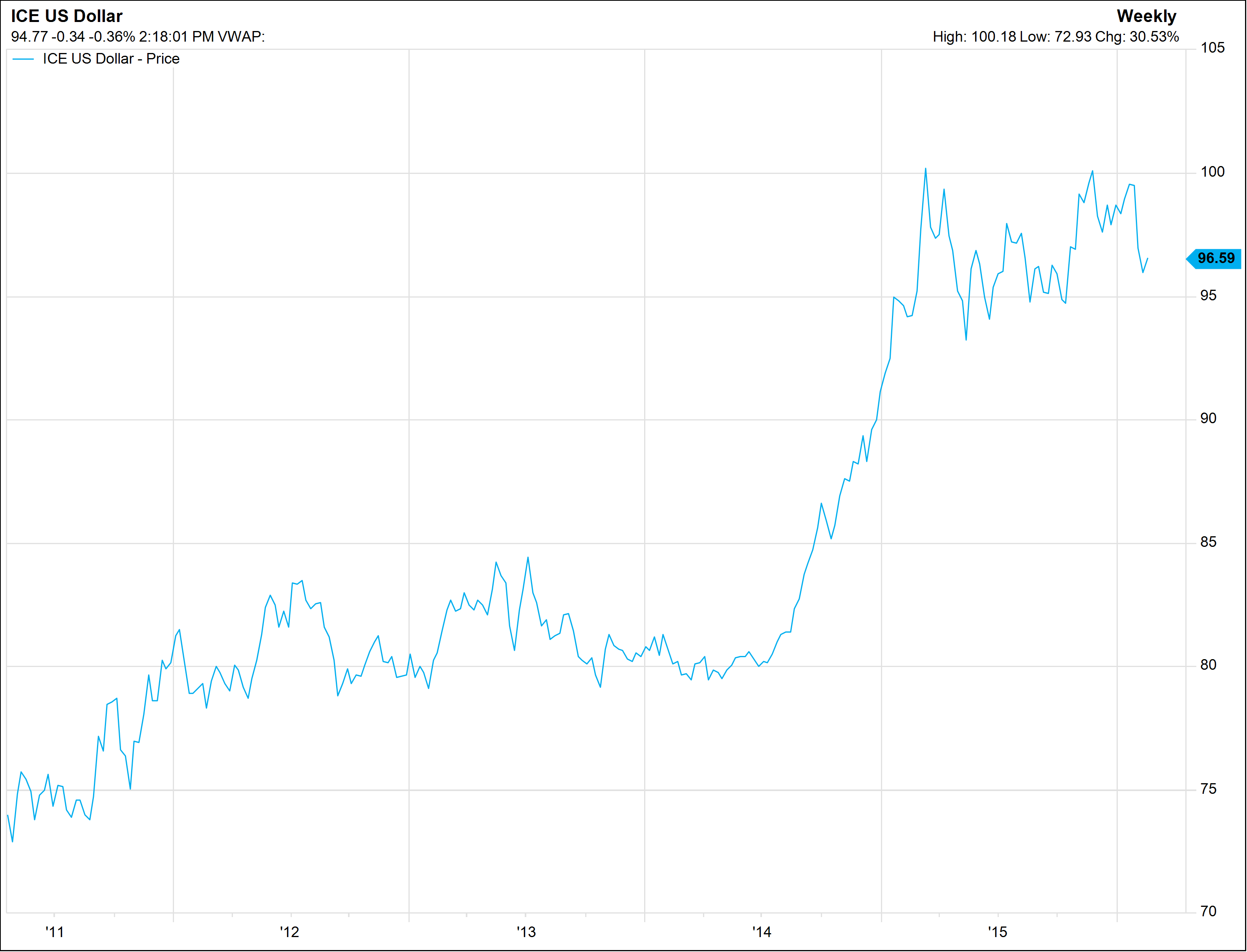

Is a strong dollar a good thing? It’s a bit of a mixed bag. The dollar’s strength in recent years has been good for the American consumer, but it’s a double edged sword in that it is a disadvantage for American companies who export products, services or equipment abroad.

