What’s On Our Minds:

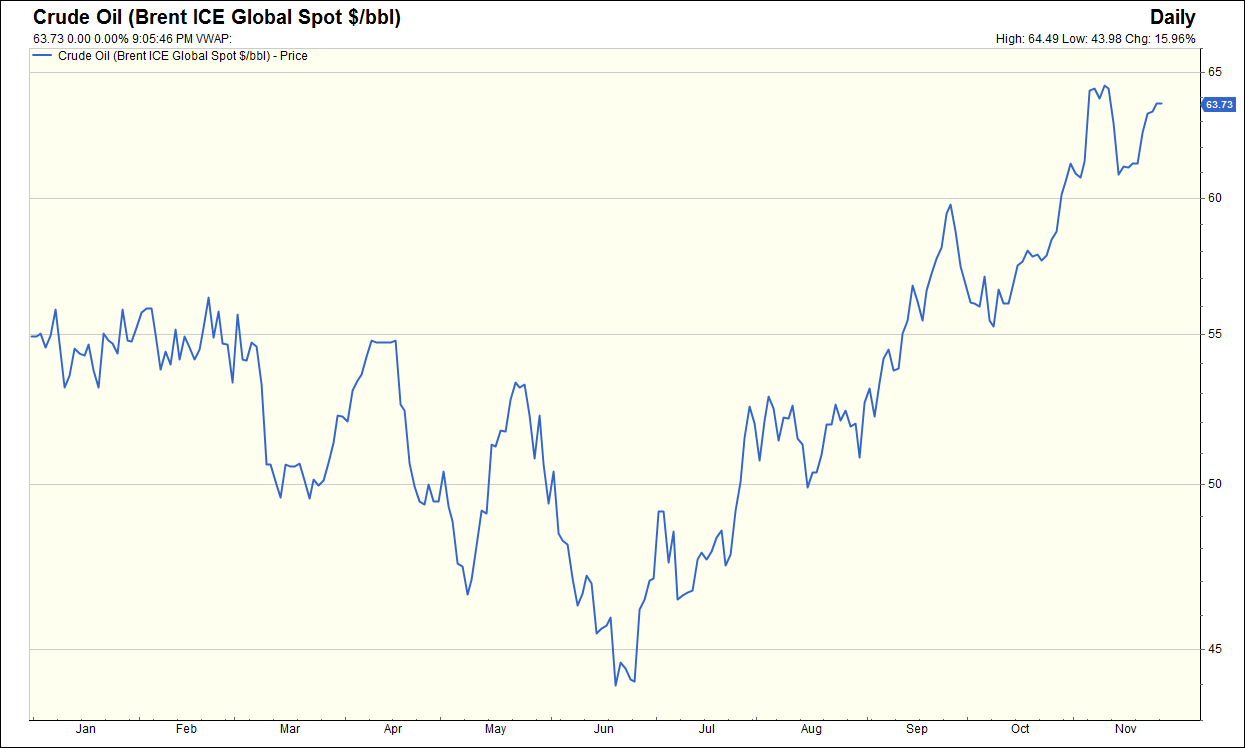

Oil investors will be focused on the OPEC meeting this week. The Organization of Petroleum Exporting Countries (OPEC), which controls over 30% of the world’s oil production, will meet this Thursday in Vienna, Austria to discuss the continuation of production cuts. The cartel agreed to a production cut at the meeting one year ago and investors are expecting a continuation of the deal – keeping roughly 1.8 million barrels a day offline.

Brent crude oil, the global oil benchmark, has risen 12% year-to-date and the price is near the highest level in nearly two years. The Brent crude oil futures curve has returned to backwardation – meaning that the Brent crude price today is higher than all future price in months and years ahead. Historically, a rotation into backwardation has been a bullish view for oil and despite the S&P Energy Index down 7% year-to-date, the index has rallied about 3.5% over the past three months as the futures curve has shifted.

It may be too soon to call, but the futures curve is saying the worst of the oil glut is behind us. Though that may not be an advantage for prices at the pump, client portfolios should benefit from rising energy stocks.

Last Week’s Highlights:

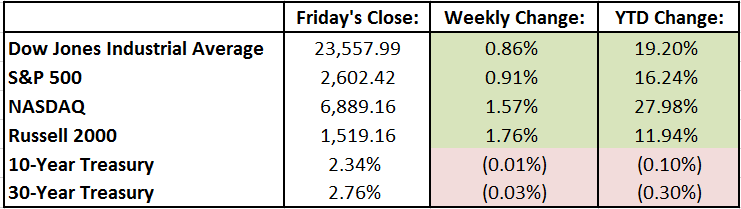

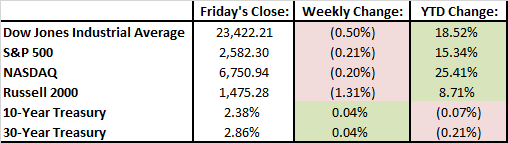

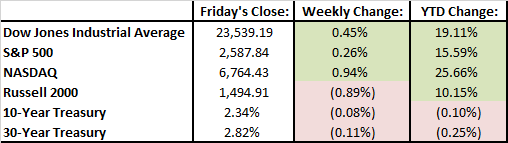

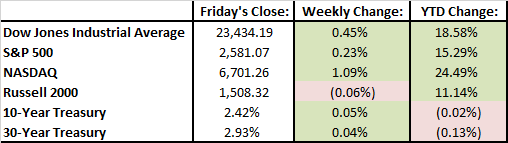

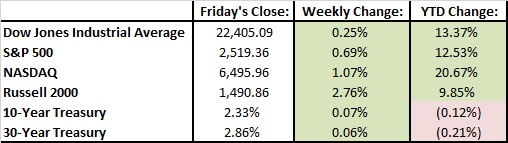

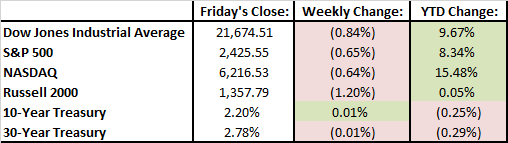

Last week, the three major indexes reached all-time highs. The S&P 500 closed above 2,600 for the first time last Friday, despite lighter trading volumes due to the Thanksgiving holiday and a shortened trading session. The Dow Jones Industrial Average is less than 2% away from breaching the 24,000 mark and the technology driven Nasdaq is rapidly approaching 7,000. Earnings season is winding down with 98% of S&P 500 companies having reported earnings updates. Up to this point, S&P 500 earnings grew 6% year over year. In corporate news, Department of Justice is suing to block the AT&T merger with Time Warner.

Looking Ahead:

This week, investors will continue to monitor news out of the Federal Reserve as well as the White House. On Tuesday, Federal Reserve Governor Jerome Powell will have a confirmation hearing before Congress. Powell has been selected as the next Chair of the Federal Reserve once Chair Janet Yellen finishes her term. Also on Tuesday, President Trump is expected to meet with congressional leaders to discuss a deal that could avoid a government shutdown in December. On Wednesday, Fed Chair Yellen will provide her views on monetary policy. Finally, on Thursday, OPEC will meet to determine oil production strategy and the Senate will vote on tax legislation.

