What’s On Our Minds:

The war of words between President Trump and North Korea’s Kim Jun Un caused the CBOE Volatility Index (“the fear index”) to spike 55% last week. While volatility has been extremely low this year, last week’s spike serves as an important reminder that volatility will inevitably rear its ugly head every once in a while. Read on to learn what drives high volatility and how investors should respond when markets gets turbulent.

High-volatility Markets

Originally used by chemists to describe chemicals that evaporate (and explode) easily, “volatile” has become the generic term for anything erratic or subject to sudden changes.

Today, most people hear about volatility in connection with investments and the stock market. But what does volatility mean in a market? Can we measure it? What does it mean for an investor’s current assets?

A Measure of Movement

Just like in chemistry, market volatility is about change. Stocks (or other investments) that are thought to have more predictable price fluctuations have “low volatility” while those expected to make drastic movements (both up and down) are said to have “high volatility.”

Most people use volatility to gauge the risk they are taking when purchasing an investment or planning a portfolio.

Highly volatile investments are judged as unpredictable with their returns. Though this means a volatile investment could significantly exceed its projected return, it also means that it is more likely to fall considerably short or cause a loss.

Two Types of Volatility

Investors commonly use one of two types of volatility when looking at stocks: historical volatility and implied volatility.

An investment’s historic volatility is measured according to its standard deviation—that is, comparing how much it has fluctuated in the past to its average rate of change.

Implied volatility, on the other hand, shows the expected volatility of a stock over the next 30 days. It is calculated using the current premiums on stock options.

Implied volatility is a measure of both anticipated performance and market sentiment. When option writers have increased concerns about a stock’s future price, they compensate by charging more for option contracts. The higher the premium they charge, the greater the anticipated fluctuations. The premium, therefore, implies the level of volatility.

The standard indicator of total market volatility is the Chicago Board Options Exchange Market Volatility Index—ticker symbol: VIX. It relates the implied volatility of all options on S&P 500 stocks due in the next 30 days.

Because the implied volatility is greatly influenced by investor emotions, the VIX is commonly referred to as “the fear index.”

What does High Volatility Mean for Investors?

Volatility is an inescapable part of investing. The future is uncertain and every investment carries risks.

However, unless an investor is involved with buying or selling options, a brief increase in volatility or the VIX is unlikely to require any changes to his or her investments.

A volatile market might cause stock prices to rise and fall by significant amounts, but it does not necessarily affect the future value of owning shares in a company.

Investors should choose stocks based on the underlying value of a company, not a temporary price fluctuation. The fear associated with the VIX should not give way to irrational buying or selling.

Nevertheless, prolonged periods of high volatility can make it more difficult for investors to plan for retirement. Even though the market could be rising in value, high volatility makes it difficult to set reliable retirement dates.

Those nearing retirement typically desire less volatility in their investments, as significant downturn can delay retirement by several years.

A high-volatility market is one that can produce both significant gains and significant losses. Investors must recognize that every investment has the potential to become volatile. Volatility is an expression of market fears and past changes, not a guarantee about the future.

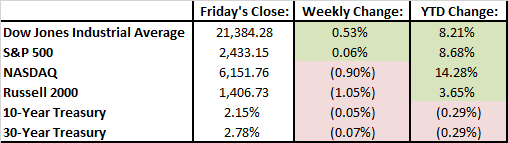

Last Week’s Highlights:

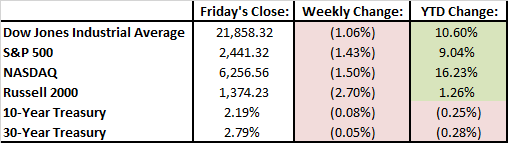

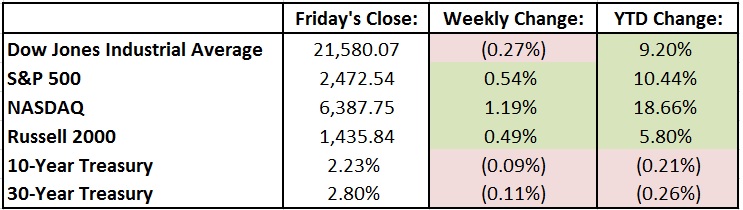

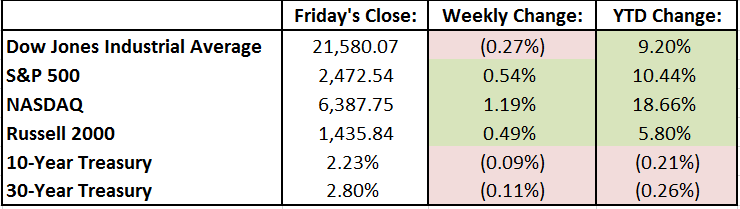

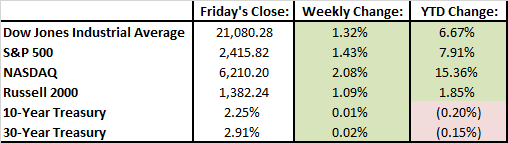

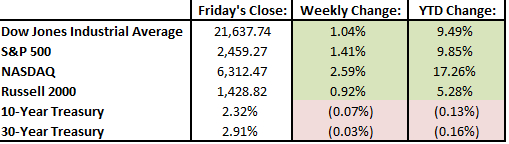

Domestic markets have been on a strong run recently during a solid second quarter earnings season. 90% of the S&P 500’s companies have reported and 74% of them have beaten investor expectations. Last week, domestic stock indices experienced a bit of a hiccup due to geopolitical tensions surrounding the situation in North Korea. After a strong run, the Dow Jones broke its 10-day winning streak on Wednesday. The trash talk between President Trump and North Korea’s Kim Jung Un caused safe havens (bonds and gold) to rally last week. Overall, last week served as a reminder that investors can be an anxious bunch and that geopolitics can in fact influence our markets here at home. The team here at Tufton continues to remind our clients and friends that these types of short term market jitters should not weigh on your long-term investment objectives.

Looking Ahead:

Aside from keeping an eye on the situation unfolding between the United States and North Korea, investors will continue monitoring earnings updates and continue trying to figure out what’s next for the Federal Reserve. The U.S Census Bureau will report retail sales for July on Tuesday. The Federal Open Market Committee will release its meeting minutes from its July 26th meeting on Wednesday and the first rounds of NAFTA negotiations between the U.S., Canada, and Mexico will commence. Weekly jobless claims will be released on Thursday. On Friday, we will close out the week with University of Michigan reporting their Consumer Sentiment figures for the month of August.

What’s On Our Minds:

One of the most interesting aspects of investment and the stock market is its ability to show trends. Any given company on any given day has a stock value that behaves individually. However, there are certain characteristics that people might expect to see from companies depending on their size.

Commonly referred to as its “market cap,” a company’s market capitalization is the total value of all shares of its stock (both common and preferred). Though market cap is easy to calculate (shares multiplied by price), determining why a company holds its current share price is much more difficult.

In general, companies are classified into one of four categories: large-cap, mid-cap, small-cap and micro-cap. Large-caps (sometimes called “big-caps”) typically have a value of over $10 billion. Mid-caps span approximately $2-$10 billion. Small-caps are usually below $2 billion, with micro-caps being smaller than $250 million. Sometimes the terms “mega-cap” or “nano-cap” are also used; these are reserved for truly gigantic and extremely small companies, respectively.

