In the Fed We Trust

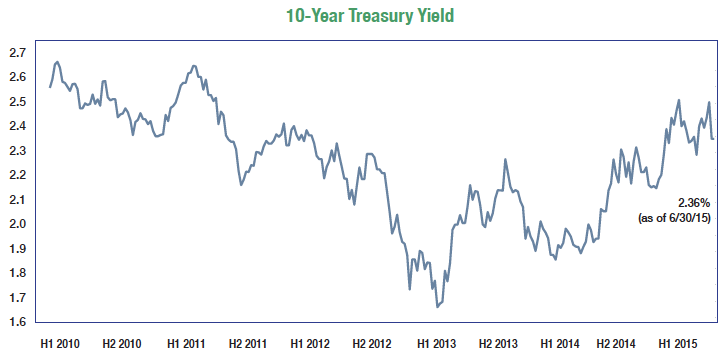

Our outlook for 2015, presented in our January issue, was titled “Don’t Fight the Fed.” Low interest rates have made bonds an unattractive investment option during a period when common stocks continue to plow higher. However, with the Federal Reserve now poised to begin raising interest rates, the uncertainty regarding the timing and magnitude of rate increases has left the equity and fixed income markets skittish. The market, in anticipation of Fed action, sent stocks lower during the second quarter. By the first week of June, nearly all stock market gains for the year had been erased. The Fed’s statement following its mid-June meeting led to a market rally as commentary was more dovish than anticipated. The bond market has also moved in anticipation of higher rates. The yield on the 10-year U.S. Treasury followed suit, climbing from a low of 1.86% to as high as 2.48% during the quarter.

Our outlook for 2015, presented in our January issue, was titled “Don’t Fight the Fed.” Low interest rates have made bonds an unattractive investment option during a period when common stocks continue to plow higher. However, with the Federal Reserve now poised to begin raising interest rates, the uncertainty regarding the timing and magnitude of rate increases has left the equity and fixed income markets skittish. The market, in anticipation of Fed action, sent stocks lower during the second quarter. By the first week of June, nearly all stock market gains for the year had been erased. The Fed’s statement following its mid-June meeting led to a market rally as commentary was more dovish than anticipated. The bond market has also moved in anticipation of higher rates. The yield on the 10-year U.S. Treasury followed suit, climbing from a low of 1.86% to as high as 2.48% during the quarter.

Although the Fed is nearing an inflection point, we do not see near-term rate actions negatively impacting the economy. In the Fed we trust: we believe any rate increases will be slow and measured. Slowing domestic economic growth, low levels of inflation and turmoil abroad provide a long runway for significant interest rate liftoff.

Economic activity continues to be sluggish. Q1 2015 Gross Domestic Product actually contracted by 0.2%. The U.S. has not generated annual Gross Domestic Product growth in excess of 3% since 2006. Even though the unemployment rate has declined to just 5.5%, the quality of the improvement is dubious: the labor force participation rate has fallen from 66% in 2007 to less than 63% in 2014 as nearly seven million people have left the workforce. These individuals do not count as unemployed. The U6 unemployment rate, which takes into account part-time workers who want to work full-time, is close to 11%. Lower gas prices have put extra cash in Americans’ pockets. This energy dividend received by consumers has not resulted in a big increase in spending. In fact, the benefit of lower energy prices has been muted by job losses in the energy industry and reductions in capital expenditures associated with energy exploration.

Inflation remains under control. Consumer prices have been growing in a range of 1.5% to 2% per year. The collapse in the price of oil and the strength of the U.S. Dollar are additional disinflationary forces. Many nations, with South Korea being the latest, have taken steps to devalue their currencies in an effort to gain a competitive advantage in international trade. Aggressive rate increases could push the value of the U.S. Dollar higher, leading to greater trade deterioration, loss of employment, and a slower economy.

European Union negotiations with Greece continue to generate front-page news. Creditors want their money back and Greek politicians are defiant, maintaining social programs while keeping taxes in check. The uncertainty created by the situation has led to massive capital flows, gyrating interest rates and currency revaluations. The U.S., viewed as a safe haven, has been impacted through Dollar strength and lower interest rates due to increased demand for Treasury securities.

Now into the seventh year of stock market gains, valuations are as high as they have been over the past decade. However, adjusted for earnings weakness due to currency translations and low interest rates, current valuations are not setting off alarm bells. We continue to be opportunistic in our equity purchases. Volatility may continue, though, as the market comes to grips with higher interest rates, a scenario we haven’t experienced in many years. The Federal Funds target rate, established by the Federal Open Market Committee to influence monetary policy and support economic activity, has been near zero since December 2008. The rate was 5.25% in June of 2006 and has decreased ever since. The marketplace is a little out of practice when it comes to dealing with rising rates. As long as rate increases are supported by stronger economic growth and inflation remains at moderate levels, higher rates most likely will not derail the economy in the short term.

We expect interest rates to rise in reaction to Fed policy. Short-term rates will be most impacted, with longer rates only rising significantly should inflation sustain levels closer to 2% or higher. The return to normal interest rates continues to be a slow process. Following the recession of 2008 and 2009, the Federal Reserve has aggressively pursued a policy of low interest rates to help stimulate the economy. The Fed augmented traditional polices with quantitative easing (the massive purchase of fixed income securities in the open market) to help drive interest rates to historically low levels. They are now slowly unwinding these programs.

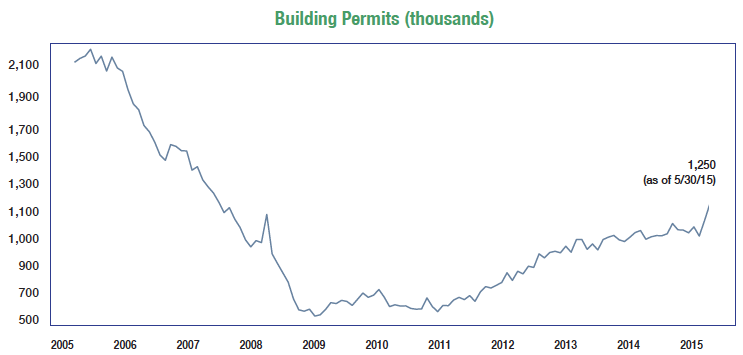

A key beneficiary of Fed policy is housing. Given the levered nature of a home purchase, housing construction and sales provide a tremendous boost to the economy. This was especially the case when a home could be purchased with no money down! Even though more rational purchase terms have reemerged, the industry is still very important. Building permits and housing starts continue their slow rise from the depths of the recession. Pushing interest rates too high, too fast, could jeopardize the recovery. In the Fed we trust.