Last Week’s Highlights:

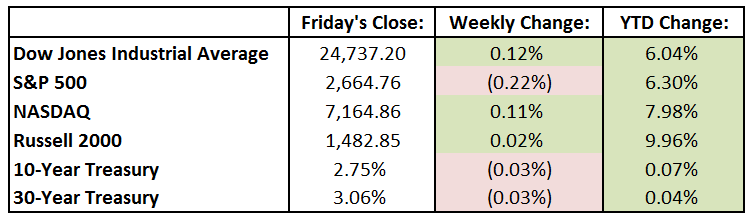

Earnings season is well underway as the market continues to digest companies’ 4th quarter results. Last week, the main US indices were essentially flat with the Dow Jones Industrial Average up just 0.12%. The S&P 500 was down 0.22% and tech-heavy NASDAQ was up 0.11%. The week brought news from many large well-known companies. Johnson & Johnson (JNJ) beat on sales and estimates, but the stock fell due to a softer 2019 outlook. Procter & Gamble (PG) also beat on sales and estimates. The stock rallied higher as the company raised their full-year guidance. On the economic front, Existing Home Sales have fell short of Wall Street estimates coming in at 4.9 million. The FHFA Home Price Index was flat month-over-month as the home prices barely budged. In addition, investors were also focused on trade tensions between the US and China as well as commentary coming out of the global economic forum in Davos, Switzerland. Finally, the government shutdown ended over the weekend.

This week, earnings will continue to be in focus as Microsoft (MSFT), Amazon (AMZN), Apple (AAPL) and Facebook (FB) all report their 4th quarter results. We will also gain some insight from the energy patch when Exxon (XOM) and Chevron (CVX) report on Friday. The behemoths of the former Telecommunications sector will also release their numbers with Verizon (VZ) and AT&T (T) reporting on Tuesday and Wednesday, respectively. In economic news, Consumer Confidence will be reported on Tuesday. Wall Street is estimating a reading of 125 versus 128.1 in December. Investors will also get a preliminary reading on 4th quarter economic growth when Gross Domestic Product is disclosed on Wednesday. Lastly, the Federal Open Market Committee (FOMC) will meet this week and are expected to leave the Federal Funds Rate unchanged at 2.25% to 2.5%.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

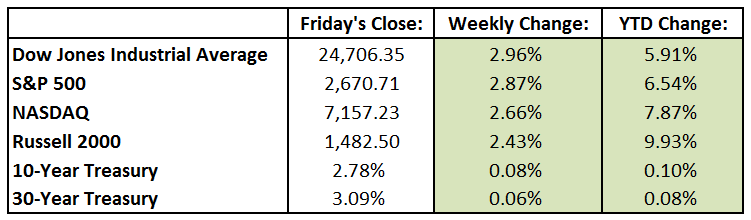

U.S. equities continued their winning ways last week, as the Dow Jones Industrial Average (DJIA) rose 710.40 points, or 3%, to 24,706.35, while the S&P 500 advanced 2.9% to 2670.71. The tech-heavy NASDAQ gained 2.7% for the week to 7157.23. The Dow is now up 5.9% in 2019, its best start to a year since 1997, and the S&P has gained 6.6%, its best start since 1987. Investor appetites for stocks continued as data suggesting that the U.S. economy is still growing and decreased tension in trade talks with China have increased market optimism. Perhaps more importantly, corporate earnings are providing a tailwind to U.S. equities – 55 companies in the S&P 500 have posted their fourth-quarter results, with 76% of the earnings coming in ahead of expectations. The government shutdown dragged on. President Trump remained unyielding, while the House voted for two bills that would reopen the government that then stalled in the GOP-controlled Senate. British Prime Minister Theresa May’s Brexit plan came up for a vote in the House of Commons and was handily defeated, one of the worst losses for a British leader since the 1920s. The Los Angeles Rams (NFC) and New England Patriots (AFC) won their playoff games and will meet each other in Super Bowl LIII in Atlanta on February 3rd.

U.S. markets are closed on Monday in observance of Martin Luther King Jr. Day. Earning season continues on Tuesday with reports from Capital One (COF), Halliburton (HAL), Johnson & Johnson (JNJ), IBM (IBM) and Travelers (TRV). The National Association of Realtors reports existing-home sales data for December (analysts forecast a 5.2 million seasonally adjusted annual rate, down from November’s 5.3 million). Wednesday is busy with more earnings, including results from Abbott Laboratories (ABT), Comcast (CMCSA), Ford (F), Proctor & Gamble (PG) and Texas Instruments (TXN). The Bank of Japan announces its monetary-policy decision, and the Federal Housing Finance Agency reports its House Price Index for November. On Thursday, the Federal Reserve Bank of Kansas City releases its Manufacturing Survey for January. Expectations are for a three reading, equal to December’s, which was the lowest in over two years, reflecting slowing manufacturing activity in the region. Earnings continue with numbers from Bristol-Myers Squibb (BMY), Intel (INTC), Starbucks (SBUX) and Union Pacific (UNP). The busy week concludes with earnings releases from AbbVie, Inc. (ABBV), Colgate-Palmolive (CL), D.R. Horton (DHI) and Synchrony Financial (SYF).