Characteristics of each Cap Category

Large

Large-caps are typically the most stable companies on the market. They are big companies with long histories and a lot of market recognition. Large-caps are more likely to pay out stock dividends and make good on bonds. Investors that focus on large-caps will try to use this stability to produce measured, consistent growth for their clients.

Mid

A mid-cap company usually carries a lot of weight in its particular industry, but is not as widespread as the large-cap companies are. Investors that predominantly use mid-caps aim to have higher gains from growth than large-caps, but put themselves at slightly more risk. During times of economic decline, mid-cap investors will usually lose more than large-cap investors.

Small

Most small-cap companies are well established, but individually, have a minor role in the market. Their functions are usually non-essential, but they have plenty of room to expand and might possibly move into the mid-cap range. Small-cap investors try to harness this growth potential, but cannot be certain of success. These funds often have years of significant gain broken up with occasional years of loss. Small-caps will often boom during economic recovery.

Choosing a Market Cap Style

There is no “right answer” when it comes to choosing a type of cap for investing. Although any single type of market-cap might outperform any other type, success in the future is ultimately unknowable. Large and mid-caps might weather economic downturns better, but are less likely to grow quickly when things are good.

When investing, whether in bonds or stocks, it is important to get all the information. Risk and return must be balanced properly in every portfolio and the means to do it is not always clear. If you are consider adjusting your investments, contact Tufton Capital Management with all your questions and concerns.

Last Week’s Highlights:

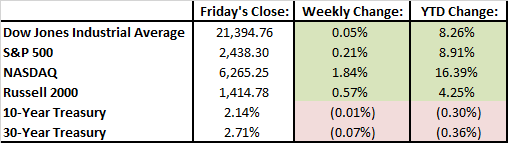

There was a flurry of activity during the week as strong earnings continued to drive the major indices higher. The Dow set a new high water mark above 22,000 and the S&P 500 continues to march towards 2500. A particular Cupertino phone company continues to be the apple of the markets eye, as AAPL had a large earnings beat. The stock finished the week with a 4.5% gain and is up 34.5% YTD. Tesla had a strong quarter on unexpected revenue growth and continues to trek higher into even frothier levels. The market values Tesla $15B more than Ford motor company and $7B more than General Motors.

There was positive economic data this week as employers added 209,000 jobs in July and brought the unemployment rate down to 4.3%. In political news, General Kelly replaced Reince Preibus as White House Chief of Staff and fired Director of Communications Anthony Scarramucci, who only held the position for 10 days.

Looking Ahead:

Earnings are starting to slow down, but Disney and Home Depot, along with younger companies, like Snap Inc., are reporting. It’s supposed to be a quiet week in Washington D.C. as no major bills or testimonies are scheduled. These truly are the dog days of summer…

What’s On Our Minds:

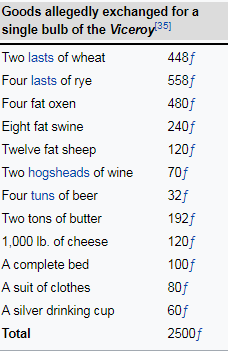

Market bubbles, like the tech bubble of the 1990’s, have formed for as long as there is record of exchange, and all follow a similar pattern of speculation.

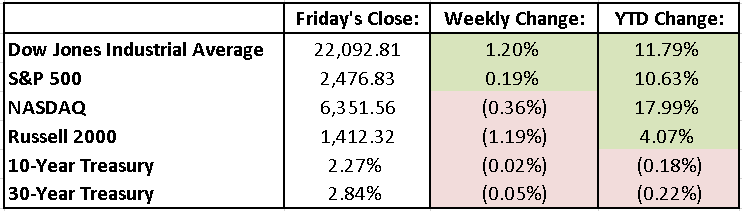

In the early 17th century, the Dutch became enraptured by tulips, and created the first chronicled speculative bubble in history. As recorded in Charles Mackay’s Madness of Crowds, tulips began to grow rapidly in popularity all around Europe, and therefore tulip prices rose sharply. Many deft merchants identified this trend and made a large profit in trading tulips. Other merchants and the nobility, seeing these extraordinary profits, jumped into the tulip market. As a result, prices for tulips kept rising and rising, backed by nothing but speculation. Soon enough, nobles, farmers, seamen, chimney sweepers, and maidservants alike were all dabbling in tulips. Below is a chart of what one individual paid for a single tulip bulb!

(Source: The Tulipmania: Fact or Artifact?)

Eventually, the tulip market ran out of new money to keep bidding up prices. As reality sat in, speculators all ran for the exit and prices plummeted. Many speculators lost all their savings as contracts they purchased were ten times the price that tulips were then trading.

This is an important lesson for us in 2017. As Benjamin Graham poignantly argues, “an investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Graham would certainly have chuckled at otherwise serious individuals who lost a whole year’s salary on buying tulips.

Buying something, be it tulips, Bitcoin, or the hot stock of the day, as an investment because everyone else is doing it, or because of tremendous recent returns is not investing, but speculating. It may work in the short term, but it always has devastating effects in the long term.

The lessons of manias past are always important to keep in mind in an ever changing market. This isn’t to compare any particular asset to the tulip bulb craze, but it is always smart to study history in an attempt to understand the present. Many people will make bold claims about “X being in a bubble” or “Y will never go down.” A prudent investor, not speculator, will not be swayed by the opinions of crowds and will continue to drown out the noise and invest in quality assets at good prices.

Tulip Price

(Source: The Tulipmania: Fact or Artifact?)

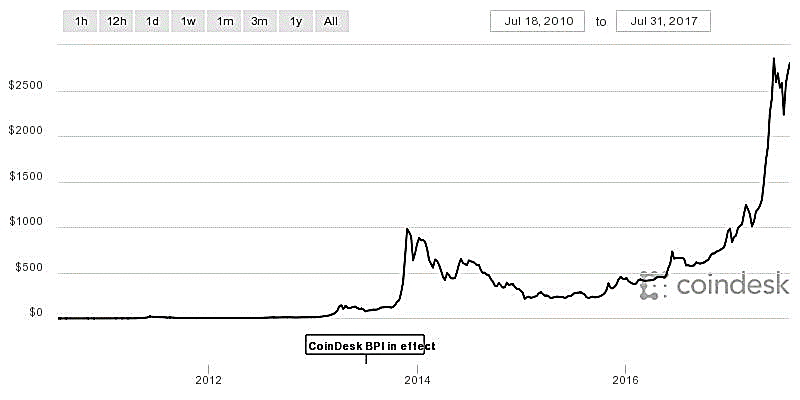

Bitcoin Price

((Source: www.coindesk.com)

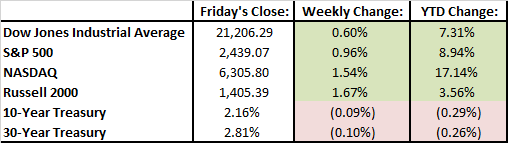

Last Week’s Highlights:

The Dow Jones Industrial Average climbed to a record 21,830.31, up 1.2% the past week, backed by strong earnings. Big names like Verizon, Google, McDonald’s, and Boeing all surpassed expectations for the second quarter and gave an optimistic forecast for the future. Oil rose 8.6% last week after Saudi Arabia cut its oil exports and OPEC said they might discipline member nations who do not follow OPEC’s production limits.

