Inflation and Pain at the Pump

By: Barb Rishel

Of all the goods and services being impacted by higher inflation, the price of a gallon of gasoline may be the one that we notice the most. It certainly is the cause for a lot of conversations these days, and opinions on why the price is so high vary considerably.

How are gas prices determined?

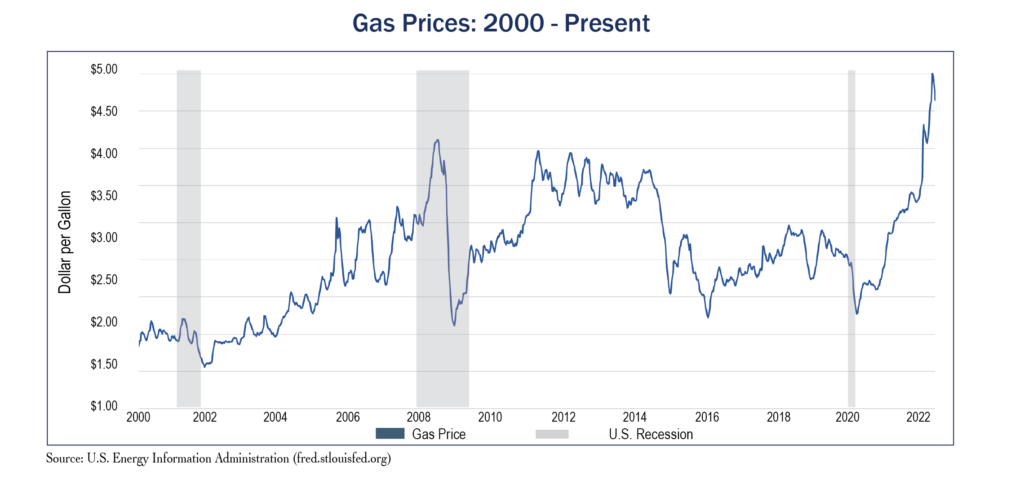

Since the early 2000s, the average price for a gallon of gasoline has hovered between $2.00 per gallon to $3.00 per gallon with a few notable exceptions (please see the chart below). During the financial crisis in the summer of 2008, the average price of a gallon hit a then record high of over $4.00/gallon (not adjusted for inflation). Prices steadily declined to under $2.00/gallon in early 2016 and rose to the current record level of over $4.00. Who determines how much we pay for gasoline? The reality is no one person, government or company controls the price.

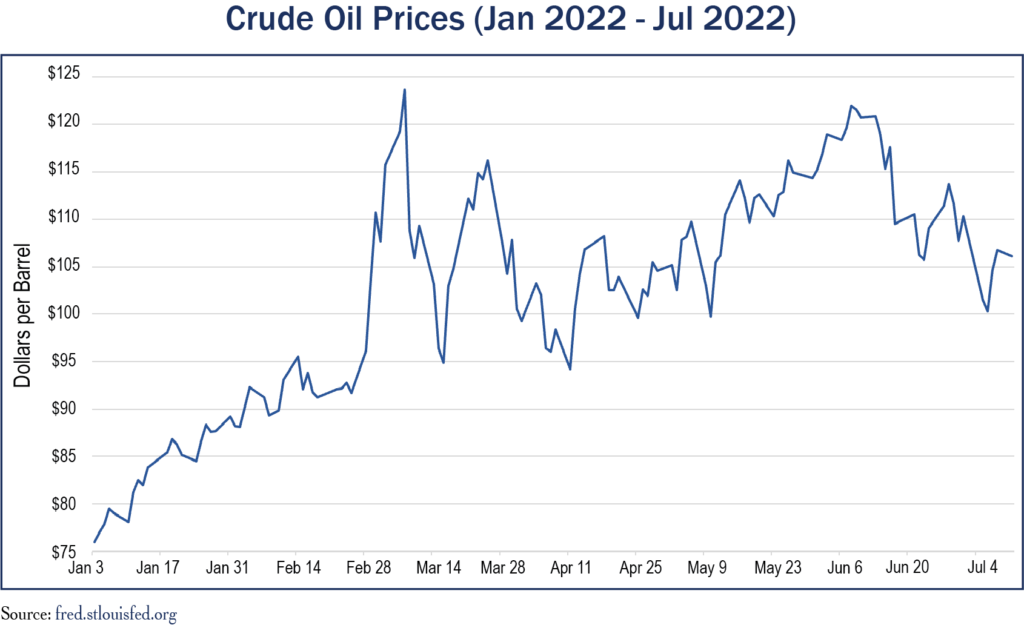

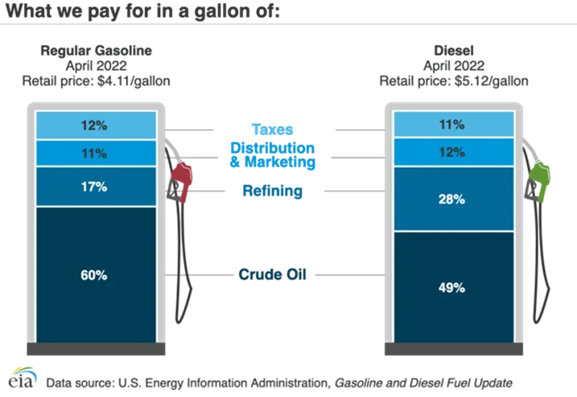

Crude oil is the most widely traded and the most widely used global commodity. The price of oil is determined by the supply of crude oil and the demand for it, and geopolitical issues can play a big part in determining supply. In 2020 during early Covid-19 when the whole world shut down, the price of oil turned negative for a brief time as demand dropped, and oil companies and OPEC instituted large cuts to their production. The world recovered, but because of these cuts, supply has been slower to rebound. The war in Ukraine has also caused a lot of disruption in the global oil market. The U.S. has historically not been a large importer of Russian oil, accounting for less than 3% of the total, but Russian oil and gas prices affect countries overseas, particularly in Europe.