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

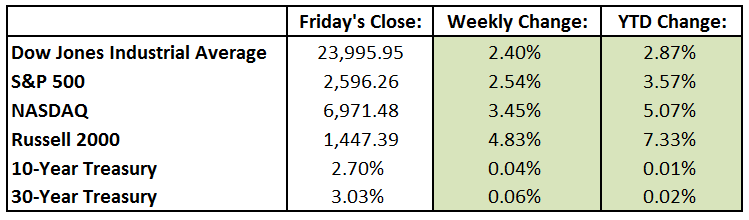

U.S. equities continued their winning ways last week, as the Dow Jones Industrial Average (DJIA) rose 562.79 points, or 2.4%, to 23,995.95, while the S&P 500 advanced 2.5% to 2596.26. The tech-heavy NASDAQ gained 3.5% for the week to 6971.48, capping off its largest three-week increase since 2011. Investor appetites for stocks have returned recently as data suggesting that the U.S. economy is still growing and a rebound in energy prices have increased market optimism. Indications following three days of U.S.-China trade talk in Beijing suggested that both sides are eager for a peaceful resolution, adding to last week’s upbeat tone. The government shutdown, now the longest in U.S. history, staggered on. Democrats continued to block President Trump’s demands for wall money, while he threatened to veto any funding bill without it. Amazon.com (AMZN) became the world’s most valuable company for the first time, replacing Microsoft (MSFT) on Monday, when AMZN’s market cap hit $797 billion.

Earning season unofficially kicks off on Monday with reports from the major U.S. banks. Citigroup (C) is the first up, reporting its fourth-quarter numbers before the market open. Tuesday is packed with more earnings, as we’ll see reports from Delta Air Lines (DAL), Wells Fargo (WFC), JP Morgan Chase (JPM) and First Republic Bank (FRC). British lawmakers vote on Prime Minister Theresa May’s Brexit deal. The Bureau of Labor Statistics releases the producer price index (PPI) for December (consensus estimates call for a slight decline of 0.1%). Wednesday is busy with more earnings, including results from Bank of America (BAC), BlackRock (BLK), Goldman Sachs Group (GS), PNC Financial (PNC) and Alcoa (AA). On Thursday, the Federal Reserve Bank of Philadelphia releases its Manufacturing Business Outlook Survey for January. Expectations are for a 10 reading, up from December’s 9.1, which was the lowest since August of 2016. Earnings continue with numbers from American Express (AXP), BB&T (BBT), Morgan Stanley (MS) and Netflix (NFLX). The busy week concludes with the release of the Consumer Sentiment Index for January and earnings releases from Kansas City Southern (KSU), State Street (STT) and SunTrust Banks (STI).

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

Last week, the broad stock market indices rose as fears of a recession faded. Federal Reserve Chairman Jerome Powell indicated he would ease on raising interest rates at a gradual pace, leading to a market rally. The S&P 500 increased 1.9% while the Dow Jones Industrial Average increased 1.6%. The tech-heavy Nasdaq bounced 2.3% and the Russell 2000, representing small-capitalization companies, rose 3.2%. Year-to-date, all major indices are in the green!

On the economic front, last week was all about Friday’s job report. Growth in Private Nonfarm Payroll jobs surged 301,000 in December versus a Wall Street estimate of 177,500. Average Hourly Earnings rose 3.2.% year-over-year surpassing estimated growth of 3.0%. The Unemployment Rate rose to 3.9% from 3.7% in November, however, the Labor Force Participate Rate rose to the highest level since September of 2017, standing at 63.1%.

Looking Ahead:

This week, several economic releases will be delayed due to the Government Shutdown. These would include, but are not limited to, New Home Sales, Construction Spending, and Light Vehicle Sales. The Trade Balance should be released on Tuesday, but could face a delay due to the fact that it is published by the Bureau of Economic Analysis. Inflation data should be released on Friday. Wall Street is expecting growth of inflation to be about 2.2% year-over-year, excluding food and energy. Next week, fourth quarter earnings season will kick off, mostly lead by the big banks.

The Tufton Capital Team thanks you for your continued support!