What’s On Our Minds:

With the end of the year quickly approaching, portfolio managers are busy reviewing accounts and, if the opportunity presents itself, harvesting tax losses in accounts.

Aside from research roles, Tufton Capital’s portfolio managers are responsible for all aspects of portfolio construction and supervision, which includes the management of gains and losses that are realized in our clients’ taxable accounts. Of course, tax implications are not the paramount concern in the management of a portfolio, but trading responsibly with this in mind can make a big difference for investors come tax day in April.

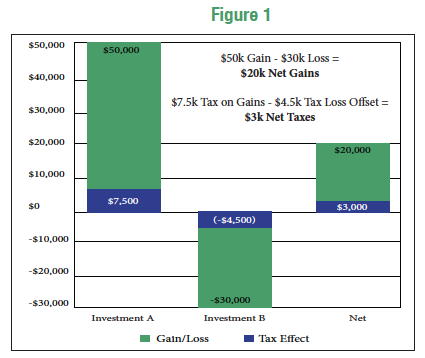

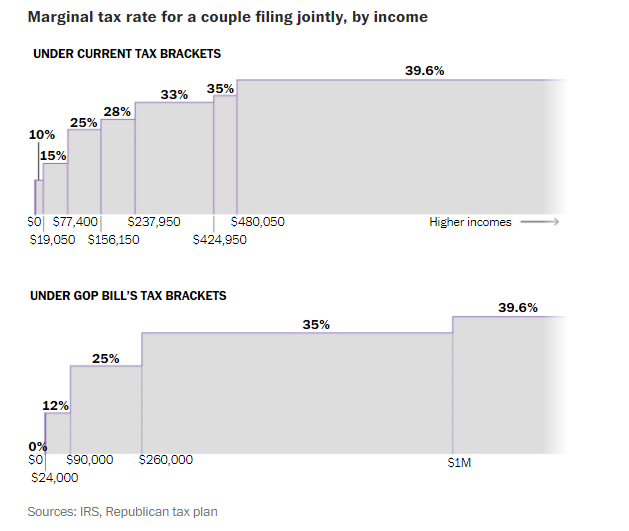

Selling at a loss may seem to run counter to your investment goals, but because the IRS allows for investment losses to be used to offset capital gains, investors should look to make the best of an otherwise unprofitable investment. With that in mind, investors should consider selling poor performers in their taxable accounts by conducting tax loss sales. This strategy is especially good for investors in the 25-35% Federal tax brackets who must pay a long-term capital gains rate of 15%. The tax savings increase for the highest income earners in the 39.6% Federal tax bracket, who must pay 20% on long-term capital gains. Plus, depending on where you live, you may be subject to capital gains taxes at the state level. Our clients in Maryland know this all too well!

Of course, we don’t make trades just for tax purposes. If we think a stock is going to increase in value, we hold it. If we think it is going to go down, we sell it. But using a tax wash sale, in which a security is sold and then repurchased after 30 or more days, enable an investor to claim the tax loss but still hang on to an investment that he or she thinks has long-term potential.

Take for example a single person who has an annual income of $100,000. He would be in the 15% long-term capital gains bracket. In his brokerage account, he has a realized long-term capital gain of $50,000 in Investment A and an unrealized long-term capital loss of $30,000 in Investment B. If he sells his shares of the losing stock, he can offset the $50,000 gain against the $30,000 loss, resulting in $20,000 of net long-term gains. If he does not harvest the loss, the Federal tax on his $50,000 long-term gain would be $7,500. By partaking in this tax loss harvest, he will save himself $4,500, which would have otherwise been a piece of his Federal tax liability for the year (See Figure 1).

Portfolios with large unrealized gains will likely have some positions that have unrealized losses. Although a loss may be hard to look at, sometimes it’s best to bite the bullet and clean these losers out of a portfolio. This management strategy allows investors to free up cash in the portfolio, which can be deployed into other, more attractive investments.

While it’s important to avoid the tax tail wagging the investment dog in your overall investment strategy, a disciplined approach to managing tax liabilities is an important component of wealth management.

Last Week’s Highlights:

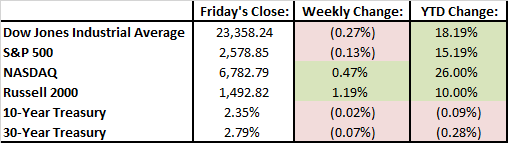

Stocks were lower for the second week in a row. After a calm summer and placid fall, we have seen a bit of volatility return over the past two weeks. Markets reacted to lower oil prices and worries surrounding the progress of Republican’s tax reform plan. Investors seem to be a bit doubtful that Republicans will be able to reconcile Congress’s plan and Senate’s tax reform plans in a timely fashion.

Looking Ahead:

Existing homes sales will be reported on Tuesday and the Federal Reserve is releasing minutes from their meeting earlier this month on Wednesday. Markets will be closed Thursday and will close early on Friday.

The entire team at Tufton Capital Management hopes all of our friends and clients have a wonderful Thanksgiving holiday this week!

What’s On Our Minds:

This morning, Tufton Capital Associates Ted Hart, John Kernan, and Neill Peck taught a sixth-grade math class at Mid Town Academy in Bolton Hill. The purpose of the trip downtown was to teach the students about stocks and the stock market. The students participate in the Stocks in the Future program which is a 501C3 charitable organization that partners with schools in downtown Baltimore and provides a three-year financial literacy curriculum for middle school students in under-served communities.

The Stocks in the Future Program introduces students to business concepts, expansion possibilities, reasons for taking a company public, and ways to compare company performance. As students progress through the program, they earn money by attending school regularly and improving their grades. The students can earn up for $80 per year which enables them buy shares in a publicly traded company. When they graduate from high school, they get to keep the shares they have purchased. Today, our Associates explained how an investment advisory firm operates and we showed them how to analyze two companies; Facebook and Under Armor.

By the end of the class, the students remembered the 3 most important rules of investing.

1. Don’t Lose Money.

2. Don’t Lose Money.

3. Don’t Lose Money.

To learn more about Stocks In the Future’s Mission, follow the link below:

Last Week’s Highlights:

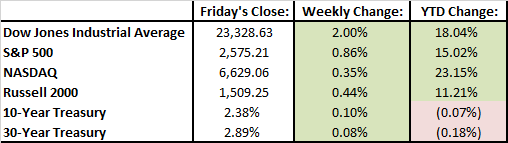

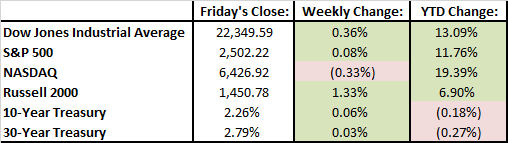

After 8 straight weeks of gains, U.S. large-cap stocks fell last week. Investors were focused on tax reform and the overall consensus is that the federal government is nowhere close to passing a bill. Congress and the Senate have both presented a plan and it will be in limbo until both houses compromise and present a mutually agreed upon plan.