The strength of the US dollar can be attributed to the strength of our economy. The most obvious benefit of a strong dollar is that your dollars go further abroad or when purchasing imported goods. In theory, a trip to Europe or a car imported from abroad should be more affordable for US consumers in the current environment. Furthermore, because imported goods are cheaper in the US, domestic products will have to come down in price to remain competitive. Thus, the consumer’s dollars go further. But producers and manufacturers suffer the opposite effect.

US companies operating abroad are paid in foreign currency. When they convert this revenue back into dollars, their profits are worth less at home. Also, exported US products are more expensive for foreign consumers, which can curb demand for US exports. Manufacturing companies’ revenues and profitability are hit especially hard from a strong greenback. On the other hand, companies that import equipment or goods from abroad and do business at home stand to benefit from a strong dollar.

All in all, strength in the US dollar is great for U.S. shoppers and travelers, but it hurts big U.S. companies operating abroad. If these companies’ profits remain low for long, they will be forced to lay off employees, and then it isn’t good for the consumer, either.

Last Week’s Highlights:

The week started off strong on Monday as the Dow rose above 18,000 for the first time since last July. Markets witnessed a pullback as the week progressed while a heap of earnings announcements were released. In tech, Alphabet (Google), Netflix, and Microsoft reported earnings that disappointed investors. Caterpillar, which is often viewed as bellwether of global manufacturing, reported disappointing earnings that were weaker than analysts’ forecasts. Baltimore based Under Armour beat earnings expectations as the company’s footwear revenue jumped 64%. McDonald’s gamble to serve breakfast all day has paid off as same store sales increased 5.4% in the first quarter.

Looking Ahead:

Earnings season is in full swing again this week with notable releases from Proctor and Gamble, Capital One, and Apple on Tuesday and Chevron and Exxon on Friday. Federal Reserve policymakers are meeting on Tuesday and Wednesday where they will announce interest rate policy moving forward. The market is currently pricing in a 0% chance of a rate hike at this meeting. Weakness in retail sales, concern about China’s economy and weak international trade are factors the will likely keep the Fed on the fence. The Fed will release first quarter GDP numbers on Thursday following their meeting. Locally, Democrat and Republican primaries are held in Maryland on Tuesday. Baltimore City’s Democratic primary race for mayor will be particularly interesting.

What’s On Our Minds:

Over the weekend, some of the world’s largest oil producers met at the center of the Middle East in Doha, Qatar to discuss a potential production “freeze” from each participant. Going into the weekend, signs of the freeze deal collapsing began as the oil representative from Iran decided not to attend. Late Sunday afternoon, it was announced that the freeze deal had in fact collapsed as the Saudi Arabian oil ministers got up from the table apparently stating that they would not freeze unless their political rival Iran agreed to take the same actions.

The oil price crash began in mid-2014 when Saudi Arabia refused to cut production as oil prices declined. This coincided with US Shale Oil production rising to a record 9.6 million barrels of production per day. Many speculated that the oil kingdom’s refusal to cut was to regain market share and put the growing US shale companies out of business. Others speculated that the Saudis took action to prevent rival Iran from funding their own operations and nuclear ambitions. Like Saudi Arabia, much of Iran’s income is derived from oil sales.

Now, the ladder theory appears to be evident. Since the lifting of federal and international sanctions last year, Iran has ramped oil production by 600,000 barrels per day and continues to develop for further production. A future production freeze or even cut among large producers is still not entirely out of the question. However, without Iran’s cooperation, expect the soap opera to continue…

Last Week’s Highlights:

Last week, the S&P 500 rose 1.62% while the Dow rose 1.82%. Financial stocks helped drive the major averages higher as the big banks reported better than expected earnings. JPMorgan Chase, the largest US Bank in terms of assets, has stated that even if the Federal Reserve does not increase interest rate, they can still expect to grow their net interest income by $2 billion – an impressive feat for any financial institution in a low interest rate environment.

