Being able to dote on children is one of the advantages of being a grandparent. But some gifts, like a college education, are a bit too big to just be handed out. For grandparents (or other extended family members) who want to support a child’s education there are a number of methods available for use—each with its own advantages and uses. All provide financial support for the student, of course, but each has its own challenges and tax considerations to take into account. (more…)

By Scott Murphy

Generally, we as value investors steer clear of thematic investing. We tend to be bottoms up rather than top down investors and let price, fundamental valuation and temporary business setbacks guide us to new investment opportunities. However, this doesn’t take us off the hook when it comes to understanding important business trends, especially in the technology area. Keeping track of major themes in technological change helps us gain a better understanding of where technology is heading and allows us to “fact check” and make sure our existing portfolio companies are keeping pace and have a shared vision of where things are headed. Today’s topic is the pending move and upgrade from the current fourth generation (4G LTE) standards to fifth generation (5G) standards in our communication networks. (more…)

by Chad Meyer

As humidity takes hold and Fourth of July memories fade, there’s just no denying it: the dog days of summer have officially arrived. And while it’s no surprise for market activity to “cool off” around this time of year, one cannot help but suspect there’s more than the usual pre-Labor Day lull currently at work in the financial world. In this space roughly twelve months ago, I described the second quarter of 2017 as “frothy times,” characterized by the feeling that almost any stock was a winner. Looking back over the last three months, it’s clear that froth has given way to a more cautious mood, due in no small part to a collective acknowledgement of uncertainty as the new normal. The view from the beach, it would seem, now includes whitecaps. (more…)

By Eric Schopf

Trade tensions escalated during this past quarter, leaving the markets with a renewed sense of uncertainty. In May, the United States imposed a 25% tariff on steel and a 10% tariff on aluminum imports, in a decision that primarily affects Canada, Mexico and the European Union. These tariffs are in addition to those levied during the first quarter on goods, such as solar panels and washing machines. Furthermore, in mid-June, President Trump announced new tariffs of 25% on up to $50 billion of Chinese goods. As a result, Canada and China, two of our largest trading partners, retaliated with tariffs on various goods imported from the United States. In response, Trump shot back by threatening an additional tariff of 10% on up to $200 billion more of Chinese goods, while also ordering the U.S. Trade Representative to identify an additional $200 billion of goods that would face the same 10% tariff. At this rate, the United States is on track to levy tariffs on nearly 90% of the approximate $505 billion worth of Chinese imports. In 2017, U.S. exports to China were just $133 billion, leading the president to believe he has more leverage in the situation. (more…)

By Rick Rubin

Philip Morris International (Ticker: PM) is a global leader in the manufacturing and sale of cigarettes and other nicotine-containing products. It has an attractive portfolio of iconic brands including Marlboro, Parliament, and L&M, which it markets internationally. All of its sales are outside of the U.S., and it has an impressive share of 28% of the international cigarette and heated tobacco market. Furthermore, it is in the process of commercializing IQOS, a “heat-not-burn” device, in nearly forty markets. In March of 2008, PM was spun off from Altria Group, formerly Philip Morris Companies. Altria is a holding company and the leading cigarette producer in the U.S., where it has the right to sell the same brands to domestic consumers through its subsidiary, Philip Morris USA. This corporate action allowed PM more freedom to operate independently in less regulated international markets, such as Europe and Asia. (more…)

After campaigning during the 2016 presidential election on the promise that he would renegotiate unfair trade deals for the United States, President Donald Trump has begun to attack the country’s trade deficits in the form of international tariffs being placed on imports. Trump has pledged to level the playing field, citing many “unfair” taxes foreign countries have long placed on U.S. exports. The president has also pointed to national security as a reason for the tariffs, directly claiming the need for a strong steel industry to supply our military with tanks and fighter jets. Indirectly, through Commerce Secretary Wilbur Ross, the administration stated definitively, “Economic security is national security.” On this issue, Trump may have an unlikely yet familiar ally in decrying our nation’s balance of trade. In 2003, Warren Buffett wrote in an article entitled “America’s Growing Trade Deficit Is Selling The Nation Out From Under Us” that, “our trade deficit has greatly worsened, to the point that our country’s ‘net worth,’ so to speak, is now being transferred abroad at an alarming rate.” Our nation’s leader and the head of Berkshire Hathaway may propose different practical solutions to the problem, but at the very least they agree that a trade deficit is not good for America. As a result, the ultimate question is: how would a potential tit-for-tat trade war affect businesses and consumers here at home? (more…)

by Chad Meyer

For much of the last year and a half, the investment community reaped the fruits of a truly odd phenomenon. While the world changed dramatically (and often, it seemed, without warning) the market stayed much the same. Beset by uncertainty on all fronts, the financial story of 2017 was one of growth that simply wasn’t bothered with the rest of the world’s worries. As the headlines zig-zagged from one controversy to the next, nearly every major index went up and to the right.