Last Week’s Highlights:

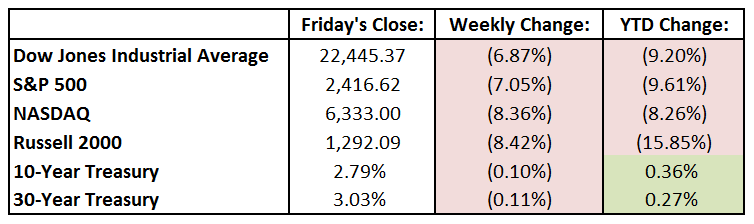

Bah Humbug! U.S. equities suffered their worst weekly loss of the year, with major indices now firmly in correction territory and the tech-heavy NASDAQ in a bear market (down 20% from its peak). Stocks started last week lower but stabilized going into the Federal Reserve’s interest-rate-setting meeting. Stocks began Wednesday on a positive note but plunged after the Fed announced a rate increase and pointed towards two more hikes next year. For the week, the Dow Jones Industrial Average (DJIA) tumbled 6.87%, to 22,445.37, while the S&P 500 decreased 7.05%, to 2416.58. The NASDAQ fell 8.36% for the week to 6332.99. Oil prices also fell for the week.

Looking Ahead:

U.S. markets close early on Monday for Christmas Eve, with the stock exchanges closing at 1pm and the bond markets at 2pm. Federal employees have an extra vacation day this year, as President Trump signed an executive order last Tuesday giving them Christmas Eve off. Tuesday is Christmas Day – Merry Merry! Markets in many countries including England, Canada and Australia are closed on Wednesday in observance of Boxing Day. On Thursday, the Department of Labor reports initial claims for the week ending December 22nd – economists forecast 215,000 claims, a slight increase from the previous week. Friday brings more economic reports, including data from the Institute for Supply Management and the Census Bureau.

The Tufton Capital Team wishes you and your families a Merry Christmas and a very Happy Holiday!

Last Week’s Highlights:

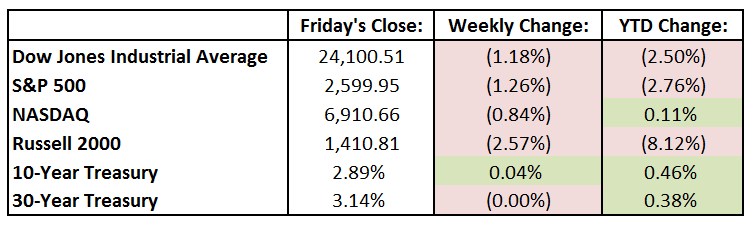

Last week began on a high note for U.S. equities, as low inflation numbers and China’s seeming concessions on trade helped move the market a bit higher through mid-week. The mood, however, turned sour by Friday, with news that the European Central Bank would cease its bond-buying program. This, combined with falling oil prices and slower economic data, led to another large selloff on Friday. For the week, the Dow Jones Industrial Average (DJIA) fell 1.18%, to 24,100.51, while the S&P 500 decreased 1.26% to 2599.95. The tech-heavy NASDAQ slipped 0.84% for the week to 6910.66. Corporate highlights included news Friday on Johnson & Johnson (JNJ), a member of the DJIA, with a Reuters report that the company had known that its talc and baby powder contained small amounts of asbestos. JNJ shares fell 10% for the day on this report. Internationally, England’s Prime Minister Theresa May delayed a House of Commons vote on the draft treaty for the U.K. to leave the European Union. On Wednesday, she survived a no-confidence vote, 200-117. Protests continued in France by the “yellow vest” movement, leading President Macron to promise tax cuts and a higher minimum wage.

Looking Ahead:

The week begins with Oracle (ORCL) reporting its fiscal second-quarter results. The Federal Reserve Bank of New York releases its Empire State Manufacturing Survey, with Economists forecasting a reading of 20.2 for December (down from last month’s 23.3 reading). Merriam-Webster will also announce its Word of the Year Monday. The main focus for the week begins Tuesday, as the Fed meeting begins. We’ll also see quarterly results from Darden Restaurants (DRI), Micron Technology (MU) and FedEx (FDX). The Fed ends its meeting on Wednesday and present its “dot plot” on future interest rate changes. The Fed is expected to hike interest rates by 0.25%. Investors will be looking very carefully for changes in forward guidance and potential signals that the U.S. central bank might be slowing down the pace of rate hikes next year. Thursday brings earnings results from Accenture (ACN), Blackberry (BB), Conagra (CAG) and Nike (NKE). The Bank of Japan and the Bank of England announce interest rate decisions that day. Friday is quadruple witching day, when index futures, index options, stock futures and stock options simultaneously expire. Winter officially begins on Friday.

The Tufton Capital Team wishes you a very Happy Holiday!