Investors also received some good news out of China. The world’s second largest economy reportedly grew 6.7% in the first quarter. This was slightly down from the 6.8% increase in the fourth quarter, but still a welcoming relief to investors as growth in China has recently been a concern.

Looking Ahead:

Looking forward to this week, more first quarter earnings reports will be on the docket. After the bell on Monday, technology companies Netflix and IBM will report. Subsequently to being a “high flyer” in 2015, Netflix is down 4.3% this year – under performing the market by 6.5%. On Tuesday morning, investors will hear about earnings and future plans from internet company Yahoo!. The company is shopping it’s core search business to potential bidders as a breakup of the company appears to be imminent. The week will finish off with results from industrial bellwethers Caterpillar and General Electric. As Jim Hardesty would say, “Pushing dirt is good business.” Let’s hope we hear the same from Caterpillar.

What’s On Our Minds:

Last Wednesday the United States Department of Labor unveiled its fiduciary rule in its final form. You would think it would be obvious, but the new rule requires retirement plan advisors to put their clients’ interests ahead of their own. The rule includes both investment products and fees.

Up until now, brokers (or “financial advisors”) and insurance salesmen who provided advice to retirement accounts and 401K plans were only required to follow a “suitability” standard, which allowed them to receive undue trail fees and commissions from mutual funds and insurance products. As one can imagine, these lucrative fees and commissions can influence a broker’s decision making process: they may make their suggestions based on what gets them a higher payout. The new rule forces brokers to follow a fiduciary standard, mandating that they suggest products that are truly in the client’s best interest.

Although the new rule has been met with opposition from the industry, it will inevitably benefit the average person who puts money away in a retirement account because over time, compounding costs will mathematically exceed compounding interest. As a registered investment advisor (RIA), our firm follows a fee-based business model and we have always acted as a fiduciary for our clients since our founding. Because this new rule forces others in the industry to put clients’ interests ahead of their own, we view this rule change as a positive development for Americans saving for retirement.

Last Week’s Highlights:

Both the S&P 500 and Dow Jones were down 1.2% last week. Oil prices surged 8% to $39.72 per barrel, which propelled energy stocks upwards. Investors worried about an increase in the value of the Japanese Yen while Japan’s central bank has been failing to drive its exchange rate lower with their negative interest rate policy.

In merger and acquisition news, Alaska Airlines agreed to purchase Virgin America for $57 per share. The $160 billion merger between Allergen and Pfizer collapsed. The deal had received criticism from President Obama because it would have allowed Pfizer to move offshore to Ireland and cut its corporate tax bill.

The Baltimore Orioles started the season off on Monday at Camden Yards. The team remained undefeated (5-0) in their first week of play. In golf, Englishman Danny Willett took home the coveted green jacket following Jordan Spieth’s meltdown on the the 12th hole at Augusta National.

Looking Ahead:

It is going to be a busy week on Wall Street as first quarter earnings season kicks off on Monday afternoon with aluminum producer Alcoa. Analyst are expecting a third consecutive quarter of negative earnings growth primarily attributed to lower oil prices and the strong dollar. We will get a glimpse of how this year’s persistently low interest rates, reduced trading revenue, and the IPO decline has effected big financial firms when JPMorgan reports earnings on Wednesday followed by Bank of America on Thursday. We will also see key economic data this week with Retail Sales on Wednesday and Consumer Price Index on Thursday. New York will hold its primaries on Tuesday, where Trump and Clinton have long been favored.

What’s On Our Minds:

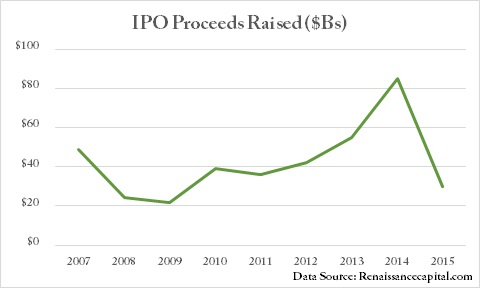

It’s being called the “Invisible IPO Market”. This year’s first quarter Initial Public Offering (or IPO) market was the slowest of any quarter since the financial crisis of 2009. Nervousness about the financial markets and the related volatility, combined with continued uncertainty in the energy industry, was the main reason for this slowdown in capital raising. Eight deals, raising just $700 million, were launched in this year’s first quarter, compared with 34 IPOs, raising $38 billion, in last year’s same period. All eight IPOs this year were by early-stage healthcare (namely biotech) companies, led by substantial buying of company shares by existing shareholders.