Refining the crude oil into gasoline is also costly, and U.S. refineries are running at full production. Refining crude oil has historically been a low profit business, and the current “windfall” profit in no way makes up for years of heavy losses, even before the downturn caused by the pandemic. In fact, it has been over fifty years since a refinery has been built in the U.S., and five refineries have shut down during the past two years, reducing refining capacity by 5%. Once crude oil is refined, it must then be transported from the refinery to a storage tank and then distributed to local gas stations. Marketing expenses can be high as gas stations can be extremely competitive, as evidenced by the number of gas stations on every corner in larger cities. It is also important to note that the big oil companies, such as Exxon and Chevron, only own 5% of the 130,000 gas stations domestically. Approximately 60% of the stations are owned by independent retailers and convenience stores with licensed agreements.

The final cost imbedded in a gallon of gasoline is the tax. Federal excise taxes of 18.4 cents for gasoline per gallon and 24.4 cents for diesel have not been raised by the U.S. government since 1993 and are not adjusted for inflation. The average state tax is 31 cents per gallon, but it ranges from 9 cents per gallon (Alaska) to 51 cents per gallon (California).

What happens to the price of gasoline when the price of crude oil declines?

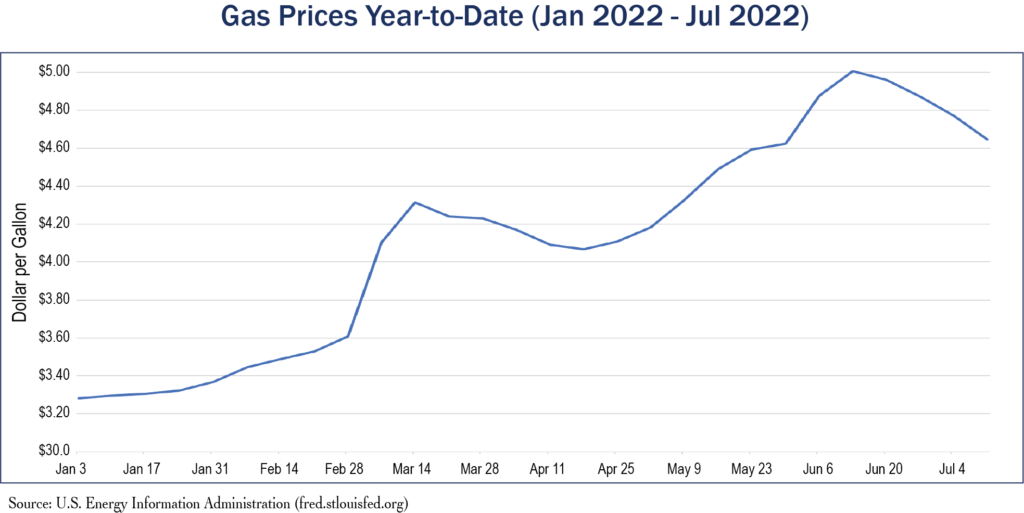

Although the price of crude oil (West Texas Intermediate or WTI) has declined 20% from its highest price of $129 per barrel (bbl) in March 2022 to $98 per (bbl) today, the price at the pump has fallen less than 10% so far. The price at the pump has stubbornly stayed above $4.00, and one of the main reasons is the gas station owners themselves.

Most gas station owners buy gasoline frequently, depending on the number of customers. Since gasoline prices have slim margins and volumes are seasonal (higher in summer months), many gas stations depend on their convenience stores to make a profit. Historically, gas station owners make more money selling coffee and cigarettes than they do on gasoline! Since gas station owners cannot lock in gas prices, they need to sell their last purchase of gasoline for a profit. If the price of crude falls quickly, the owners need to wait until the higher priced gasoline is sold, or they risk selling at a loss. Some station owners may have purchased the lower gasoline and are willing to sell at a lower price while still making a profit. This creates confusion and ill will with gasoline consumers, and this is also why there is such so much disparity in prices. Larger independent companies such as Costco do not depend on fuel prices for profits, and they can purchase gasoline in higher volumes and offer better prices to consumers.

Looking ahead, we expect the price at the pump to reflect the price of crude oil more directly as the supply/demand equation becomes more balanced. Hopefully, this happens sooner rather than later!

Crude oil is a significant commodity for many of the companies in the Tufton portfolio. Some companies benefit as prices rise, including integrated oil corporations Exxon (XOM) and Chevron (CVX). Others benefit as oil prices decline, as we see with chemical, industrial and healthcare companies. Other companies, such as Caterpillar (CAT), provide products for drilling for and refining oil. There is always a company in your portfolio that benefits either way!