The Federal Reserve left interest rates unchanged after their meeting Wednesday. They hinted that the tapering of its $4.5 trillion balance sheet will begin “relatively soon.” GDP rose 2.6% in the second quarter, which was slightly less than the estimated 2.7%. The growth was driven by increased consumer spending and increased business investment, both positive signs for the macroeconomic health of the US economy.

In Washington, the GOP’s repeal and replace effort to end ObamaCare has concluded for now. In a vote for “skinny repeal,” John McCain shocked the nation by casting the decisive “no” vote, resulting in a 49-51 vote. The market has been indifferent to the chaos in Washington as the major indices continue to climb, despite a recent legislative defeat (TrumpCare), high profile firings (Chief of Staff Reince Preibus), and swirling allegations surrounding the current administration. The next major agenda item is tax reform, which is very important to corporate America, and has been a major reason for the so-called Trump Bump.

Looking Ahead:

There will be a slew of economic data released this week. On Monday, the Chicago Purchasing Managers Index will be announced. Personal income and spending data, and the ISM Manufacturing Index will be reported on Tuesday, and nonfarm payrolls will be released Friday. The Bank of England also will issue a rate decision on Thursday.

In large cap earnings this week, Apple, Under Armour, Sprint, Time Warner, Kraft Heinz, and Pfizer are all set to report. Oil earnings are in full swing with BP, EOG, Devon, Chesapeake, and EPD reporting throughout the week. At General Electric, John Flannery will be replacing Jeff Immelt on Tuesday and investors will be waiting for any news about the direction of the company.

In political news, there are hopes that Republicans will abandon Healthcare reform for the time being and begin to focus on tax reform. Mike Pence will visit Eastern Europe.

What’s On Our Minds:

With very little volatility in domestic markets lately, let’s review the tax management strategy of “tax loss harvesting”.

Aside from research roles, Tufton Capital’s portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must pay a long-term capital gains rate of 15%. The tax savings increase for the highest income earners in the 39.6% Federal tax bracket, who must pay 20% on long-term capital gains. Plus, depending on where you live, you may be subject to capital gains taxes at the state level. Our clients in Maryland know this all too well!

Of course, we don’t make trades just for tax purposes. If we think a stock is going to increase in value, we hold it. If we think it is going to go down, we sell it. But using a tax wash sale, in which a security is sold and then repurchased after 30 or more days, enable an investor to claim the tax loss but still hang on to an investment that he or she thinks has long-term potential.

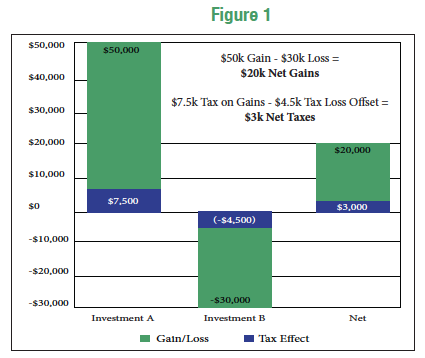

Take for example a single person who has an annual income of $100,000. He would be in the 15% long-term capital gains bracket. In his brokerage account, he has a realized long-term capital gain of $50,000 in Investment A and an unrealized long-term capital loss of $30,000 in Investment B. If he sells his shares of the losing stock, he can offset the $50,000 gain against the $30,000 loss, resulting in $20,000 of net long-term gains. If he does not harvest the loss, the Federal tax on his $50,000 long-term gain would be $7,500. By partaking in this tax loss harvest, he will save himself $4,500, which would have otherwise been a piece of his Federal tax liability for the year (See Figure 1).

Portfolios with large unrealized gains will likely have some positions that have unrealized losses. Although a loss may be hard to look at, sometimes it’s best to bite the bullet and clean these losers out of a portfolio. This management strategy allows investors to free up cash in the portfolio, which can be deployed into other, more attractive investments.

While it’s important to avoid the tax tail wagging the investment dog in your overall investment strategy, a disciplined approach to managing tax liabilities is an important component of wealth management.

Last Week’s Highlights:

On the back of strong earnings, all three domestic market indices notched new record highs during the week, but finished with mixed results. Major banks reported earnings, with most producing top and bottom line beats but with mixed results beyond the headline numbers. Goldman Sachs had gains in its equity portfolio but reported weak trading revenue. Bank of America posted a surprise drop in net interest income. Netflix was a major winner for the week, adding 5.2 million users in the quarter, and posting a 32% jump in revenue. Activist investor Nelson Peltz stated his intentions to begin a proxy battle with Procter and Gamble over obtaining a board seat. He argues that P&G has not followed through on long term plans and doubts future plans will be implemented.

In economic news, ECB President Mario Draghi hasn’t discussed the wind-down of the ECB’s bond buying program, but is expected to do so later this year. Baker Hughes’ U.S. rig count reported a loss of 2 rigs but still reports 488 more rigs than the year prior.

On Capitol Hill, Republicans failed to bring the health care reform bill to vote due to lack of support, but they promise to bring a full repeal bill to vote soon. They also hinted at a potential tax cut, and Dodd-Frank partial repeal, but markets failed to react due to Republicans’ perceived inability to enact legislation.

Looking Ahead:

This coming week has a packed schedule, both on Wall Street and in Washington. The Senate is poised to vote on a stand-alone repeal of ObamaCare sometime this week, as Republicans try to keep true to their 7 year old campaign promise. The Senate is going to hear testimonies from Jared Kushner, Donald Trump Jr., and Paul Manafort, which should provide some color on the ongoing Russia investigation.

On Monday, ministers from six OPEC nations gather in Russia to discuss the current supply gut in oil and how the cartel is going to respond to it. On Wednesday, the Federal Reserve will end its two-day meeting and announce its decision on interest rates. They are expected to clarify their language on when they will start to normalize their $4.5 trillion balance sheet. Treasury Secretary Steve Mnuchin will testify on the state of the International Financial System on Thursday. Lastly on Friday, the US’s 2nd quarter GDP growth will be reported.

In the markets, Google, Haliburton, AT&T, Caterpillar, Coca-Cola, and Exxon Mobil are among the notable companies reporting earnings this week. Tesla is expected to deliver the first of its lower-cost Model 3 cars. Scaling and production have been hiccups for Tesla in the past, so the market is looking to see if the Model 3 rollout will be successful.

What’s On Our Minds:

THE WORST OF THE BEST: Mistakes Made by (Otherwise) Successful Investors

In Wall Street’s long history, many investors and companies have made successful investments that put them on the map (and made them hundreds of millions of dollars). Their success leaves people astounded and, in all likelihood, a bit envious.

But, despite their prolific returns, no one has a perfect investment record. In the hunt for extraordinary profits, an investor’s mistakes can lead to extraordinary losses. And, though it won’t make your stock-picking skills any better, it’s nice to be reminded that even investing giants are still human beings. Here are just a few of the biggest investing mistakes from the past few decades.

Carl Icahn Bets on Blockbuster’s Resilience and Loses

A skilled investor known for turning around failing businesses, Carl Icahn is reported to have invested over $190 million in video rental giant Blockbuster from 2004–05. Icahn believed the shares to be severely undervalued, but, in reality, the company was permanently losing its market share and was later forced to liquidate. Icahn ended up losing around 97 percent (more than $180 million) of his total investment by the time he threw in the towel in 2010.

The silver lining? Icahn recognized the value of video streaming service Netflix, which was largely responsible for Blockbuster’s decline, and quickly bought nearly 10 percent of the company. When he sold just half of his shares in October 2013, he pocketed over $800 million in profits.

