What’s On Our Minds:

Warren Buffett recently announced that he’s offering up $1 million per year, for life, to one of his 377,000 employees if they can correctly predict the NCAA basketball teams that make it to the tournament’s Sweet Sixteen. A charitable gesture? Hardly. USA Today reminds us that the odds of predicting the sixteen bracket slots correctly is less than one in a million. Still, with 377,000 employees, someone at Berkshire Hathaway has a shot, right? Our own math suggests someone at the USA Today writing office is being lazy: the chances of randomly* picking those 48 games correctly is more like one in 281,400,000,000,000.

This is a great example of how Warren Buffett knows what Tufton knows: most people vastly overestimate their chances of being “right.” We all have a bias in thinking that we have special information, looking for that unique chance to make a million dollars (every year for life, in this case). A better route is to depend on two things: a time-tested, rational strategy, and other people consistently acting on their emotions— and being wrong.

Aside from his basketball wager, the billionaire investor also made headlines recently when he released his annual letter to Berkshire Hathaway shareholders on February 24th. His letter was shorter this year than in years past at “just” sixteen pages, but readers got a good idea of how Buffett is feeling about his business and the market.

For some perspective on Buffett’s success and why his annual letter draws so much attention from investors, let’s briefly consider what brought us here. When Warren Buffet acquired a controlling stake in Berkshire in 1965, the stock was trading at $18 per share. Since then, the stock has risen to $314,345 per share, a return of 1,600,000%. Comparatively, the S&P 500 has returned 3,000% over the same time. It’s no wonder that investors anticipate Buffet’s annual insights and are keen to hear how his company will move forward now that he is eighty-seven years old and his partner Charlie Munger is ninety four. They have had an amazing run, but they are not exactly spring chickens!

Buffett held his cards close to the chest when discussing a succession plan at Berkshire, noting “Our directors know my recommendations. All candidates currently work for or are available to Berkshire and are people in whom I have total confidence.” Many commentators have speculated that board members Gregory Abel and Ajit Jain could potentially be tapped to take the reins at Berkshire.

Buffett was also a bit vague on Berkshire’s plans to spend the company’s $116 billion in cash that it has amassed. For the most part, it sounds as if Buffett has had trouble finding anything to buy – at least at what he considers an attractive valuation. The company only spent $2.7 billion on acquisitions in 2017. By comparison, Berkshire spent $31 billion buying companies in 2016. There is speculation that moving forward Buffett may finally begin to pay a dividend to shareholders, instead of using all the company’s cash to make acquisitions. Buffett’s struggle to find businesses that are “affordable” according to his own strict calculations reminds us of his mentor, the fabled value investor Benjamin Graham.

As he has in years in the past, Buffet dedicated a portion of his letter criticizing the “helper” class of investment professionals (those who use products with high fees that deliver under performance over the long term). This year, Buffett wrote, “Performance comes, performance goes. Fees never falter.”

*Nitpicker’s note: The winners aren’t exactly random. For example, there’s a pretty good chance that in the first round, the #1 seed will beat the #16 seed in each of the four divisions. But those exact probabilities are largely a matter of opinion, so we used 50% for our calculations. The actual probability of choosing a correct bracket will be better than our number.

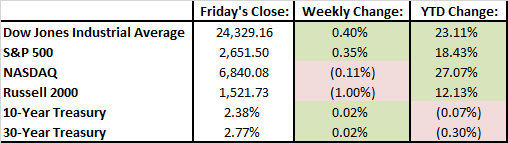

Last Week’s Highlights:

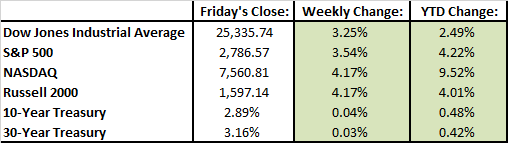

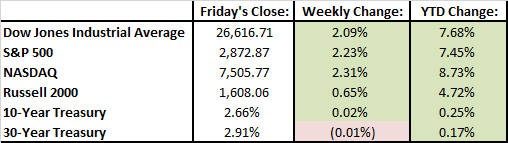

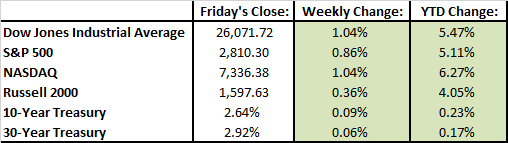

Stocks had a very strong week and closed out the week considerably higher. The Dow gained 3.5%, the S&P 500 rose 3.9%, and the Nasdaq increased 3.1%.

Stocks struggled on Wednesday after Gary Cohn announced late on Tuesday that he was planning on resigning as President Trump’s top economic adviser. Cohn has long been considered a free trade supporter and most are speculating that the President’s protectionist ideas in recent weeks brought about his exit. On Tuesday, fears of an impending trade war were tempered when the President announced Canada and Mexico would be excluded from steel and aluminum tariffs.

Friday’s Jobs Report revealed robust jobs gains which pushed the market higher. The US economy added 313,000 jobs in February, but wage growth came in below expectations. Friday’s data and reaction was a marked difference from January which showed a spike in hourly earnings. Lower wage growth in February quelled investors’ inflation fears on Friday.

Looking Ahead:

Information is light this week but investors will likely continue to focus on inflation and how it could weigh on the Federal Reserve’s interest rate decisions moving forward. We get indication of inflation this week, with an update on consumer prices due Tuesday. Retail sales are scheduled for release on Wednesday.

What’s On Our Minds:

Why was the Dow down 700 points last week between Thursday afternoon and Friday midday? Don’t the markets know the U.S. has a trade deficit, not a trade surplus?

To make sense of the reaction, there are two things we need understand: trade deficits and tariffs.

A trade deficit sounds scary. It sounds like “deficit spending,” which we all know is bad. But a trade deficit isn’t necessarily bad. In fact, sometimes it is decidedly good. A trade “deficit” just means that there is more money coming in than going out (exports-imports). We would expect that to be the case if our companies are doing well, our tax system has improved, and foreign investors and companies want to spend their money in the U.S.

As long as the US economy is strong, we want money to be coming into the country. And the US economy looks very strong. Your own political leanings can lead you to your own conclusions about why it is strong, but every economic indicator is looking up for the U.S.

Then there’s the issue of tariffs.

A tariff reduces the deficit by making certain imports more expensive for U.S. buyers. This makes domestically-produced goods look cheaper by comparison. The domestic producers’ companies are thereby protected from foreign competition.

This sounds good- why not protect our companies from foreign competition? This was indeed the general attitude in economics until David Ricardo developed the theory of comparative advantage in 1817. Without going into too much economic detail, comparative advantage shows that if every country produces what it is best at making (has the comparative advantage), and lets other countries make their best products, all the countries will benefit! It’s counterintuitive, but by letting everyone sell what they produce best, everyone ends up with more wealth overall.

