What’s On Our Minds:

With summer coming to an end and fall quickly approaching, it’s important to make sure your IRA accounts are all set for the end of the year and that you maximize the tax benefits these accounts have to offer. It’s also important for IRA holders over 70 ½ years old to remember to take their required minimum distributions before the end of the year.

For folks saving for retirement, IRAs offer vast savings advantages over taxable accounts so it’s important to maximize your IRA contribution to grow your tax exempt accounts. If you are under 50, you can contribute $5,500 per year and above 50 years old, you can contribute $6,500 per year. If you make less than $117,000 per year ($184,000 if you are married and filing jointly) it’s a good idea to contribute to a Roth IRA seeing that accounts have the added benefit of tax free withdraws once you reach the age of 59 1/2. A lot of parents advise their young adult children to open Roth IRAs to help them to get a jump on retirement savings before they reach the Roth income threshold. With disciplined annual contributions and a sound investment strategy, these accounts can grow into rather substantial assets by the time you are considering retirement.

After years spent saving for retirement in your IRA, the time will inevitably come when you turn 70 ½ and you will have to a required minimum distribution (RMD) from the accounts. The good news in you can sell securities in the accounts without paying capital gains taxes, but the tough news is that each distribution you take from a retirement account will be taxed at your federal and state income tax rate (with the exception of distributions from a Roth IRA.) RMDs are calculated by dividing the balance of your account at the end of the previous year by a life expectancy factor that the IRS determines.

If you have any questions regarding your annual IRA contributions or distributions, feel free to give us a call.

Last Week’s Highlights:

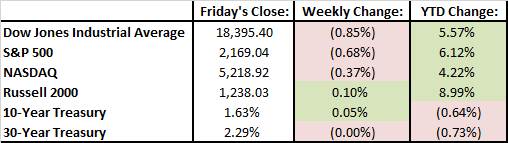

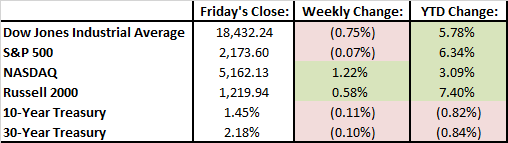

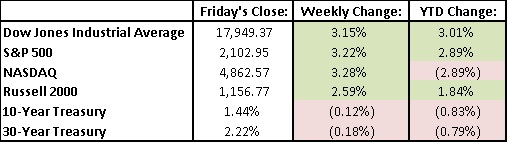

Equity markets were down last week with major indexes each ticking down almost 1%. Investors were a bit cautious last week going into Janet Yellen’s speech scheduled for the end of the week. On Friday, she addressed the Jackson Hole Economic Symposium where she was a bit more hawkish on interest rates so there is chance we will see a bump in interest rates in September. She had this to say on Friday: “In light of the continued solid performance of the labor market and out outlook for economic activity and inflation, I believe the case for an increase in the federal funds rate has strengthened in recent months.” Currently the market is pricing in a 42% chance of a September increase and a 66% chance the fed moves higher by the end of 2016.

Looking Ahead:

Several important economic reports come across the wire this week: productivity numbers, weekly jobless claims, ISM manufacturing, and the U.S. unemployment report. Investors will be looking at these numbers as they are key indicators going into the fed’s September interest rate decision. Expect fed speak to dominate headlines this week.

What’s On Our Minds:

Contributing a portion of your estate to charity may be something that you and your family strongly believe in, whether or not you receive any benefit from it. Although generosity is the driving force behind philanthropy, there are also many benefits that a donor can reap from making charitable contributions.

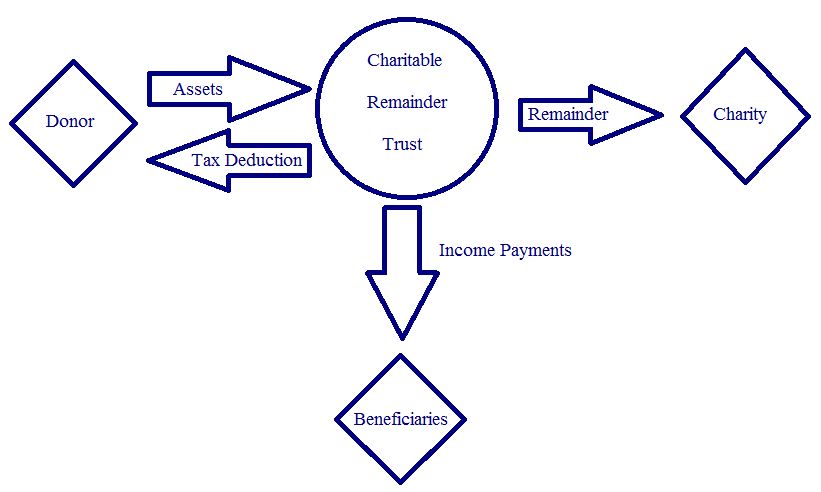

Considering that our firm’s home state of Maryland levies a 16% estate tax (on individual estates larger than $2 million) and the federal government charges a 40% estate tax (on individual estates larger than $5.43 million), it’s important for wealthy families to consider the many estate planning strategies available that can help reduce the tax bite upon a generational wealth transfer. One strategy is the creation of a charitable remainder trust (CRT).

CRTs are an option as they allow wealthy individuals to fulfil their philanthropic goals by moving assets out a taxable estate which can then grow, tax free, through investment. Meanwhile, during the life of the trust, it is required that the CRT distributes between 5 and 50 percent annually to the beneficiary of the trust (either the grantor of the trust or their family). These payments will last for a set number of years or the remainder of the grantor’s life, depending on how the trust document is written. The trust will end at the predetermined time and the remaining funds with go to the charity of your choice.

The tax advantages continue with the creation of a CRT. Along with moving funds out of a taxable estate, upon the creation of the trust, the grantor can take an income tax deduction for the full value of the trust that can be spread over five years. Finally, the creation of a trust helps individuals avoid capital gains taxes. Assets with large unrealized gains can be moved into the trust, sold, and reinvested into a portfolio of income producing investments.

At Tufton, we provide comprehensive planning services to portfolios of all sizes and complexities and give you objective solutions. Armed with a plan, you can be sure your loved ones are taken care of while minimizing taxes.

Last Week’s Highlights:

With earnings season winding down, market moving news was sparse last week. Markets reached another record high on Monday but by the end of the week, we were back where we started. The Fed released minutes from its July meeting on Wednesday which did not provide any excitement. The Fed did not strike down a September or December rate hike, but there is still uncertainty surrounding Brexit and inflation numbers.

On Monday night, Obamacare took a blow when news broke that one of the nation’s largest health insurers, Aetna, would suspend its offering of coverage in 70% of counties where it currently operates.

Looking Ahead:

Some important housing data will come across the wires this week with New Home Sales numbers on Tuesday and Existing Home Sales data on Wednesday. The Fed will hold its annual Jackson Hole Symposium beginning on Thursday. Big shots in the Central Banking world will gather to discuss their trade. The biggest speech of the week is on Friday when Janet Yellen will offer her incites. Per usual with her speeches, investors will be listening intently to hear what she has to say about the Fed’s interest rate policy moving forward.