Warren Buffett’s Oil Fiasco

Despite being the most successful investor of all time, Warren Buffett has made a few errors in judgment. His biggest mistake began in 2007–08, when oil prices peaked across the world. Buffett, known for his ability to pick out undervalued stocks, made an uncharacteristic purchase of highly priced ConocoPhillips stock. His purchase was massive, approximately $7 billion in shares. As demand and prices fell following 2008, the stock lost almost half its value. Although ConocoPhillips somewhat recovered, it is estimated that Buffett lost at least $1.5 billion on his commodity speculation.

LTCM Defeated by the Russian Winter

In the 1990s, John Meriwether and his hedge fund Long-Term Capital Management (LTCM) were astounding investors on Wall Street. Using detailed mathematical models and borrowing money to leverage their investments, LTCM targeted small, but predictable, bond trades. LTCM was rarely wrong and produced fantastic returns. However, in 1998, LTCM made a $10 billion bet on Russian bonds, leveraging their money 100-fold. When the bonds went the wrong way later that year, LTCM became destabilized and had to be bailed out by other Wall Street firms to avoid a meltdown in the bond market. By the time Meriwether dismantled LTCM in 2000, it had lost some $4.6 billion.

Bill Ackman Helms a Sinking J.C. Penney

An activist investor, Bill Ackman is known for finding underperforming stocks and pushing their company profits to the limit. In October 2010, Ackman’s hedge fund took a nearly $1 billion stake in the struggling J.C. Penney and put Ackman on the company’s board of directors. However, the changes made to the company were largely ineffective and the share price continued to plummet. In less than three years, Ackman stepped down from the board and sold his fund’s shares in the company; the resulting losses exceeded $400 million.

David Bonderman’s Bankrupt Bank

Billionaire David Bonderman has been known to find huge profits in scooping up companies on the brink of failure. During the financial crisis, the giant Seattle-based bank Washington Mutual, or “WaMu,” looked like a perfect buying opportunity for Bonderman. Spearheaded by his renowned investment firm TPG Capital, investors dumped a total of $7 billion into the bank in April 2008. However, just five months later, the FDIC shut down WaMu and took all its assets, destroying its investment value. Investors lost every dollar they paid, and TPG Capital’s own $1.35 billion stake in the bank vanished overnight.

Conclusion

The history of investing is littered with hundreds of investors, financiers, and businesses that made big bets and lost. These examples serve as a good reminder that all investments are uncertain, even for the smartest investors in the world.

In investing, success is not about being perfect, but about getting more investments right than wrong. As an investor who is not working with millions or billions, you can only aim to avoid extremely risky investments and not get carried away when buying into an apparent opportunity.

Last Week’s Highlights:

Markets finished the week at a record high Friday with the all major indices gaining a percent or more. Oil prices were up 5%. Janet Yellen spoke in a dovish tone when speaking in front of congress. She highlighted the strength of job growth and indicated the intent to wind down the Fed’s $4.5 trillion balance sheet starting this fall. Her major worry is that inflation remains below the Fed’s target of 2%. Low inflation coincides with a soft Consumer Price Index (CPI) number and lagging real estate prices- not good for economic growth. China posted Q2 GDP growth of 6.9%, driven by 10% growth in consumer spending and firmer exports, especially steel. President Trump has made cutting US’s trade deficit with China a top agenda item and has also flagged the steel trade as a point of contention.

Looking Ahead:

Earnings season is officially in full swing with some big names reporting this week, including Under Armour, Bank of America, Microsoft, and General Electric just to name a few. With major tech, industrials, and financial firms all reporting, earnings this week will showcase the health of corporations across a large portion of the economy.

There will also be a host of economic data being reported. Tuesday will have export and import data. Housing data will be released this week on Tuesday and Wednesday, and initial jobless claims will be reported on Thursday. With Janet Yellen taking a slightly dovish tone, all eyes will be on any potential data points for the Fed to base its monetary policy on. Also, Japan and ECB will be announcing their monetary decisions later this week.

In political news, gridlock continues on Capitol Hill as the vote on the bill to replace Obamacare has been delayed until Senator John McCain recovers from surgery.

What’s On Our Minds:

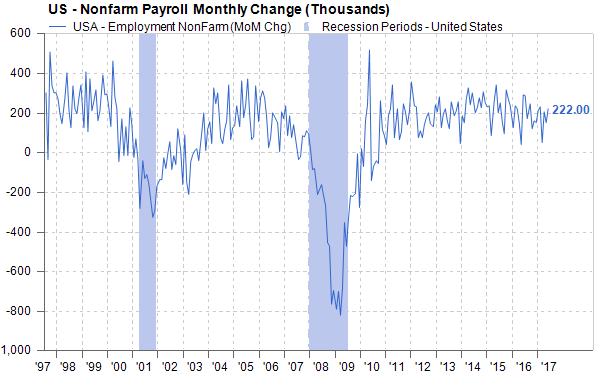

Nonfarm payrolls rose 222,000 in June, beating economists’ expectations. Unemployment remains near historic lows at 4.4%. This came in well above economists’ predictions of 178,000 jobs. April and May numbers were also revised upward. A negative in Friday’s report was the wage growth numbers, which rose 2.5% from last year, below estimates of 2.6%. Wage growth continues to be slow and is another indicator of lower than expected inflation.

Economists believe low wage growth and inflation will give the Fed an even greater case to continue to tighten monetary policy. It is also important to realize these numbers are constantly revised, so all interpretations should be taken with a grain of salt. Moving forward, all eyes will be on wage growth and whether strong jobs numbers will have a positive effect on GDP growth, which has been tepid.

Another interesting topic is whether or not the natural employment rate is lower than once thought. The Fed believes the natural rate is somewhere between 4.7%-5.8%. Economists normally believe inflation should “catch” soon after employment dips below the natural rate and that a shortage in the labor market should force wages higher. In theory, this should cause the economy to start to overheat, but this has yet to be seen in the current expansion. Is the natural rate lower than once thought or is something else going on?

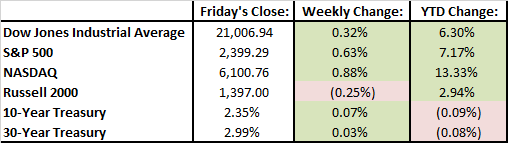

Last Week’s Highlights:

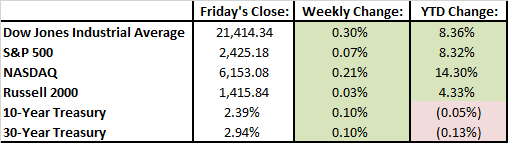

With a mix of strong economic data and geopolitical uncertainty, markets eked out gains during the week of trading shortened by the July 4th holiday. Both the S&P 500 and Dow Jones remain up by more than 8% for the year. Stocks had a good day Friday after the June jobs report was released. The Federal Reserve’s meeting minutes were released, and the Fed discussed plans to continue unwinding its $4.5 trillion balance sheet. The G20 summit and tensions with North Korea put geopolitics in the forefront of investors’ minds.

Looking Ahead:

Janet Yellen will be speaking before Congress on Wednesday. Investors are eager to hear what she will have to say regarding the Fed’s reaction to recent jobs and inflation data. Inflation and retail sales data will be released on Friday. Second quarter earnings season gets underway this week with reports coming out of J.P Morgan Chase, Wells Fargo, and Citigroup on Friday.