On Thursday, the Dow was down over 200 points at its lows and the S&P 500 nearly broke its more than 40-day streak of no losses greater than 0.5% for a given session. Investors should see last week’s dip as a healthy retreat based on the rally we have seen in the last year. Remember, we have been experiencing one of the calmest markets in history this year and we remain close to all time highs.

Looking Ahead:

Earnings season is coming to an end. 483 companies in the S&P 500 have already reported. Economic news and progress on tax reform will likely rule the headlines this week. On Wednesday, retail sales numbers will be released and on Friday, we will hear housing starts and building permit figures.

What’s On Our Minds:

House Republicans released their long-awaited tax reform bill last week. They are calling the bill the Tax Cuts and Jobs Act and are looking to have it passed by the end of the year. The bill aims to permanently lower the corporate tax rate from 35% to 20% and to reduce the number of individual tax brackets. The plan eliminates the alternative minimum tax and it doubles the standard deduction for individuals and couples. The plan limits the home interest deduction to loans up to $500,000, increases the child tax credit to $1,600, and doubles the estate tax exemption immediately and then will eliminate it by 2024.

Under the Republican plan, people will still be able to deduct up to $10,000 on the property taxes they pay locally, but they will no longer be able to deduct the other taxes they pay to state and local governments from their federal tax payments. This compromise appears to cater to a Republican’s base living in states where local taxes are relatively low and has drawn criticism from GOP representatives from New York, New Jersey, and Pennsylvania.

The tax plan does not make direct changes to how income on your investment portfolio is taxed. While the new plan doesn’t directly address capital gains and investment income taxes, setting new income tax rates means many investors will pay less in taxes on short term capital gains and dividends because their ordinary income tax rate will effectively be lower.

Though cutting benefits for 401k contributions was allegedly on the table at first, the official plan makes no changes to retirement savings tax breaks provided by contributing to 401k and IRA accounts. That is good news for investors saving for retirement.

Last Week’s Highlights:

Stocks has a strong week and were in the green for the eighth week in a row.

President Trump nominated Jerome Powell to replace Janet Yellen as the 16th chairman of the Federal Reserve board early next year. Powell is a lawyer by training who served as a top Treasury Department official under H.W. Bush and then joined the Carlyle Group (a private equity firm), where he remained from 1997 to 2005. President Obama nominated him for a spot on the Federal Board of Governors in 2012. Powell has always been supportive of Yellen’s moves, which suggests a continuation of slowly raising rates and easing regulations.

October’s Jobs Report was released on Friday. Nonfarm payrolls rose by 261,000 and the unemployment rate dropped to 4.1%.

Earnings season continued. Facebook and Apple reported strong numbers. Baltimore’s Under Armour reported poor performance and shares took a beating.

Looking Ahead:

We are getting close to the end of earnings season but hundreds of companies are set to report third-quarter results this week. 48 companies in the S&P 500 report earnings will share their results this week. President Trump will spend the week touring Asia. University of Michigan’s Consumer Sentiment report is set to be released on Friday.

What’s On Our Minds:

The Tufton Investment Committee meets weekly to discuss our current holdings and examines our entire universe of companies that we would like to own at the right price. Managing all assets in house and conducting independent research is a timely process but the strategy is designed to pay off over the long term. We believe that it is our responsibility to manage a portfolio of individual securities, rather than merely play “quarterback” by redirecting funds to outside managers.

The Tufton Investment Committee is very conscious of price and we shy away from overpaying for shares in a company. While this may hurt us when the rest of the street is chasing momentum stocks higher, we believe that by purchasing undervalued securities our clients are provided a “margin of safety”. We believe that our independence is an advantage.

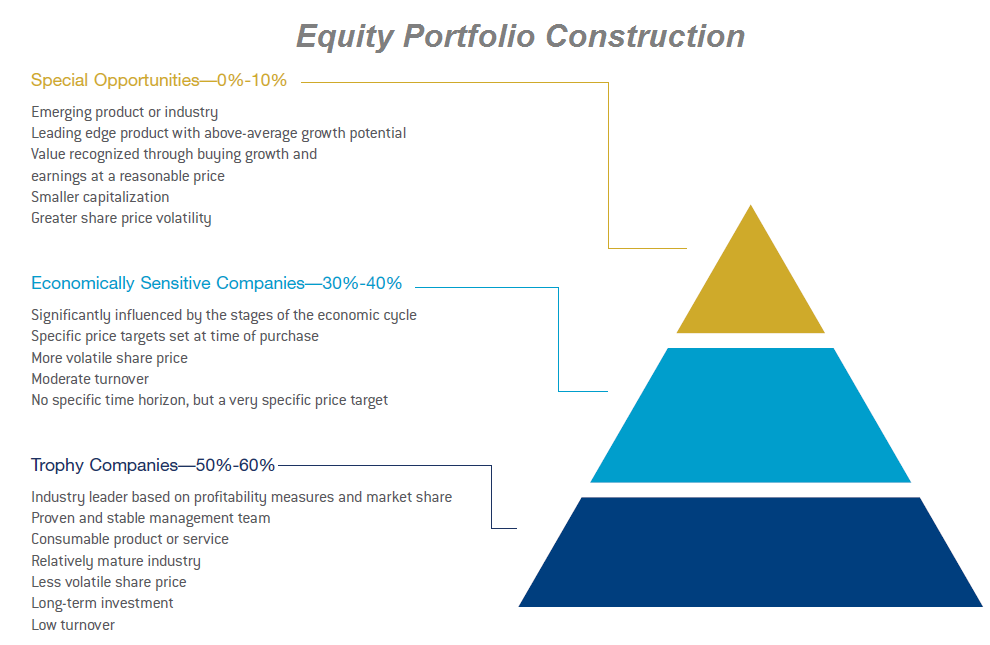

Tufton Capital seeks to build our equity portfolios of 40-50 stocks. Of these companies, 50-60% equities we hold are what we consider to be “trophy companies”. These companies are industry leaders based on profitability measures and market share. These companies have proven and stable management teams, consumable products or services, operate in a relatively mature industry, pay a dividend, and their share price is typically stable. We look to buy and hold these stocks for the long haul.

30-40% of a Tufton’s equity portfolios are made up of what we consider to be “economically sensitive companies”. These companies we purchase with no specific time horizon, but we set very specific price targets. These companies are significantly influenced by the stages of the economic cycle and can be more volatile than our trophy companies.

The remaining 0-10% of an equity portfolio is what we consider to be “special opportunities”. These companies are typically have smaller market capitalization, operate in an emerging industry, have some sort of leading edge product with above average growth potential. These companies’ share prices can be volatile but we recognize the value in buying shares in these types of companies at a reasonable price.

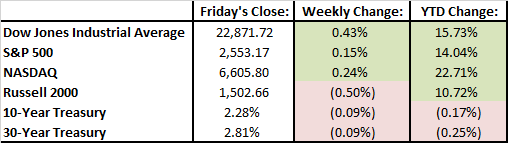

Last Week’s Highlights:

For the seventh week in a row, domestic equities were positive and reached record levels. It was the busiest week of third quarter earnings season and investor optimism was confirmed by strong numbers. The technology sector had a particularly strong week. The NASDAQ was up 2.2% on Friday. While single stock volatility can be increased during earnings season, overall, equity markets continue to be strong.