Last Week’s Highlights:

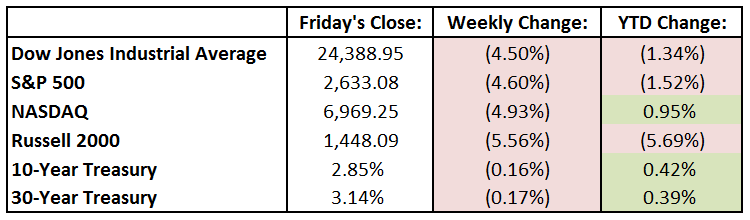

Recession fears took center stage on Wall Street, leading to a tough week for equity investors. The yield curve showed signs of inversion, an indicator of a possible economic slowdown, as the gap between short-term and long-term treasury yields narrowed. The Dow Jones Industrial Average (DJIA) fell 4.5%, the S&P 500 fell 4.6%, and the tech-heavy NASDAQ dropped 4.93%. The Russell 2000, which contains small capitalization stocks, fell the most, declining 5.56% for the week. On the economic-front, Construction Spending declined 0.1% in October versus estimates for 0.4% growth. Domestic Auto Sales also came in below consensus, with 4 million vehicles being reported. Friday was “Jobs Day” as Nonfarm Payroll Jobs rose 155,000 in the month of November. Wall Street was estimating 196,000. Average Hourly Earnings rose 0.2%, coming in below the estimate of 0.3% growth. The Unemployment Rate remained steady at 3.7%.

Looking Ahead:

Earnings season is winding down for the largest companies in the market. A few retail names will report this week. On Tuesday, the footwear distributor DSW Inc. (DSW) releases earnings before the opening bell. After the market closes, American Eagle Outfitters (AEO) will provide its quarterly results. Several cloud providers will also report this week, including Adobe (ADBE) after the bell on Thursday.

The economics calendar is a busy one this week, and inflation levels will be on investors’ minds. Growth of the Producer Price Index (PPI) will be released on Tuesday. Wall Street is estimating that growth was essentially flat month-over-month due to the decline in gasoline prices. On Wednesday, results from the Consumer Price Index (CPI) will be released. As with expectations for PPI results, investors believe that growth will be flat month-over-month. Consensus estimates reflect an inflation reading that rose 2.2% year-over-year, which is right around the Federal Reserve’s 2% target. On Friday, data on Retail Sales will be released. Investors are expecting growth of 0.2% for the month of November.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

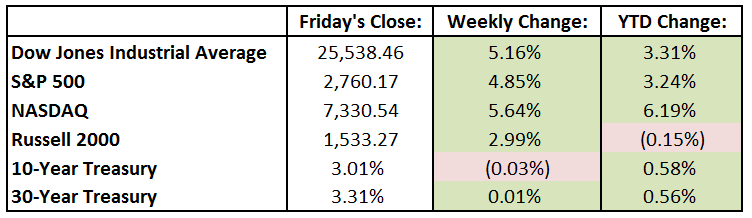

U.S. stocks rebounded sharply last week, initially helped by Black Friday and Cyber Monday holiday sales reports. Things got really exciting on Wednesday when Federal Reserve Chairman Jerome Powell stated that interest rates are “just below neutral”, signaling to investors that fewer rate hikes may be on the horizon. Powell’s dovish tone resulted in stocks and bonds rallying, and the U.S. 10-year Treasury yield fell below 3%, its lowest level in over 10 weeks. The Dow Jones Industrial Average (DJIA) rose 1252 points, or 5.16%, to 25,538.46, while the S&P 500 increased 4.85% to 2760.16. The beaten-down tech-heavy NASDAQ soared 5.64% for the week to 7330.54. General Motors (GM) announced plans to stop making some models, which will result in nearly 15,000 job cuts. The European Union approved the draft Brexit plan negotiated by U.K. Prime Minister Theresa May. An agreement is now needed from Parliament, which may be more challenging. Tariff rhetoric continued throughout last week, as President Trump and Chinese President Xi Jingping continued their threats ahead of the G20 meeting (more about that below).

Looking Ahead:

G20 trade talks over the weekend in Buenos Aires resulted in a trade truce between China and the U.S., setting the stage for a powerful market rally to start the week. The deal was greeted with relief as concerns over a new Cold War between the two largest economies abated. On Monday, we’ll see earnings from Finisar (FNSR), and Ford Motor (F) reports U.S. sales data for November. The Institute for Supply Management releases its Purchasing Managers’ Index for November, with expectations calling for a 57.5 reading. Tuesday is a busy one for earnings, as we’ll see results from AutoZone (AZO), Dollar General (DG), Hewlett Packard Enterprise (HPE) and Toll Brother (TOL). Wednesday has been declared a Federal Holiday in honor of the 41st President of the United States, George H.W. Bush. Markets will be closed that day. Wednesday also brings earnings from H&R Block (HRB) and Brown-Forman (BF), and ADP releases its National Employment Report for November (expectations call for a 200,000 gain in private-sector employment after adding 227,000 jobs in October). On Thursday, OPEC and several of its allies will meet in Vienna to discuss possible production cuts for 2019. We wrap up the week with earnings from Vail Resorts (MTN). Also on Friday, the Bureau of Labor Statistics releases its employment report for November. Estimates call for an increase in nonfarm payrolls of 200,000 after jumping 250,000 in October.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