The pipeline of companies looking to raise capital is strong, but most companies looking to raise initial public capital are awaiting better (i.e. less volatile) market conditions. Companies such as Univision, Albertsons, Elevate Credit and Neiman Marcus have planned their IPOs and may perhaps launch them later this year. There are over 120 companies that have already filed an S-1, the initial registration form required by the Securities and Exchange Commission for a future IPO.

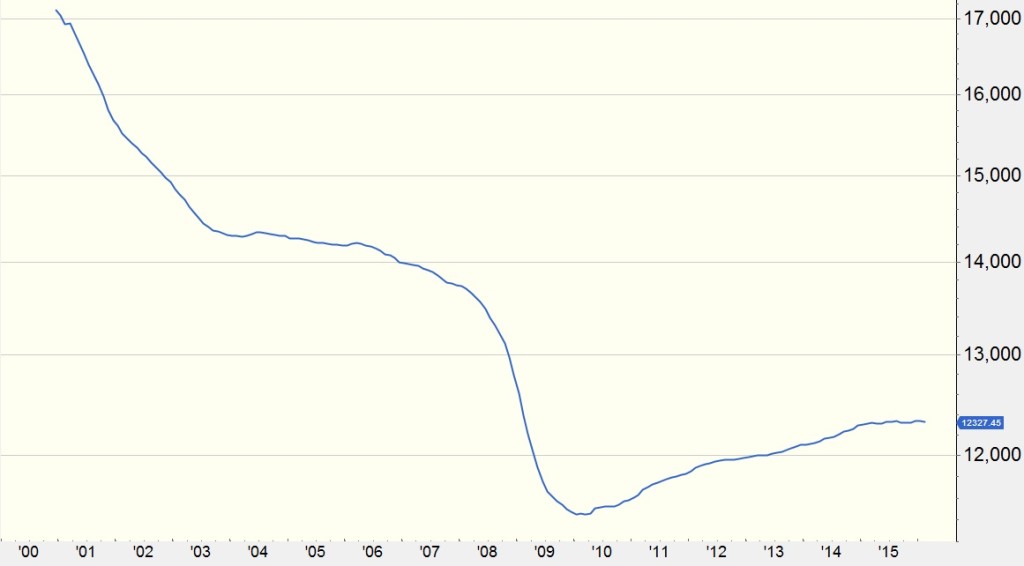

Market-watchers look to the level of IPO activity as a barometer of the market’s health: a super-active IPO market often means the market is getting “too hot.” But as we can see in our inflation, interest, and employment numbers, that doesn’t appear to be the case at this time. In the past, a large swing downward in IPO activity has accompanied a major economic slowdown (see chart, below). It is possible that IPOs will rebound or at least slowly recover from this point, but caution is warranted. In finance, we say that at the top of the market, the fool says “this time is different.” At the same time, we have to recognize that the IPO slowdown came at the same time as a market correction- maybe this time was just less bad.