Looking Ahead:

It’s a busy week with 135 of the S&P 500’s companies reporting third quarter earnings. The Federal Reserve will issue its decision on interest rates on Wednesday. October’s jobs report will come across the wire on Friday morning.

What’s On Our Minds:

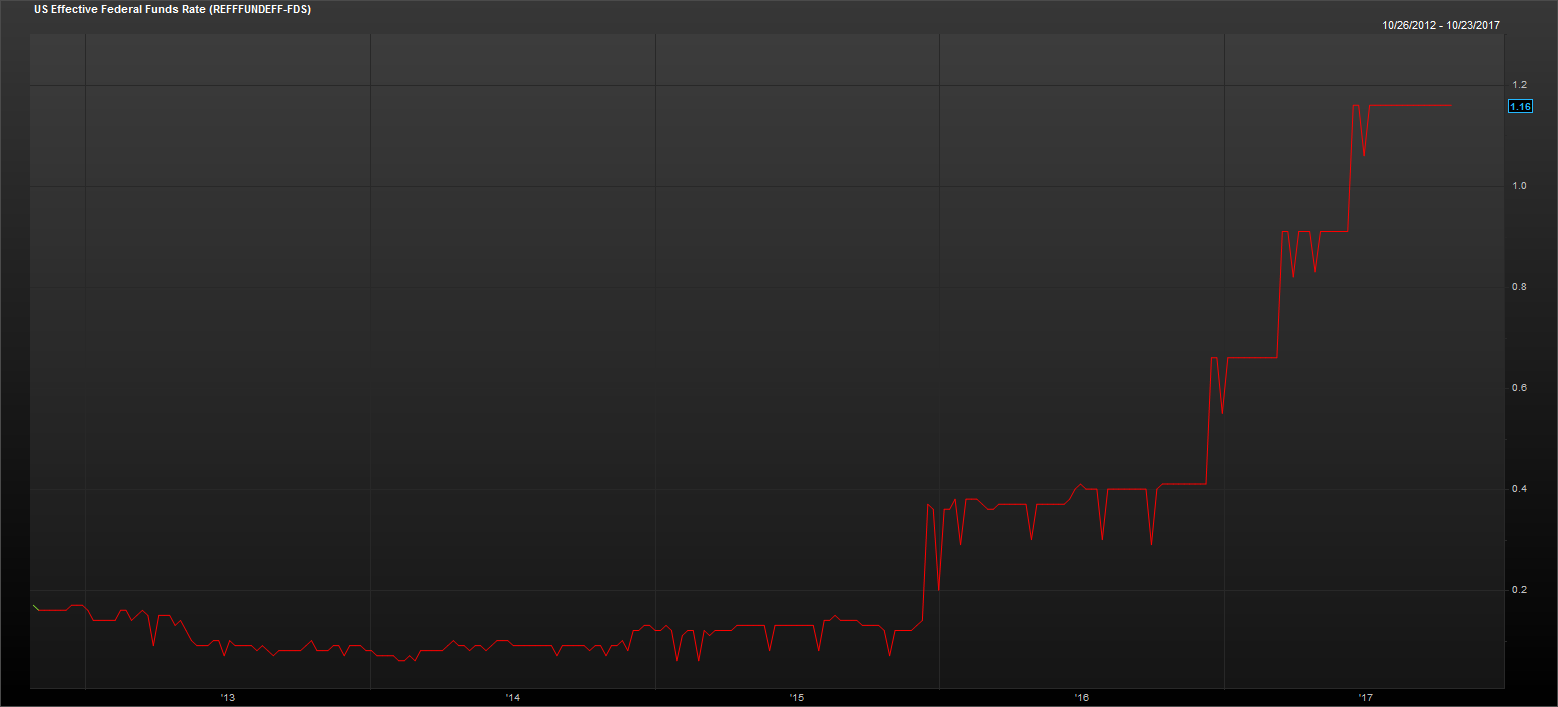

Equity markets have been on a roll lately, but don’t forget about interest rates!

Interest rates are, to put it mildly, a complex beast. There are a few mechanisms by which rates affect the economy and the stock market, not all of which are obvious, but which have large effects. We’ve tried to break down these levers without getting too granular or using financial jargon.

The first is the most obvious: a lower interest rate means it’s cheaper to borrow. Consumers borrow more money to buy houses or cars, businesses borrow money to expand production. And thus, we get economic growth. Everybody’s happy. Except, maybe, the people who get less money in interest for loaning out their hard-earned cash.

An interest rate raise, like the one that seems imminent, is a signal that rates are moving higher, might cause both consumers and Chief Financial Officers to cut back on spending. So businesses earn less, and earnings fall.

Another very important but more abstract concept is the valuing of stocks via a discount rate. If I think a company is going to earn $10 million in ten years, the interest rate would have to be 0 for me to want to buy its stock now for a $10 million valuation. But if interest rates are higher, I’d be better off just putting the money in the bank for ten years and earning some interest in those ten years. In this way, investors compare interest rates with their expectations for the earnings of companies. If interest rates are low, companies’ stocks are more attractive, and therefore worth more in today’s dollars.

Whenever you hear about Janet Yellen attending a big Federal Reserve meeting, they have to think about all of this, with the added complexity of inflation. The inflation target is 2-3%: at this level, prices are stable, but there is incentive to spend, rather than save, money, and to push the economy along. With inflation at zero, you know that the car you want to buy will cost about the same in year, so you might just think about it for a while, dampening economic activity.

Deflation, when inflation falls below zero, is a major problem: here, you might wait to buy that car, since it will be cheaper next year. And the year after that. And… This gives rise to the “pushing on a string” phenomenon that was one of our investment committee’s favorite metaphors. You can’t entice people to spend money by cutting rates indefinitely, since rates below zero (usually) are avoided by simply keeping the cash. This illustrates, in part, one of the major limitations of monetary policy (setting interest rate, money supply, etc.) vs. fiscal policy (where and how the government spends their money). But fiscal policy is a topic for another post.

Last Week’s Highlights:

Equity markets enjoyed their 6th consecutive week in the green. The Dow Jones and S&P 500 recorded record highs on Thursday on the 30th anniversary of Black Monday. The Dow Jones had a great week and was up 2%. So far, we have seen strong third quarter earnings reports that has investors pushing equity market ever higher. General Electric was an exception to the news of strong earnings figures. GE’s CEO opened earnings remarked by saying, “The results I’m about to share with you are completely unacceptable.” He telegraphed big changes ahead for the company. According to the numbers, American companies appear strong and the economy continues to improve. Investors were also supportive of the news that Jerome Powell could be nominated to replace Janet Yellen.

Looking Ahead:

Can stocks continue steaming upward? That’s the question on everybodys’ minds.