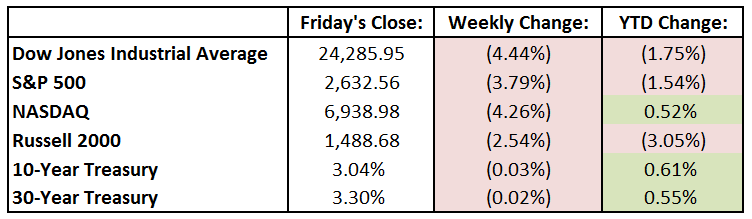

Last week’s trading activity was shortened due to the Thanksgiving holiday. There were only three and a half days of trading, as the market was closed Thursday and open until 1 PM on Friday. Nevertheless, the major indices were on the move as the Dow Jones Industrial Average fell 4.4%, the S&P 500 fell 3.8% and the tech-heavy NASDAQ declined 4.3%. The Dow Jones, which is a price-weighted index, was weighed down by some of its largest components, including Apple (AAPL), Boeing (BA) and Goldman Sachs (GS). In addition to these stocks, the S&P 500 was also affected by a 3% decline in the energy sector as West Texas Intermediate (WTI) crude oil dropped nearly 8% on Friday, closing at about $50 per barrel. WTI is now off 35% from a 4-year high of $77 per barrel set this past June. Energy investors have growing concerns about oversupply, declining demand and slowing global growth.

On the economic-front, Building Permits and Housing Starts results for October were released on Tuesday, each coming in around consensus estimates. There were 1.263 million Building Permits filed in October. As the Federal Reserve has continued to raise rates, the trend has been downward since the 10-year high of 1.3 million set in May. Housing starts were also about 1.2 million in October and slightly up from the 9-month low set in June.

Looking Ahead:

Earnings season continues to wind down this week, as most companies in the S&P have reported. Cracker Barrel (CBRL) and Salesforce (CRM) will report on Tuesday. Retail will be back in focus on Wednesday when Dick’s Sporting Goods (DKS) and Tiffany & Co (TIF) report before the opening bell. La-Z-Boy (LZB) will report after the market closes. On Thursday, Dollar Tree (DLTR) and Abercrombie & Fitch (ANF) will release their quarterly results.

Housing will be on the minds of investors again this week with the S&P/Case-Shiller Housing Price Index being released on Tuesday. Wall Street is expecting growth of 0.3% month-over-month. Information on New Homes Sales and Pending Homes will be provided to Wall Street on Wednesday and Thursday, respectively. The minutes from the most recent Federal Open Market Committee meeting will also be in focus on Thursday.

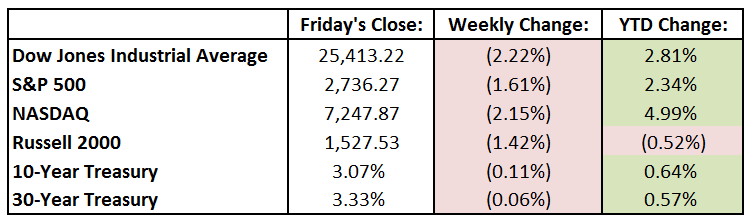

Last Week’s Highlights:

U.S. stocks were lower on the week, as volatility continued along with plenty of news and economic data for investors to digest. Fears that business growth is ebbing and the U.S. economy may be in for a slowdown next year weighed on domestic equities. The Dow Jones Industrial Average (DJIA) dropped 575 points, or 2.2%, to 25,413.22, while the S&P 500 fell 1.6% to 2736.27. The tech-heavy NASDAQ continued its recent weakness, dropping 2.1% for the week to 7247.87. Technology stocks were down following warnings from Apple (AAPL), supplier Lumentum Holdings (LITE) and dismal guidance from Nvidia (NVDA). The tech sector, which is up 7.9% for the year, has now been replaced as the top-performing sector by health care, which has gained 11% in 2018. Internationally, a draft deal for England’s withdrawal from the European Union was reached, but the plan needs to survive vetting in Parliament.

Looking Ahead:

It’s a short week for the markets, as exchanges are closed all day Thursday for Thanksgiving and will close at 1pm Friday. On Monday, we’ll see earnings from Intuit (INTU), JD.com (JD) and L Brands (LB). The National Association of Home Builders’ November Housing Market Index is expected to show a slight decline from October when it releases numbers Monday. Several retailers, including Best Buy (BBY), Lowe’s (LOW), TJX (TJX) and Target (TGT), will report earnings on Tuesday. Deere (DE) releases results on Wednesday, and we’ll get a reading on existing-home sales (expectations call for continued weakness as mortgage rates continue their climb). Black Friday is the retail industry’s Super Bowl, and a strong consumer is expected to help increase this year’s holiday spending by 4.8% from last year.