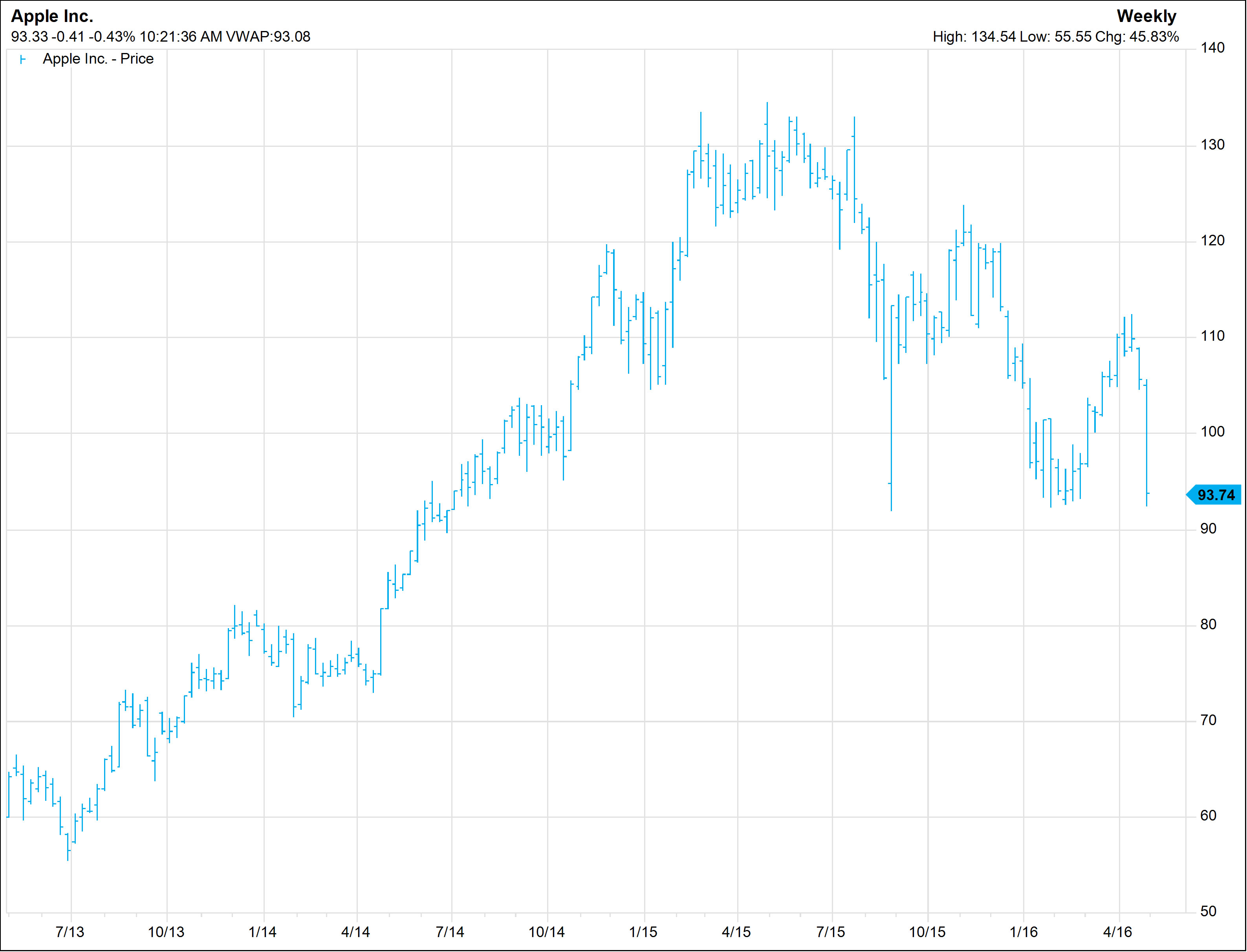

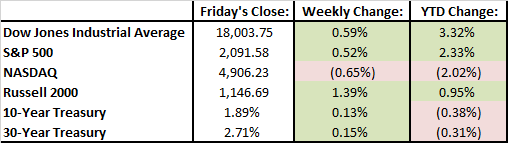

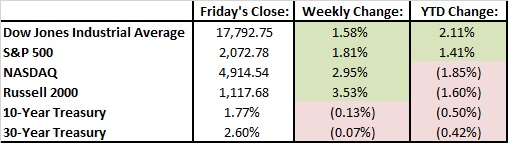

Last Week’s Highlights:

Strength continued in the equity markets, as stocks posted solid gains to close out the year’s first quarter. The Dow Jones (DJIA) rose 1.6% for the week, while the S&P 500 increased 37 points, or 1.8%. Bond prices were higher last week, pushing the U.S. 10-Year Treasury bond yield down slightly to 1.77%.