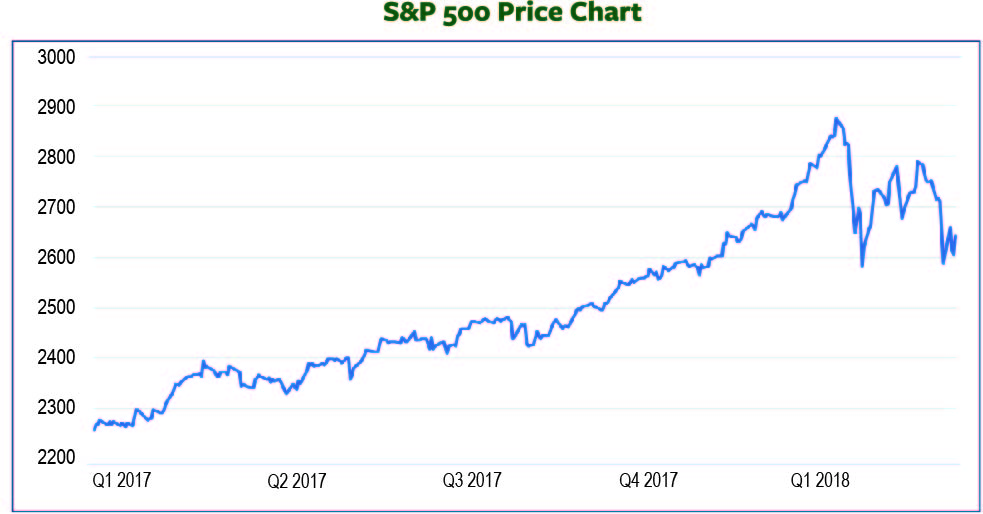

As the saying goes, you don’t know what you got ‘til it’s gone. In the first three months of 2018, the Dow Jones Industrial Average dropped 2.0%, while the S&P 500, turning in its first quarterly loss since 2015, fell by 0.8%. Of course, more telling than the numbers themselves was the bumpy path that produced them. Writing in this space last spring, I noted the market’s “historically low levels of volatility.” By contrast, the S&P rose a stunning 5.7% this January, only to sink more than 3% in February, and went up by 2.7% on March 27th, only to shed 1.7% the very next day. When it comes to the era of low volatility, it appears history has moved on to the next chapter.

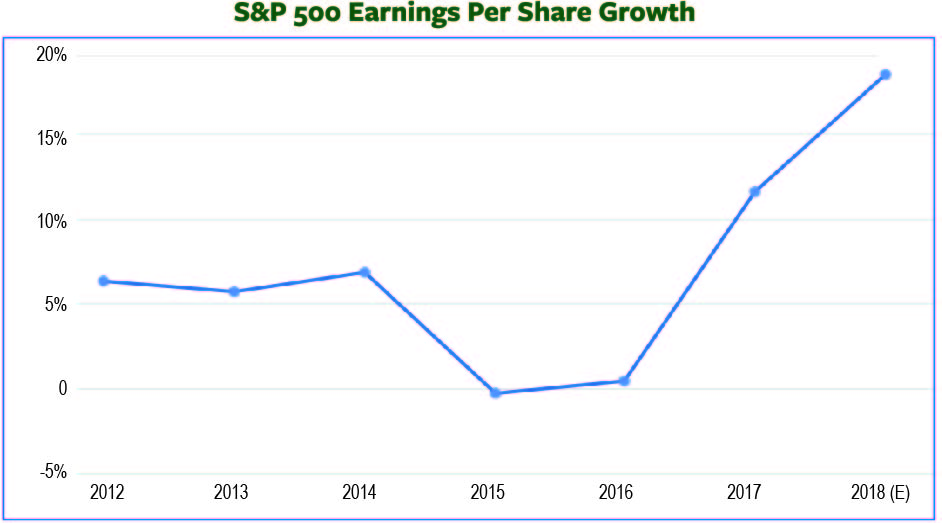

To the extent it counsels for caution, as opposed to outright doom-and-gloom, we believe this sea-change in sentiment merits our attention. Indeed, with the current economic expansion set to become the second-longest in American history next month, the need for prudence in capital allocation has never been greater. But taking a close look at fundamental, rather than sentimental, indicators of the American economy, we firmly believe that while prudence is wise, passivity is not. Corporate earnings, the linchpin of the bull market’s nine-year run, are expected to post 17% growth for the first quarter, with technology firms (the same ones much-maligned in the press) leading the pack. Coupled with an anticipated tax-cut related increase in corporate spending, and set against the backdrop of continued “synchronous” global expansion, we believe this momentum bodes well for U.S. equities as we move deeper into 2018.

More particularly, we believe it bodes well for you. As the “volatility vortex” continues to deliver wild, headline-driven intra-week swings, our team will be able to strategically add to high-conviction positions—and enter into new ones—at price levels that simply weren’t available in 2017. And though we do not, by any stretch, welcome corrections of any length or degree, we are heartened by the knowledge that historically, our conservative, value-driven approach has performed best in bearish market climates. Whether or not the storm clouds that drifted over the market this past quarter disperse, darken, or do anything in between, we remain confident in our ability to continue the protection and growth of your hard-earned capital.