The Tufton Capital Team wishes you and your family a very Happy Thanksgiving!

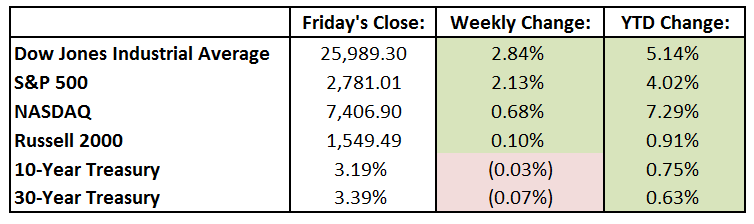

Last Week’s Highlights:

The major indices were all up last week following the midterm elections as the results did not catch many investors by surprise. It was widely predicted that the Democrats were going to take the majority in the House while the Republicans held on to the majority in the Senate. The Dow Jones rose 2.8% and the S&P 500 rose 2.1%. The tech-heavy Nasdaq lagged with returns of 0.7%. Health Care names led to the upside – the ballot-box was favorable to the expansion of Medicaid in many states leading to gains in several Managed Care stocks. The Communication Services sector led to the downside as Facebook (FB) dragged the sector lower. The Energy sector also underperformed as oil declined for the tenth day in a row. Since oil futures were launched 35-years ago, oil has never been down this many days consecutively.

On the economic front, the JOLTS Job Openings Survey reported that there were about 7 million open jobs. Consumer Credit rose $10.9 billion in the month of October. This was under the consensus estimate of $16.5 billion. The Federal Reserve also affirmed current views that another interest rate hike will be coming in December.

Looking Ahead:

Earnings season is winding down as about 90% of S&P 500 companies have reported. Retail stocks will be in focus this week as they finish off reports for the third calendar quarter. On Tuesday, Home Depot (HD) and Advanced Auto Parts (AAP) release results before the opening bell. Macy’s (M) will provide their earnings on Wednesday before the open, while Cisco (CSCO) the technology company will report after the market closes. Thursday will bring results from Walmart (WMT), JCPenney (JCP) as well as Nordstrom (JWN).

For economic releases, investors will be watching inflation and retail sales. For inflation, the growth in the Consumer Price Index (CPI) will be released on Wednesday. Estimates are for growth of 2.5% year-over-year. Retail sales for the month of October will be disclosed on Thursday. Wall Street is expecting growth of 0.6% for the month.

The Tufton Capital Team hopes that you have a wonderful week!

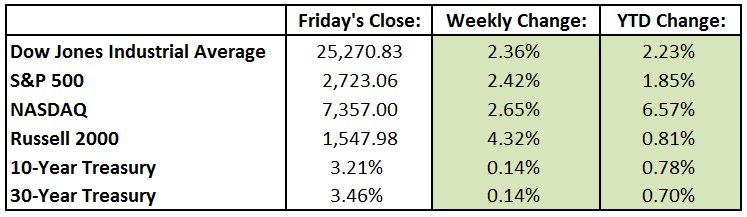

Last Week’s Highlights:

Stocks finished higher last week, as the equity markets experienced positive earnings, improved investor sentiment and progress in China trade talks. The Dow Jones Industrial Average (DJIA) rose 582 points, or 2.4%, to 25,270.83 last week, while the S&P 500 gained 2.4%, to 2723.06. The tech-heavy NASDAQ climbed 2.6%, to 7356.99. Volatility continued last week and was capped off by Friday’s huge reversal, when the Dow turned a 198 point gain into a 109 point loss. Apple stock (AAPL) was off 6.6% Friday after reporting weaker-than-expected guidance, and the payroll data that was released was strong (good news for the economy but further indication that the Federal Reserve will almost certainly hike rates again in December). Earnings season is winding down as nearly 75% of the S&P 500 companies have reported their Q3 results. Overall, quarterly profits appear to be growing at their best pace in eight years, and together with the market decline, have resulted in lower valuations. We happily bid farewell to October, as it was a tough month for stocks: the DJIA and S&P 500 declined 5.1% and 6.9%, respectively.

Looking Ahead:

Although earnings season is winding down, we’ll still see a flurry of results this week. On Monday, Loews (L), Marriott International (MAR), PG&E (PCG) and Sysco (SYY) report their third quarter results. Don’t forget to vote on Tuesday, as November 6th marks the mid-term elections. We’ll also see earnings from Eli Lilly (LLY), AmerisourceBergen (ABC), Martin Marietta Materials (MLM) and CVS Health (CVS) that day. The Federal Open Market Committee (FOMC) meeting begins Wednesday, and Cardinal Health (CAH) and KLA-Tencor (KLAC) host their annual shareholder meetings. On Thursday, the FOMC will announce its latest interest rate decision – it is widely expected that the federal-funds rate will remain unchanged at 2% to 2.25%. Friday is World Freedom Day, but the day will not be free of more economic reports. The Bureau of Labor Statistics releases the producer price index (PPI) for October (estimates are for a 0.2% gain). The University of Michigan reports its Consumer Sentiment Survey for November – expectations are for a 98 reading, down from last month’s 98.6.