Comments by Federal Reserve Chair Janet Yellen on Tuesday helped the markets, as she indicated that the Fed should proceed cautiously with respect to future hikes in interest rates. Many investors welcomed these dovish comments, feeling that we may be in a “Goldilocks” economy: one that is not “too hot” and needing a cool-down in the form of a rate raise, but also not “too cold,” or growing too slowly.

March Madness lived up to its name, as the S&P rose 6.6% last month and approached new market highs. Stocks ended the first quarter slightly higher, following a very volatile period of double-digit losses followed by double digit gains.

Looking Ahead:

First quarter “earnings season,” when public companies report their financial results for the first three months of the year, takes off in a few weeks. As only a few companies will release their financial reports this week, investors’ focus will remain on any macroeconomic developments. Specifically, what is the Federal Reserve thinking, and how long can it continue saying the “right things” to help the stock market’s continued move up?

Minutes from the March meeting of the Federal Open Market Committee meeting will be released on Wednesday and closely examined by investors. Additionally, factory and durable goods orders, to be released Monday, will help determine if U.S. manufacturing growth, which has picked up, is sustainable.

What’s On Our Minds:

We try not to get political on this blog. But something that perhaps all of us can agree on: politicians don’t understand economics. Or at least, they say a lot of misleading things about the economy. One example in the headlines is trade protectionism: the “protect our jobs” argument. Here’s a non-partisan fact: those manufacturing jobs aren’t coming back. How can we say that? Because we can bring (and have brought) manufacturers back to the U.S., but we have become so good at automation that we don’t bring the factory workers’ jobs back with them. It’s not China taking those jobs. It’s our own technology.

What we should produce is based on our comparative advantage, as we economists call it. We have a comparative advantage in things like technology and services. The concept behind comparative advantage is simply that if each country specializes in what they are especially good at, every country is better off. This is true even if one country is better at everything. That far superior country (ours, of course) should specialize in what they’re good at making, since they can produce larger amounts of valuable stuff and trade for the rest.

But that arrangement creates problems for politicians who have voters to answer to. We might be able to import a million HDTVs a year from, say, Mexico and save ourselves $50 on each one- our consumers gain $50 million. But that comes at the expense of a factory that employs 50 people at $50,000 a year each, or $2.5 million per year. The net gains are a whopping $47.5 million a year- but the 50 factory workers who just lost their jobs are going to make a much bigger fuss to their congressman than the people who might not be able to buy a cheap TV.

We are not taking a political stance, but only hope that with a greater understanding of these concepts we might be able to better prepare for the future.

U.S. Manufacturing Jobs (thousands), as reported by ADP

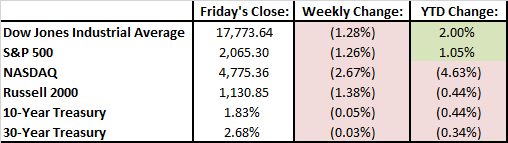

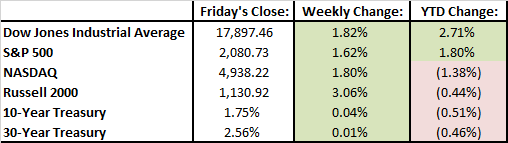

Last Week’s Highlights:

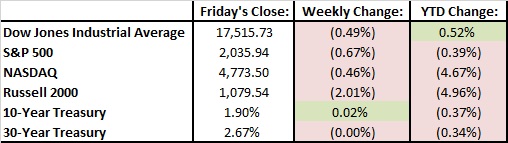

The S&P 500 and the Dow Jones fell about half a percent last week. Overall, we are still about flat for the year. The US economy continues to show signs of improvement. Oil is finally pulling back some after surging about 50% over the last few weeks (trough to peak).

Looking Ahead:

The first of April will be an important day for USA economics- we’ll see both manufacturing PMI numbers and the March jobs report. Until then, things are quiet as we await earnings season being kicked off on April 11 by Alcoa.