What’s On Our Minds:

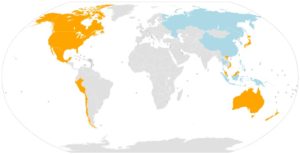

In our blog post about Brexit (http://tuftoncapital.com/the-weekly-view-71116-71516/), we discussed the economic effects of a free trade agreement. There has been a lot of talk about the Trans-Pacific Partnership or TPP recently in the run-up to the election. At first blush, the same arguments would seem to apply to the TPP as any free trade area. However, the TPP is much more complicated.

The TPP, signed but not yet ratified, has twelve members, orange in the map below: Singapore, Brunei, New Zealand, Chile, the U.S., Australia, Peru, Vietnam, Malaysia, Mexico, Canada, and Japan. Potential future members are shown in blue. (Credit: Wikipedia user L. Tak) The agreement is some 5,600 pages long, and makes many significant rules for signer countries.

The most obvious part of the TPP is free trade between members, with all tariffs on US manufactured goods and almost all farm goods being eliminated completely. But it also makes rules about environmental protection (but not climate change), governance standards, human rights, patent and copyright law (especially surrounding pharmaceuticals), and labor standards.

Respected academics, environmental groups, and public figures have come down on both sides of every major issue. For example, Nobel Memorial prize-winning economist Joseph Stiglitz points to “grave risks” and that the agreement “serves the interests of the wealthiest.” However, Harvard economist Robert Z. Lawrence finds that the economic gains to laborers will actually be greater than those for owners. Similarly divided, the World Wildlife fund wrote a piece in favor of the agreement in furthering environmental goals, while Greenpeace and the Sierra Club have come out against it.

The overall direct economic impact is likely to be small for the United States, on the order of a percentage point change in growth by 2030. But its impacts on other areas, such as the ease with which countries can trade with each other, or the ability for adversely affected companies to sue governments, could have ripple effects that cannot be foreseen.

We close this brief overview with a restatement of our previous view on trade’s effects on US jobs: the types of jobs that are in danger of being replaced, such as manufacturing, are in much more danger from automation and secular changes in our economy than they are from changes in our trade arrangements.

For those wanting more detail, there is a very good (albeit long) article on Wikipedia at https://en.wikipedia.org/wiki/Trans-Pacific_Partnership.

Last Week’s Highlights:

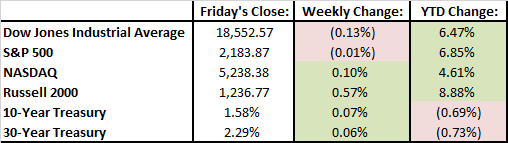

While it was a relatively flat week, markets continue to inch higher. The S&P 500, Down Jones, and the Nasdaq all closed at record highs on Thursday afternoon. Last week we saw strong earnings reports from several major retailers and higher oil prices. Nordstrom, Kohl’s and Macy’s reported strong earnings and sales that beat Wall Street estimates and these companies’ shares rose nicely. Oil was up almost 7% last week on news that Saudi Arabia would finally agree to cut their crude production. Earnings season is wrapping up, and we now see that about 70% of the companies in the S&P 500 beat expectations during the second quarter. With the excitement of earnings behind us, investor focus shifts towards macroeconomic themes; elections news and fed speak .

Looking Ahead:

A couple more earnings reports come across the wire this week with Cisco on Wednesday and Wall-Mart on Thursday. Cisco’s stock has been having a good year, up 15% YTD. Wall-Mart is up almost 20% YTD, and is one of the strongest performers in the DOW Jones this year. It will be interesting to see if their momentum continues. On Wednesday at 2 PM, minutes from the Federal Reserve’s July meeting will be released and analyzed by investors. While the Fed did not decide to raise rates last month, we have seen solid job growth in the US over the summer so a rate hike could be in the cards for later this year.

Maryland residents should get back to school shopping out of the way this week as it is tax-free week in retail stores. Through Aug. 15th, any single qualifying article of clothing or footwear priced under $100 or less, regardless of how many items you purchase, will be exempt from the state’s 6% sales tax. Good news for parents getting ready to send their kids back to the classroom!

What’s On Our Minds:

On Friday, the S&P 500 and Nasdaq both climbed to an all-time high after the Bureau of Labor Statistics reported that the US economy added 255,000 nonfarm jobs in July – beating Wall Street’s expectation of 175,000. Job growth in June was revised higher from a previous reading of 287,000 to 292,000. On previous jobs report Fridays, the markets have surged higher whether or not the report was strong or weak. A “bad news is good news” report typically held the belief that the Fed would continue accommodative policy and not increase interest rates. The response from the markets this past Friday was “good news is good news” as it appears the economy is strong enough to withstand further interest rates hikes from the Fed this year.

The other employment reports were strong as well with average hourly earnings rising 2.6% year over year and the labor force participation rate increased from 62.7% to 62.8%. This is encouraging as the rate hit a multi-decade low in late 2015. For August, let’s hope those seeking employment continue to avoid the beaches.

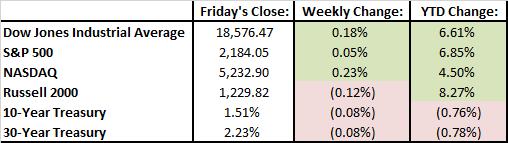

Last Week’s Highlights:

The stock markets rose on the week with all the major indexes in the green. The Dow Jones increased 0.6% while the S&P 500 and the Nasdaq increased 0.4% and 1.1%, respectively. With the rise in expectations of interest rate hikes, the financial sector jumped 1.2% and the utility sector declined 2.6%. Investors are betting that banks will make more money on their loans that they offer at a higher interest rate and that utility companies will have to pay higher interest rate on the debt they currently owe or will owe in the future.

Earnings season is winding down as approximately 87% of S&P 500 companies have reported their quarterly results. 69% of S&P 500 companies reported better than expected results. Furthermore, 53% of S&P 500 companies had their earnings estimates for 2016 revised higher, however, 56% of the companies had their 2017 earnings estimates revised lower.

Looking Ahead:

Looking ahead, the week is somewhat light on economic and company data. Pharmaceutical company Allergan and Tyson Foods report quarterly earnings on Monday. On Tuesday, Walt Disney and the troubled Valeant Pharmaceuticals International will report. Valeant’s stock has fallen from a high of $262 per share last August to $22 per share on Friday due to a government investigation on price increases of their drugs. Thursday will offer guidance and results from the battered retail stores will Macy’s, Nordstrom and Kohl’s all reporting. The report on July’s retail sales will be released on Friday giving investors a gauge of the US consumer – let’s hope all had too much fun on vacation.