The Tufton Capital Team hopes that you have a wonderful week!

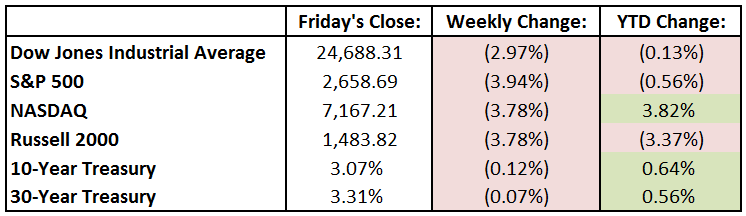

Last Week’s Highlights:

Last week, the major indices were down as investors feared a slowing of global growth, the US economy overheating and a possible recession in sight. The Dow Jones Industrial Average held up best, falling 2.97%. The S&P 500 dropped the most as the index declined 3.94%. The technology-heavy Nasdaq fell 3.78%. As of the opening bell Monday morning, with the exception of the Nasdaq, the S&P 500 and Dow Jones had fully wiped out their year-to-date gains with the recent market volatility. On the economic-front, Building Permits came in above Wall Street’s forecast, with 1.27 million reported in the month of September. Despite beating estimates, permits have generally been on the decline since reaching a ten-year high in March. New Home Sales missed estimates coming in at 553,000 for the month of September – Wall Street was forecasting 625,000 new home sales. High interest rates have hurt growth in mortgage applications, as increases in borrowing costs have discouraged many consumers. Last Friday, the first reading on 3rd Quarter GDP growth was released. At first glance, the US economy grew 3.5% in the quarter. Regarding corporate earnings, 48% of S&P 500 companies have reported their quarterly results. 78% of those companies have outperformed their respective earnings estimates. Lastly, over the weekend, International Business Machines (IBM) announced a takeover of cloud-service provider Red Hat (RHT) for $33 billion, representing the second largest tech deal in history.

Looking Ahead:

This week, further earnings reports and information on US employment will be in focus. On Monday, results showed that Personal Income grew 0.2% month-over-month. Wall Street was expecting growth of 0.4%. On Tuesday, a gauge of Consumer Confidence will be released by the Conference Board. Consumer Confidence is expected to remain near a 20-year high. Friday is “Jobs Day” as investors get a read on average hourly earnings, growth in nonfarm payroll jobs and the unemployment rate. For S&P 500 companies, Mondelez International (MDLZ) will report after the closing bell on Monday. Tuesday brings a plethora of well-known companies as General Electric (GE), Mastercard (MA), Coca-Cola (KO), Under Armour (UAA), and Pfizer (PFE) will all report before the market opens. Facebook (FB) and eBay (EBAY) will report once the market closes. On Halloween, General Motors (GM), Molson Coors (TAP) and American International Group (AIG) will provide their quarterly results. Starting off November on Thursday, investors’ eyes will be on Apple (AAPL), Starbucks (SBUX) and DowDupont (DWDP). Finally, wrapping up the week, Friday will give Wall Street a read on the energy sector with ExxonMobil (XOM) and Chevron (CVX) both reporting.

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

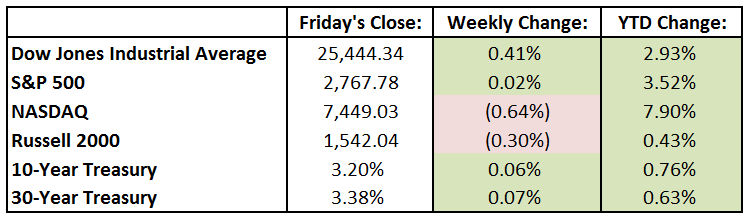

After a crazy week on Wall Street, filled with major earnings reports, Fed minutes and a volatile stock market, the S&P 500 ended the week almost exactly where it started – at 2767.78. The Dow Jones Industrial Average (DJIA) gained 104 points for the week, or 0.4%, to close at 25444.34. Despite weakness in many technology stocks, the tech-heavy NASDAQ managed to close down just 0.6% for the week to 7449.03. As mentioned above, the stock market was quite volatile – it started last week lower, rallied 548 points, or 2.2%, on Tuesday, fell 327 points on Thursday, and failed to hold on to a 200-point gain on Friday. Volatility is indeed back (more on that below). Corporate earnings seasons for third-quarter results picked up steam last week. With the exception of a few negative surprises in the industrial sector, early indications point to strong revenue and earnings growth in aggregate. Some 72% of companies that have reported Q3 earnings so far have topped analyst forecasts. Revenue growth, while still impressive, has not been as strong as the profits seen in the third quarter: some 58% of companies have exceeded top-line analyst forecasts. The suspected killing of Washington Post columnist Jamal Khashoggi in the Saudi consulate in Istanbul dominated headlines late last week, as Saudi Arabia is a very important business partner to the U.S. and many other developed countries. This escalating situation hurt attendance at an investment conference hosted by Crown Prince Mohammed bin Salman, as major figures, including Treasury chief Steven Mnuchin, called.