What’s On Our Minds:

Tufton Capital Management would like to wish all of our clients and associates a Happy Independence Day!

Last Week’s Highlights:

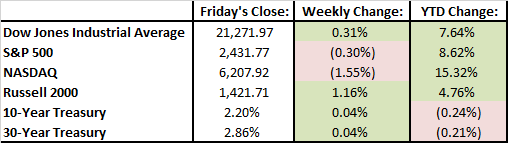

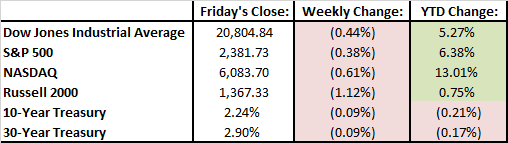

The first half of 2017 is officially in the books. Tech stocks were Wall Street’s darlings in the first half of the year but have struggled recently. Bank stocks came back into vogue in June.

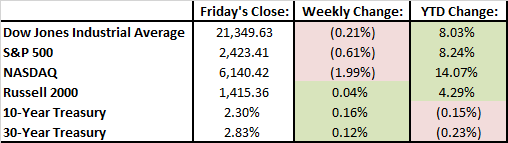

Stocks were mixed last week. The S&P was down slightly, the Dow was flat, but the NASDAQ was down 2% due to volatility in the tech sector. Financial stocks had a good week after it was reported that all 34 U.S. banks passed the Federal Reserve’s annual stress test.

Looking Ahead:

It’s a short week of trading but investors will have plenty of fresh economic data to review. The market will close at 1 PM on Monday and will be closed on Tuesday as Americans celebrate the Fourth of July. The PMI and ISM manufacturing indices and construction spending from June will be reported on Monday. On Wednesday, the Fed will release minutes from its last meeting. On Friday we will cap off the week with the highly anticipated June jobs report.

What’s On Our Minds:

One may associate the summer months with longer days, beach vacations, leisurely weekends, and a general slowdown in the business world. But instead of getting lulled into the “Summertime Blues”, at Tufton Capital, we are cranking up our research efforts with a full crew of summer interns.

At Tufton, our Investment Committee stays busy throughout the year as our five portfolio managers and two research associates conduct all the firm’s equity research in house. To stay ahead with our research efforts during the summer months, it has long been a tradition for the firm to hire highly qualified summer interns to run valuations, write reports, and present their findings to our Investment Committee. It is important work that we believe benefits both the firm and our interns as they look to get into the investment business after college. Many of the alumni from our internship program have gone on to land great jobs on Wall Street after college.

This year we are happy to have a crew of four interns joining us for the summer.

Chris Guidry is joining us from Hood College where he is majoring in Economics with a concentration in Finance. Chris is the Chief Investment Officer of the Hood College Student Investment Fund. Prior to attending Hood, Chris was a Sergeant in the United States Marine Corps.

Nick Kuchar interned with the firm in 2015 while he was at Gilman and is joining us again this summer from the University of Michigan. Nick is a member of the Michigan Interactive Investment Club where he and other students manage a $20,000 fund. Nick is also a recruiting analyst for the school’s football team.

George Sarkes is joining us for his second summer at Tufton. George recently graduated from Washington and Lee University where he majored in Accounting and Business Administration and was a member of the Beta Alpha Psi honor society.

Haley Greenspan is joining us from the University of Maryland where she is attending the Robert H. Smith School of Business and is majoring in Finance and Computer Science.

We are very pleased with our intern team’s progress thus far this summer and appreciate the hustle and bustle they bring to our office.

Last Week’s Highlights:

Markets were quiet last week as there were not any market moving catalysts. Senate released the long awaited healthcare bill after closed door negotiations. Details are still being figured out. Oil once again dipped in bear market territory; it lost 4.4% on the week and ended at $43.01. Banks passed the Fed’s stress tests that require them to have adequate capital levels to lend during a recession. Uber CEO, Travis Kalanick, resigned under pressure from investors amid ongoing negative PR and controversy.

In global news, tensions spiked in Syria as an American jet shot down a Syrian government jet. International stability is topic of concern for investors, and developments overseas continue to affect the markets.

Looking Ahead:

All eyes will be on Washington D.C. for the upcoming vote on Senate Republican’s alternative to Obamacare, the BCRA. The Congressional Budget Office (CBO) will issue a report on the BCRA Monday, estimating the bill’s cost/savings, along with how many individuals will be left uninsured. Five Republican Senators ranging from hard-line conservative Ted Cruz (R-TX) to moderate Dean Heller (R-NV), have openly opposed the bill in its current form. Mitch McConnell can only afford two GOP defections to pass the bill, and he plans to vote on the bill on either late Thursday or Friday, before the July 4th recess. One sixth of the US economy could be affected by the changes in the healthcare law.

On Wednesday, the Federal Reserve will publish its results on if big banks passed their stress tests. The stress tests, which were started because of the Dodd-Frank financial overhaul, are expected to be less strenuous because the Trump administration removed the qualitative part of the test that led to embarrassing failures for banks, such as Citigroup, Deutsche Bank, and Banco Santando.

Lastly, Blue Apron, the meal-kit company, is set to IPO Wednesday. They are expecting to raise $586 million from the IPO and are given a $3 billion valuation, making it one of the bigger IPOs of 2017.

What’s On Our Minds:

On Friday, it was announced that Amazon will make its largest acquisition to date by acquiring Whole Foods for $13.7 billion. By acquiring the 460-store grocery network, Jeff Bezos, CEO of Amazon, is planning on Amazon becoming a top five grocery retailer by 2025. Traditional grocers, like Krogers, Costco, and Walmart, saw their shares sink on Friday at the prospects of a pricing war and disruption in the industry.

This purchase should be a game changer for the grocery business. Like any merger or acquisition, there will be some winners and some losers. As Amazon continues to transform the way consumers shop, they should benefit from more grocery options and a more efficient shopping experience which should save them time and money. The deal could end up being an unfortunate scenario for Whole Foods cashiers and other minimum wage employees, as Amazon will be looking to cut costs and optimize efficiency in brick and mortar stores.

Amazon is known for waging fierce price wars and upending traditional logistics methods to cut costs. Market commentators have speculated that Amazon will look to cut costs at the pricey chain by eliminating cashiers, changing inventory, and updating the stores’ approach. As one might expect from Amazon, technology could play a large role.

Last year, Amazon released a concept called “Amazon Go” where shoppers walk into an Amazon grocery store, check in with an app on their phone, pick out what they want to take home, and then simply walk out. Amazon Go stores can track which products you take off their shelves and automatically charge your account. Amazon calls it “just walk out” technology. While it’s unclear if Amazon will apply the concept in Whole Foods stores, it’s likely we will be seeing some changes in our neighborhood Whole Foods stores.

Click here to see a video on the “Amazon Go” concept

Last Week’s Highlights:

The S&P 500 finished up 0.06% last week. Technology stocks continued their slide, down 1.37% as fears continue to mount about the sector being overvalued at 2000-esque levels. Industrials (+1.13%), Real Estate (+.81%), and Utilities (+.82%) were the winners of the week with Tech (-1.37%), Consumer Staples (-1.27%), and Materials (-1.12%) being the losers.

