Choppy Global Growth Boosts US Treasuries

As the third quarter wound to a close, we learned from the Bureau of Economic Analysis that gross domestic product for the second quarter was revised to 3.9% year-over-year growth from a previous estimate of 3.7%. Despite the strong economic data, the stock market posted dismal performance, with the broad Standard & Poor’s 500 index down 6.9% for the quarter. Volatility has reemerged as investors face an uncertain landscape. Although we often analyze economic data to provide insight into future stock market returns, more often is the case that the stock market provides a glimpse into the future of the economy.

As the third quarter wound to a close, we learned from the Bureau of Economic Analysis that gross domestic product for the second quarter was revised to 3.9% year-over-year growth from a previous estimate of 3.7%. Despite the strong economic data, the stock market posted dismal performance, with the broad Standard & Poor’s 500 index down 6.9% for the quarter. Volatility has reemerged as investors face an uncertain landscape. Although we often analyze economic data to provide insight into future stock market returns, more often is the case that the stock market provides a glimpse into the future of the economy.

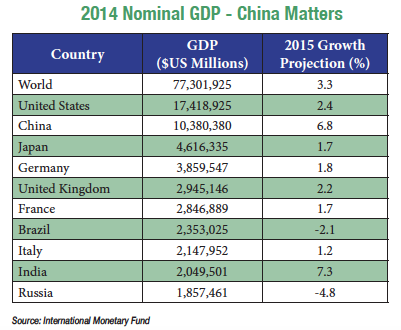

The global economy is as weak as it has been since the Great Recession. A slowing of the Chinese economy is the latest cause of indigestion. It is difficult to overemphasize the importance of the second largest economy in the world. With reported annual average GDP expansion rates in excess of 7% for many years, the Chinese economy has been the global growth driver. As Chinese production has slowed, the prices of raw materials for that production have dropped all over the world. This industrial commodity deflation is evidence of the sagging world economy. Crude oil and base metals are also feeling the pressure of lower demand. Canada slipped into a recession during the second quarter due in part to its sizeable exposure to energy and mining industries. Other commodity-rich nations such as Russia, Brazil and South Africa are also under pressure with their currencies and financial markets taking a hit.

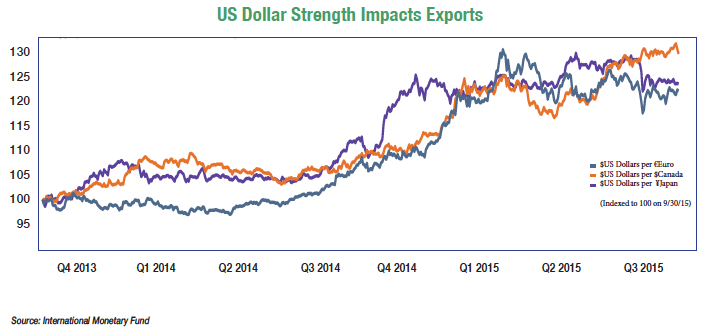

The ramifications of a slowing Chinese market extend to the credit markets. China has been selling US Treasuries and using the proceeds to purchase their currency, the Yuan, in an effort to keep the currency strong. The selling of Treasuries is bearish and has the potential to lead to higher interest rates. However, purchases by other global players looking for a safe haven have helped to keep interest rates very low. The recent market volatility was cited as a reason for the Federal Reserve to leave short-term interest rates unchanged at its mid-September Open Market Committee meeting. Although Chair Janet Yellen walked back some of her dovish comments late in September, the disinflationary pressure exerted from a slower Chinese economy will keep any interest rate increases on a shallow trajectory. The strong US dollar continues to negatively impact US exports, while making imported goods less expensive. This is a decisive blow in keeping interest rates in check.

The slowing global economy has led to a widening of credit spreads in the fixed income market. The spread is the difference between what is earned from a bond and a like-maturity US Treasury. As the risk associated with a bond increases, so too does its spread over the risk-free Treasury. Credit risk (the risk associated with the bond issuer defaulting) has pushed aside interest rate risk (price volatility due to changes in interest rates) as we evaluate fixed income securities. High-grade corporate and municipal bonds should remain strong as weaker credits are impacted by lower interest coverage due to reduced earnings. US Treasuries will also remain strong. Price stability combined with more modest coupons will provide solid total returns.

Economic growth in the near term will be challenged by an aging business cycle. Demand for goods and services that was pent up during the recession has long been met. An extended acceleration in profits this late in an economic recovery is highly unlikely. The projected slower corporate profit growth will lead to lower capital spending as chief financial officers tighten their belts to reduce expenses. The impact will be business growth that is not strong enough to trigger rapid wage growth – one more reason for the Fed to move slowly.

Companies have responded to the difficult operating environment by taking steps to improve their bottom lines. Mergers, acquisitions and restructurings are occurring with greater frequency. Chubb, a long-time Hardesty Capital holding, is being acquired by ACE Limited, an insurance company headquartered in Zurich, Switzerland. DuPont has spun off its commodity chemical business, Chemours, and has eliminated nearly a third of its manufacturing plants over the past three years. General Electric has been shedding financial services assets as it returns to its industrial roots. GE will close on the acquisition of energy assets from Alstom, a French company, later this year.

The broad theme for the market remains unchanged. The economy grinds higher in a saw-tooth pattern at a 2% annual rate. Meanwhile, interest rates are maintained at low levels in the absence of corrosive inflation and modest employment growth. Although we have become far more selective in our investment choices, we are more attracted to valuations that are beginning to emerge in the equity markets.