What’s On Our Minds:

At a time when fewer business owners are deciding to take their companies public and more money is being invested privately, powerful players in the investment world have quietly been meeting over the past year to discuss corporate governance standards for public companies. Late last month the group released a letter and report outlining “common sense” recommendations to improve corporate governance and ultimately the relationship between companies and shareholders. Included in the bunch of concerned investors is Warren Buffet and a dozen other chief executives from major investment shops including Laurence Fink from Blackrock and Abby Johnson from Fidelity. One of their major concerns is the pressure being put on companies offering earnings guidance as it can influence them to manipulate results to meet expectations. In their letter they state, “the financial markets have become too obsessed with quarterly earnings forecasts … Companies should not feel obligated to provide earnings guidance – and should only do so if they believe that providing such guidance is beneficial to shareholders.” The report also pushes for companies to have smaller and independent boards. In our opinion, it’s positive to see this sort of thought leadership from Wall Street. If put into practice, these new standards will allow America’s leading companies to focus on their long term success which should ultimately be beneficial to all parties.

Last Week’s Highlights:

In typical summer fashion, the markets saw very little trading volume. The market was down slightly as analyst digested a heap of earnings reports. Apple’s stock increased, iphone sales fell less than expected, Facebook shares hit a record high on strong earnings, and revenues that exceeded Wall Street’s exspectations. Alphabet, the parent company of Google, reported a 22% increase in sales mainly driven by mobile advertising. Oil prices declined to a three-month low Friday which brought shares in energy companies down. On Wednesday, the Fed noted improvements in the labor market which was seen as a potential for a September in interest rate increase.

Looking Ahead:

The S&P 500 is sitting near all time highs and we are about 2/3rds of the way through earnings season. Earnings releases continue this week with Proctor & Gamble and Pfizer on reporting Tuesday, Clorox and Twenty-First Century Fox on Wednesday, and Duke Energy and Transocean on Thursday, and EOG Resources and E.W. Scripts on Friday. Friday is jobs day and it is estimated that we added 175,000 jobs in July.

What’s On Our Minds:

The International Monetary Fund (IMF) announced last week a cut to its global growth estimate; the Fund cut this year’s estimate by 0.1%, bringing the estimated figure to 3.1%. Not surprisingly, the decision to cut growth approximations was Brexit-induced, but the IMF also cited other factors—growing political instability, nationalism, and terrorism to name a few—as chief reasons for the decrease, stating that these issues could even further stymie growth. Shocking.

In a message targeted at G-20 nations, the IMF stressed that continued lackluster growth should incentivize nations to keep access to cash “cheap”, utilizing all fiscal and monetary policies at their disposal. This requested targeted our home front—the IMF stated that while the United States economy is set to take off on a (much needed) upward trajectory, the Fed needs to be cautious with rate-hikes (an evaluation intended to spur-off the potential for a September rate increase), citing the negative effects of a stronger dollar amidst global disinflationary and deflationary struggles.

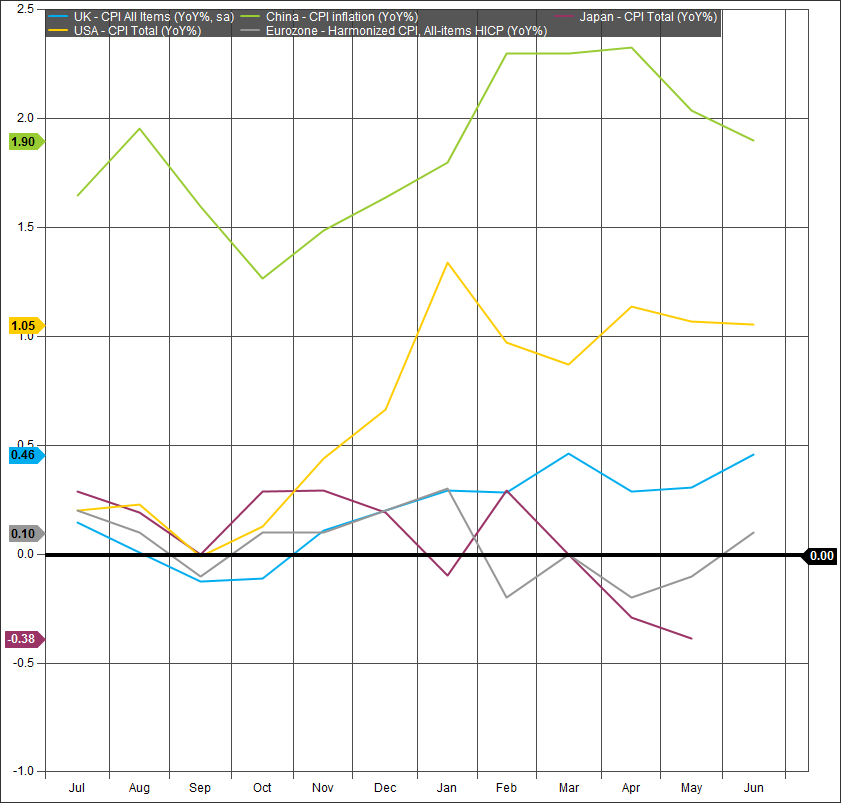

Year-Over-Year CPI Inflation Trends of Major Economies

Global periods of slow growth—or as the academics of the world dub it: “secular stagnation”— plus the implications of Brexit place relatively strong economies, like the United States, between a rock and a hard place: increase rates and be the cause of a potential macro mess, or move along with trepidation hoping that European turmoil does not burst and put us deeper in the rut from which we are (slowly) climbing out. Now those are some choices!

Like those before them, these IMF revisions have not changed the strict and conscientious approach taken by Tufton’s research and investment teams. We continue in remaining anchored to our disciplined long-run approach to investments.

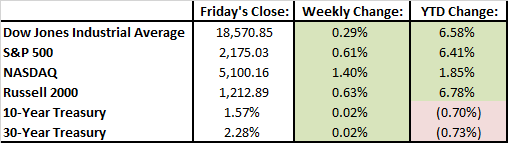

Last Week’s Highlights:

Equity markets were up, continuing a four week winning streak. The Dow Jones added 0.3% while the S&P 500 and Nasdaq both rose 0.5%. Companies reported strong second quarter earnings numbers which helped propel indexes higher. Boston Beer (SAM), the maker of Samuel Adams beer, posted big results and its stock gained 15% on the news. Burrito chain, Chipotle, has had a rough year so far but posted strong results last week which send its stock up 6%. Nintendo shares have skyrocketed since the release of the Pokemon Go game earlier this month, but the company has warned that the impact the game will have on the company will be “limited”.

Looking Ahead:

Earnings season gets exciting this week with some headline grabbers reporting. Under Armour reports earnings Tuesday morning. Apple reports after the closing bell on Tuesday afternoon. Apple has been under performing the market this year and analysts are expecting that iPhone sales declined during the quarter. Facebook is currently trading near all-time highs and will report earnings on Wednesday afternoon. Then on Thursday, Amazon will report results. Alphabet (still referred to as Google by most) also reports on Thursday afternoon. It will be interesting to see if these four big tech companies can pick up their momentum. Ford reports on Thursday. The company has been selling their F-series pickup trucks like hot cakes so far this year but the stock is off 2%.

by John Kernan

There are many hotly debated topics concerning the presidential candidates. One that people come to us about time and again is, “Who would be better for the markets?”