Politicians in Washington seem to be getting closer to proposing a tax reform plan. Equity analyst will be busy listening to earnings calls this week. CNBC provided the chart below highlighting key earnings releases coming from blue chip companies this week.

What’s On Our Minds:

This Thursday marks the thirty year anniversary of “Black Monday”. On that day, the Dow Jones tanked nearly 23% in a chaotic selling spree. For the most part, the one day crash was caused by growing complexity in the market. Computerized trading platforms were new at the time and complicated hedging strategies that used equity index futures contracts were just being introduced. Today, on a percentage basis, that correction would knock over 5,200 points off the DJIA. As a former stock broker told us this morning, “that was a tough day in the trenches”. On the bright side, the S&P 500 has returned nearly 900% since.

Tufton Capital Portfolio Managers, Randy McMenamin, saved the Wall Street Journal from that day. This paper, along with other “fateful” days in the markets are kept it in our firm’s library as a reminder that corrections can and do happen.

Last Week’s Highlights:

Third quarter earnings season kicked off and investors were optimistic.

Going into the week, investors were expecting solid performance in the big bank’s earnings reports. On Friday, Bank of America’s report was met with happy investors and the company’s share price increased by 1.5%. JPMorgan and Citi sold off as they failed to meet some important metrics. Particularly, both banks failed to deliver strong loan growth and loan quality metrics.

Looking Ahead:

Investors will have a keen eye on earnings reports coming across the wire this week. Many believe that in order to sustain the rally we have seen in equity markets, investors will need to see strong earnings growth over the next few week.

On Monday we will hear from highflier, NetFlix. On Tuesday we will see earnings from Goldman Sachs and Harley Davidson. On Wednesday, Abbot Labs reports their results. Phillip Morris, Berkshire Hathaway and Taiwan Semiconductor report on Thursday. On Friday, we will wrap up the week with reports from General Electric and Proctor & Gamble.

What’s On Our Minds:

Donating Appreciated Securities

This time of year, charities may begin hounding you to make your annual donations. Have you ever considered donating appreciated securities? It’s a tax efficient way to support charities. Read on to learn how you might be able to “kill two birds with one stone” utilizing this strategy.

Charitable giving provides donors with tax relief every tax season in the form of deductions. In an effort to encourage positive social action, the IRS provides incentives for all kinds of charitable contributions, from monetary donations to used cars. You can even donate your appreciated securities (stocks, bonds, mutual funds, etc. that have risen in value) to the charity of your choice. Long-term appreciated securities are the most common non-cash donations, and they can be the best way for donors to give more to their chosen charities. The tax advantages to donating stocks are such that both the donor and the charity benefit.

What are the benefits?

Donating appreciated securities yields two tax benefits for the donor. The first tax benefit is the elimination of capital gains tax. Normally when you sell an appreciated stock, you pay capital gains tax on the amount your securities have increased in value since being purchased. For example, if you bought stocks for a total of $1,000 and then sold them years later for $5,000, you would owe capital gains tax on $4,000 of income from the sale. This tax can add up significantly depending on what tax bracket you fall under, how many stocks you sell and how much they’ve appreciated over time. When you donate appreciated securities, however, you don’t owe any capital gains tax, no matter how much they’ve increased in value. The charity receiving your donation is free from capital gains tax on your contribution as well.

Tax Deductions

The second tax benefit is writing off the donation on your tax return. As long as you itemize, you can deduct charitable contributions on your return, and the more you donate, the more you can deduct. In this case, you’ll be donating more since you can donate the entire value of the asset, not the value minus taxes. Thus, your tax write-off will be greater. In other words, you can take a charitable deduction on money that hasn’t been taxed. This also benefits the charity, because they’ll get a larger donation than they’d otherwise receive.

There is a limit to how much you can deduct for charitable contributions, which varies depending on what you’re giving and what organization you’re donating to. Most organizations are subject to a 50 percent limit, meaning your charitable tax deduction cannot exceed 50 percent of your adjusted gross income. Other organizations have a 30 percent limit. You can check with the IRS or ask the organization themselves to be sure. These limits apply to monetary charitable donations. If you’re donating appreciated securities, the limits change; a 50 percent organization’s limit becomes 30 percent for appreciated securities, and a 30 percent organization’s limit moves to 20 percent.

Reducing Risk

Another benefit to donating your appreciated securities is reducing risk in your portfolio. If too much of your portfolio is dedicated to a certain kind of investment, your risk increases because your portfolio is less diversified, so your assets are all relying on that one kind of investment to succeed. To decrease that risk, you’d normally have to sell the stocks and pay capital gains taxes. Donating them, on the other hand, is a tax-free way to rebalance your portfolio.

Last Week’s Highlights:

Equity markets hit record highs again last week. Stocks continue to “climb a wall of worry” but investors got some encouraging economic data releases last week. Reports showed stronger than expected trends in the automotive, manufacturing, and service sectors. Friday’s job report was weaker than expected but that was attributed to the effects of the recent hurricanes in the southeast.

Looking Ahead:

Earning season is upon us! We will kick things off with Delta and BlackRock on Wednesday. Thursday we will see earnings from JPMorgan and Citigroup and then Bank of America and Well Fargo on Friday. Also on Friday, the U.S. Census Bureau will announce retail sales numbers for September. August’s figures showed a 0.2% dip from July to August, but an increase of 3.2% from August 2016. We will also see how the American consumer is feeling with the University of Michigan’s consumer sentiment figure for October. Their survey found a 1.7% dip in confidence from August to September so it will be interesting if things change course.

What’s On Our Minds:

“A year from now, it’s not going to be Tech.”

Such was the general consensus at last week’s investment meeting at Tufton Capital. While the Tech sector analyst is characteristically overenthusiastic about the forward march of technology, we are reminded by history that the high flyers are rarely up for very long, and when they are, the crash is ever the more painful.

As we look at this year’s winners, the Tufton approach gets pooh-poohed as more exciting names are gobbled up and soar ever higher. “Why isn’t half your portfolio cryptocurrencies?” is not quite the question we are always getting, but it seems that way. We are confident, however, that a disciplined approach will win out over time. But in the mean time, the temptation remains strong to jump into these names that just seem to keep going up in price. Why shouldn’t you?