By Eric Schopf

The first quarter served as a reminder that the stock market can, in fact, go down. Higher interest rates and global trade tensions collided with a market left vulnerable by the recent surge in share prices and valuation levels. Although the Standard and Poor’s 500 was only down 0.8% for the quarter, it felt much worse because of the nearly 9% retreat from February through March. The drop came after the market was up nearly 7.5% for the first four weeks of January alone. January’s gain was on top of 2017’s 21.8% return and left the market ripe for a pullback. Fixed income securities provided little shelter during the quarter with prices falling and yields rising. The 10-year Treasury moved from 2.43% to 2.74%, while the 3-month Treasury moved from 1.39% to 1.72%.

The political climate has added a layer of uncertainty with trade tensions running high. President Trump would like to reset trade agreements that he thinks are disadvantageous to America. His initial salvo was to impose tariffs on imported steel and aluminum. Although the United States imports steel from countries around the world, the tariffs are aimed primarily at China. The president has also taken aim at Canada and Mexico by expressing his displeasure with the North American Free Trade Agreement (NAFTA). China retaliated by announcing tariffs that primarily target an assortment of agricultural products. Trade talks with Canada and Mexico are ongoing, and no retaliatory measures have been taken.

We would not characterize the current situation as a “trade war” due to the limited scope of the newly-proposed tariffs. Metals and agricultural products are mere pawns in a game with far more important issues at stake. Technological knowledge and intellectual property rights are the kings and queens of the board. We cannot stress enough the importance of free and fair trade. Disruptions in trade policies could have a negative impact on economic growth and corporate profits. So far, the result has been increased volatility in the markets. But we are not ready to hit the panic button yet. The President has established a pattern of taking an aggressive and emphatic stance on important issues. He then backs off a bit as the negotiation process unfolds and he moves on to his next agenda topic. As with any negotiation, there are at least two parties at the table. China’s reaction will obviously impact the outcome of trade negotiations. It is clear to many that the tariffs put in place by China to protect their fledgling economy and key industries are now outdated. They have established themselves as viable producers on the global stage and no longer require the same level of protectionism for support. We believe the current trade disputes will be settled with minimal economic disruption.

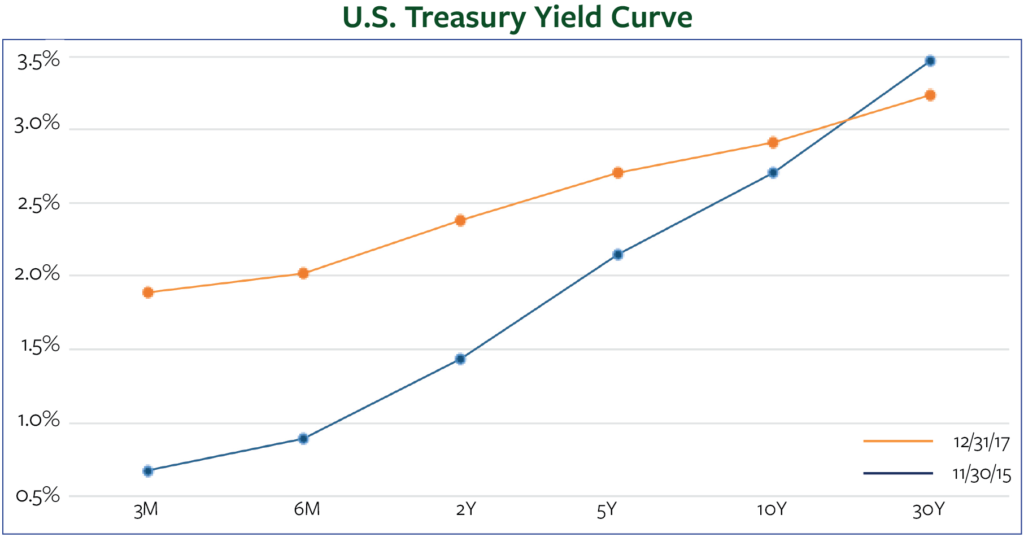

Higher interest rates reflect an economy on solid footing. However, rising rates also mark the anticipation of additional interest rate hikes over the balance of the year. The Federal Reserve increased the federal funds target rate to 1.75% in March and two to three more increases are in the offing. The last rate increase was the sixth since the end of 2015. Short-term interest rates are directly impacted by Federal Reserve policy and have moved the most. Longer-term rates reflect economic growth and inflation expectations. The increase in long-term rates has lagged the short end of the yield curve, creating a headwind for stocks. Higher rates have also triggered some concern in the credit markets. Low interest rates provide an inexpensive source of funding for business. However, refunding the debt may become problematic when interest rates rise or when the economy begins to falter and the earnings available for debt service contract.