Markets hate uncertainty. Even uncertainty about two outcomes that are mostly neutral can push markets lower. While Trump supporters may believe that his pro-defense, conservative stance might provide more stability, Clinton supporters fire back with the fact that Trump is an unknown quantity and brings uncertainty. Clinton would be a known quantity, for good or for ill, and is often viewed as an extension of the current administration.

It is tempting to look to historical averages to get a better idea of what result would have the best effect on the market. Indeed, we found plenty of articles online that do just that. However, some very basic statistical analysis- just looking at the numbers- shows us we can’t rely on those averages. There are simply far too few elections for any average to make sense.

To analyze the effects on the market, we need to look at elections where no incumbent was running, of which there have been only eight in the last century. One of those, in 1928, had a 49% gain- which had more to do with speculative trading and the roaring 20’s than the election of Herbert Hoover. Similarly, it was the housing crash and financial crisis, not the election of Barack Obama, that led to a 31% loss in 2008. So, we look elsewhere.

Trump’s plan for a wall and increased immigration policing can be partially offset by decreased military spending. His plans are to support larger, more powerful armed forces with less money. However, his proposal to institute big tax cuts that are revenue neutral are under intense scrutiny (and sometimes ridiculed) by professionals. The Committee for a Responsible Federal Budget (CRFB) estimates Trump’s plan will reduce federal revenues by $10.5 trillion in the first decade, and increase debt by $11.5 trillion. Trump counters that his plan would generate enough growth that it would more than pay for all of the spending. The CRFB disagrees.

Clinton also looks to increase spending, but would increase debt by $250 billion, close to where it would be without any changes at all to the current plan. The difference is a tax increase on high earners and businesses. Without the promises of large tax reductions, her budget plans look much easier to realize.

There simply is not enough to go on here to justify a change in investment policy. Whether Clinton means lower growth, or Trump means higher borrowing costs, or vice versa, anything that is knowable is already priced in to the market. While some investors might believe they have a special understanding of the international debt markets, for example, and can earn a premium over the next several months, that is not how we believe most people should be investing.

We find it very unlikely that either candidate will by themselves cause the financial markets to change their patterns of risk and return. We continue to watch individual stocks for their exposure to tax plans that may affect their business—aerospace companies like Lockheed Martin, for example. But no election result would likely cause us to reallocate money out of, or into, different asset classes. Furthermore, because indexes like the S&P 500 are market capitalization weighted, as the price of a stock increases, the stock receives a greater weighting in the index. This conflicts with what we focus on as value investors – buying securities as they fall in price.

by Scott Murphy

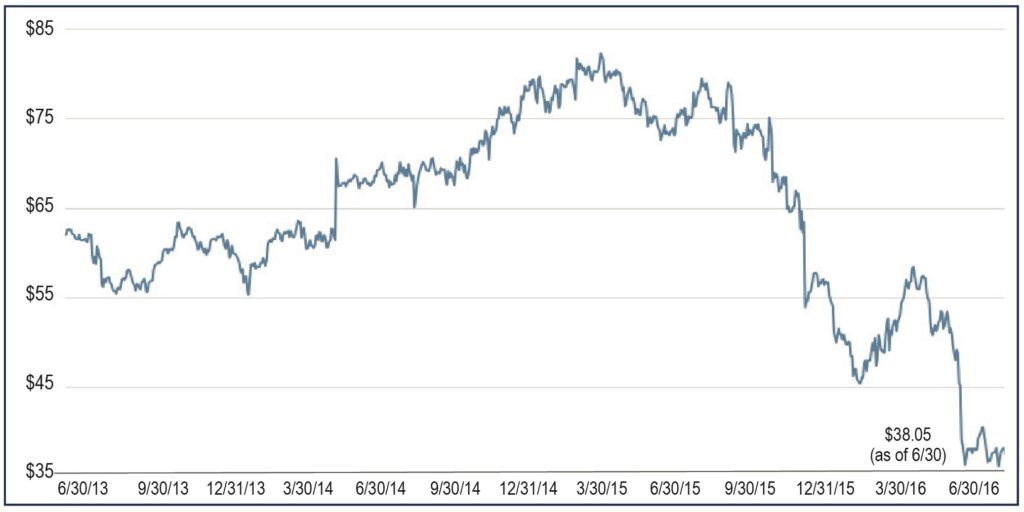

It is a well-known fact that Nordstrom (Ticker: JWN) is the retailer with the greatest return policy in the industry: if you are not happy with your purchase, return it for a no-questions-asked refund. This laser focus on the customer experience is what separates Nordstrom from its competitors and inspires the customer loyalty that is the envy of the retailing world. With its headquarters in Seattle, Washington, it is currently operating 315 stores in the U.S. and Canada. These include 121 full-line stores and 194 Nordstrom Racks located in 38 states with good prospects for store growth in underserved regions of the country.

The stock price has fallen 20% year to date due to a significant reduction in its sales forecast and expected earnings per share for 2016. Nordstrom certainly isn’t alone in this consumer-led stock selloff, and of those in its industry that have sold off, Nordstrom retains a leading position. Management is pulling back store openings and will cut its corporate staff by 10% in order to better position the company for rosier times. As value-oriented investors, we will continue to monitor this investment and stay patient. We believe our original thesis is still intact, and more time is needed for the underlying business of this great company to recover.

We still feel Nordstrom is a solid company and will trade higher as the industry conditions improve. The company has a strong balance sheet, is selling at five-year lows using Price/Earnings and Price/Cash Flow metrics and has a generous 4% dividend yield. Sometimes it takes patience for a great company to work out to be a great investment. Brick and mortar retailers are not “in fashion” right now on Wall Street, but we believe that fact means a good value for our clients.

Nordstrom (JWN) Price Performance

by Rick Rubin

At Tufton Capital, we allocate portfolios based on our clients’ financial objectives, risk tolerance and time horizon, and we factor in our expectations for long-term investment returns. For most clients, we manage balanced accounts that consist of diversified portfolios of stocks, bonds and cash. Occasionally, a client asks us whether all their investments should be fully invested in stocks, because stocks have higher returns over time. Our answer is usually … NO! A key reason to diversify your assets is related to a concept known as “correlation.”

How do we apply this concept to managing money? Correlation quantifies the strength of the association between two variables. Correlation is expressed as a value between -1 and 1, with 1 indicating perfect positive correlation and -1 indicating perfect negative correlation. Our ultimate goal is to identify a portfolio of securities with high return expectations and with high negative correlation to each other (-1 or slightly under). Said differently, we want to own securities that perform well in the long run and whose price changes do not track each other closely.

For example, we invest in stocks across a wide range of economic industries such as technology companies, utilities, financials, etc. We like the long-term value characteristics of many technology companies (Microsoft, Oracle, Qualcomm), and yet we continue to have sizable investments in slower-growth utility and telecommunications sectors. In part, we can justify these seemingly differing investment positions because of the “correlation” benefits. That is, the technology sector’s stock prices behave quite differently than stocks in the other two sectors in the short term.