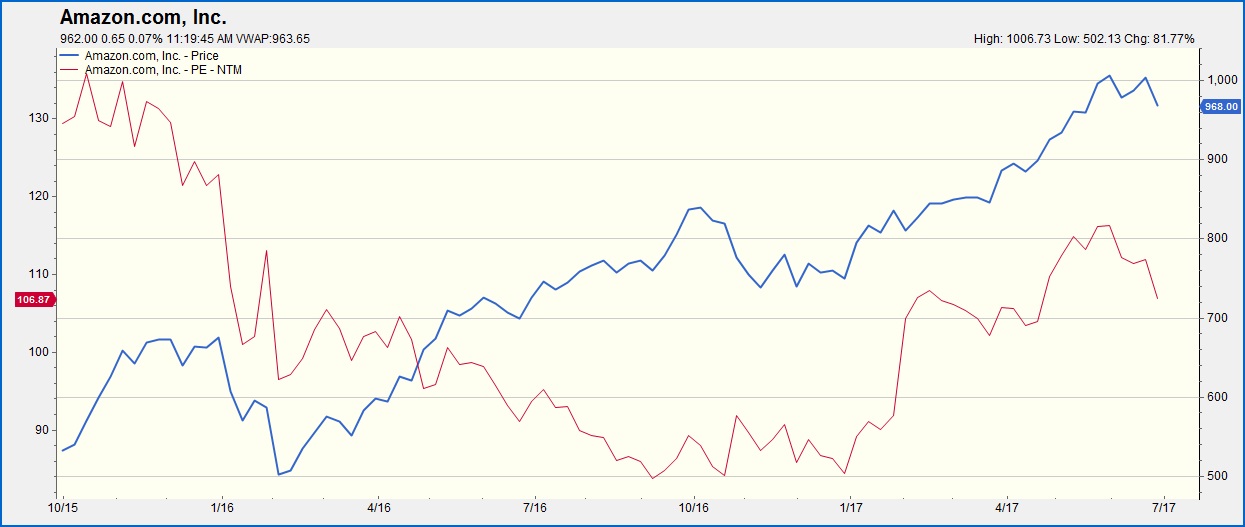

Another joke around the Tufton offices when we have another big up day is to say, “Wow, stocks just always go up!” Of course, the joke is that they don’t, and to be careful of another fall. The tech stocks at the head of the run-up have amazing possibility in them: self-driving cars, artificial intelligence, interconnected everything, a new kind of currency that will reshape accounting and the financial world. Even if all these things come to fruition, there is a price for everything, and an overvaluation for everything. How does one determine the correct valuation for Bitcoin? We’re afraid no one will know for sure until after the climb comes to a screeching halt. Similarly, Amazon and Facebook are valued like they will rule their respective worlds someday very soon. Perhaps they will, but betting on the next world-changing trend has been nothing but a loser’s game in the past.

Amazon has had Price/Earnings ratios in the triple digits for years.

What’s a value investor to do?

Last Week’s Highlights:

Stocks were again higher last week and hit record levels. High hopes for the Republicans’ tax plan pushed stocks ever upward. Stocks are looking at moving into mid-teen growth for the year, a solid performance to be sure. The 10-year Treasury continued to rise. While resulting in lower bond prices, increased rates are signs of a solid recovery, and gives the Fed more breathing room.

Looking Ahead:

Plenty of economic data this week, including manufacturing PMI on Monday, vehicles sales Tuesday, and the September jobs report on Friday.

What’s On Our Minds:

Tune your TV to CNBC on any given day and more and more attention is given to activist investors and the companies they target. As activists, investors look to maximize shareholder value by often taking large enough positions to influence management decisions- they are looking to shake things up at the company. Activists may decide to move in on a company if they believe management has stumbled, it would be better off as a private company, it has excessive costs, or if the activist think they have a better capital allocation strategy, such as buying back stock or raising the dividend.

Often activists are targeted by the media and politicians for being “hit and run” investors, but activists will argue that they are genuinely concerned about companies and the U.S. economy. The issues surrounding activism are not clear cut; some activist may just be greedy, while others actually want to maximize shareholder value over the long-term.

Over the summer, Nelson Peltz’s $12.7 billion hedge fund, Trian Partners, took aim at household product conglomerate Proctor and Gamble. His fund currently owns $3.3 billion worth of P&G shares. Peltz thinks P&G is not structured properly and believes that the company in resistant to change. He is currently in a proxy fight for a seat on the company’s board. The company says they have been actively working with Trian but is against adding him to the board. In dollar terms, P&G is the largest company to ever face a proxy fight of this nature.

Activists take positions in all different types of companies, across many different industries and of various market caps, but more often than not, activist target companies that have been beaten up and are considered value stocks. At Tufton Capital, we are not activist investors but we do look for undervalued stocks so it’s not uncommon for companies in our equity portfolio to have activist involvement. Thus, we do have to pay attention to the hype created by these market players.

While activist investors grab plenty of headlines, it’s tough to determine the actual impact activism is having on the overall market. According to a study conducted by the Wall Street Journal last year, of the largest 71 activist campaigns between 2009 and 2014, only about 50% of targeted companies outperformed their peers.

Last Week’s Highlights:

Stocks were marginally higher last week and hit record highs. The highlight of the week was the Federal Reserve’s announcement that it would begin normalizing its balance sheet in October. The Fed also stated that it would keep its federal funds rate between 1 and 1.25 percent. The announcement caused 2 and 10 year Treasury yields to increase along with the the value of the dollar.

Looking Ahead:

Investors will see how the housing market is doing this week when the Case-Shiller Index of home prices and new home sales figures are released on Tuesday. We will also get a report on consumer confidence on Tuesday and Janet Yellen is scheduled to deliver a speech. Investors are expecting her elaborate on the Fed’s plans to unwind the huge balance sheet it has amassed since the financial crisis.

What’s On Our Minds:

There was a good amount of stock speculating in recent weeks as day traders tried to take advantage of the short-term effects of Hurricanes Harvey and Irma. While it may be tempting to speculate how companies’ stock prices may gyrate around these types of events, we believe it’s important to remember that stock speculation is rarely successful over the long term.

Conversely, the investment professionals at Tufton Capital believe that a long-term, buy and hold investment strategy is the to safest, and smartest, way to build wealth in the stock market. Quite simply, it’s been proven time and time again to return exponential gains on invested capital.

Cultivating Your Portfolio

The term “buy and hold” doesn’t mean investing and forgetting about your portfolio for the next 20 years. There are ways to cultivate and prune your portfolio while still maintaining a long-haul investing strategy. For instance, if a company you invest in changes fundamentally, you may not want to continue owning that security. If the overall market changes dramatically, as it has in the past, you may actually benefit from selling an investment or group of investments. Finally, changing goals as you get closer to retirement may warrant a more conservative portfolio.

Bad Markets

The typical investor is tempted to get out of a bad market by selling when prices are low, which is a poor strategy. The economy fluctuates between good and bad all the time, and those who constantly buy and sell will be hit the hardest in a bad economy. By holding on to your investments, you’ll be better able to ride out a down market, especially if your portfolio is diversified.

Taxes and Fees

Frequent trading results in higher fees, so long haul-investors pay less while fees eat up much of a day trader’s profits. Additionally, short-term gains are taxed at a higher rate than long-term gains. Even if you have the fortune of timing the market successfully, your profits will be diminished by taxes and fees.

Investing for the long-haul is the best investing strategy for the majority of investors because it not only ensures modest gains but is also less likely to yield major losses. A long-haul investment strategy is based on informed, careful decision making and patience.