As the quarter closed, technology-enabled stocks were in the spotlight. Facebook and Alphabet (Google) garnered attention over data privacy issues. Amazon, a favorite target of President Trump, was once again in his cross hairs as he attributed the United States Postal Service’s fiscal deficits to undercharging for package delivery. The drop in value of these three companies has cast a pall over the market since they are three of the largest corporations in the U.S.

So where do we stand as we enter the second quarter? The economy continues to chug along with the engine stoked by a shot of lower corporate and personal income tax rates. Inflation remains subdued despite a very strong job market. Trade relations are being reassessed, and although there will be winners and losers, we should avoid economy-buckling protectionism. Corporate profits are growing at a healthy clip and dividend increases are being funded with income tax windfalls. The primary concern remains the action of the Federal Reserve in response to a strengthening economy and falling unemployment. The big complication comes from the engine-stoking fiscal policy. Such policy is very unusual for the late stages of a business cycle. Typically, fiscal stimulus is initiated during or following a recession to give the economy a jump start. Monetary policy, that is, the actions of the Federal Reserve to promote maximum employment and stable prices, is being put to the test. Economic growth is determined primarily by the growth in the workforce plus the rate of productivity improvement. For the U.S., this indicates growth potential of around 2%. U.S. economic growth has exceeded expectations and has been closer to 3% due to a cyclical rebound in demand in addition to the fiscal stimulus. Absent the stimulus, the Fed’s job might be finished. However, with the economy running hotter than planned, the concern is that wages will rise and inflation will become a problem, leading to a more hawkish Fed. The Chairman, as well as half of the Federal Reserve Open Market Committee, has been replaced, adding to this uncertainty.

These economic and political concerns are bringing the stock market back down to earth. With a new quarter comes a new set of challenges. We are using the opportunity to find investments to add value to your portfolio.

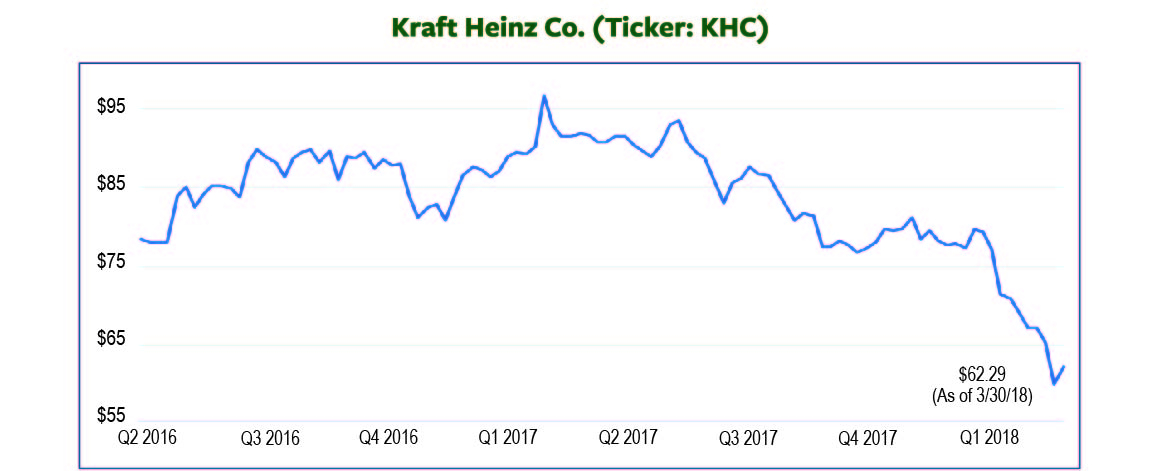

There are very few Americans who would not recognize the brand names “Kraft” and “Heinz.” Formed in a merger in 2015, Kraft Heinz Company (KHC) is a manufacturer of many popular food brands such as Heinz Ketchup, Kraft cheeses, Oscar Mayer meats, Philadelphia Cream Cheese, and Planters Peanuts. Prior to the Kraft and Heinz merger, there were several acquisitions and companies that were spun off. Kraft and Mondelez International (MDLZ) were a combined company before splitting up in 2011. Mondelez took the snack business with an international focus, while Kraft took the core brands with a North American focus. In 2013, H.J. Heinz Company was taken private by Warren Buffett’s Berkshire Hathaway and 3G Capital (a Brazilian private equity firm) for $23 billion. Today, Berkshire and 3G own about 50% of Kraft Heinz common stock.

Buffett and 3G both have excellent track records of successfully managing companies. 3G is a proven cost cutter and has improved margins at companies such as Ambev, Anheuser Busch InBev (BUD), and Burger King. Since the merger, the cost cuts have increased profitability dramatically at KHC with operating margins growing from a low of 11% in 2014 to 28% this past year.

At current levels, we believe KHC shares are significantly undervalued with respect to the company’s long-term growth potential and strong brands. Our investment rationale is predicated on management’s ability to take the brands to international markets in order to boost growth. Also, we believe KHC may lead consolidation in the packaged food sector, which could be a potential catalyst for the stock.