What’s On Our Minds:

Last week, the 50% plunge in the stock price of Canadian drug maker Valeant displayed the importance of diversification in an investor’s portfolio. In the past two years, Valeant was considered a hedge fund darling due to its unconventional business model that has produced significant growth in earnings and cash flow. Instead of spending money on research and development to develop new drugs, Valeant has acquired smaller pharmaceutical companies with mature specialty drugs. Following the closing of the acquisition, Valeant would restructure the former company’s costs and assets, raise their drug prices and by being based in Canada, utilize a lower corporate tax rate. Many investors fell in love with this business model and held positions in Valeant that amounted to over 15% of their total portfolio.

For some time, these investors looked like geniuses as the stock climbed from $50 in 2012 to $263 in July of last year. Then, in the Fall of 2015, accusations arose regarding the company inflating sales and price gouging – the stock tumbled. Next came legal investigations from customers and the regulators – the stock tumbled more. Last week, the company provided weak guidance and stated that they lacked cash to make further acquisitions, planned on spending more on compliance and reporting, and that first quarter earnings would be cut in half. As a result, the company’s stock lost $12 billion dollars – or 50% – in value.

One of the largest holders in Valeant is activist investor Bill Ackman, who runs hedge fund Pershing Square Capital Management. Prior to the company’s decline, Valeant was the largest of the fund’s nine holdings. According to the Financial Times, Ackman has now lost more than half of his client’s money since the stock peaked last July.

It pays to be diversified.

Valeant Pharmaceuticals (VRX)

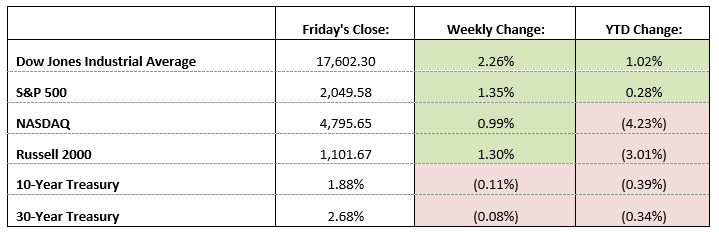

Last Week’s Highlights:

The S&P 500 rose 1.35% and the Dow Jones rose 2.26% on the week. The Federal Reserve held their March Federal Open Market Committee (FOMC) meeting and left interest rates unchanged and implied two possible rate-hikes during 2016. The markets cheered the lower-for-longer near zero interest rate policies. Increases in oil and other commodity prices also improved market sentiment.

Looking Ahead:

The week is somewhat light on economic data. The condition of US oil and gas companies will be in focus at the annual Howard Weil Energy Conference in New Orleans. On Thursday, investors will get a gauge of the industrial sector when the Flash Manufacturing PMI for March is released at 9:45 AM. Any reading above 50 implies that there was growth in the period – Wall Street is estimating a reading 50.3. The markets will be closed on Friday in observance of Good Friday as traders prepare for Easter.

Remember – don’t put all your eggs in one basket.

What’s On Our Minds:

Our Investment Committee has been especially focused on recent employee figures and what they “really” mean. One of our crack analysts (who also writes for the Weekly View) prepared the below chart for the committee. It shows the timeline of a very familiar data point (in blue): Initial Claims. This figure is the number of people filing for unemployment benefits for the first time, and is widely considered to be an important leading (forward-looking) indicator of the stock market. The initial claims number shows that the number of people filing for first-time benefits is as low as it was in the late 90s.

The conclusion is not, however, “Sell everything.” We can see that between about 2005 and 2008, we were also at levels suggesting full employment. We certainly would not have wanted to be out of the market for that entire three year period

Last Week’s Highlights:

The S&P 500 was up 1.2% on better economic data and a rally in oil prices. The market has bounced off of February lows and is now down 1.2% Year to Date.