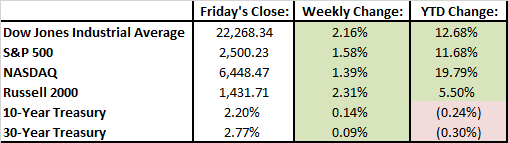

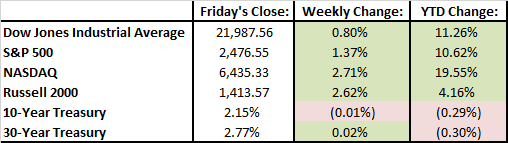

Last Week’s Highlights:

Equity markets were strong last week. The Dow Jones surged more than two percent and the S&P 500 was up over one and a half percent. It was the strongest week for the S&P since January. Most of the optimism was spurred by news that congressional Republicans are planning on releasing their tax reform policies later this month.

Looking Ahead:

The Federal Reserve is holding their two-day Federal Open Market Committee meeting this week. It will wrap up on Wednesday and Janet Yellen will give a speech. Investors don’t expect a bump in interest rates but it’s likely that the central bank will hash out how they plan to start unwinding their 4.5 trillion-dollar balance sheet.

What’s On Our Minds:

Tufton Capital Management is committed to helping our clients take control of their financial future. Armed with an effective estate plan, you can be sure you preserve your family’s legacy while minimizing taxes. By taking advantage of direct gift limits allowed by the IRS, individuals with estates totaling $5.49 million, and married couples with $10.98 million, can get a head start on generational wealth transfer and reduce the ramifications inflicted by estate taxes.

Taxes and direct gifts

Depending on their amount, direct gifts can be given tax-free. You may give up to a combined $5.45 million in life or death without the money being subject to estate or gift taxes, and there is also a $14,000 annual exemption rate per donee (recipient). Couples can combine their annual exclusions to double this amount, meaning they can give $28,000 per donee per year. Even if only one spouse technically makes the gift, as long as both spouses consent, it is considered by the IRS to have come from both. This allows couples to maximize their gifting ability. In addition, all gifts you give to your spouse throughout your lifetime are tax-free, as long as he or she is a U.S. citizen. Annual gifts can make a big difference over time, and since they are a “use it or lose it” exclusion, it makes sense to transfer as much money as possible this way as part of an estate plan.

Since annual gift tax exemptions are based on the calendar year, timing is important when gifting. For example, instead of gifting $25,000 to someone in December, if you gifted $14,000 in December and the remaining $11,000 in January, you could avoid gift taxes altogether. If your gifting amount for the year does end up exceeding the annual exemption amount, you have to file an informational gift tax return for that year and either pay 40 percent of the excess amount or use up some of your $5.49 million lifetime estate/gift exemption. One thing to consider with estate and gift taxes is that if you have to choose between the two, it will usually cost less to gift while you are living (even if it is above the exemption amount) than to wait until after death. Gifts made before death shrink your taxable estate by both the amount of the gift and the interest the money would have gained by the time of your death.

In addition to gift taxes, generation-skipping transfer tax (GST tax) is also a consideration for those subject to estate taxes. GST tax is applied to property that is passed to related persons more than one generation younger than the donor or to unrelated persons who are more than 37.5 years younger than the donor via a will or trust. This tax was created because many people had discovered that they could pass their estates directly to their grandchildren and therefore avoid one generation of estate taxes. GST tax rates and exemptions are the same as estate taxes, with up to a $5.49 million exemption and a 40 percent taxation rate.

Appreciated Assets

Gifts do not always have to be in cash. By gifting appreciated assets, you not only move money out of your estate, but you also move any future appreciation of those assets out of your estate and out of the grip of estate taxes. Another benefit of gifting appreciated assets is a possible capital gains tax advantage. Capital gains tax is enforced on the amount that the value of the asset increases from its original value. For example, if a stock was bought for $2,000 and then gifted when it was worth $2,500, capital gains tax would be assessed on $500. If the recipient of the assets is in a lower tax bracket than the donor, he or she will end up owing less money on this asset.

Last Week’s Highlights:

Stocks were lower last week. Political headlines and the impact of both Hurricanes Harvey and Irma weighed on investors’ minds. The Dow Jones slipped .86% and the S&P 500 shaved off .61%.

Investors were relieved last week when President Trump reached across party lines to extend the nation’s debt ceiling which will keep the government funded for the next 3 months. Although they may have only “kicked the can” on the issue, the move showed some rare bipartisan cooperation.

The monetary cost of Hurricanes Harvey and Irma will not be totally calculated for some time but the overall cost of both storms together could be in the several hundred billion dollar range. It is likely that property and casualty insurers covering Texas and Florida will see large claims in coming quarters.

Looking Ahead:

Monday is the 16th anniversary of the 9/11/2001 terror attacks.

On Tuesday, Apple will release the highly-anticipated iPhone 8. Experts are expecting the new iPhone to include “Face ID” technology that will recognize the owner’s face so that users and simply look at the phone to unlock it.

On Friday, retail sales, industrial production, and capacity utilization figures will all be reported. Also on Friday, contracts for stock index futures, stock index options, and stock options all expire on the same day. These “triple witching” days occur four times a year and can result in escalated trading activity during the final hour of the day.

What’s On Our Minds:

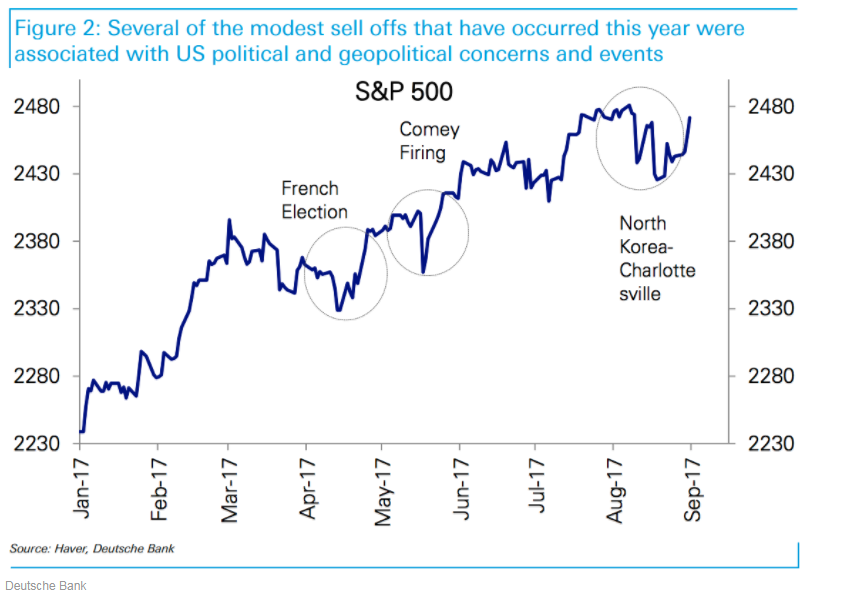

The S&P 500 has been on a ten-month run without a 3% sell off. It has been a historically calm market that has some investors worried that we are long overdue for a pullback. As we wrap up summer and move into fall, bears are concerned that markets are poised to get more volatile.

With plenty of geopolitical uncertainties currently in the mix, their worries are not without basis. Congress must decide to raise the debt ceiling this month and the civilized world must deal with a North Korean regime that continues to threaten nuclear war. Of course, the 24 hour news cycle is doing its best to frighten the average investor.