As compared to stocks, we view bonds and cash as “defensive” investments. Typically, bonds we purchase tend to perform well when the stock market is weak. In particular, U.S. Treasury bonds are viewed as a safe haven by investors, and these bond prices rise sharply during times of stock market turmoil (think 2008-2009 financial crisis). Thus, we invest a portion of our clients’ money in U.S. Treasuries because these bonds have high negative correlation to the stock market.

We use stocks as the primary vehicle of producing capital appreciation, income and dividend growth for clients. Stocks prices are volatile, and they can add stress to investors’ lives as they watch their investments fluctuate. As your portfolio manager, we work to lower your portfolios’ volatility by using a balanced allocation and purchasing value-oriented stocks that offer a margin of safety. It’s important to remember that even though stocks can be volatile in the short term, historically, stock returns far exceed the returns of bonds and cash. Also, stocks protect a portfolio’s purchasing power against the negative impacts of inflation.

We believe above-average dividend yields of high-quality companies provide huge benefits to a portfolio. One of the biggest advantages of reinvesting dividends is a compounding wealth effect. Albert Einstein realized this concept when he said “compound interest is the eighth wonder of the world. He who understands it, earns it … He who doesn’t … pays it.” Although slowly compounding dividends may not be as exciting as your friend’s hot stock tip, this strategy helps build and preserve your wealth over time. We believe in owning shares of well established companies that consistently pay and grow their dividends!

Learn how to use charitable giving tools to grow a donation through investment, possibly allowing you to donate more than by gifting directly.

When making a sizable donation as a direct gift, you know exactly how much you can afford to give and how it will affect your overall finances, but you may wish you could do more. If so, charitable trusts and annuities provide ways for you to make a major charitable donation while simultaneously receiving reimbursements that can help provide financial security.

Charitable Gift Annuities (CGAs)

With a normal annuity, donors fund the annuity with an initial payment, this payment receives gains from investment and then the donor is paid a fixed income throughout the year using this money. With a CGA, the charity, rather than an investment firm, serves as the management company, and any profits the investment earns go to the charity rather than the donor.

Essentially, CGAs allow a charity to borrow the money put into the annuity for investment growth before returning the majority of it back to the holder through annuity payments. CGAs usually have lower return rates than other annuities, but can compensate for these low returns through the tax benefits that they offer. The charitable donation deduction amount is equal to the present value of the charity’s “remainder interest” of the donation, or the excess of the fair market value of the donation over the present value of the annuity. This allows the donor to receive an income tax deduction as well as a portion of the donation back through annuity payments.

As with any investment, CGAs do have some downsides. They can tie up a large portion of your retirement funds and are costly to terminate outside of their set term. Before you enter into a CGA, you should be completely sure that you will not need the funds you are contributing in the immediate future. CGAs can also be risky because they will terminate if the charity you donate to goes bankrupt. In order to avoid this, it’s crucial to research the charity you will donate to and make sure that it is financially stable.

Charitable Remainder Trusts (CRTs)

CRTs provide a different way to grow charitable donations through investment. The donor makes an initial donation to the trust, which is then invested and makes annual distributions to a beneficiary (usually the grantor), giving the remainder to the chosen charity. CRTs offer more security than CGAs because they don’t make the donation until the end of their term, so donors can give to smaller and potentially less stable charities without putting their income at risk.

CRTs offer many tax benefits, including an income tax deduction and the fact that the trust itself is not taxed for income. However, the beneficiary is taxed on any income distributed to him or her.

Many people nearing or at retirement age choose to donate through a CRT because it can provide them with an annuity for a number of years. For those donors who have estate planning concerns, CRTs may be especially attractive, as they offer a full estate tax deduction if created at the grantor’s death. When considering CRTs, grantors should keep in mind that they are required to distribute between 5 and 50 percent annually to the beneficiary of the trust.

Charitable Lead Trusts (CLTs)

CLTs are similar to CRTs, except that they make their annual distributions to the charity and hold the remainder for the grantor or beneficiary instead of the other way around. If the grantor receives the remainder, it is referred to as a “grantor trust,” while if a beneficiary or third party receives the remainder, it is referred to as a “non-grantor trust.”

Grantor trusts offer an income tax deduction, while non-grantor trusts provide an estate tax deduction. Additionally, with a grantor trust, the grantor is taxed for income not given to the charity. With a non-grantor trust, the trust itself is taxed for this income. Grantor trusts are usually used if an individual wants to donate during his or her lifetime, while non-grantor trusts are used to provide a gift to an individual’s family after his or her death while still providing money to charity.

Annuities versus Unitrusts

CRTs and CLTs both come in two different forms, annuity and unitrust. The only difference between the two is how annual payments are calculated. With CRATs (charitable remainder annuity trusts) and CLATs (charitable lead annuity trusts), the beneficiary receives annual payments of fixed dollar amounts. With CRUTs (charitable remainder unitrusts) and CLUTs (charitable lead unitrusts), the beneficiary receives annual payments at a fixed percentage of the trust’s value for that year. CRATs and CLATs offer more consistency, while CRUTs and CLATs give the beneficiary the opportunity to potentially receive larger (or smaller) payments depending on the trust’s value that year.

Choosing a Giving Method

Charitable trusts and annuities can allow you to make a larger contribution to charity than a simple gift, because they allow your money to grow over the trust’s term. However, these options can be expensive and difficult to manage. They also create an extended timeline, which delays the full benefit of your donation from reaching the charity until a number of years have passed. Yet, for donors that would otherwise have to sacrifice their charitable goals to protect their own finances, trusts and annuities may be a more appealing option.

Before deciding to integrate these types of giving vehicles into your charitable strategy, interested donors should seek financial and legal advice to avoid any potential complications. n

This article was written by Advicent Solutions, an entity unrelated to Tufton Capital Management. The information contained in this article is not intended for the purposes of avoiding any tax penalties. Tufton Capital Management does not provide tax or legal advice. You are encouraged by your tax advisor or attorney regarding any specific tax issues. Copyright 2013 Advicent Solutions. All rights reserved.

What’s On Our Minds:

Are we done talking about Brexit yet?

The US and worldwide news cycle might lead you to believe that we’re in turmoil, but the markets beg to differ. The gravity of the issues that face our country and our world shouldn’t be downplayed. There are a lot of things going on surrounding Brexit, and investors have come to us with questions. We thought this would be a good place to address some of them.

Is Brexit good or bad?

This is the political question of the day. Economic theory states that free trade is always better for society overall. For example, say that a country can import 1,000,000 TVs for $400 each, or make them at home, where they will cost $425 each. That’s a $25 million savings for the country overall- but that one company that just lost out on $425 million of sales is going to make a lot more of a fuss than a bunch of people who probably don’t even realize why they saved $25 on a TV. The country then has to decide if it’s worth having more expensive products in order to save a few jobs (for each product).