Why make tariffs at all, then? Comparative advantage tells us the country will be better off overall, but that doesn’t mean every industry within the country will thrive. A concrete example (with made-up numbers for simplicity) is to suppose China can produce and sell steel for $50 a ton, but Americans can only produce it for $100 a ton. If we slap a tariff on steel, yes, it will save the 100,000 workers’ jobs at the steel mills. It also means all our manufacturers are paying $50/ton more for steel. If those manufacturers are buying 10 million tons of steel, that’s a difference of $500,000,000 that the consumer ends up paying in higher prices. That’s a lot of money, but the headline reading “1,000,000 Cars Cost $500 More on Average” isn’t quite as eye grabbing as a headline reading “100,000 Steel Workers Lose Jobs.”

In the end, economics, rather than politics, will drive the market.

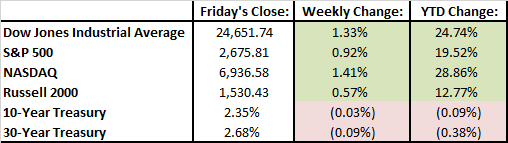

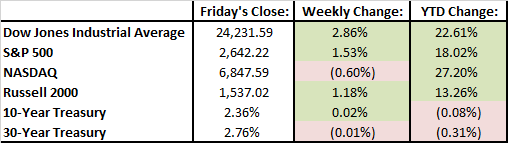

Last Week’s Highlights:

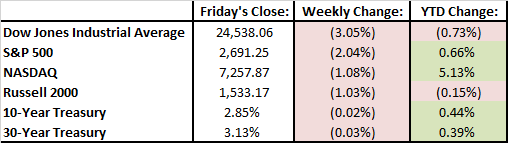

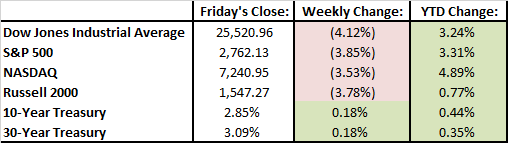

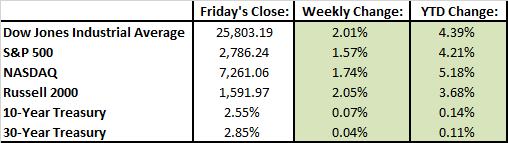

Markets fell last week and finished February in the red. This was the first monthly loss for the S&P 500 since October of 2016. Equity markets remained volatile last week, with four out of five trading days experiencing a move exceeding 1%.

On Thursday, President Trump announced he wants a proposed 10% tax on all aluminum imports and a 25% tariff on steel, causing U.S. stocks to fall sharply. American steel and aluminum manufacturers praised the policy but other businesses did not. Critics of the President’s announcement noted that consumers will see prices increase on everything from cars to canned goods to baseball bats.

On Saturday, the President held firm on his trade plans Tweeting; “Our jobs and wealth are being given to other countries that have taken advantage of us for years. They laugh at what fools our leaders have been. No more!” He also threatened a tax on European cars after the European Union threatened to tax American made motorcycles, bourbon, and jeans.

Looking Ahead:

Investors will continue to grapple with the economic consequences of newly-imposed tariffs and potential retaliation from other U.S. trading partners.

Investors are also preparing for the month’s biggest economic report – the February jobs report. This report will likely weigh on the Federal Reserve’s interest rate decision on March 21st. Investors are expecting that the U.S. economy added 205,000 jobs and that the unemployment rate fell to 4%.

What’s On Our Minds:

As stocks have zigged and zagged in recent weeks, it is likely that some investors can’t help but worry. While we do not take market declines lightly at Tufton Capital, we are stressing the importance of staying the course over the long haul. We understand that it can be a bit worrisome when market pundits are stoking investors’ fears. As long-term investors, however, we must force ourselves to wear “blinders” in order to avoid this type of media hype. Instead of getting caught up in short-term market moves, our Investment Committee continues to rely on its fundamental market research. We suggest that our clients and friends do the same.

Investors Take Note: Blinders keep racehorses focused on what is ahead, rather than what is at the side or behind.

Ten percent corrections like the one we experienced earlier this month are common and have occurred about once every two years since 1957. Selling or trimming positions during these correction is one of the worst investment decisions one can make. Rather than running for the sidelines, history has shown that during these brief periods of investor panic, it’s best to get tough and stay in the game.

Historically, it is in the stock market’s nature to fluctuate sharply during the short term, making volatility inevitable. The market’s volatility is often measured by its standard deviation, a formula that shows how results differ from the expected average. Periods when prices fall or rise quickly can cause spikes in volatility and take time to revert back to the norm. While driven by many factors, uncertainty is a primary culprit.

But what drives uncertainty? Everything from investors’ emotional responses to differing opinions from experts. Investors tend to overreact to specific events in the market, causing a contagion-like episode that spreads from one institution to another. The 24-hour news cycle and differing opinions from market experts also complicate matters. Emotional reactions along with oversaturation with financial information drive volatility.

Investors must understand their personal risk tolerance levels to succeed during volatile times. Remaining disciplined to proven strategies can be effective if you force yourself to stick to your plan in the face of short term volatility. It’s vital to remember that the short term is merely a blip on the market’s long-term journey.

Given the absence of a change in fundamentals, Tufton Capital’s investment approach will mimic our advice, “Stay the Course”.

Last Week’s Highlights:

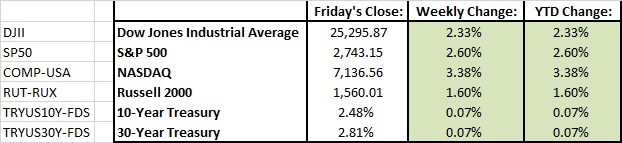

Stocks remained volatile last week but finished in the green. Investors grew jittery as the 10-year treasury bond increased to almost 3%. The Federal Reserve signaled that it saw broad improvement in the U.S. economy and pointed to a pickup in inflation toward the end of last year. However, it didn’t suggest that a rise in prices warranted more aggressive policy action. This dovish view helped ease investor concerns later in the week.

Looking Ahead:

A full economic schedule will have investors on their toes this week.

On Monday, investors will likely be reviewing Warren Buffet’s annual letter to shareholders, and the U.S. Census Bureau will release January new home sales figures. On Tuesday, Fed Chairman Jerome Powell is set to deliver his first semiannual monetary policy report. Fourth quarter GDP estimates will be released on Wednesday, followed by personal income and spending levels on Thursday. On Friday, we will wrap up the week with University of Michigan’s Consumer Sentiment number.

And while Friday does mark the first Friday of the month, we will not get the February jobs report until the following Friday, news that will come just a few days ahead of the next monetary policy announcement from the Federal Reserve.