Optimists disagree with the bears and believe that any volatility spurred from these coming events will be short lived. Bulls are pointing to recent double digit growth in corporate earnings and increased economic growth throughout the world as catalysts that can continue pushing the market higher. Furthermore, market bears have continued to be disappointed this year as sell offs instigated by geopolitical and US political drama have been brief. (See the graph below from Deutsche Bank.)

At Tufton, we continue to remind our clients and friends that even though “noise” may affect equity markets from day to day, it remains crucial to remain focused on the long term. Uncertainty is a fact of life in the investment business, and over the years, a disciplined approach through thick and thin has benefited our clients handsomely.

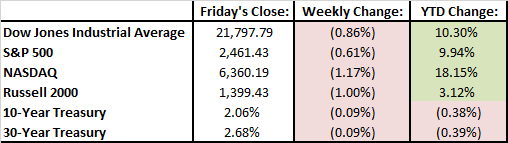

Last Week’s Highlights:

Equity markets moved higher last week in the face of devastating flooding in Texas and more hostile moves by the North Korean regime. Hurricane Harvey dumped 50 inches on rain in the Houston area, killed 46 people, and temporarily shut down a good portion of the nation’s refineries which has pushed fuel prices higher.

Friday’s job report was strong and showed that the U.S. economy added 156,000 jobs in August. Treasury Secretary Steven Mnuchin said that the Trump administration and Congress will release more details on their plans to overhaul U.S. tax code in coming days. United Technologies announced they are closing on a deal to acquire Rockwell Collins. Gilead Sciences announced it was purchasing Kite Pharma.

Looking Ahead:

Domestic markets were closed on Monday in observance of Labor Day. Factory and durable goods orders will be reported on Tuesday. The ISM non manufacturing index for August will be reported on Wednesday. The European Central Bank is meeting on Thursday to issue its decision on interest rates. Another hurricane is making its way across the Atlantic and could potentially hit Florida and head into the Gulf of Mexico

What’s On Our Minds:

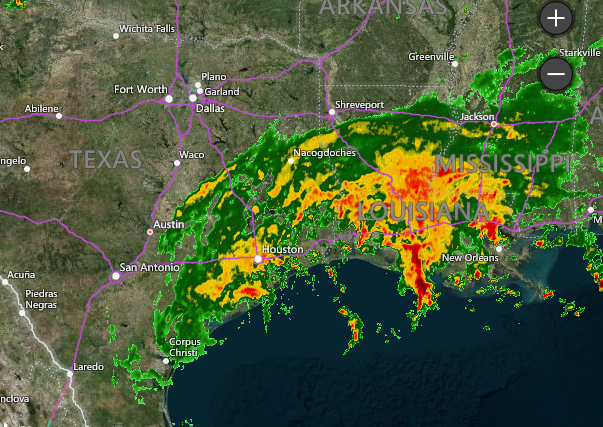

Over the weekend, Hurricane Harvey walloped the Texas coast and caused major flooding throughout the Houston area. Five deaths have been reported so far and over 3,000 water rescues have been performed. It looks like rain will continue through the week and the city could receive up to 50 inches of rain by the time it’s all said and done. Along with the humanitarian issues brought on by the storm, many are asking how this historic weather event will affect business along the Gulf Coast.

The storm will without a doubt be a major hit on insurance companies covering homes and business in the area and it will also affect the local oil industry. The hurricane’s path goes right through a corridor of critical energy infrastructure in the Houston and Galveston area. Investors are expecting the storm to send ripples through the energy industry this week. Thus far, the hurricane has forced 15% of the U.S.’s oil refining capacity to temporarily shut down, and it looks like it could get worse as the storm heads east towards refineries along the Texas and Louisiana boarder. Experts are saying that even though refineries may not be damaged, the Houston Shipping Channel has been closed since Friday. As a result, crude can’t get into port and refined product can’t be shipped. Several major pipelines that lead in and out of the Houston area may also see interrupted operations due to the storm. Rest assured, the U.S. prepares for times like these and has a large stockpile of gasoline on the east coast that can sustain the entire country for 2 weeks.

Oil investors are expecting the crack spread (the metric that tracks the difference between the price of oil and gasoline) to widen in the short term following the storm. Depending on how fast refineries can get back up and running after the storm will determine how quickly the crack spread will normalize. Look for gas prices to spike in the short term following the storm.

Texas and Louisiana are bracing for more rain as Hurricane Harvey moves onshore. Source: Accuweather.

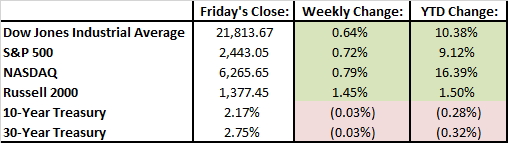

Last Week’s Highlights:

Domestic equity markets saw small gains last week. The S&P 500 was up 0.72% and the Dow Jones increased by 0.64%. Materials and telecom sectors had a strong week but consumer staple stocks declined. Grocery store stocks had a tough week due to Amazon’s announcement that they would lower prices at their recently acquired Whole Foods stores.

With earnings season wrapped up, happenings in Washington D.C. continue to drive investor sentiment. On Tuesday, markets were up 1% as President Trump renewed his focus on pushing pro-growth tax reform policies. Then, we witnessed a bit of a pullback on Wednesday when Trump threatened to allow for a shutdown of the federal government if Congress refused to fund his border wall.

Looking Ahead:

The last official week of summer going into the Labor Day weekend will have investors on their toes with a good amount of economic data coming across the wire. U.S. GDP numbers are being reported on Wednesday and consumer spending figures will be released on Thursday. Auto sales, ISM manufacturing data, and the unemployment number from August will all be reported on Friday. Wall Street is expecting strong gains in Friday’s job report.

What’s On Our Minds:

Tufton Capital has recently taken on the responsibility of sponsoring one mile of highway on Interstate 83 South. The firm is proud to partner with the Sponsor-A-Highway program. It is an easy and effective way to help keep our local roadways and environment clean. A sign with Tufton’s logo is now in place on our stretch of highway just north of our offices in Hunt Valley.

Last Week’s Highlights:

Stocks were lower again last week, mostly due to political drama in Washington D.C. and the terrorist attack in Barcelona. Since the S&P hit a record high on August 7, the index has pulled back 2.2%. President Trump’s pro-business agenda took a hit last week when it was announced that the White House Manufacturing Advisory council would be dissolved. Reduced optimism about the likelihood of passing the President’s pro-business reforms clearly weighed on investor sentiment last week. While we have witnessed some volatility lately, it’s important to remember that, in historic terms, markets have been unusually placid this year.

Looking Ahead:

Earnings season is over, so investors will refocus on big picture issues. The Federal Reserve is holding their annual Jackson Hole symposium this week and investors are expecting them to remain dovish in regards to increasing short term interest rates. Investors aren’t expecting any market moving news out of Jackson Hole. Investors will also keep an eye on Washington after President Trump’s incendiary comments following the protests in Charlottesville, VA last weekend.

New home sales data will be released on Wednesday and existing home sales data will be released on Thursday.