The Federal Reserve raised its benchmark interest rate to between 1% and 1.25%. This is the second increase this year, and Fed Chair Janet Yellen suggested that it will stick to plans to raise rates three times in 2017. Yellen also laid out a plan to gradually ‘normalize’ the Fed’s $4.5 trillion balance sheet by not reinvesting the principle when the 10-year Treasury notes and Mortgage Backed Securities come due.

Travis Kalanick, the embattled CEO of Uber, announced an indefinite leave of absence as the firm agreed to recommendations to conduct an independent review into its abrasive corporate culture that has led to a series of PR disasters, mostly related to corporate sexism. With half its C-Suite empty and operating at a $607 million loss, Uber is certainly going through growing pains.

Oil prices plunged to their lowest levels in seven months after data from the International Energy Agency indicated that stockpiles of crude in America are falling by much less than had been expected, and they do not expect the global supply glut in oil to ease this year.

Looking Ahead:

Brexit talks begin today, and investors will be hungry for any information related to the extent and timing of the UK’s exit from the European Union. Many economists are hoping the new agreement will at least partly maintain the UK’s participation in the European free trading area.

The White House will be holding a tech summit this week, and the Paris Air Show will be taking place all week. The Paris Air Show is a perfect platform for Aerospace/Defense to showcase new technology, so look for market-making news to come from this event. The tech summit should give insight to the lengths the Trump administration will go to modernize the nation and partner with tech companies.

U.S. housing market data and crude oil inventory numbers will be released on Wednesday, Initial Jobless Claims report and EU consumer confidence on Thursday, and the EU leader’s summit will take place Thursday-Friday.

What’s On Our Minds:

Forget about FANG; there’s an updated group of market moving mega-cap tech stocks in 2017. The “Fabulous Five” includes Facebook, Amazon, Apple, Microsoft, and Google. The street is calling the high-flying group “FAAMG”. Combined, the FAAMG stocks have added $660 billion in market value this year and even though these companies are only 1% of the number of companies in the S&P 500, these top 5 tech stocks account for 13% of the market value weighting in the index.

Last Friday, Goldman Sachs’ research department took a shot at the FAAMG high-fliers noting that the overall return of the Nasdaq and S&P 500 is getting increasingly dependent on the FAAMG group. The report even went as far to compare the run up in these stocks to the euphoria in tech stocks before the burst of the Dot-Com bubble nearly 20 years ago. Goldman analyst Robert Bourojerdi wrote, “This out performance, driven by secular growth and the death of the reflation narrative, has created positions extremes, factor crowding and difficult-to-decipher risk narratives (e.g. FAAMG’s realized volatility is now below that of Staples and Utilities).” For investors, Friday’s report from one of Wall Street’s top firms, was hard pill to swallow and the exuberance built in these companies’ share prices was interrupted. Facebook was down 2.27%, Amazon was down 2.95%, Apple was down 3.52%, Microsoft was down 2.39% and Alphabet was fell 2.3%.

Clearly, Goldman’s research department is a bit worried the investors are getting caught up in the game of chasing growth in this small group of names.

Even though these types of moves are exciting to follow, we urge our readers to avoid getting caught up in the day to day media hype, and remain focused on the long-term prospects of their investment portfolio. The Tufton investment team continues to diligently monitor developments throughout the market and clients’ individual portfolios.

Last Week’s Highlights:

While financials had a great week due to a Dodd Frank repeal moving through the House of Representatives, a move Friday by technology stocks drove the S&P and NASDAQ into the red. NASDAQ was pushed lower by note by Goldman Sachs that suggested investors are overestimating the stability and strength of many recent outperformers in the Tech space. This led to a quick selloff and profit taking across the board in tech, and ended with the Technology Select Sector SPDR ETF (XLF) slumping -2.47%. Energy stocks had a volatile week, dropping in value midweek, but recovered on Friday. The price of WTI oil moved to its lowest level since November, on higher than expected inventory levels, as supply and demand forces continue to duel it out causing uncertainty in the energy sector.

Political forces continued to drive the narrative and influence the markets, but last week, economic forces took the wheel in moving the needle. The Comey testimony before Congress did not reveal anything particularly material or surprising, and markets reacted positively. In other news, Nordstrom is seeking to take itself private, GM sided with management against activist investor David Einhorn’s proposals, and Alibaba surged on raised guidance.

Looking Ahead:

All eyes will be on the Federal Reserve this week when they decide Wednesday whether to raise short term interest rates. The Street is expecting the Fed to increase rates by 25 basis points. Janet Yellen will also hold a press conference afterwards, which will be closely followed, because it could shed light on the state of the US economy, future Fed rate hikes, and if they will start to unwind the Fed’s $4.5 trillion balance sheet.

The Producers Price Index (PPI) and the consumers price index (CPI) will be reported Tuesday and Wednesday respectively. Both are measures of inflation and it is estimated that each increased between 0.2% and 0.5% this past month.

To wrap up the week on Friday, the stock market will likely see increased volume because it is a ‘triple-witching’ day. Triple witching days happen four times a year in March, June, September and December. It is a day when contracts for stock index options, stock index futures, and stock options all expire on the same day, and the stock market is flooded by arbitrage traders seeking to exploit price disparities.

What’s On Our Minds:

At Tufton, we often bring in new accounts holding numerous mutual funds. It’s likely that the client’s previous advisor was ‘filling the buckets” by picking what they believed were the best funds for each category. It’s a common strategy that is not necessarily a bad one, but we believe investors with sizable assets deserve a higher level of service: a customized portfolio constructed with individual securities.

It’s commonly said that “diversification is the only free lunch in investing.” In its most basic sense, diversification involves the accumulation of assets with negative or low correlations to reduce risk and increase potential return. At Tufton, we believe in diversification, but we’re not for over-diversification, or what famous fund manager Peter Lynch coined as “diworsification:”

The process of adding investments to one’s portfolio in such a way that the risk/return trade-off is worsened. Diworsification is investing in too many assets with similar correlations that will result in an averaging effect. It occurs where risk is at its lowest level and additional assets reduce potential portfolio gains, as well as the chances of outperforming a benchmark.

Consider that the average mutual fund owns about 100 different stocks. If you own 5 to 10 different mutual funds, do you know exactly what you own? An account invested in 10 different mutual funds may own over 1,000 different securities, and you may even hold the same stocks in different funds. Moreover, the fund likely charges a management fee on top of the fee paid to the financial advisor playing “quarterback” and picking the funds. If an investor wants this type of broad diversification, why not just purchase an index fund? It would be much cheaper!

At Tufton, we believe that an equity portfolio made up of 30 to 50 stocks is a sweet spot where portfolio managers can limit volatility stemming from each security (company-specific risk) and still produce alpha in an account.

Last Week’s Highlights:

Stocks had a strong week as investors remain optimistic that improving economic statistics and corporate earnings will continue to gain positive momentum. Even though it was a strong week overall, individual sectors of the market did not all move higher. Energy and financial stocks declined last week, while telecom shares led the market higher.

On Friday, the May jobs report showed that the U.S. added only 138,000 jobs in May. The disappointing number did little to upset investors though, and stocks reached all-time highs on Friday. Some investors believe that the disappointing number will persuade the Federal Reserve to hold off on increasing interest rates later this month. Thus, the anemic number may actually have been a positive for equities. Since 2010, the U.S. economy has added 16 million jobs and the unemployment rate currently sits at 4.3%.

Looking Ahead:

There are numerous important events that will test the stock market this week.