What’s On Our Minds:

The markets have quickly recovered some of their losses, but that doesn’t mean we’re out of the woods yet.

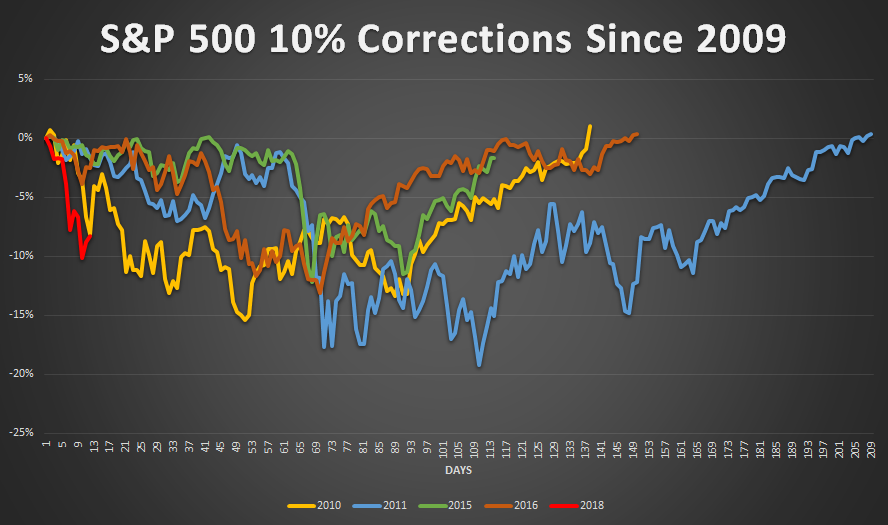

As we said last week, the market has taken, on average, 220 days after a 10% correction to reach its previous highs. In this quick dip, we’re already up some 7.5% from the bottom and have only about 5% more to go to get back to record highs. Or, 150 points on the S&P and 1,400 on the Dow.

Phew, back to normal, right? Hopefully not. We hope that this dip and the emotions that it stirred will help to reverse two related trends in the financial markets.

First, the “stocks always go up” mentality in savers. While we have certainly had corrections since the Great Recession, there has been just one since 2011: the 12.4% correction in late 2015. Any associated woes were quickly forgotten in the wildly positive markets of 2016 and 2017. Therefore, there is a generation of savers who have been working since 2009-2011 that have never really seen their investment accounts decline.

It’s easy to call yourself a long-term investor when the market numbers are green. “Oh, me? I don’t worry about market volatility. I know if I leave my 401(k) alone, it’ll all work itself out, on average, over the next 15 years,” says the 29-year old as he sips on his latte. “Frankly, I don’t even check my account balance that often,” he lies, as he closes the internet browser he had open on his phone just moments before.

We hope at Tufton that the fictitious Millennial above is as good as his word, because a “market correction of 15%” is a lot easier to rationalize than seeing $13,000 disappear from your accounts in a week. The latter tends to have a lot more impact than we realize. OF course, strength is forged through trials, and this correction wasn’t so bad, so it might temper savers for the next one.

Second, the over-reliance on (or undue faith in) index funds. More and more investors have heard that index funds, on average, outperform their actively managed counterparts. As more money moves into indexes, there are fewer analysts moving dollars to take advantage of mispricings in the market. That is, if a respected analyst comes out and says “Google is too hot! Sell Sell Sell!”, it won’t stay hot for long. But if everyone’s in index funds, it will stay too hot. Those mispricings can grow and cause market distortions.

What will that means for the market? No one knows yet. But a few corrections will help to remind people that we need to have active traders for the markets to function.

What’s On Our Minds:

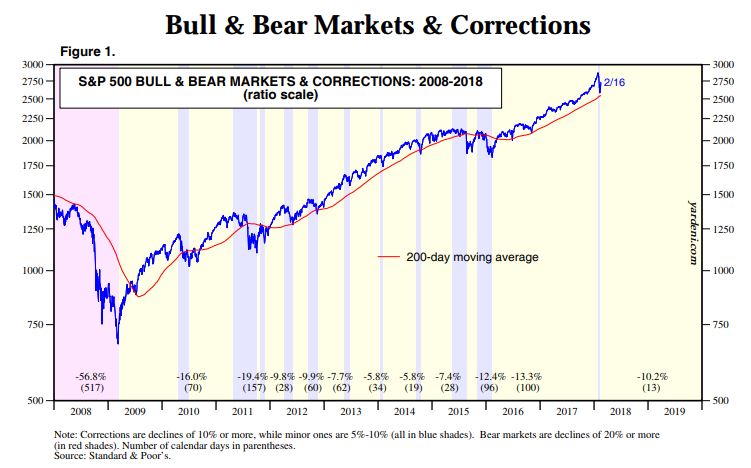

After a long cruise of low volatility and smooth sailing upward, the S&P 500 and DJIA officially dipped into “correction” territory last Thursday as the index shed 3.8% of its value. By definition, a correction is a reverse movement of at least 10% in value for a financial asset. Last week, both indexes officially reached correction territory when they dropped by just over 10% from their peaks that were reached on January 26th.

This correction is the first since the one that ended in mid-February 2016. Back then, investors were worried about a possible recession in the U.S. economy, falling oil prices, and a decrease in value of the Chinese renminbi. The current correction can be linked to worries of rising inflation spurred by an acceleration of global growth.

While it’s tough watching the equity portion of your account drop by 10%, market corrections can be healthy for both the markets and investors. Remember, even though we haven’t experienced any real volatility recently, (up until the past 10 days, that is) historically the stock market can be very volatile on a short-term basis but has a strong track record over the long term.

As of Friday’s close, the stock market is down 8.7% from its record high and indices are back to levels where they were in early December of last year. Last week it seemed as if volatility begot more volatility as trades unwound amid a chain reaction where emotion took hold and caused some investors to sell.

For some perspective, this is the fifth 10% correction we have experienced since the current bull market began its run in 2009. In the chart below, you will notice that it takes some time for the market to find its footing after a correction and to then recover its initial 10% loss. However, in each scenario markets have tested a bottom and recovered to previous levels. (Note: In 2015, the S&P 500 experienced another 10% correction before it reached its previous high.) On average, since 2009, it has taken 220 days for the S&P 500 to recover to its previous high following a 10% correction.

Of course, what has happened during similar situations in the past is not indicative of how this particular correction will play itself out, but one thing is for certain: corrections happen from time to time and they should be expected. Furthermore, in many cases a correction can be viewed as an opportunity for investors to test how comfortable they are with market risk, and to make changes to their portfolio if warranted. Also, corrections present investors an opportunity to potentially add to positions in companies at a discounted price, or to dollar cost average down on existing positions.