Then, with free trade comes the freedom of movement afforded by the EU. This means that once a person is inside the EU, he or she is free to move between countries without any border controls, much like the movement between states here. It is also an economic fact that an influx of workers willing to accept lower wages will lower the median wage for everyone. Since countries in the EU retain a lot of sovereignty and identity, they don’t think of it as giving jobs to other Europeans; they think of other countries taking their jobs. We in Maryland don’t worry about “no-good Alabamans” taking our jobs, because we think of everyone as part of one country. But in the EU, countries still think of themselves as very separate.

Trying to have a unity between countries in Europe like we did between states after the Civil War is not something that will come quickly, without tension, or without political and cultural change.

What does Brexit mean for the US?

Well, as it turns out, not much. As we discussed last week, markets panicked at first, but then seemed to realize that things here will be good, with or without a united United Kingdom. UK markets, too, recovered (see below).

So why all the fuss?

England is only about 4% of the world’s GDP. But the EU as a whole is larger than the United States. If there is contagion and a breakdown of the ties between EU countries generally, it could spark a worldwide financial and economic crisis perhaps worse than the 2008/9 one here in the US. Needless to say, a big deal. As it stands, though, we don’t think and EU meltdown is in the cards.

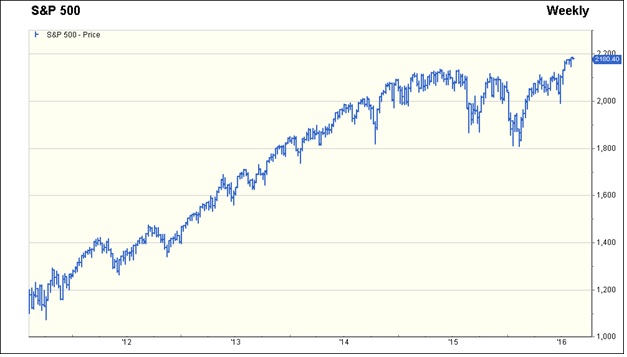

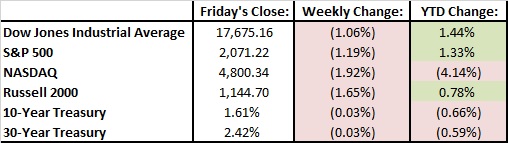

Last Week’s Highlights:

For the third week in a row, stocks were up. With last week’s 1.5% gain in the S&P 500, markets have rebounded 8% since the big drop following the Brexit. Since then, U.S. jobs numbers have showed strength, retail sales numbers beat expectations, we have had a good start to earnings season, and foreign governments have committed to stimulating their weak economies abroad. It was a record-breaking week, as for the first time since 1998 the S&P 500 hit intra-day record highs each day. In company news, Germany’s Bayer increased its offer to purchase seed-maker Monsanto to $125 per share. Disney issued corporate bonds with record-low yields. The company issued a 10 year debt with a 1.85% yield and 30 year debt at 3%.

Looking Ahead:

Even with tragedy last week in France, an attempted coup in Turkey over the weekend, and another horrific attack on police in Louisiana on Sunday, Wall Street remains optimistic on stocks. A good start to earnings season has helped boost investor sentiment. This week, we enter the second week of Q2 earnings season, and our analysts and portfolio managers will be busy listening to earnings calls and reviewing results. After last week’s positive results, we will see if momentum continues. On Monday, we will hear from Bank of America, IBM, and last year’s darling stock, Netflix. On Tuesday, Goldman Sachs and Microsoft release results. Halliburton and Morgan Stanley will release their earnings on Wednesday, followed by General Motors and Capital One on Thursday. We will wrap up the week with General Electric on Friday.

What’s On Our Minds:

The Labor Department’s report for June demonstrated strong growth—287,000 jobs were added in the month—for the United States, particularly when compared to May’s dismal addition of only 11,000 jobs. The average for these two months, 149,000 in payroll growth, is closer to the 100,000 in sustained growth Chairwoman Janet Yellen finds necessary in order to keep the unemployment statistics at its natural rate of 5%.

Supporting this sentiment, the unemployment rate rose to 4.9% in June, up from the previous month’s rate of 4.7%. So, you might ask, “what exactly does this mean?” Well, the closer that statistic approaches 5%–eliminating so-called “slack” in the labor market–the greater the amount of upward pressure on wage growth; the farther unemployment drops below 5%, the higher inflation moves above our annual target of 2%

While hourly wages rose a very modest 0.1% in June, year-over-year wage growth was up 2.6%, up from the targeted 2% and indicative of a growing, albeit slowly, economy. Thus, while June’s employment statistics are very reassuring, we need to remember that our economy targets 2% inflation (growth), and cannot tolerate continued job growth in the 200,000s.

As it relates to interest rates, the optimism implied in June’s statistics might enable the Federal Reserve to modestly raise rates in the near future—maybe even as soon as September. However, given the post-Brexit macro climate, it is not out of question for the Fed to continue surveying the future landscape of both the domestic and global markets in order to ensure its actions benefit the economy.

The Labor Department’s report injected investors with optimism, helping drive the markets to near record-highs by Friday’s close. But as with all economic and market data, it is important that investors evaluate their decisions with long-term implications in mind, not getting caught up “in the moment”, so to speak. And while the investment and research teams here at Tufton were surely happy with Friday’s market performance, we remain disciplined in our approach to grounded, long-run investment decisions.

Last Week’s Highlights:

Domestic markets were closed on Monday for Independence Day. In the abbreviated week of trading, the stock market accelerated its rally. Since Brexit news shocked the market, we have experienced a 4% gain over the past 2 weeks. Believe it or not, we have now regained all of the losses experienced due to the Brexit uncertainty and we are flirting with all-time highs. At the beginning of the week we saw investors continuing a move towards safety but some good economic numbers were released later in the week which helped to propel stocks higher. Friday was “Jobs Day” and the market opened up after the Department of Labor reported that June payrolls increased by 287,000 which was more than expected. The Fed’s dovish tone on keeping rates low appeared to be a signal of “let the good times roll” for domestic equity markets. All of this action in the equity markets over the past few weeks is a reminder of how important it is to take a long term approach to equity investing.

Looking Ahead:

Markets will look to build on last week’s gains. We will get a look at more economic data and we will be monitoring the beginning of earnings season. Alcoa will kick off second quarter earnings season when it releases its results after the closing bell on Monday. Earnings calls from a few big financial institutions will be interesting this week as analysts will likely be asking for their opinions on post-Brexit fallout. On Thursday, our analysts will be listening to earnings calls from JPMorgan Chase and on Friday, Citigroup and Wells Fargo. Thursday we will see the Bank of England’s first monetary decision since the nation’s Brexit vote. Some believe they may cut Britain’s interest rate from 0.5% to keep their economy going during a time when uncertainty rules their headlines. Back home on Friday, the Department of Commerce will also release June retail sales numbers. The market is expecting an increase of 0.1%. Also on Friday, the Department of Labor will release consumer price index numbers from June. The market is expecting an improvement of .03%.