The following economic data will be released this week:

- Monday: non-farm productivity, unit labor costs, ISM non-manufacturing data, factory orders and durable goods.

- Tuesday: labor turnover survey results and job openings

- Wednesday: consumer credit figures

- Thursday: results from the quarterly services survey.

- Friday: wholesale inventory numbers.

On Tuesday, the Business Roundtable (an association of chief executive officers from America’s leading companies) will release its 2017 CEO Economic Outlook Survey. The survey should indicate what companies are expecting in regards to sales, hiring, and capital spending.

On Thursday, the European Central bank will issue its latest statements on monetary policy. On top of that announcement, Britain will be holding elections. An upset of conservative Prime Minister Teresa May would certainly upset Brexit plans.

It will also be a busy week in Washington. Congress is expected to vote on the Financial Choice Act, which is a plan to roll back banking industry reforms that were made after the Great Recession. On Thursday, former FBI director James Comey will testify on allegations that President Trump’s campaign had improper contact with Russian officials.

What’s On Our Minds:

Are mounting Student Loans the next bubble?

Many Americans—specifically Millennials—are being crushed under the weight of student loans; currently, outstanding student loan debt in the United States totals more than $1.3 trillion. The average graduate from the Class of 2016 has over $37,000 in student loan debt. Stemming from this, there are concerns that student loan debt could represent the next “bubble” for the economy — even drawing comparisons to the housing market collapse that led to the Great Recession. Just how does the current state of student loan debt compare to the collapse of the housing market?

Understanding the student loans crisis

It is no secret that the cost of college is rising at a seemingly unsustainable rate. Since 1980, college-related costs have increased tenfold, while inflation itself has only tripled. Additionally, wage growth has only kept pace with inflation. Rapidly increasing tuition costs paired with low wage growth means that students must go further into debt while generally not benefiting from proportional salary growth.

Aside from the debt itself, the default rate on student loans is among the highest it has been in decades. In fact, the percentage of Americans who were in default on their student loans increased by more than 150 percent from 2003 to 2013. Given these factors, it is easy to understand the concern that some have regarding how the student loans crisis may affect the economy.

Comparing student loans to the housing market collapse

Of the many possible contributing factors to the housing market crisis, there is one that sticks out as being remarkably similar to the current economic conditions surrounding student loan debt: loan accessibility.

In the late 1990s and early 2000s, the American government enabled low- and middle-income families to access mortgages more easily than before. Between the American Dream Down payment Assistance Act and HUD Secretary Andrew Cuomo announcing a 10-year plan to make $2.4 trillion available to low-and middle-income families, mortgages were made available to more people. According to US Census data, the median price of a home doubled between 1992 and 2006 from $121,500 to $246,500.

The accessibility of student loans through the Federal Direct Student Loan Program (FDSLP), passed in 2010, mirrors the proliferation of mortgages in the early 2000s. This program provided aid to many students who otherwise may not have had access to student loans.

Per the Government Accountability Office, state funding for public colleges decreased by 12 percent from 2003 to 2012. Over this same timeframe, tuition increased by about 55 percent across all public colleges. It is worth noting that a significant portion of these shifts took place from 2010 to 2012, which is the timeframe directly following the passing of the FDSLP.

States have largely decreased funding to public universities and the onus has been shifted to families — either pay for education out-of-pocket, with federal loans, or some combination of the two. Though the decline of state funding and the increase in federal funding may not have a direct causation link stemming from the FDSLP, there is an observable correlation on a similar timeline.

The differences between the two

Though both mortgages and student loans represent a huge portion of our national debt, the total amount of debt varies widely between the two. In the midst of the housing market collapse, mortgages comprised nearly 75 percent—or about $9.25 trillion—of all debt in the United States. Around that time, the delinquency rate on mortgages peaked at about 11.5 percent. Comparatively, student loans represented about 10 percent—or $1.3 trillion—of debt in the United States in 2016. Currently, the delinquency rate on student loans is about 11.4 percent. In terms of direct economic impact, student loans represent a far smaller portion of the total debt in America than mortgages did nearly a decade ago. Though the delinquency rates are similar, the total monetary value of debt for student loans is far lower than either mortgages today or at the height of the housing bubble.

The effect of high student loan defaulting could, however, create a ripple of economic and financial events. Much like how mortgage defaulting significantly affected many more aspects of the economy than just the housing market, student loan defaulting could create unforeseen issues in the economy. Though the circumstances surrounding the housing market collapse and the student loan crisis may not be the exact same, there are definite similarities between the two.

The ubiquity of individuals obtaining student loans, as well as the life-changing impact they have on the life of an average American, evokes flashbacks to what preceded the Great Recession. It seems unlikely, however, that a similar default rate on student loans would have a comparable impact on the economy. Only time will tell how the student loan crisis is handled. In the meantime, the rate at which Americans are going into debt with student loans appears to exhibit no signs of slowing.

Last Week’s Highlights:

It was a strong five days for U.S. equity markets. U.S. large cap stocks experienced significant gains upwards of 1.5% last week following the previous week’s apprehension regarding President Trump’s relationship with Russia and the firing of James Comey. From where we sit now, the S&P 500 is up nearly 8% for the year, thanks to a sense of faith in the Trump administration’s policies on infrastructure spending and tax reform.

Investors were happy to hear that U.S. GDP was revised up from 0.7% to 1.2% for the first quarter thanks to strong consumer spending.

On the international side, markets have been improving rapidly. Developed-market equities (EAFE) have seen gains above 12% this year. Emerging-market stocks have increased 18% since the beginning of the year.

Looking Ahead:

U.S. markets were closed on Monday in observance of Memorial Day. Even though it’s an abbreviated week, there is plenty of economic data coming across the wire this week. On Tuesday, we will hear results from the Conference Board’s Consumer Confidence Survey. On Wednesday, investors will be examining pending home sales data. Vehicle sales and construction spending data will be released on Thursday. To wrap up the week, on Friday, we will get May’s jobs report. Investors are expecting 175,000 job gains and wage growth of 2.7% year-over-year in May.

What’s On Our Minds:

Last week, volatility returned to the markets so this week we will forgo our usual “Last Week” section and focus on last week’s news and the market’s emotional response.

After months of remarkably low stock market volatility, we got our fair share last week. Markets took their biggest hit of the year on Wednesday when investors turned bearish as President Trump fired FBI Director James Comey and it was reported that Trump had asked him to drop an investigation into former National Security Advisor Michael Flynn’s dealings with Russian officials. Traders got anxious on the news, seeing it as a threat to Trump’s policy initiatives. After hovering around its lowest level for weeks, the CBOE Volatility Index (VIX) surged 46% on Wednesday.

While the 24-hour news cycle may have suggested that the sky was falling on Wednesday, investors refocused on the stock market’s improving fundamentals Thursday and Friday. By the end of the week, it was clear that the emotional reaction to Wednesday’s market drop was more severe than the actual potential economic damage that the revelations may cause.

Recent political events (Brexit, China devaluing their currency, the night of the US election, and North Korea concerns) have not been able to interrupt the 8-year-old bull market. In times like these where political events can cause media hysteria and drive the market one way or the other, it’s important to remember that the market reflects the future expected earnings of companies. Seeing that S&P 500 companies posted 14% earnings growth during the first quarter of 2017, the labor market is strong, the housing market is close to cycle highs, and industrial production has picked up recently, it’s not surprising to see resilience in the current market. Too put it another way, it’s not all about President Trump.