Last Week’s Highlights:

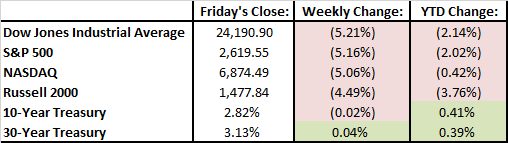

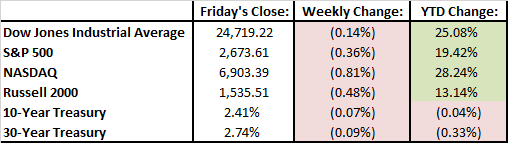

It was a volatile week for markets. Equity indices ping ponged up and down and finished the week deeply in the red. Both the Dow Jones and S&P 500 were down 5.2%. The CBOE volatility index spiked to 49 on Tuesday before settling in the mid-30s for much of the week. (The average for this index has been 18.51 since 2004.) Investors are attributing last week’s volatility to rising interest rates and the unwinding of volatility bets that went bad for certain investors.

Looking Ahead:

Earnings season will continue to wrap up this week with 59 companies from the S&P 500 reporting.

On Monday, President Trump is plans to announce a $1.5 trillion infrastructure spending plan.

Wednesday’s inflation report will be very important as much of last week’s volatility was partially spurred by fears that high inflation will be brought on by recent wage growth and economic expansion. Retail sales will also report on Wednesday, followed by consumer sentiment on Friday.

What’s On Our Minds:

Equity investors have spent the last year enjoying green flashing across their trading screens and have shrugged off economic and geopolitical risk. They’ve cited the strength of the U.S. economy, driven by banner corporate profits and President Trump’s push for lower taxes and reduced regulation. This bullish sentiment drove major indexes to gain more than 20% in 2017 and had the market hitting all-time highs. After a string of records, an eventual pullback should not be viewed as cause for panic.

Last week, investors suddenly became skittish as we saw volatility return to equity markets. The Dow Jones and S&P 500 fell by more than 3.5%, posting their worst week since January 2016. The pullback is being attributed to a recent bump in interest rates. Expectations for further Fed policy tightening and stronger economic readings have pushed rates and caught investors’ attention. It should not be forgotten that interest rates are still sitting at historically low levels, and while we are expecting them to rise gradually this year, rates should remain well below levels that risk choking off economic growth.

In times like these Tufton Capital stresses the importance of staying level headed in the face of changing market conditions. In fact, most experts have been predicting this sell off for some time, given that we have enjoyed unprecedented levels of low volatility over the past 12 months. Since 1900, the U.S. has seen 125 corrections of 10% or more (roughly one per year). So, if we end up getting into the 5-10% correction territory, remember this is to be expected annually.

In short, as a firm focused on the long-term growth of our clients’ portfolios, we understand that volatility can be unsettling, but it should not be forgotten that the market is up 52% over the past 2 years and periodic dips should be expected. Occasionally, even the strongest of bull can get tired.

Last Week’s Highlights:

President Trump delivered his first State of the Union address on Tuesday evening. He attempted to stress unity and touted a strong economy and record stock prices. He outlined a path to citizenship for 1.8 million “dreamers” (children who were brought to the U.S. illegally by their parents) in exchange for funding a wall on the southern border and ending a visa lottery system.

Amazon, Berkshire Hathaway, and JPMorgan announced their intention to form a healthcare company that would lower healthcare costs for their employees. The company would be free from profit making incentives.

Fed Chair Janet Yellen ended her last meeting of the Federal Open Markets Committee without raising rates.

Friday’s Jobs Report stated that the US labor force grew by 200,000 in January, beating analyst estimates. Average hourly earnings increased by 2.9% on an annualized basis, the best gain since the early days of the recovery in 2009.

Looking Ahead:

Earnings season will continue to be in full swing this week. On Monday we will hear from Bristol-Myers Squibb, Hess, and Sysco. On Tuesday dozens of companies report including Chipotle, Gilead Sciences, Disney, and General Motors. Wednesday will bring along reports from 21st Century Fox, Humana, and Michael Kors. Thursday’s earnings released will be headlined by Grubhub, Kellogg, Yum Brands, and Tyson Foods. On Friday, we finish the week with reports from Pacific Gas & Electric and Brookfield Infrastructure.

What’s On Our Minds:

Last week, stocks rallied to fresh record highs, boosted by stronger-than-expected earnings reports from a number of US companies, corporate tax rate reductions, and an improving economy. Believe it or not, the Dow Jones and S&P 500 are both up more than 7% after just one month of trading in 2018. Equity investors who have been long the market are likely riding high and feeling great as we continue to see gains but some might be asking, “how long can this bull run?”

As always, we continue to stress the importance of staying invested over the course of the market cycle. As history has shown us time and time again, it’s nearly impossible to successfully time the market (at the top or the bottom) and long term outperformance can be enjoyed by following a disciplined approach and investing throughout the market’s ups and downs.

Retail investors (those who trade their portfolios non-professionally) have performance that significantly lags the market overall. This dynamic occurs because they tend to act on emotion, selling at the bottom and missing the large early gains of a recovery. There is a common example often given of the costs of missing the “best days in the market” that shows this point, but we find it misleading—missing the worst days is just as good as missing the best days is bad! So instead, we focus on the fact that if you act on emotion, you tend to sell near bottoms. We’re not missing “the best days,” we’re standing on the sidelines for the best months: the recovery itself.

We encourage our clients and friends to remember that we look to the long-term and that downturns are not only “ok,” they are expected, and are a reminder that our understanding of the markets is sound. We look for areas of the market that have good long-term growth. Short-term, temporary problems are at worst inconsequential, and may present a buying opportunity.

It’s easy to say these things when the market is chugging along. But we also remember the panic 10 years ago, when it seemed the world was ending. Even then, we knew of those who called their advisor or portfolio manager in March 2009 and told them to sell it all. That was the absolute bottom, and you would have missed out on one of the longest bull market runs in history.

So, when the downturn comes, just remember: we’ve been here before, we’ll be here again, and we have a plan.

Last Week’s Highlights:

The stock market notched out impressive gains last week. All sectors advanced into the green with telecom as a leader. For the most part, earnings season has shown us that corporations had a positive fourth quarter and most reports have shared a positive outlook for 2018.

Looking Ahead:

It will be a busy week for investors with a slew of important news coming across the wire. Throughout the week, 4th quarter earnings season will be in full swing. President Trump will deliver his State of the Union speech on Tuesday evening. Many are expecting him to provide some color on an infrastructure spending plan. The Federal Reserve will provide an updated policy statement on Wednesday. January’s Jobs Report will be released on Friday.