Along with other food companies’ shares, KHC stock has been hit by declining sales as consumers look to private label brands, fresh foods, and locally sourced products. Also, we acknowledge other issues for food companies, including consolidation of U.S. retailers and the significant growth of Amazon. That said, we believe investors are getting paid to wait for KHC’s turnaround; the stock currently yields above 4%.

by John Kernan

No one likes it when the price of something that they buy goes up (unless of course, it is in your investment portfolio). No one except, it seems, those ivory-tower dwellers at the Fed, who insist that prices should rise about 2% every year. How can inflation be good for the economy? Most economists agree that inflation serves several purposes.

First, it is in the interest of those who regulate our economy for people to buy and sell things- the more, the better (just don’t take out too much debt to do it). This is what we count to measure GDP (Gross Domestic Product) or how much “stuff” is bought and sold in a country in a year. When we see prices rising year after year, we tend to go out and buy what we want today to avoid the possibility of higher prices tomorrow. This gentle push speeds up our economy.

Second, having a bit of inflation keeps nominal interest rates up, even when real interest rates fall below zero. In English, that means that even if the economy is moving so sluggishly that the “natural” rate of interest is at or near 0%, inflation pressure will push it up a little, so the rate we actually see at our banks is something like 1 or 2%. That way, the central bank still has some wiggle room to fight the recession by lowering rates a bit further if necessary.

And third, inflation and unemployment are negatively correlated. As firms produce more, they need to hire more people, so unemployment declines. Since business is booming across the country, prices are also rising as the economy moves to (and beyond!) maximum stable output. This is the subtlest of the three points that we present here, and the Tufton economic team is resisting the urge to put in a technical graph to explain it. Suffice it to say that the monetary authorities won’t push back against a trend that means that more and more people are getting jobs.

Inflation means more jobs, which is great, but obviously we don’t want to end up with too much inflation, lest we become the next Weimar Germany and start papering our walls with cash. How does the Fed make sure that doesn’t happen? They raise interest rates.

The Federal Reserve doesn’t just go out their front door, post the new interest rate on a sign, and hope it goes well. Instead, they set the federal funds rate, which is the interest rate we’ve all heard of but don’t quite understand. It is simply the rate that banks charge each other for quick, usually overnight, uncollateralized loans of cash when they have a very short-term liquidity need. Banks use this rate to determine every other rate, and its influence spreads throughout the world.

Thus, when the federal funds rate rises, banks start charging more for a car loan or that new mortgage. Fewer people are willing to pay the new, higher rates to fund business expansion. At the same time, people see that they can now earn more money by just leaving their cash parked in a savings account, so they are less likely to spend it. Sitting in that bank account, the money can’t contribute to inflation.

The very existence of extra money doesn’t cause inflation. It is the money people spend that causes prices to rise. How many times per year a country’s cash changes hands is known as the velocity of money. If the velocity of money is low, and you have money simply sitting in the aforementioned bank accounts, then prices don’t rise – Fed’s goal at the start.

Other, faster-growing countries like India or Brazil often have inflation targets closer to 4% or 5%. It seems like a shame to lose 5% of your purchasing power every year. But then we remember the link between rising prices and rising production. People are getting more jobs, making more money, and expanding their businesses. The central bank wants to make sure they have a monetary environment to keep doing that.

We would be remiss not to mention that the level of inflation affects the stock market. If a company promises it can earn 8% more per share in three years, it means a lot less if inflation is sitting around 2%. An investor in equities might demand 2% a year for his time, 5% for the riskiness of stocks, and 2% to make up for inflation, for a total of 9% equity returns per year. If inflation expectations are flat, we would see 7% returns in the market per year – all else equal. Of course, all else is always equal in economics, but never in finance.

As this piece goes to press, the Commerce Department has just released its inflation estimate for February, indicating that prices had risen 0.2% from the month prior, and were up 1.8% from a year earlier. As we edge closer to that 2% target, we can expect the Fed to raise rates in order to prevent an economic overheating (inflation and other not-so-good things).

We hope that this discussion about the ins and outs of rising prices and monetary policy has enlightened you, or perhaps it has made your head spin. Hopefully, you now have an appreciation for both the complexity of our monetary system and the necessity for a bit of inflation.

Tufton Capital Management is pleased to announce our firm’s continued involvement with the Baltimore-based charitable organization “Stocks in the Future.” This non-prof- it partners with schools in downtown Baltimore and provides a three-year financial literacy curriculum for middle school students in under-served communities.

“Stocks in the Future’s” mission is to develop highly motivated middle school students who are eager to learn and dedicated to attending class. The financial literacy program introduces Baltimore City students to business concepts, expansion possibilities, reasons for taking a company public, and ways to compare company performance. As students progress through the program, they can earn money in an investment account by attending school regularly and improving their grades. Their money can be used to purchase shares in a publicly traded company. When they graduate from high school, their hard work pays off, since they are able to keep the shares that they have purchased.