Furthermore, given the flat market we have been experiencing lately, last week’s volatility may have seemed like a big deal, but it shouldn’t surprise investors as this type of move is really not unusual. As JPMorgan pointed out last week, stocks have averaged a drop of 14.1% at some point in each calendar year since 1980 and have finished in the green 28 of those 37 years.

Moral of the story last week? Don’t get caught up in the hype and stay focused on the long term.

Looking Ahead:

This week, as earnings season is coming to an end, investors will shift their focus from individual companies’ first quarter results to macroeconomic data coming across the wire. Preliminary Manufacturing PMI numbers will be released on Tuesday. Investors will be looking for continued improvement in this number. Investors will also look to the Federal Reserve’s May meeting minutes which are being reported on Wednesday. On Friday, consumer sentiment data will be reported along with the durable goods number.

What’s On Our Minds:

Have you ever asked yourself, “Will I have enough saved up to fulfill my retirement dreams? Will Social Security be enough to sustain me?”

Unfortunately, the answer to the latter question is “probably not.” Government assistance is not designed to sustain you through retirement, so you must be proactive in saving for your future. The good news for you is that with smart investing, you will be better equipped to plan for a successful retirement.

Investing for a Sound Future

Retirement is expensive, there is no doubt about that. Many experts estimate that you will need 70 percent of your pre-retirement income (90 percent or more for lower earners) to maintain your standard of living when you stop working. It’s time to take charge of your financial future today. Below are some tips on how to maximize your retirement savings:

- Invest in your employer’s pre-tax savings plans, such as a 401(k). Contribute as much as you are financially able to responsibly, and use the automatic deduction feature to place money into your retirement account at every pay period. Over time, compound interest and tax deferrals will make a big difference in the amount you will accumulate.

- Place your money into an Individual Retirement Account (IRA). When you open an IRA, you have two basic options—a traditional IRA or a Roth IRA. In general, traditional IRA contributions are not taxed until the time of withdrawal, whereas Roth IRA contributions are taxed immediately but not taxed at withdrawal. Keep in mind, the after-tax value of your withdrawal will depend on inflation, your tax bracket and the type of IRA that you choose.

- Avoid dipping into your retirement savings, as you will lose principal and interest, and may lose tax benefits. If you change jobs, consider rolling over your savings directly into an IRA or to your new employer’s pre-tax retirement plan.

- Start saving early—the sooner you are able to start saving, the more time your money has to grow. Devise a savings plan, stick to it and set goals for the future.

- Take advantage of employer matching funds if you are able. Most employer-sponsored plans require the employer to match a certain percentage of your income. This may be the closest thing to free money, so take advantage!

- Study your investment choices carefully. The more you know about investing, the more likely you will choose wisely.

- Learn as much as you can about your plan’s administrative fees, investment fees and services fees to avoid reducing the amount of your retirement benefits unnecessarily.

Investing a predetermined amount on a regular basis through your company 401(k), a Roth IRA, etc. makes solid retirement sense. For more information, contact us to learn more about how our solutions can help you prepare for your future.

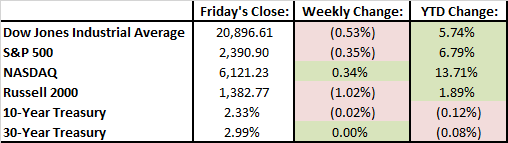

Last Week’s Highlights:

Economic data, drama in Washington D.C. and corporate earnings had the market moving up and down last week. By Friday afternoon, the S&P 500 was off 0.35% and the Dow Jones was down 0.53%.

Stateside, the consumer price index and retail sales figures disappointed investors last week while President Trump fired embattled FBI Director James Comey. Abroad, investors are betting big on Europe: according to Bank of America, a record $6.1 billion was added to funds focused on European stocks last week. Finally, we note a development that affects the whole world: computer hacking. On Friday, a global cyberattack hit dozens of countries. The “ransomware” locks up a Windows computer, and demands a $300 ransom to free it.

There were some big deals announced last week. Verizon agreed to buy Straight Path Communications for $3.1 billion, Sinclair Broadcast Group agreed to buy Tribune Media for $3.9 billion and Coach said it would acquire Kate Spade for $2.4 billion.

Over the weekend, Russia and Saudia Arabia agreed to jointly extend oil production cuts until March 2018. Oil prices posted strong gains Monday morning.

Looking Ahead:

Earnings season is slowing down but a few important companies report this week. Retail behemoth Wal-Mart will report its first quarter results on Thursday, and on Friday Deere & Co. will report their results.

The IPO market will be busy this week. On Monday, compact loader manufacturer ASV Holdings will go public. 3.8 million shares are being offered at $7 each. On Wednesday, cancer treatment biotech company G1 Therapeutics goes public with 6.25 million shares being offered at $16 each.

What’s On Our Minds:

Over the weekend crowds of investors flocked to Omaha, Nebraska for Berkshire Hathaway’s annual shareholder meeting where Warren Buffet, a.k.a. the “Oracle of Omaha,” and his longtime business partner Charlie Munger spent hours talking shop with 35,000 of their faithful shareholders. Berkshire is currently America’s sixth largest company by market capitalization, behind Apple, Alphabet (Google), Facebook, Amazon, and Microsoft. The company currently has $86 billion of cash on hand which constantly has investors asking, “What will they buy next?”

Buffet and Munger spent their Saturday discussing a changing investment landscape that has made them buyers of airline stocks and Apple, and a seller of IBM. They also discussed the recent fake-account scandal at Well Fargo, which happens to be one of their largest holdings. Buffet blamed executive level management for the scandal, as he believes they didn’t react to whistleblowers. Buffet was also critical of the bank’s incentive system that, in his words, “incentivized the wrong kind of behavior”.

The pair also fielded questions on technology and autonomous driving. Buffet had mixed opinions on the idea of self-driving vehicles and said, “Autonomous vehicles widespread would hurt us. My personal view is that it will come but I think it will be a long way off. If they make the world safer it is going to be a very good thing, but it won’t be good for our auto insurers.” Buffet and Munger also talked about how they missed the opportunity to invest in Google back when it was a fledgling new company.

Towards the end of the meeting, Buffet underscored the importance of finding a capable successor to take over the day-to-day management of Berkshire. Seeing that Warren (86) and Charlie (93) are both getting up there in age, this continues to be the looming “elephant in the room” for the company.

Last Week’s Highlights:

The market was up slightly last week, but has been unusually flat over the last eight trading days. Major indexes haven’t moved by more than 0.4% during that period. Major indexes are currently siting near all-time highs, thanks to a mix of strong corporate earnings and economic data that has shown a healthy domestic job market.

Last Wednesday, the Federal Reserve announced it would hold interest rates steady at 0.75%-1.00%. The House of Representatives narrowly passed a new healthcare bill that seeks to replace Obamacare.

Over the weekend, news broke that Hunt Valley-based Sinclair Broadcast Group is close to buying Tribune Media for $3.9 billion. This comes just weeks after the Federal Communications Commission voted to ease the limit on TV-station ownership in the U.S.

Looking Ahead:

Earnings season begins to slow down this week. On Monday, Sturm Ruger reports their earnings followed by Disney and News Corp. on Tuesday, Snapchat and Wendy’s on Wednesday, Kohl’s and Macy’s on Thursday, and JCPenney on on Friday.

On the economic front, it will be a light week with retail sales and inflation data being released on Friday.