What’s On Our Minds:

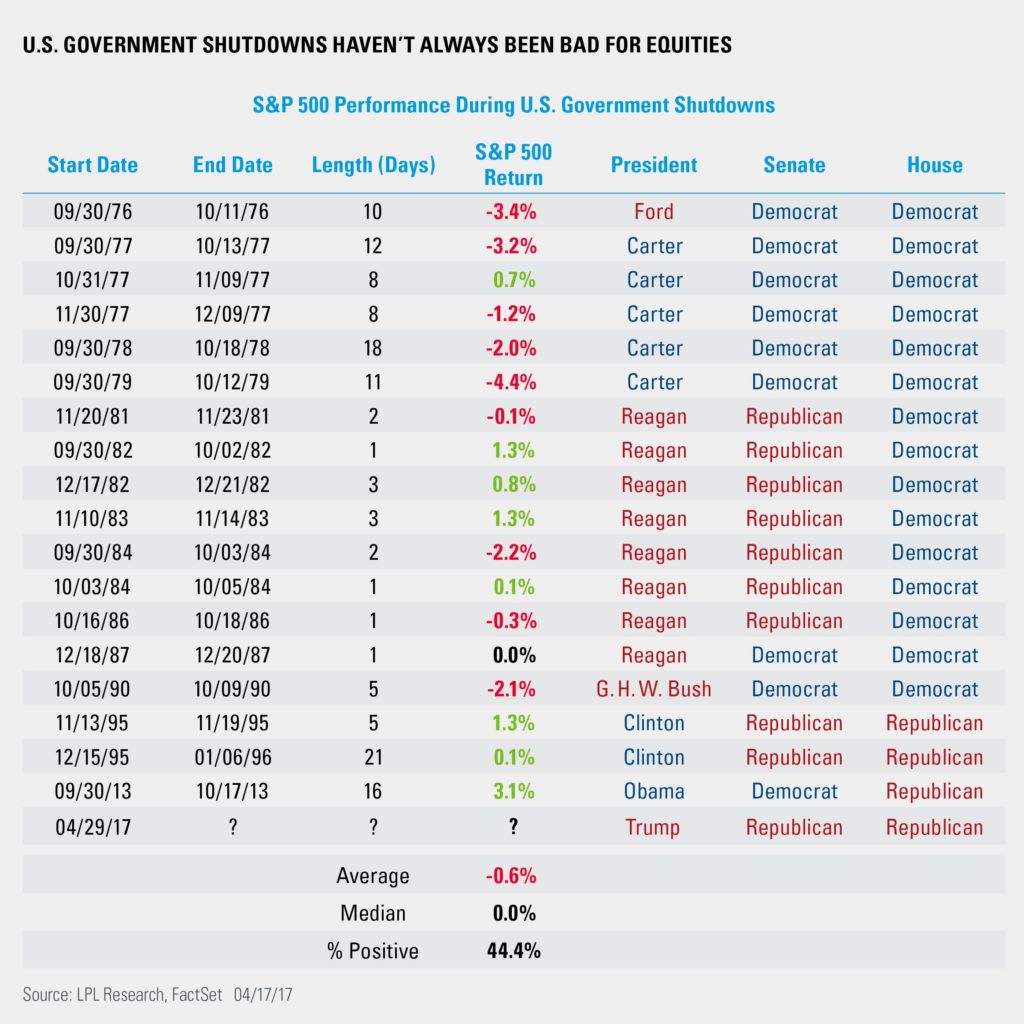

The federal government will enter its third day under a partial shutdown on Monday after the Senate failed to break an impasse on Sunday. On Monday, roughly 800,000 federal workers woke up locked out of their jobs. This turmoil in D.C. has investors wondering what may happen to the stock market if this political stalemate persists over a long period.

While this post is not meant to predict what may happen during this shutdown period and past performance is not indicative of future results, historically, stocks have traditionally shrugged off the pessimism brought on by previous government shutdowns.

The partisan tug-of-war currently occurring in Washington is without a doubt disconcerting, but we continue to remind our clients and friends that there is no need to panic. In the past, government shutdowns have been fleeting events that have left no economic scars. All in all, volatility may tend to increase around these events, however, historically, shutdowns have had little lasting impact on markets. Remember, stock prices are almost random over short periods of time and it is important to focus on the long-term prospects of your portfolio.

Last Week’s Highlights:

The stock market didn’t miss a beat last week. It was an abbreviated week of trading due to the MLK holiday on Monday but market indices charged higher. Both the S&P 500 and the Dow Jones are up by more than 5% this year after just 14 days of trading. Overall, there was giddy optimism among investors as corporations are still counting all the extra cash on hand that the reduced tax rate will make available to them.

Looking Ahead:

79 companies from the S&P 500 will report their 4th quarter earnings this week. There will also be some important economic metrics released – existing home sales will be released on Wednesday, the Leading Economic Index will be reported on Thursday, and GDP from last year’s 4th quarter will be released on Friday.

What’s On Our Minds:

There’s a saying used this time of year as folks are diligently working on sticking to their new years’ resolution. – The trick of getting ahead is getting started. This phrase is especially true for saving for retirement. Below are our 10 tips that may help reach your retirement goals. Remember, it’s never too late to start and it doesn’t hurt to save more!

1. Start now

It’s a simple fact that the earlier you begin saving for retirement, the more time your money has to earn interest and grow. If you’ve put off saving until your 30s or later, make up for lost time now by stashing away 10 to 15 percent of your salary.Plan your retirement needs

2. Plan your retirement needs

If you want to retire at 55 and travel the globe or work for as long as you can but stick close to home, how much money you need to retire is unique to you. Rather than relying on figures that suggest you’ll need 80 percent of your preretirement income to live comfortably later in life, talk with your spouse and financial advisor to settle on an amount to save that’s tailored to you.

3. Learn about and contribute to your employer’s plan

If your employer offers a tax-sheltered plan, contribute at least enough to get the employer match. Your employer can provide you with a summary plan description, which recaps your plan and vesting eligibility, as well as an individual benefits statement.

4. Consider saving “on the side”

If you don’t have access to an employer-based plan, contributing to a traditional or Roth IRA allows you to get similar tax benefits for your retirement savings. Even if you do contribute to an employer-based plan, an IRA can supplement those savings.

5. Make saving as easy as possible

Eliminate the need to move money from one account to another by setting a monthly savings goal and automating a deposit to that amount. By making savings routine, you are more likely to see your retirement nest egg grow. To help boost your regular savings, funnel any extra cash windfalls, such as from a bonus or inheritance, directly to your retirement savings.

6. Increase savings as you near retirement

Your income will likely rise with age and experience, so it makes sense to save more as you earn more. After age 50, you will also be eligible for catch-up contributions, which allow you to contribute beyond the set limit. For 401(k)s, you can contribute an extra $6,000, while for IRAs you can contribute an extra $1,000.