Tufton’s associates have been actively volunteering with the Program. Our employees have taught middle school math classes and have worked with teachers to help them better understand the Program’s curriculum. Tufton Capital is happy to support the “Stock in the Future” organization, and we believe its incentive- based curriculum can make a difference in students’ lives.

To learn more about “Stocks in the Future’s” mission, visit the organization’s website: www.sifonline.org

by Chad Meyer

In this space, a bit over twelve months ago, I admitted that I didn’t have a clue what sort of market 2017 would bring. “Perhaps the economy will thrive…buoyed by the message that America is now ‘open for business’,” I wrote. “Or perhaps…our new president-elect will prove uniquely problematic, unduly influencing the market one late-night ‘tweet’ at a time.”

On Wall Street, however, where confidence is king, well-paid prognosticators were obliged to issue a more definite outlook. And as you may recall, that outlook was rather bleak. On January 3, 2017, CNBC reported that Wall Street’s collective annual forecast was the most bearish it had been in over a decade. The following day, Goldman Sachs warned clients of “downward pressure” on U.S. equities. With sociopolitical tumult and a bull market that was officially long in the tooth, it seemed as though worrying over a slowdown was the respectable analyst’s only prudent move.

What happened next is history. Over the last twelve months, that bull market has grown even longer in the tooth, surmounting the Street’s “wall of worry” (and continued sociopolitical tumult) in truly rare form. In 2017, while volatility sat at historic lows, the S&P 500 rose 22% (total return), posting its largest yearly gain since 2013. Not to be outdone, the Dow Jones shot up 25%, its second-biggest annual gain of the last decade. With this increase, it turned in nine consecutive months of growth, its longest streak since 1959. So much, it would seem, for those January jitters.

Yet, pleasant as the market’s surprises were in 2017, one question still looms large. What should investors expect in the year ahead? Given the strong start U.S. equities have already had in 2018, it’s no surprise that many once-dour pundits have taken on a sunnier tone. Open the morning paper, and you’re likely to read about the market’s “record run,” spurred on by an encouraging global economic outlook. As Goldman Sachs’ asset management arm now succinctly puts it, “We think equities will continue to outperform in 2018.”

We certainly hope Goldman Sachs’ prognostication will prove to be the case. However, all good things must eventually come to an end, and we at Tufton Capital will continue to implement a bottom-up, value-driven investment philosophy that delivers performance in a strong market—and perhaps more importantly – provides peace of mind when things take a turn for the worse. For twenty-two years, this approach has kept our clients in good stead from the “Great Recession” of 2008 throughout the “great gains” of 2017.

As we charge into 2018, I will again forgo a firm “outlook”. Instead, I offer this simple assurance. Above all else, your team of investment professionals at Tufton Capital remains honored by your trust and committed to your interests. From all of us here at Tufton Capital, Happy New Year.

by Eric Schopf

The frigid weather that ushered in the New Year has been no match for the red hot stock market. The Standard and Poor’s 500 delivered a total return of 6.6% for the fourth quarter and 21.8% for the year. As many expected, the fourth quarter continued the trend of consistent returns with little volatility. Although technology stocks led the way with returns in excess of 38%, the rally was broad with most sectors posting double-digit returns. This widespread improving economy, combined with low interest rates and benign inflation, continues to attract investors to the equity market.

Interest rates were once again on the move, with the Federal Reserve raising the Federal Funds rate to 1.5% in December. This rate increase was the fifth since the Fed began tightening two years ago. Despite the increases, interest rates are not yet attractive enough to entice investors to move out of stocks and into bonds. Longer-term interest rates continue to be a challenge. Although the Fed has raised the Fed Funds rate from .25% to 1.5% since the tightening cycle began in 2015, longer-term rates (maturities of 10 years or greater) have essentially remained unchanged. Although the business cycle is approaching maturity, which would normally suggest some shift to bonds, we thus have little appetite for the longer-term instruments that offer returns that are just slightly higher than the rate of inflation. Higher rates on the short-end are a welcome relief. It is nice to actually earn something greater than zero on cash held in money market funds.

The major news headline in the quarter was tax reform. The Tax Cut and Jobs Act was passed along party lines in late December and provides some tax relief for many individuals. However, the lion’s share of the law was designed to reduce corporate taxes. Although the corporate rate has been reduced to 21% from 35%, the impact will vary from company to company. Legions of accountants are employed to minimize corporate taxes, so most corporations have not been taxed at the 35% level. Nonetheless, extra cash generated through any tax savings may be deployed in a shareholder-friendly fashion. Investment in plant and equipment made to produce future earnings or reduce costs, share buybacks, and higher dividends are all potential uses of the extra cash. President Trump and his administration expect the lower tax rate to help “make America great again” by attracting more business back to our shores from abroad and igniting economic growth.