What’s On Our Minds:

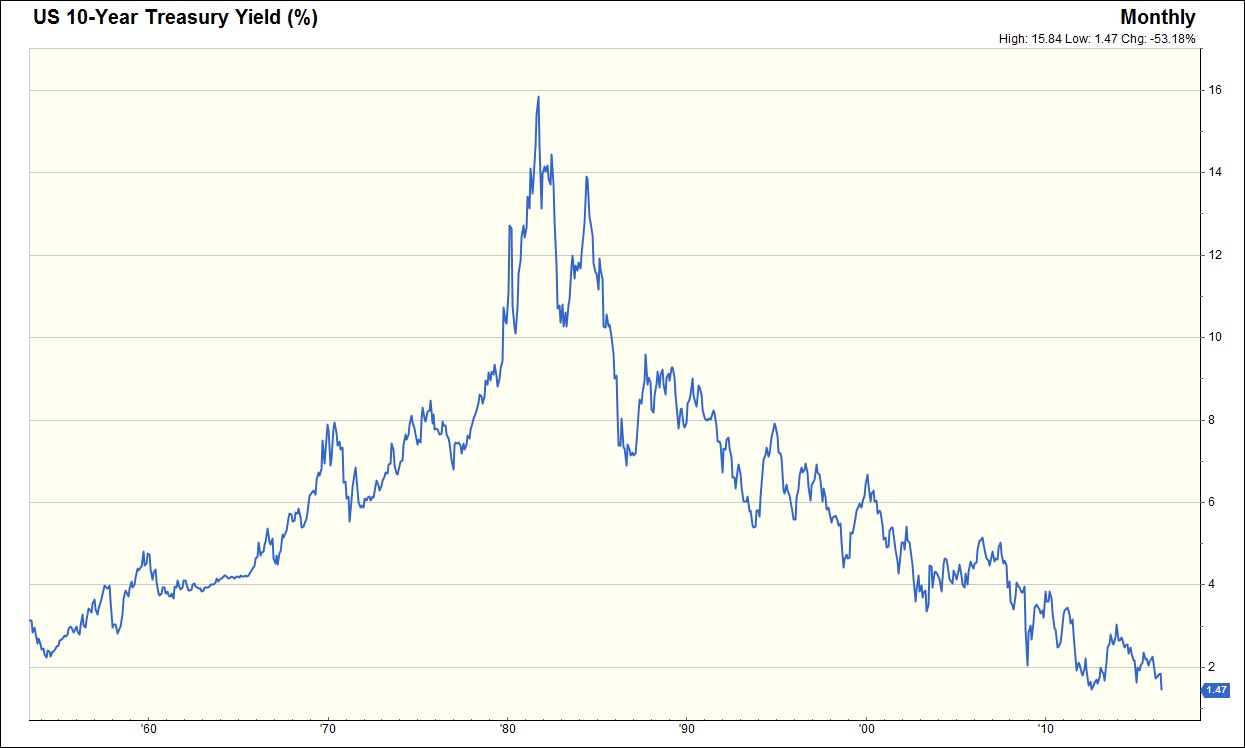

The search for yield continues as the yield on the 10-Year Treasury hit a record low this morning. With government bonds overseas offering negative yields, it appears foreign buyers are scouring the globe to find anything that may offer them investment income. Last week, investment in High Dividend Yield ETFs led ETF flows while the high yielding Utility and REIT ETFs also gained investor interest. In addition, value stocks (that have typically yielded more than the market recently) have also been in favor.

On the bond side, investors are flocking to US Corporates and Treasuries. Not long ago, there were many more options for those seeking investment income. From 2011 to 2013, initial public offerings of the high-yielding Master Limited Partnerships (MLPs) averaged more than 1 per month while oil and gas producers continuously issued bonds with well-above average interest rates. Emerging Market debt also offered attractive returns.

In the second half of 2014, oil crashed and the MLPs and energy debt followed suit. Now, many oil and gas producers and service companies have filed for bankruptcy. Some energy survivors have also slashed or even cut their dividend. Most MLPs can no longer access the debt markets and have turned to issuing more stock/ units, diluting the stock/unit value of their current investors. Emerging Markets also took a dive, but have since started to recover.

With the German 10-Year Bund offering -0.18%, the Switzerland 10-Year bond offering -0.62%, and the Japan 10-Year bond offering -0.25%, it seems investors have flocked to “the best house in a bad neighborhood”: The United States.

Hopefully this party will end without broken windows, but at this point, we’re not too sure who’s on the guest list.

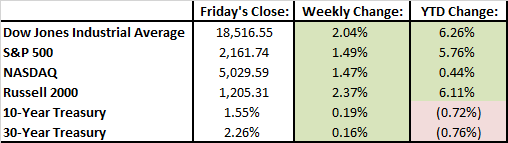

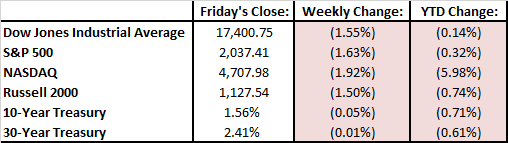

Last Week’s Highlights:

For the week before the holiday, investors were able to shrug off the Brexit jitters as the Dow Jones Industrial Average and S&P 500 rallied 3.15% and 3.22% respectively. While stocks recovered, the bond market did not display much of the same “risk-on” feel. The yield on the US 10-Year Treasury ended the week at 1.47%, well below the pre-Brexit yield of 1.74%.

Year-to-date, the S&P 500 is up 2.89% and the Dow Jones is up 3.01%, not including dividends. The Nasdaq is just the opposite of the S&P, actually down 2.89%. The Nasdaq continues to be weighed by the technology constituents, particularly Apple, which is down 10% this year.

Looking Ahead:

This week, the markets will be focusing on a variety of economic data. On Wednesday, the final reading of the Purchasing Managers Index for June will be released at 8:30 AM providing investors a status of the private sector. At 2 PM on Wednesday, the minutes from the most recent Federal Open Market Committee meeting will be released. Investors will look for hints on the direction of interest rates. Friday is “Jobs Day” as employment numbers for June will be released at 8:30 AM. Next week, prepare for second quarter earnings with Alcoa kicking off the season after the closing bell on Monday.