Last week we marked the seven year anniversary of the current bull market. Although it feels like investors have been beaten up over the past nine months, the bull market that began on March 6, 2009 continues: we have not seen a drop of more than 20% in the market in over seven years. We have seen two 10% corrections since last summer, but the market recovered on both occasions and the volatility presented tremendous buying opportunities. The average bull market since World War II has lasted 56 months and posted a 144% gain. In comparison, the current 84 month bull has posted a 193% gain in the S&P 500. Clearly, this bull has come a long way!

Looking Ahead:

After unexpectedly resorting to negative interest rate policy in January, the Bank of Japan will announce its updated interest rate policy on Tuesday. So far, the bank’s radical move has failed to assuage the country’s deflation and stagnation woes.

At home, investors will be watching the Federal Reserve this week as they hold their two-day policy meeting on Tuesday and Wednesday. We expect the Fed to keep another interest rate increase on hold this time around, but Janet Yellen could give an indication of future moves during her press conference on Tuesday at 2:30 PM.

On Tuesday we will get one step closer to electing our new president as Florida, Illinois, Missouri, North Carolina, and Ohio voters head to the polls in their respective primary elections.

What’s On Our Minds:

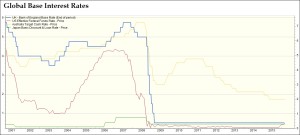

As talk about negative interest rates in Europe and Asia increases in the financial news, we’ve received more and more client inquiries asking what this means for global markets and their portfolios. After all, the financial system is built around positive interest rates, and the current overseas rate structure seems to be “upside down.” We spend a lot of time thinking about, discussing and structuring portfolios around various interest rate scenarios, whether they be positive or negative. We’ll first explain how and why rates can go negative, and then discuss the chances of negative rates entering our domestic financial system.

A negative interest rate policy means that a central bank will charge commercial banks negative interest: instead of receiving money on deposits, depositors must pay to keep their money with the bank. Central banks, specifically several in Europe and Asia, have introduced such a policy to stimulate their weak economies and increase inflation levels, which have been well below comfortable levels. By introducing negative interest rates, it is hoped that commercial banks will lend more money at very low interest rates. Doing so should entice bank customers to borrow more, spend more, and save less, thus boosting economic activity. As importantly, negative interest rates often drive down the value of a country’s currency, making its exports more affordable and competitive with overseas trade partners (which also helps economic growth). Banks must be careful, though, to avoid the specter of deflation.

While negative rates in the US are always a possibility, we think that such a scenario is highly unlikely, as the domestic economy would have to get much worse before the Fed would contemplate such a move. We are not forecasting such weakness or a related recession in the near term and therefore do not foresee negative rates in the US during this economic cycle. Moreover, introducing such a strategy would be an extreme move in the history of our country’s monetary policy. Such a move would likely have broad political implications, possibly provoking Congress to limit the powers of our country’s central bank.

Last Week’s Highlights:

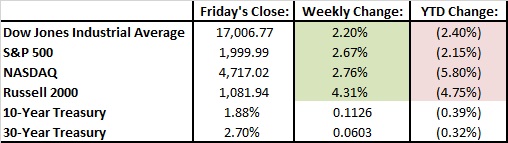

Strength continued in the equity markets, as stocks posted solid gains for the third week in a row. The Dow rose 2.2% for the week, the S&P 500 was up 2.7%, and the Nasdaq increased 2.8%. Many investors are becoming more confident in the US economy’s growth (slow growth though it is), and talk of a recession in the near term is less alarming.

Friday’s jobs report came in well above expectations, with the US economy adding 242,000 jobs in February (above economists’ 195,000 estimate). The unemployment rate remained 4.9% (as expected by the Street), and wages declined 0.1% for the month.

Looking Ahead:

Front and center for investors this week will be Thursday’s meeting of the European Central Bank (ECB), which is expected to push a key interest rate even further into negative territory. Doing so would boost its current stimulus program in order to help economic growth in the Eurozone. More volatility is expected with this week’s meeting, especially if the ECB provides less stimulus than investors are anticipating. Please read our thoughts on the negative interest environment and its impact on global markets (in the above “What’s On Our Minds” section).

There is little US economic data to be released this week, so all eyes will be on Europe.