7. Be an active participant in your plan

Automating your retirement savings and amount doesn’t mean you should “set it and forget it.” Examine your quarterly statements to ensure you are on track to meet your goals. Can you afford to contribute more? Are your investments still appropriate? Do you need to lower your exposure to risk? By taking active control now, you take control of creating the best retirement lifestyle possible.

8. Decide on your Social Security strategy

Social Security benefits may be available at age 62, but up until age 70, your retirement benefit will increase by a fixed rate (based on your year of birth) each year you delay retirement. Waiting means you may be able to take advantage of some extra cash. If you are married, you may also be able to receive spousal benefits, which boost the amount you and your spouse receive in Social Security as a couple. To learn more, visit www.socialsecurity.gov.

9. Be a savvy investor

It’s important to be smart about not only the amount you save but also how you save. To help insulate against market swings, diversify your investments within sectors and across asset classes and geographic regions. The more intentional you are about where your assets are invested, the more secure you can feel about them.

10. Don’t touch your savings until retirement

Dipping into your retirement savings is a last resort. In addition to harsh penalties, you lose principal, which in turn depletes interest earnings and tax benefits. Also, if you switch jobs, rollover your retirement account rather than “cashing out.” Preserving your retirement savings may be difficult when funds are tight, but will benefit you when you truly need it most.

Last Week’s Highlights:

Stocks were up for the second week in a row. We have had a remarkable start to the year and major indexes are up more than 4%. Stocks have not recorded two consecutive weeks of 1% moves higher since July of 2016. Earnings season kicked off last week. Big banks reported losses due to the new tax code but had pre-announced so the loses had been baked into share prices.

Looking Ahead:

Markets were closed on Monday in observance of Martin Luther King Day. Along with earnings reports coming across the wire, investors will be eyeing some important economic data this week. Industrial production and capacity utilization is reported on Wednesday. Housing starts are reported on Thursday followed by consumer sentiment data on Friday.

What’s On Our Minds:

The Tufton Economics Team takes the reins this week to talk a bit about the changing shape of the American consumer. As our readers know, the stock market continues to hit new highs as corporations enjoy an increasingly business friendly environment in the US. But the consumer does not seem to be sharing in those gains. Now more than in decades, Americans’ balance sheets are looking weak: they “owe more, save less, and are poorer.”

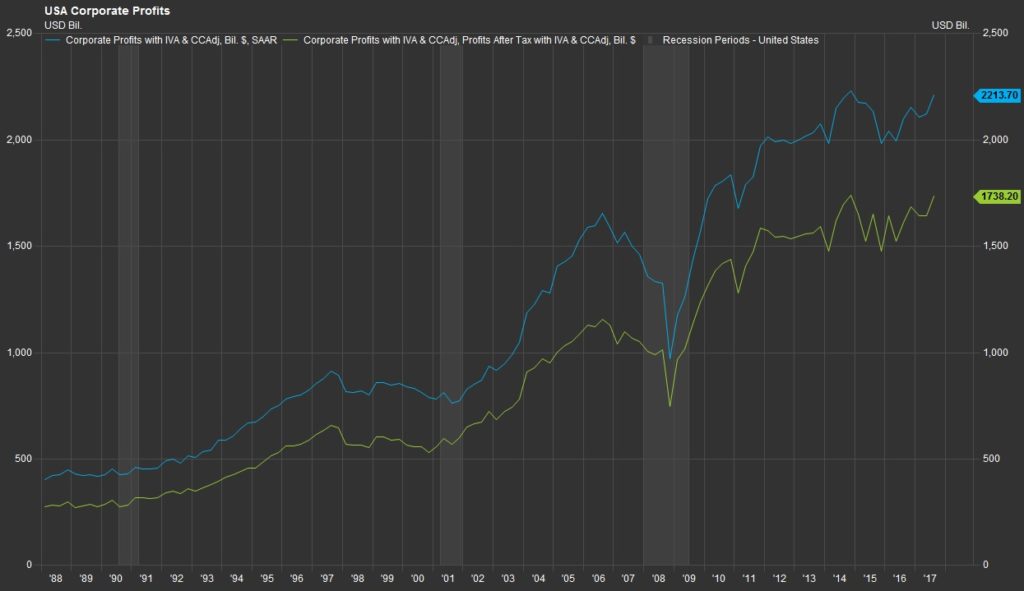

Corporations’ earnings have steadily risen, but the median consumer hasn’t seen the gains (note that the comparison isn’t perfect: there is no “per-corporation” data like the per-capita data we have for consumers). The Economics Team will stay on the sidelines as far as the political implications of this relationship, but we would like to point out that weakening consumers are also bad for economic growth.

Corporations’ earnings have steadily risen, but the median consumer hasn’t seen the gains (note that the comparison isn’t perfect: there is no “per-corporation” data like the per-capita data we have for consumers). The Economics Team will stay on the sidelines as far as the political implications of this relationship, but we would like to point out that weakening consumers are also bad for economic growth.

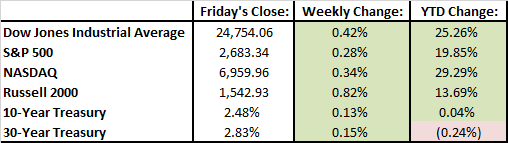

Last Week’s Highlights:

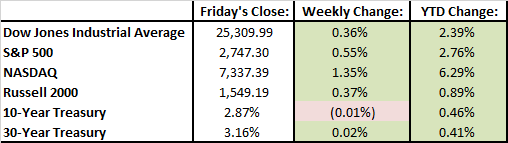

The new year got off to a good start, and interest rates ticked up slightly, resulting in an all-green summary chart below. Hopefully we can keep that up all year.

Looking Ahead:

This week should be a relatively light one in terms of earnings and economics. We’ll be watching the weekly claims, as always. CPI and retail sales numbers come out Friday, which should help us get a better picture of the consumer economy that we talked about in the blog post.

What’s On Our Minds:

Happy New Year! By all measures, 2017 was a stellar year for stock markets around the globe. It appears the bull market continued to climb its proverbial “wall of worry”. For the first time since 2012, international stocks outperformed U.S. stocks. Domestic market indexes were no slouches though. The S&P 500 was up over 20% and the Dow Jones added 5,000 points, its largest ever point gain in a calendar year. The rally was fueled by resurgent economic growth, blockbuster corporate profits, and the promise of sweeping Republican tax cuts which should save corporate American billions of dollars.

After a great 2017, investors are likely asking, “so what does 2018 have in store?” Well, of course it is hard to predict but market experts seem to agree that the outlook for the new year is good but not a rosy as last year. Wells Fargo forecasts the U.S. economy will grow by an average of 2.5% each quarter in 2018 and 2019. As the labor market continues to tighten, wage growth and increased energy prices could start to squeeze corporate earnings, but expanding sales and lower corporate tax rates should also give earnings a boost. Meanwhile, if the economy continues to improve, the Federal Reserve plans to continue increasing interest rates.