What’s On Our Minds:

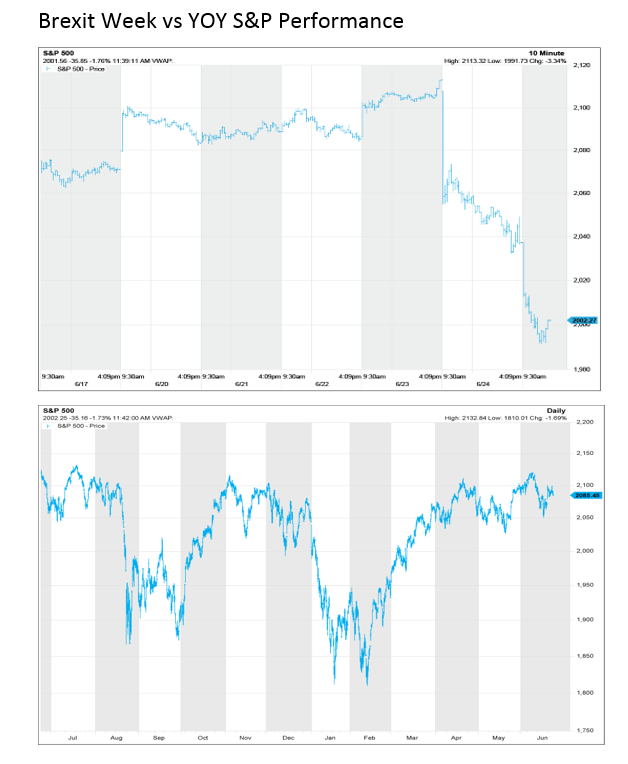

In late June, tennis at Wimbledon is usually the big news coming out of Britain, but not this year! British citizens have spoken; they want to leave the European Union and the referendum results last Thursday sent shocks through global equity markets on Friday. Stocks sank, currency values were volatile, and gold values increased. It was the eighth-largest drop in the Dow Jones index on a point basis but on a percentage basis (3.6%) it ranked below the correction the S&P 500 experience in August of 2015. Furthermore, the market had rallied to near all-time highs leading up to the vote as many predicted Britain would vote to stay in the EU. The decision to “stay” was priced into the market leading up to the vote, and the uncertainty brought on by a “leave” vote sent markets south.

It’s important to note that unlike the financial event that led to collapse of Lehman Brothers in 2008, the Brexit is a political event. It’s clear that Britain has become increasingly polarized; Prime Minister David Cameron made a campaign promise to hold a referendum as a concession to a growing faction in his conservative party that wanted to exit the EU. These “Brexiteers” want to have more control over their borders and believe their EU membership costs could be redirected to benefit the nation domestically. They will get their wish if Britain can successfully complete the 2 year process of negotiating its way out of the EU.

In our opinion, we continue to take a long term view on the equity markets as investors throughout the world continue to digest the unexpected Brexit. That being said, we believe our portfolio of companies has the financial strength to ride this storm out and continue paying dividends.

Last Week’s Highlights:

Without a doubt, it was a tough week on Wall Street. Markets had rallied big early in the week only to tank on Friday’s Brexit news. On Friday, the S&P 500 fell 3.6%. The Dow fell 3.4%. This puts the indexes in the red for the year. The NASDAQ is now down almost 6% year to date. The nation’s biggest banks passed their stress test. The Fed considered the 33 of them to be in good health and can withstand a recession based on higher capital, better loans, and lower costs. In company news, Tesla made an offer to purchase SolarCity for $2.8 billion. Boeing announced it had signed jetliner deal with Iran worth roughly $27 billion. Volkswagen announced it will pay $10 billion to either buy back or fix cars it sold with emissions cheating software.

Looking Ahead:

On Monday, Janet Yellen and ECB President Mario Draghi will be speaking at a European forum on central banking on the impact of the Brexit. On Tuesday, the final estimate for Q1 GDP is reported along with June consumer confidence numbers. On Wednesday, May spending and personal income numbers will be reported. Thursday we will hear about the U.S. economy and monetary policy from the St. Louis Fed President, James Bullard. We will also get quarterly results from Hunt Valley based, McCormick.

What’s On Our Minds:

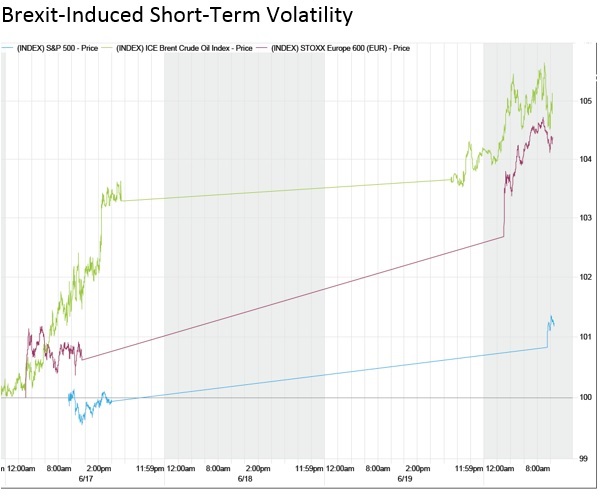

Thursday’s impending “Brexit” vote has caused notable short-term volatility and uncertainty over the past week; these market swings are not just limited to British markets, but global markets as well. Until Thursday, it appears that the only thing the market is focused on is “stay or leave.”

While we don’t rely on gambling shops (or bookies) in our investment research, it has been fun watching the odds of an EU exit change as we get closer to the vote. British gambling odds have been in favor of staying in the EU—76% of current gamblers are leaning towards a “remain” vote according to Ladbrokes—last week’s odds and polls illustrated a near 50/50 split among U.K. residents’ view on the vote, representing a slight uptick in the share of residents that felt strongly about an impending “leave” vote. The aforementioned shifts in the market are, as The Wall Street Journal has stated, a product of the markets’ complacency—investors had held comfortably to the U.K. remaining in the European Union, so the aforementioned increase in “leavers” had notable short-term effects on the markets. Supporting this sentiment, this morning’s issue of The Wall Street Journal shared that many investors “may be guilty of putting too much weight on the scenario they wish to see rather than reality.” The Federal Reserve even mentioned Brexit’s impact on its decision to keep rates low during last week’s FOMC meeting.

God-willing and the creek don’t rise, it looks like Britain will remain a member of the EU after Thursday, removing a cloud of uncertainty from global markets and regulatory bodies. While we here at Tufton feel that the Brexit debate itself will have little direct long term effect on the markets, its undeniable that a British departure from the EU would have a lasting impact on the Euro Zone; London’s role as a crucial financial center weighs heavily in the Union’s global impact from a political-economy perspective. We will be watching the markets and news regarding Brexit throughout the week. For what it’s worth, we would bet on the majority opinion.

Last Week’s Highlights:

It was a tough week on Wall Street with both the Dow Jones and S&P 500 down just over 1%. Based on concerns over the state of the labor market, the Federal Reserve voted unanimously to “stay the course” on interest rates. At their meeting, they shed light on their current thinking; they will likely make make more gradual rate hikes moving forward. This was a change from the hawkish tone we heard from the Fed in March. Oil moved lower on worries of weak demand. In company news, Merck announced it would pursue an acquisition of privately held biotech company, Afferent Pharmaceuticals. Also, Microsoft announced it would acquire LinkedIn for $26.2 billion. I was a good week for LNKD shareholders as shares skyrocketed 47% on the news.

Looking Ahead:

The first official week of summer should be interesting for the markets. On Monday, President Obama is speaking at the Commerce’s US investment summit. On Tuesday, Janet Yellen will be busy in Washington, delivering a monetary policy report to the Senate Banking Committee and attending a Financial Stability Oversight Council meeting. On Wednesday existing home sales for the month of May are reported and on Thursday, new home sales numbers. Britain will vote on whether it will be leaving the European Union on Thursday. On Friday, the Russell Indexes will be re-balanced which is always one of the busiest trading days of the year.