Looking Ahead:

Earnings season is well underway, as more than 30% of the S&P 500 companies report their third-quarter results over the next five days. On Monday, Halliburton (HAL), Hasbro (HAS), Kimberly-Clark (KMB) and TD Ameritrade (AMTD) lead the earnings charge with their reports. The Chicago Fed releases its National Activity Index for September (consensus estimates call for a 0.18 reading). Tuesday brings another very busy day for corporate earnings, as we’ll hear from 3M (MMM), Caterpillar (CAT), Harley-Davidson (HOG), McDonald’s (MCD), Verizon Communications (VZ), among others. Wednesday includes New Home Sales and the Fed Beige Book on the economics-front, and corporate earnings will be released by Boeing (BA), General Dynamics (GD), Ford (F), Visa (V) and United Parcel Service (UPS). The Census Bureau releases its Durable Goods Report for September on Thursday (consensus calls for a decline of 1.8%). Many technology companies will report that day, including Alphabet (GOOG), Amazon.com (AMZN), Intel (INTC) and Twitter (TWTR). The week ends with the Bureau of Economic Analysis releasing its advance estimate for Q3 GDP (estimates are for 3.3%). Companies reporting that day include Colgate-Palmolive (CL), Weyerhaeuser (WY) and Charter Communications (CHTR). Phew!!

The Tufton Capital Team hopes that you have a wonderful week!

Last Week’s Highlights:

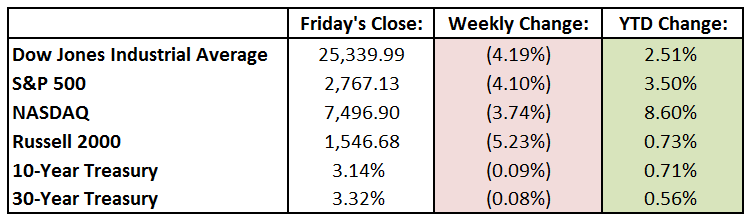

The major indices declined last week, as fears of rising interest rates outweighed several strong corporate earnings reports. The Dow Jones Industrial Average fell 4.2% for the week, while the S&P 500 declined 4.1%. The tech-heavy Nasdaq was down 3.7%, and the small capitalization companies in the Russell 2000 were hurt the most with a 5.2% selloff. On the economic front, investors received insight into inflation with the Producer Price Index (PPI) report. Producer prices were up 2.6% year-over-year. Energy prices fell 0.8% in September, as did food prices, which fell 0.6%. The prices for intermediate unprocessed goods increased 1.7% in the month. The Consumer Price Index (CPI) was also released, offering investors another indicator of inflation. Consumer prices were up 2.3% year-over-year. From last September, fuel and energy commodities were up 16% and 10%, respectively. Transportation services also rose 4%. On the downside, the prices of used cars and trucks fell the most, at 1.5%. Women’s and Girl’s Apparel prices also declined, falling 1%. In other economic news, the NFIB Small Business Index hit its third highest level of all-time. The Michigan Consumer Index dipped slightly in October, reflecting some concerns about personal finances and the long-term economic view. The index, however, remains near historic highs, as the consumer generally has a favorable view of the economy.

Looking Ahead:

Earnings season is underway! Three of the four big banks reported last Friday, and Bank of America reported on Monday morning. The banks reported strong earnings, but overall loan growth continued to slow. Over the weekend, the big-box retailer Sears filed for bankruptcy. Sears was at one point part of the Dow Jones Industrial Average. Quarterly earnings will be the main focus for the remainder of the week. On Tuesday, Morgan Stanley (MS), Johnson & Johnson (JNJ) and Goldman Sachs (GS) will all be reporting in the morning. After the closing bell, investors will hear from International Business Machines (IBM) as well as Netflix (NFLX). On Wednesday, Wall Street will gain further readings from the banking sector when U.S. Bancorp (USB) and M&T Bank (MTB) release their quarterly results. On Thursday, BB&T (BBT) and Phillip Morris (PM) will report before the opening bell and American Express (AXP) will report after the market closes. Finally, on Friday, investors will hear from Procter & Gamble (PG) and V.F. Corporation (VFC).

The Tufton Capital Team hopes that you have a wonderful week!