If Wall Street’s predictions for the new year hold up and the bull market continues, it will put the economy on track for its longest expansion in decades.

Last Week’s Highlights:

Stocks were down slightly during the final week of 2017 which was shortened by the Christmas holiday. It was reported that Russian tankers have been supplying North Korea with oil in recent months which increased geopolitical worry. The minor declines experienced last week still left investors happy with significant gains experienced across the board in 2017.

Looking Ahead:

Important economic data comes across the wire this week as we kick off 2018. Manufacturing purchasing managers index will be reported on Tuesday followed by vehicle sales and minutes from the Federal Reserve’s December meeting on Wednesday. On Friday, we will close out the week with December’s jobs report.

What’s On Our Minds:

The team at Tufton Capital Management wishes you a season of joy as we look forward to continued success in 2018.

Last Week’s Highlights:

Stocks were up last week as investors focused on the passage of the U.S. tax bill.

The tax bill is the largest tax cut in U.S. history for the nation’s largest companies. Starting on January 1, 2018, big businesses’ tax rates will be reduced from 35% to 21%. Republicans have argued that companies’ tax burden will be decreased one trillion dollars over the next ten years which should help the economy. Time will tell if the tax bill will accelerate economic growth.

Looking Ahead:

This week, investors will be busy closing the books on 2017 which has been a strong year in equity markets. Many are wondering if we experience a “Santa Claus Rally” this year. This typically occurs when investors see a surge in the price of stocks during the last week of December though the first two trading days in January. There are numerous explanations for it, including tax considerations, happiness around Wall Street, and people investing their holiday bonuses.

What’s On Our Minds:

The economic team at Tufton has been thinking about employment quite a bit lately. We have a few internal reports, the first of which we’ve adapted here for our blog.

The employment rate has remained remarkably low, while wages have refused to budge. In theory, when labor is in low supply, employers will raise wages to attract talent. That increase in wages tells us that our economy is starting to heat up, and we need to be caution of above-trend growth- the kind that causes recessions. At least, that’s how it’s always happened in the past. What is different now? Our labor force is changing, in age, skill, and desires.

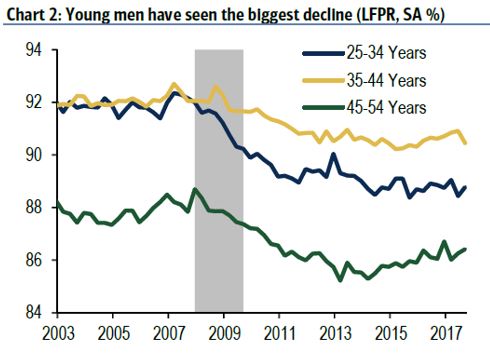

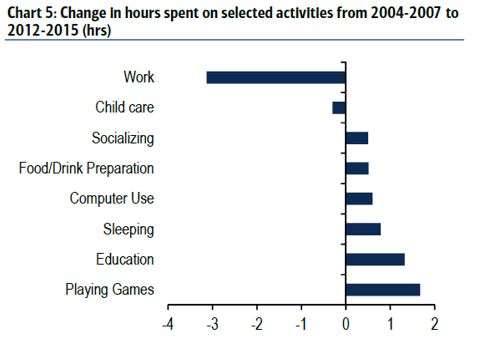

That is to say: not only are consumer preferences changing, but so are labor preferences, as evidenced by the below chart. The reasons for the labor force decline among young men are likely threefold: drugs, jail, and video games. The opiate epidemic has hit hard, especially in those young males who found themselves jobless. Additionally, supply has been fueled by drug companies who have pushed these drugs on doctors. Because of these and other causes, the percentage of previously-incarcerated males has risen from 1.8% in 1980 to 5.8% in 2010. Of course, this makes it harder for this segment to re-enter the workforce, and they may choose to stay on the sidelines. Finally, to the dismay of parents everywhere, it seems that many young men would rather simply stay home and play video games (see charts, from Bank of America / Merrill Lynch).

Last Week’s Highlights:

We are experiencing a bonfire Santa Claus rally this month.

Markets continued their march higher as investors continue to weigh the impacts of the tax reform deal. The S&P 500 rose nearly 1% and the Dow Jones added 1.3%. The S&P experienced a drop on Thursday when Senator Marco Rubio said he would oppose the bill if it didn’t include a larger tax credit for parents with children. On Friday, senators gave in to Rubio’s suggestions and equity markets charged to reach new all-time highs. Since the tax reform bill passed in Congress, the S&P 500 has gained roughly 3%.

As investors had expected, the Federal Reserve increased its federal funds target rate by 25 basis points to 1.25%-1.5%. Janet Yellen shared an optimistic view on the economy and upgraded the Fed’s outlook on GDP growth citing the impact of corporate and personal tax cuts.

Looking Ahead:

Market futures are up big to begin the week before Christmas. The House of Representatives is set to vote on the tax bill either Monday or Tuesday and Senate will vote shortly thereafter.

Important housing data will be in focus this week. New home starts and permit data will be released on Tuesday and new home sales will be reported on Friday.

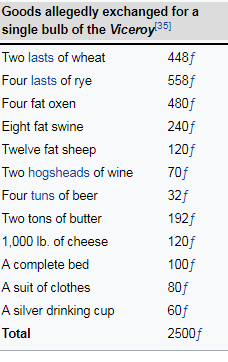

What’s On Our Minds:

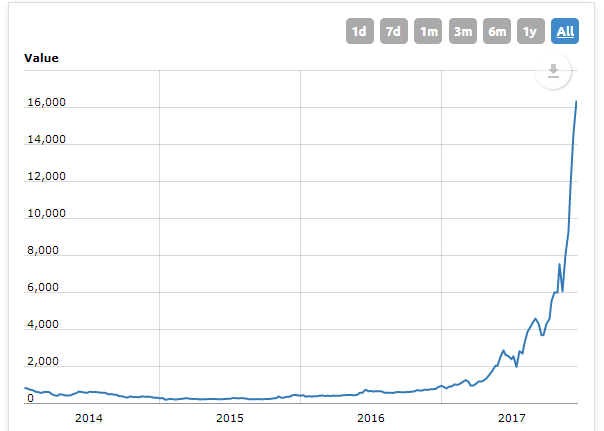

Even with a strong year in equity markets, the meteoric rise in the value of Bitcoin has been grabbing headlines left and right. Bitcoin’s run up in price has been nothing short of astounding. For instance, if you invested $1,000 in bitcoin at the start of 2013 and never sold any of it, you would now have around $1.3 million. In 2010, a software developer paid 10,000 bitcoins for two large pizzas which today would be worth about $160 million. Bitcoin has seemingly deified the laws of gravity as levels of speculation and fascination continue to increase.