While lower corporate taxes are a good thing, there is no such thing as a free lunch. Unless spending is reduced or economic growth truly does generate enough incremental tax revenue to allow the tax cuts to be self-funding, the Treasury will need to issue a lot of debt to cover the expected expansion of our nation’s deficit. The Congressional Budget Office estimates that the deficit will grow by $1 trillion over the next decade. The issuance of debt to cover the deficit will come at a time when the Federal Reserve is winding down their balance sheet amassed during quantitative easing. The end result will most likely be higher interest rates.

Low interest rates have not been the only pillar of the soon-to-be nine year old bull market. The economy has improved, which has had a tremendous impact on the equity market. Gross domestic product grew in excess of 3% in the second and third quarters. This is the first time our economy has grown at these rates for consecutive quarters since 2014. Additionally, consumer confidence has bubbled higher. Confidence hasn’t been this high since the dotcom era of 1997 to 2000, and it may further improve once individuals feel the impact of lower taxes. Corporate earnings growth has also provided a stable footing for the stock market. Wall Street estimates going forward are strong, and the rebound in energy prices should drop to the bottom line for a wide range of companies that support the industry.

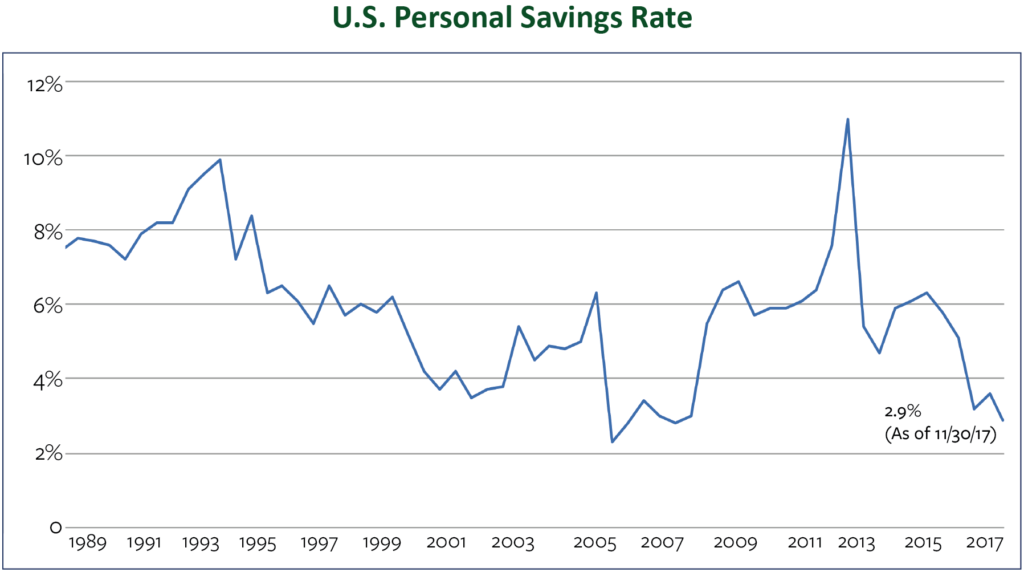

Our optimistic outlook for the near term reflects the mosaic of earnings growth, low inflation and interest rates, along with the continuation of a strengthening economy. We temper our enthusiasm knowing that the business cycle is not extinct. The five interest rate hikes initiated by the Federal Reserve have not put a damper on the economy. However, with three or four more hikes potentially in the cards for this year, the impact may be more apparent. We must also pay attention to the fact that the growth in share prices has been much greater than underlying earnings. Stocks are just more expensive. It is becoming increasingly difficult to find quality investments at reasonable prices. Finally, consumers are very confident and are spending freely. The U.S. savings rate has dipped below 3%, the lowest levels since 2005 – 2007, prior to the Great Recession.

Soaring consumer confidence and dwindling personal saving leave little room for future improvement. It may seem that all these factors together suggest imminent recession. However, history has proven that these conditions may persist for many years.

Although we turn the calendar to a new year, our investment style and strategy remain consistent. We continue to seek quality companies that are trading at temporarily depressed levels. We place a premium on above-average dividends and sound balance sheets. Portfolios are maintained within asset allocation guidelines spelled out in our clients’ investment policy statements. This consistent and disciplined approach has served Tufton’s clients well over the numerous business cycles throughout our firm’s twenty-two year history.

by John Kernan

International Business Machines (IBM) reinvented itself before. Now it is looking to do it again. In the tech boom of the late 1990’s, IBM developed a technology services business that became the envy of all the other big tech names. Meanwhile, the company started to move away from the hardware businesses that defined it for a generation. Now, it seeks to make a new name for itself in the burgeoning field of artificial intelligence.

The impressive defeat of all human challengers on Jeopardy was remarkable for sure, but IBM’s powerhouse artificial intelligence system Watson is more than a quiz show smarty-pants (or smarty-motherboard, as the case may be). It is powering industry-specific solutions as the world’s businesses move to hosting their data on the cloud. Companies that have turned to Watson to solve problems in security, healthcare, and automation have seen productivity gains significantly beyond what human engineers could accomplish.

But the great-sounding story of Watson comes on the back of revenue numbers that came in under consensus in 14 of the last 20 quarters. Wall Street is waiting for evidence that IBM has truly turned a corner. As it does, we have stock that is yielding almost 4% and trading at attractive multiples. Technology is a fast-paced, quickly changing industry, and the timing of IBM’s turn is far from certain. But Big Blue has been investing in this change for years. Now we have a company with a strong balance sheet, good customer relations, and a history of success that has a solvable problem affecting the stock price – the value investor’s ideal.

by Neill Peck

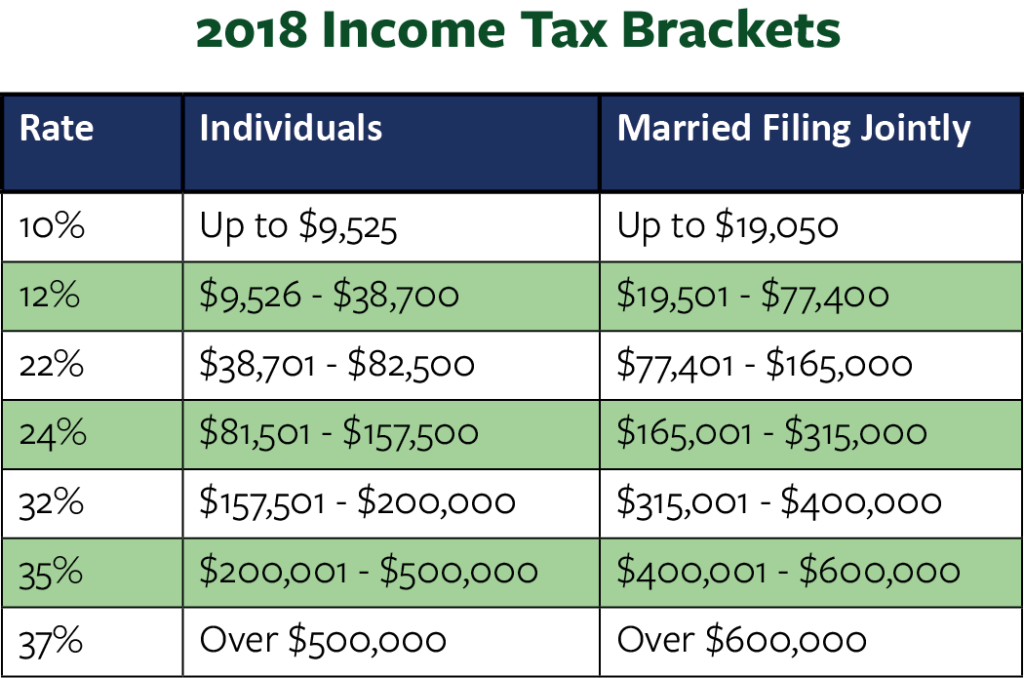

Just before Christmas, President Trump scored his first major legislative victory when he signed the Tax Cuts and Jobs Act. The bill dramatically reworks the U.S. tax code and promises to immediately alter the financial lives of families across the economic spectrum.

The Tax Cuts and Jobs Act represents the largest one-time reduction in the corporate tax rate in U.S. history, lowering it from 35% to 21%. The 503-page bill also lowers taxes for a majority of American households, as well as for small business owners – at least until the personal tax cuts expire after eight years. The bill lowers taxes for top income earners. Prior to its passage, couples earning over $470,000 per year paid 39.6% in federal income taxes. The GOP bill drops that rate down to 37% and increases the threshold at which that rate kicks in to $600,000 for married couples. This new break for millionaires is intended to ensure that wealthy earners in highly taxed states such as New York, Connecticut, and Maryland don’t end up paying substantially higher taxes. Moving forward, taxpayers will only be able to deduct $10,000 in state, local, and property taxes.

The final tax plan lowers taxes for most Americans until 2026, since it will decrease rates for every income level. Even though the personal exemption is being scrapped going forward, the plan nearly doubles the standard deduction. It also doubles the child tax credit that parents receive to $2,000, and it increases the credit’s income threshold from $75,000 to $200,000. The bill also creates a new $500 temporary credit for non-child dependents (children 17 or older, a disabled adult child, or an ailing elderly parent). Moving forward, the new plan lowers the cap on the mortgage interest deduction on a first or second home. Now, homeowners will only be allowed to deduct interest on the debt up to $750,000, down from $1 million today. While early versions of the bill had proposed repealing deductions on medical expenses and student loan interest, these changes did not make it into the final version.

Republicans in Congress had originally wanted to do away with the estate tax entirely but ended up settling on increasing the taxable threshold from $5.5 million per person to $11 million. Going forward, a wealthy couple will be able to pass $22 million on to their heirs tax free. Small businesses are getting a big tax break under the new plan. Pass-through companies (LLCs, S corps, partnerships, etc.) will receive a 20% reduction under the new tax code.

Investors saving for retirement will not expect many changes under the new tax plan, since it makes no changes to the tax-free amounts they can put into 401(k)s, IRAs, and Roth IRAs.