Just this morning Bitcoin’s value has surged again as the Chicago based CBOE launched a futures exchange Sunday evening that allows traditional investors to trade futures contracts on the unregulated currency. Even though it has been exciting watching Bitcoin’s meteoric rise, Tufton Capital does not believe there is a place for Bitcoin in a traditional investment portfolio given its “Wild West” like nature, its volatility, its shady history, and the cyptocurrency’s unproven track record. Many critics of Bitcoin are suggesting it shows the classic signs of a bubble.

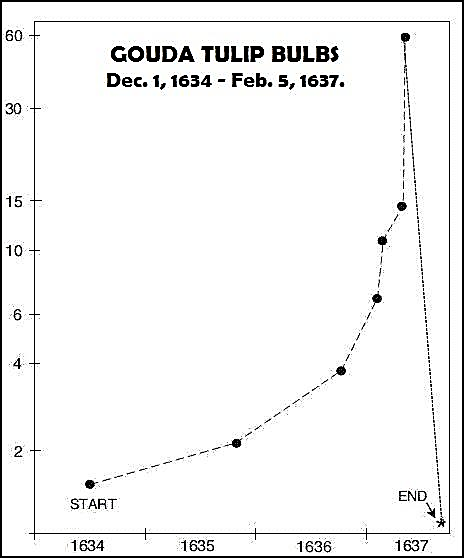

Market bubbles, like the tech bubble of the 1990’s, have formed for as long as there is record of exchange, and all follow a similar pattern of speculation.

In the early 17th century, the Dutch became enraptured by tulips, and created the first chronicled speculative bubble in history. As recorded in Charles Mackay’s Madness of Crowds, tulips began to grow rapidly in popularity all around Europe, and therefore tulip prices rose sharply. Many deft merchants identified this trend and made a large profit in trading tulips. Other merchants and the nobility, seeing these extraordinary profits, jumped into the tulip market. As a result, prices for tulips kept rising and rising, backed by nothing but speculation. Soon enough, nobles, farmers, seamen, chimney sweepers, and maidservants alike were all dabbling in tulips. Below is a chart of what one individual paid for a single tulip bulb!

Eventually, the tulip market ran out of new money to keep bidding up prices. As reality sat in, speculators all ran for the exit and prices plummeted. Many speculators lost all their savings as contracts they purchased were ten times the price that tulips were then trading.

This is an important lesson for us in 2017. As Benjamin Graham poignantly argues, “an investment operation is one which, upon thorough analysis, promises safety of principal and an adequate return. Operations not meeting these requirements are speculative.” Graham would certainly have chuckled at otherwise serious individuals who lost a whole year’s salary on buying tulips.

Buying something, be it tulips, Bitcoin, or the hot stock of the day, as an investment because everyone else is doing it, or because of tremendous recent returns is not investing, but speculating. It may work in the short term, but it always has devastating effects in the long term.

The lessons of manias past are always important to keep in mind in an ever changing market. This isn’t to compare any particular asset to the tulip bulb craze, but it is always smart to study history in an attempt to understand the present. Many people will make bold claims about “X being in a bubble” or “Y will never go down.” A prudent investor, not speculator, will not be swayed by the opinions of crowds and will continue to drown out the noise and invest in quality assets at good prices.

BitCoin Price Cart (2014-Present)

Last Week’s Highlights:

US stocks had a strong week. Equity markets closed on Friday near record highs as investors continue to wait for a finalized tax reform bill.

Friday’s job report was better than expected. The US economy added 228,000 jobs in November. Average hourly earnings grew 2.5% over the past year which is up from November’s 2.3% number. GDP has risen by more than 3% over the past 6 months which continues to show a favorable backdrop for stocks.

Looking Ahead:

Investors will keep their focus on Washington D.C. The GOP’s plan promises to be the biggest change to individual and corporate rates since Ronald Reagan’s tax overhaul in the 1980s.

Investors are expecting the Federal Reserve to increase its federal funds rate from 1.25% to 1.50% on Wednesday. Janet Yellen recently restated that she and her colleges, “continue to expect that gradual increases in the federal funds rate will be appropriate to sustain a healthy labor market and stabilize inflation around the FOMC’s 2% objective.”

What’s On Our Minds:

The hum of the holidays has begun at our offices in Hunt Valley, and with equity markets at or near all-time highs this year, investors are feeling joyous indeed. With plenty of green flashing across traders’ screens this holiday season as opposed to the dreaded red, the hangover left by the Great Recession feels like a distant memory to most. Not everywhere is the good cheer so merry, though. Customers are experiencing sticker shock thanks to the 2008-2009 downturn somewhere many wouldn’t guess: the Christmas tree lot.

During the financial crisis, cash-strapped Americans cut back on their spending and bought fewer trees. As demand plummeted tree growers either went out of business or planted fewer saplings during those years. Because it takes 7 to 10 years for a Christmas tree to grow, the entire market is now faced with a shortage this year.

The leading source in the Christmas tree business is the state of Oregon, which harvested an estimated 5.2 million trees in 2016. They are followed by North Carolina with 3.5 million, Michigan with 3 million, Pennsylvania with 2.3 million and Washington with 1.5 million. Since a freshly cut tree can retail anywhere between 60 and 80 dollars, that adds up to some serious money in the Christmas tree business.

The high prices of authentic trees this year has growers worried that families will switch to artificial trees that outlast their natural competitors. The American Christmas Tree Association estimates that artificial trees accounted for nearly 81 million of those displayed in the U.S. in 2016, while 19 million were natural.

Last Week’s Highlights:

Happenings in Washington D.C. had investors on their toes last week. Stocks were higher but more volatile. The Dow Jones passed 24,000 for the first time in history. Tuesday and Thursday were both strong days as investors grew more optimistic that the Senate was getting closer to passing a tax reform bill. On Friday we saw a pullback when news broke that President Trump’s former national security advisor, Mike Flynn, might testify regarding interference in last year’s Presidential election.

GDP data from the third quarter was revised higher to 3.3%. This was the second consecutive quarter that saw growth above 3%. Business investment figures were up, suggesting that economic conditions continue to improve.

Looking Ahead:

News coming out of Washington will likely drive investor sentiment again this week. Funding for the government is set to expire on Friday. Government officials are hoping to avoid a government shutdown by pushing the deadline out into the future but President Trump has signaled that he could play hardball. Meanwhile, the GOP is looking to pass their tax reform bill before the end of the month.

On Thursday, AT&T will go to court against the Justice Department over AT&Ts bid to acquire Time Warner. The government has cited antitrust concerns.

Friday’s jobs report will also have investors watching.